HRAUN/E+ through Getty Images

It’s had to do with 8 months given that I composed my mindful note about The Clorox Business ( NYSE: CLX), and because time the shares are up about 15.75% versus a gain of about 18.2% for the S&P 500. This minor underperformance has me a bit intrigued, so I believed I ‘d evaluate the name today to see if it deserves purchasing or not. I’ll make this decision by taking a look at the most current monetary efficiency and comparing that to the appraisal. Likewise, given that whatever in investing is relative, I wish to pay specific attention to the dividend, and exercise the likelihood that it’ll grow over the coming years. If the dividend can grow, I will not mind getting about 210 basis points less on the yield today, however if it’s most likely stuck, then there’s no point in handling more threat and getting less earnings in my view.

We’re all extremely hectic individuals. I make sure a number of my vibrant and intriguing readers are preparing remarkable holidays to unique areas, or exercising whether to take the personal jet or helicopter out for a spin. For my part, I have actually got a Dungeon’s & & Dragons video game to strategy, so time presses all of us. Because of that, I compose a “thesis declaration” near the start of each of my short articles to provide financiers the capability to get in, read my point of view, and after that go out prior to being slowed down by an entire 1,600 word post. You’re welcome. I’m going to continue to avoid Clorox, and I would advise doing the very same. I believe the factors are relatively uncomplicated. The dividend yield is lower than the threat complimentary rate, and I believe there’s little factor to believe the dividend will grow much from existing levels. Hence, financiers are paying a lot of systems of threat while getting insufficient possible return. That’s never ever a fantastic concept in my view. If the shares were extremely inexpensively priced, I might want to look past this relative unattractiveness on the part of the stock, however they’re not. The shares of this low grower stay exceptional priced. I believe this will end severely, and I ‘d rather not be at that celebration when things go sideways.

Financial Picture

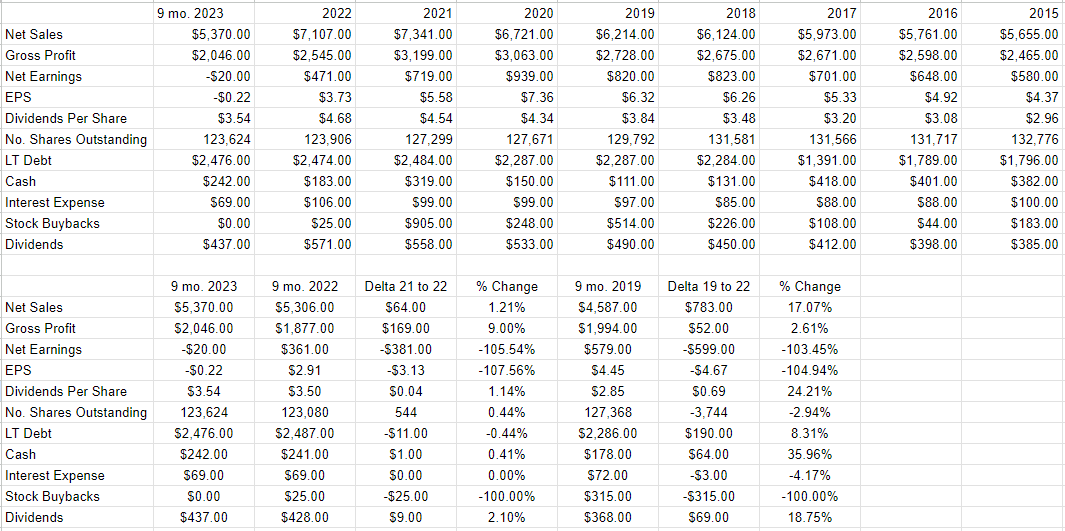

I believe the most current monetary efficiency was “middling to bad.” While profits budged a bit greater than it remained in 2022, earnings definitely collapsed, down to a loss of $20 million. This was clearly the outcome of a $445 million writedown. For some factor financiers deal with such things as unimportant rather of what they are: the sins of overpayment coming house to roost. That composed, I would acknowledge that gross revenue increased perfectly, up about 9% from the year ago duration. I believe it’s likewise worth keeping in mind that although profits is up perfectly from the pre-pandemic duration by 17%, gross revenue has actually hardly budged, up just about 2.6% when compared to 2019. So, I would not characterise this as a development business by any ways.

Something I am rather delighted about is the truth that the business appears to have actually handled to hold the line on financial obligation. This is amazingly unusual at the minute in my view.

