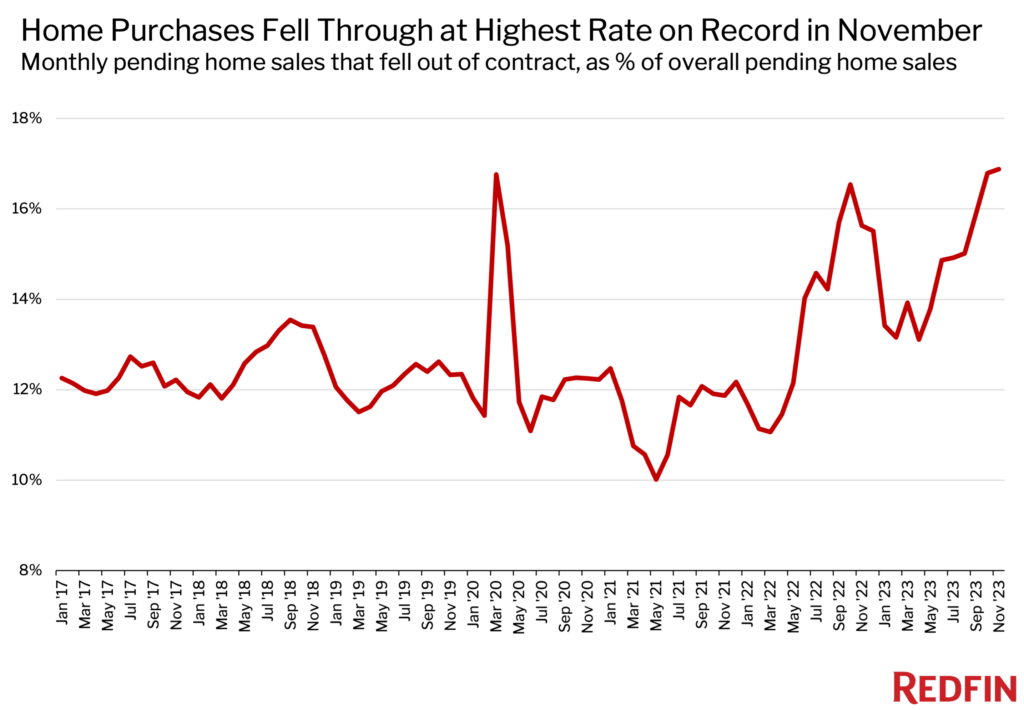

More homes are altering hands as home loan rates drop and purchasers and sellers see more eye to eye on cost. Still, offers are failing at the greatest rate on record due to remaining financial unpredictability, and some cities continue to see cost decreases.

New listings and pending home sales both reached the greatest level in approximately a year in November as purchasers and sellers got tired of waiting on the sidelines and home loan rates ticked down. Home costs likewise leapt, publishing the greatest year-over-year boost given that late 2022.

New listings increased 1.3% month over month to the greatest level given that October 2022 on a seasonally changed basis, and increased 0.1% from a year previously– a little gain, however the very first in a year and a half. Active listings, or the overall supply of homes for sale, grew 3.9% month over month– the greatest boost given that July 2022 (though they fell 7.9% from a year previously).

” Purchasers and sellers are discovering to deal with unpredictability,” stated Shay Stein, a Redfin Premier property representative in Las Vegas “They have actually understood nobody has a crystal ball that can anticipate precisely when home loan rates will fall back to 5%, so they’re making relocations now due to the fact that they can just wait so long to be near their grandkids, reside in a recreational vehicle like they have actually constantly imagined or complete their divorce.”

While rates aren’t back to 5%, they have actually fallen in current weeks, which has actually inspired purchasers, Stein stated. In most cases, their month-to-month payment is $200 less than it would’ve been had they secured a rate 3 weeks earlier when they began looking, she described. The typical 30-year-fixed home loan rate decreased each week in November after striking a 23-year high of 7.79% at the end of October. It ended November at 7.22%, and presently stands at 6.95%, though that’s still greater than the 6.3% rate of a year earlier.

Pending home sales increased 2% month over month in November to the greatest level in a year on a seasonally changed basis, and fell 0.1% from a year previously.

