CHUNYIP WONG

The energy landscape continues to alter, with ongoing pressure from federal governments worldwide to cut emissions contradicting the truth of the energy shift: moving far from nonrenewable fuel sources will be neither inexpensive nor fast. Oil and gas business discover themselves in a difficult position, attempting to provide the world with its requirements while browsing altering policies and a deeply unfavorable public that sees them as the bad person.

There is a Japanese saying that equates as “the nail that stands out gets hammered down”. The supermajors make engaging targets for both suits and political vitriol since they are both popular and have properties to pursue. In action, majors have actually given in to needs almost widely. Net no by 2050 (or much better) targets have actually been put in location, production price quotes have actually been cut, and capital investment continue to move towards renewables that have actually had blended returns on invested capital at finest.

Get In Exxon Mobil

There is one exception: Exxon Mobil ( NYSE: XOM). In contrast to its peers, Exxon Mobil has actually been pursuing a separated method compared to other supermajor oil business by focusing on production development instead of just keeping production flat. At the end of in 2015, management put out a Development Report on its 2019 – 2027 Financier Method Summary, marking nearly the middle. It got a great deal of flak for that method throughout the pandemic recession, with the business adhering to what wound up being counter cyclical financial investment: it continued to invest greatly in development even at the bottom of a product cycle.

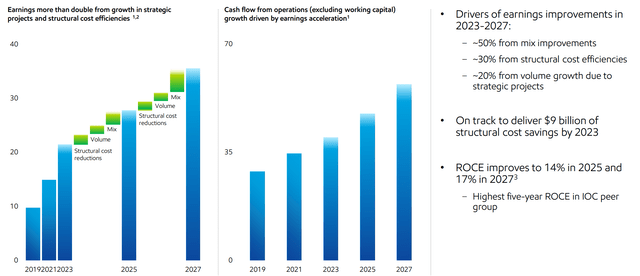

Profits Development (Exxon Mobil)

In its interactions to Wall Street banks and myself over the numerous months, senior management stays dedicated to what was the primary anchor of that Financier Method pitch: a doubling of business capital by 2027 that is grounded in both development and driving effectiveness throughout its services. And while that development is grounded throughout all of its section lines consisting of petrochemicals and refining, majority of that capital development is going to originate from upstream production development. To put it simply, more oil and gas production.

There is even a growing sense that upstream targets may be a layup. Even with the effect of its exit of its Russian services, there has actually been substantial favorable task news out of its significant jobs. Guyana has actually had absolutely nothing however favorable news every year. Exxon Mobil has actually embedded expectations of listed below 900,000 barrels of energy each day (” boepd”) in production out of Guyana by 2027, however present pacing recommends set up drifting production storage and offloading (” FPSO”) professional rata capability of 1,200,000 boepd already offered the speed of one FPSO put in location each year. That leaves out backfill chances.

On the melted gas (” LNG”) side, Golden Pass will have 3 trains online by 2024, providing it more utilize to worldwide gas standards in Asia and Europe. Alternatives beyond 2027 consist of Papua LNG, the Rovuma Basin, and maybe a go back to thinking about advancement at Mozambique. Locally, the Permian continues to see strength, with Exxon Mobil continuing to include rigs and preparing additional advancement. Contrary to other manufacturers like Leader Natural Resources ( PXD) or Occidental Petroleum ( OXY) that have actually seen decreasing well leads to 2022 and in 2023 versus older vintages, Exxon Mobil has actually not seen the exact same sort of decreases which might show a bit much better acreage quality.

What Guyana and the Permian share is that they sit lower on the expense curve than other existing tradition production paths at Exxon Mobil. As production grows over the next numerous years, minimal production expenses per barrel will decrease. Assistance has actually discovered towards total portfolio breakeven moving closer to $30.00 per barrel even offered with the present inflationary environment, below $40.00 per barrel today.

Exxon Has Whatever

Usually, financiers need to quit something when choosing business to put their cash behind. Compromise is all over in the markets, however I believe Exxon has an uncommon setup: development, defensive, and a fondness for returning excess capital to investors. That mix is quite darn uncommon.

- Development. Regardless of the obstacles dealt with by the energy market, Exxon Mobil has actually been unfaltering in its pursuit of production development. The business’s distinguished method of focusing on production development over keeping flat production sets it apart from its peers and positions it to take advantage of possible unanticipated boosts in oil and gas need in the future. Its concentrate on broadening its production capability, especially in high margin jobs, lays the structure of revenues development over the next numerous years.

- Defensive in Nature. While not touched on here, Exxon operations cover several locations and sections of the energy worth chain. That is among the worth proposals for majors in the top place: less revenues volatility. important supplies it with a protective position in the face of market volatility. Holding upstream expedition and production, downstream refining and marketing, and chemicals making alleviates dangers related to changes in oil and gas costs and local need patterns. The cherry on top is Exxon Mobil’s enduring existence in the market, comprehensive facilities, and developed client relationships.

- Strong Investor Returns. Exxon Mobil has actually developed a tested performance history of providing strong investor returns through a mix of dividends and share repurchases. I anticipate dividends to grow together with broadening capital, strengthened together with a sector-leading buyback program which has actually assisted lower share count and therefore its small dividend commitments. Exxon has actually been actively buying its shares to return worth to investors. The business’s dedication to investor returns is supported by its strong capital generation, which supplies it with the capability to keep its dividend payments and carry out share buybacks.

Now, Exxon does trade more expensively compared to peers – especially those throughout the pond. Financiers are spending for these qualities. That stated, I believe the space in between Exxon and its peers is less than it may appear offered the development outlook. All else equivalent, the space is much tighter a couple of years down the line as peers see stagnant revenues and Exxon continues to strengthen capital. As constantly seems the case in energy, financiers tend to be capital looking for: they wish to see dividends and significant share count retirements. That is what drives understanding of worth – not theoretical numbers. European majors are a fantastic example. All of its European peers (e.g., Shell ( SHEL), BP ( BP), others) have actually underperformed substantially because their particular dividend cuts regardless of no genuine significant modification in running totally free capital.

Takeaways

In conclusion, Exxon Mobil Corporation is running a separated method compared to other supermajor oil business by concentrating on production development and recording market share. The business’s objective to double capital by 2027 looks more than obtainable, and integrated with its inherent attributes of development, protective nature, and strong investor returns, the stock is an appealing financial investment choice for financiers looking for direct exposure to the energy sector.

Editor’s Note: This short article talks about several securities that do not trade on a significant U.S. exchange. Please understand the dangers related to these stocks.