Dividend Sustainability

Now, I have actually got as much of a fascination for accrual accounting as the next semi-sane financing geek, however I believe most financiers are more thinking about the future. In specific, they have an interest in the degree to which a dividend can be kept and can grow. This is clearly due to the fact that dividends use a a lot more foreseeable stream of capital, which makes preparing a lot easier for individuals. In addition, the dividend is encouraging of cost, so if I get a sense that a dividend is going to be cut, I range from the stock. I’m for that reason going to invest a long time evaluating the practicality of the dividend here, while attempting to exercise whether there’s capacity for development.

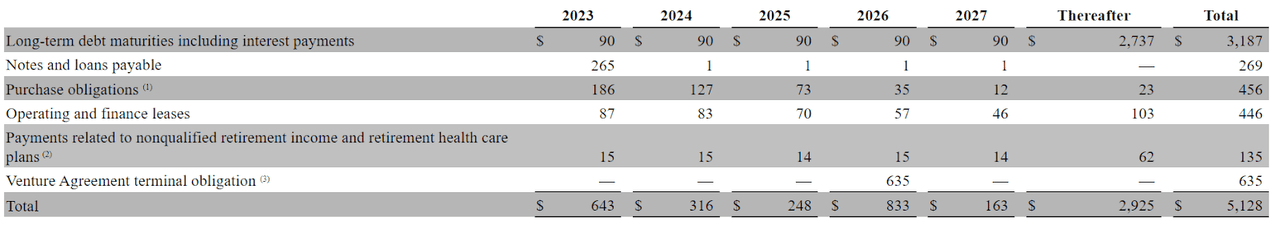

In order to make that decision, I take a look at the size and timing of future responsibilities, and compare those to the most likely net money streams the business will enjoy in the future. If there suffices space in the “future cat”, I end up being sanguine about dividend development capacity. Let’s begin with the responsibility. I have actually plucked the following table from the current 10-K for your satisfaction and illumination, and it reveals the size and timing of the business’s upcoming monetary responsibilities. This year will be fairly heavy, with the business “on the hook” as the youths state, for $643 million in responsibilities. Likewise, 2026 will be a reasonably rough year, offered the requirement to come up with $833 million.

Clorox Financial Commitments ( Clorox 2022 10-K)

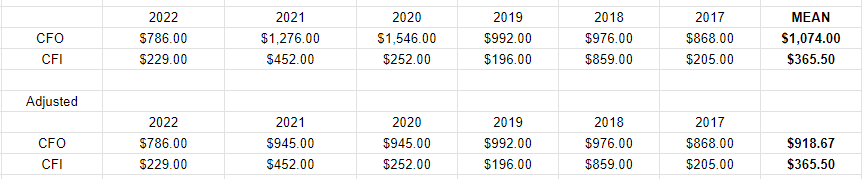

Versus these responsibilities, the business has actually created approximately $1.07 billion yearly in money from operations from 2017 to 2022, while investing approximately $365 million on business. I feel required to advise readers of the truth that for much of the years 2020 and 2021, everybody on the planet appeared to end up being definitely frightened of every surface area in the world, so the money streams to this business were unusually high throughout these years. So, if we take the numbers as published, the business created approximately about $1.07 billion yearly in Money from Operations in between 2017 and 2022. If we alter the figures published in 2020 and 2021 to the average of the previous 3 years, the typical CFO in between 2017 to 2022 drops to $919 million. I’m more comfy utilizing that as a “normal” average, however the reader’s complimentary to trust the figures as specified. Both point of views have some authenticity in my view.

Anyhow, we can see that the business has a great performance history of producing in between $545 and $635 million in excess money over the previous numerous years. When we compare this to the responsibilities, we see that the business has the capability to fulfill the huge bulk of its responsibilities from money usually created from operations. Hence, there’s no responsibility to tap capital markets in my view. Even if the business remains in a position to fulfill responsibilities does not imply that there suffices left over for dividend boosts, however. I believe the idea that there’ll be considerable dividend boosts at this moment is a little a dream, so I’m going to presume restricted or no dividend development in my analysis. Bear in mind that the payment ratio struck 121% in 2015, and there’s very little space to grow from existing levels in my viewpoint.

Clorox Web Money Flows ( Clorox 2022 and 2019 10-Ks)

Clorox Financials ( Clorox financier relations)

The Stock

If you read me frequently for some factor, you understand that I think about the stock and business to be 2 various things. For example, business produces profits by offering cleansing items, while the stock is a slip of virtual paper that gets traded around the general public markets. This stock represents a claim on the future profits and success of business, however you would not always understand that from the method the important things pops around in cost. Put another method, the stock’s cost motions are more unpredictable than a lot of modifications in the underlying service.

In my experience, this volatility is the only source of sustainable revenues when it pertains to purchasing and offering stocks. Particularly, I’m of the view that the only method to generate income trading stocks is to exercise the presumptions that are presently embedded in cost, and trade versus those presumptions when they are unreasonably positive or downhearted. Taking note of what’s understood by a lot of other financiers at today is fairly ineffective as existing news is currently “priced in.”