” Another factor sales are ticking up is purchasers and sellers are lastly residing in the exact same truth,” Stein stated. “A year earlier, sellers had problem comprehending why they weren’t getting $20,000 over the sticker price like their next-door neighbor did throughout the pandemic homebuying boom. Now, they comprehend that to offer their home, they require to price it relatively and sometimes use the purchaser concessions like cash towards closing expenses or mortgage-rate buydowns“

November 2023 Emphasizes: United States

| November 2023 | Month-Over-Month Modification | Year-Over-Year Modification | |

|---|---|---|---|

| Average list price | $ 408,732 | -1.1% | 3.7% |

| Pending sales, seasonally changed | 406,687 | 2.0% | -0.1% |

| Residences offered, seasonally changed | 411,958 | 0.2% | -5.4% |

| Brand-new listings, seasonally changed | 504,263 | 1.3% | 0.1% |

| All homes for sale, seasonally changed (active listings) | 1,504,094 | 3.9% | -7.9% |

| Months of supply | 2.9 | 0.2 | -0.1 |

| Average days on market | 36 | 2 | -1 |

| Share of for-sale homes with a cost drop | 18.7% | -1.3 ppts | -0.7 ppts |

| Share of homes offered above last sticker price | 28.7% | -3.0 ppts | 2.3 ppts |

| Typical sale-to-final-list-price ratio | 99.0% | -0.3 ppts | 0.5 ppts |

| Pending sales that fell out of agreement, as % of total pending sales | 16.9% | 0.1 ppts | 1.3 ppts |

| 7.44% | -0.18 ppts | 0.63 ppts |

Note: Data undergoes modification

Home Costs Published the Greatest Boost Considering That October 2022

The mean U.S. home list price was $408,732 in November. That’s up 3.7% from a year previously– the greatest dive given that October 2022– and down 1.1% from a month previously.

Yearly home cost development appears to be stabilizing after costs rose as much as 26% at the height of the pandemic homebuying boom and after that fell as much as 4% in early 2023 amidst raised home loan rates. Cost development is now back to the 2% -7% variety it remained in previous to the pandemic.

Despite the fact that raised home loan rates have actually moistened need in current months, costs have actually continued increasing in part due to the fact that purchasers are completing for a restricted variety of homes. While listings have actually inched up in current months, they stay low by historic requirements.

Purchases Failed at Record Rate as Some Purchasers Got Cold Feet

While pending sales struck the greatest level in a year in November, closed sales hovered near their current low. They were little bit altered from a month previously (0.2%) on a seasonally changed basis, and fell 5.4% from a year previously. That’s partially due to the fact that a great deal of offers failed at the last minute.

Approximately 45,000 U.S. home-purchase contracts were canceled in November, equivalent to 16.9% of homes that went under agreement that month– the greatest portion in Redfin records that go back to 2017. That’s up from 16.8% one month previously and 15.6% one year previously.

While some purchasers and sellers have actually pertained to terms with today’s financial unpredictability, that exact same unpredictability is triggering a number of them to get cold feet, Stein stated. Despite the fact that home loan rates have actually dropped, real estate price stays stretched, suggesting a great deal of purchasers still get worried when they see their month-to-month payment on paper.

Financial troubles are keeping many individuals out of the real estate market entirely. A great deal of Americans feel that the economy remains in a bad location in spite of financial development, increasing incomes and low joblessness. One apparent perpetrator is the real estate market, which remains in its least budget friendly year on record.

Please keep in mind that homes that fell out of agreement throughout a provided month didn’t always go under agreement the exact same month. For instance, a home that fell out of agreement in November might have gone under agreement in October. Scroll to the bottom of this report to discover the offer cancellation rate for the 50 most populated U.S. cities, together with other regional insights.

Metro-Level Emphasizes: November 2023

Information in the bullets listed below originated from a list of the 91 U.S. city locations with populations of a minimum of 750,000. Select cities might be omitted from time to time to guarantee information precision. A complete metro-level information table can be discovered in the “download” tab of the control panel in the month-to-month area of the Redfin Data Center Describe our metrics meaning page for descriptions of metrics utilized in this report. Metro-level information is not seasonally changed.

- Pending sales: In Anaheim, CA, pending sales increased 18.7% year over year, more than any other city Redfin examined. Next came San Antonio (16%) and Richmond, VA (14.5%). The greatest decreases remained in Greensboro, NC (-30.2%), Birmingham, AL (-27.6%) and Knoxville, TN (-27.4%).

- Closed sales: Closed sales climbed up from a year previously in simply 6 cities, with the greatest boosts in North Port, FL (26.1%), Orlando, FL (6.3%) and Cape Coral, FL (5.3%). They fell most in Tacoma, WA (-35.1%), Nassau County, NY (-20%) and New York City (-19.7%).

- Costs: Average price increased most from a year previously in Rochester, NY (17.9%), Anaheim (17.7%) and Fort Lauderdale, FL (13.5%). They fell most in Austin, TX (-8.8%), San Antonio (-6.2%) and New Orleans (-3.7%).

- Listings: New listings increased most from a year previously in North Port (34.1%), Omaha, NE (29.3%) and Cape Coral (22.5%). They fell most in Honolulu (-18%), Atlanta (-15.3%) and Greensboro (-13.9%).

- Supply: Active listings increased fastest in Cape Coral (50.7%), North Port (39.2%) and New Orleans (24.2%). They reduced fastest Las Vegas (-34.7%), Stockton, CA (-28.1%) and New Brunswick, NJ (-24.6%).