In addition, I believe it deserves keeping in mind that purchasing inexpensive stocks tend to cause greater returns. Not just are inexpensive stocks lower threat due to the fact that they have far less to drop in cost, they likewise use higher possible benefit, due to the fact that it’s simpler for the business of these stocks to outshine low expectations.

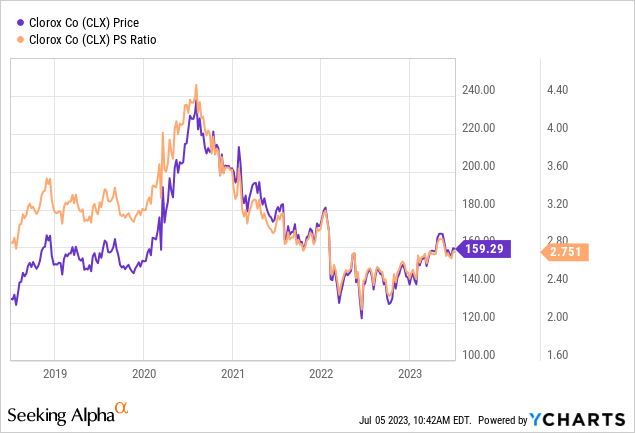

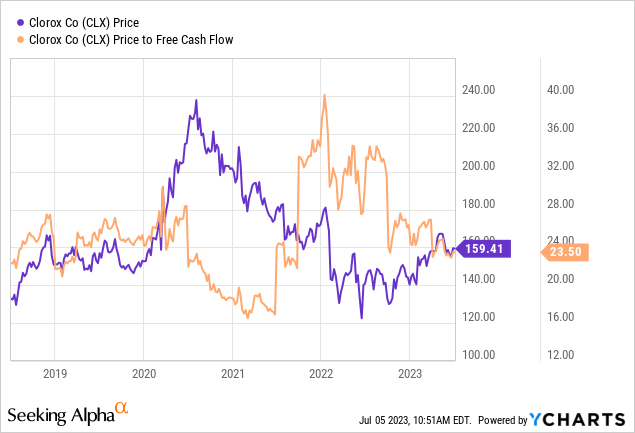

My regulars understand that I determine “inexpensive” in a couple of methods, varying from the basic to the more intricate. On the basic side, I like to take a look at the ratio of cost to some procedure of financial worth, like revenues, sales, and so forth. I formerly shunned Clorox due to the fact that the PE was around 42, the marketplace was paying about $2.43 for $1 of sales, and the marketplace was paying 30.84 times complimentary capital. That was egregiously pricey in my evaluation.

Quick forward to today, and here’s topography. The marketplace is paying about 11.5% more for $1 of sales, however it’s undoubtedly 44% more economical on a cost to complimentary capital basis. Keep in mind that I have actually omitted PE from my analysis due to the fact that the huge writedown the business simply took has actually driven revenues unfavorable.

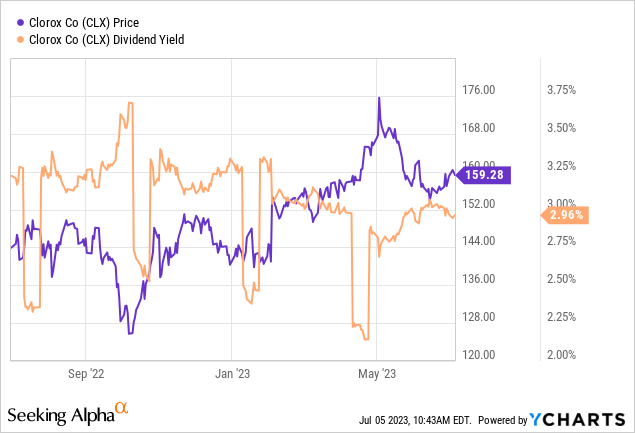

Considering that I blathered on about the dividend previously, I ought to likewise mention that the existing dividend yield has to do with 210 basis points listed below the threat complimentary rate When we include that truth to my view that the dividend will not grow much from here, that’s problematic. Financiers who purchase this stock today are handling all of the dangers related to stock investing, while getting less money for their problems than they would from a threat complimentary federal government financial investment. I’m uncertain how it works where you originate from, however where I’m from, paying more and getting less is usually a bad concept.

Provided all of the above, I believe there are much better usages for capital at the minute, and will continue to advise preventing shares of Clorox till the appraisal ends up being more appealing. Considered that I believe dividend development will be sclerotic from here, the shares are a dreadful financial investment in my view. The yield would need to be greater than federal government securities on a threat changed basis, and these shares are the opposite.