- Competitors: In Rochester, 70.4% of homes offered above their last sticker price, the greatest share amongst the cities Redfin examined. Next came Newark, NJ (62.2%) and Buffalo, NY (59.7%). The shares were least expensive in West Palm Beach, FL (8.9%), Cape Coral (10.1%) and New Orleans (11.5%).

- Speed: In Rochester, 66.2% of homes that went under agreement did so within 2 weeks– the greatest share amongst the cities Redfin examined. Next came Buffalo (52.8%) and Cincinnati (51.4%). The most affordable shares remained in Honolulu (5.7%), Knoxville (9.3%) and Lake County, IL (10.1%).

Home-Purchase Cancellations

Information listed below originated from a list of the 50 most populated city locations.

| City Location | November 2023: Pending Sales That Fell Out of Agreement, as % of General Pending Sales | October 2023: Pending Sales That Fell Out of Agreement, as % of General Pending Sales | November 2022: Pending Sales That Fell Out of Agreement, as % of General Pending Sales |

|---|---|---|---|

| Anaheim, CA | 16.0% | 15.1% | 14.7% |

| Atlanta, GA | 24.8% | 24.2% | 26.1% |

| Austin, TX | 15.4% | 14.5% | 18.3% |

| Baltimore, MD | 14.3% | 13.5% | 13.2% |

| Boston, MA | 11.6% | 10.5% | 11.5% |

| Charlotte, NC | 14.0% | 12.9% | 14.9% |

| Chicago, IL | 18.5% | 18.0% | 17.3% |

| Cincinnati, OH | 15.0% | 14.8% | 13.9% |

| Cleveland, OH | 23.1% | 18.5% | 19.0% |

| Columbus, OH | 17.0% | 17.3% | 18.4% |

| Dallas, TX | 19.5% | 18.8% | 22.4% |

| Denver, CO | 18.3% | 20.0% | 18.5% |

| Detroit, MI | 18.3% | 16.9% | 15.4% |

| Fort Lauderdale, FL | 22.8% | 23.6% | 20.7% |

| Fort Worth, TX | 19.4% | 23.2% | 20.4% |

| Houston, TX | 21.0% | 20.1% | 20.5% |

| Indianapolis, IN | 18.3% | 19.0% | 18.4% |

| Jacksonville, FL | 24.8% | 24.7% | 25.6% |

| Kansas City, MO | 16.1% | 16.6% | 17.1% |

| Las Vegas, NV | 22.6% | 22.0% | 20.4% |

| Los Angeles, CA | 17.2% | 17.0% | 17.3% |

| Miami, FL | 21.0% | 18.3% | 18.1% |

| Milwaukee, WI | 12.2% | 10.9% | 11.2% |

| Minneapolis, MN | 12.0% | 11.5% | 11.8% |

| Montgomery County, PA | 8.8% | 7.6% | 9.3% |

| Nashville, TN | 18.0% | 17.0% | 15.8% |

| Nassau County, NY | 5.5% | 6.6% | 6.7% |

| Brand-new Brunswick, NJ | 12.5% | 13.7% | 12.9% |

| New York City, NY | 9.7% | 10.7% | 8.0% |

| Newark, NJ | 10.3% | 10.5% | 11.9% |

| Oakland, CA | 10.6% | 9.9% | 8.8% |

| Orlando, FL | 22.1% | 23.2% | 23.2% |

| Philadelphia, PA | 12.9% | 13.1% | 14.6% |

| Phoenix, AZ | 19.3% | 20.2% | 19.0% |

| Pittsburgh, PA | 17.2% | 17.9% | 17.1% |

| Portland, OR | 15.7% | 15.9% | 16.6% |

| Providence, RI | 14.0% | 13.1% | 11.9% |

| Riverside, CA | 18.8% | 21.2% | 18.4% |

| Sacramento, CA | 16.7% | 18.9% | 17.4% |

| San Antonio, TX | 20.2% | 19.9% | 13.1% |

| San Diego, CA | 16.7% | 16.2% | 15.7% |

| San Francisco, CA | 5.8% | 5.9% | 6.2% |

| San Jose, CA | 6.7% | 8.6% | 8.2% |

| Seattle, WA | 11.5% | 11.8% | 12.4% |

| St. Louis, MO | 15.6% | 14.8% | 15.4% |

| Tampa, FL | 21.4% | 21.7% | 23.2% |

| Virginia Beach, VA | 17.3% | 16.9% | 13.8% |

| Warren, MI | 13.1% | 12.9% | 13.4% |

| Washington, D.C. | 13.1% | 12.5% | 13.2% |

| West Palm Beach, FL | 17.7% | 17.9% | 17.5% |

| National– U.S.A. | 16.9% | 16.8% | 15.6% |