In these times, double down– on your abilities, on your understanding, on you. Join us Aug. 8-10 at Inman Link Las Vegas to lean into the shift and gain from the very best. Get your ticket now for the very best cost

Chaos in the banking system might act as the driver for a modest economic crisis, however it’s most likely to look like the cost savings and loan crisis of the 1980s more than the 2008 monetary crisis, Fannie Mae economic experts stated Friday.

The failures of Silicon Valley Bank and Signature Bank might show to be a double-edged sword for real estate– offering a tailwind for house sales in the kind of lower home mortgage rates however likewise triggering little and midsized local banks to tighten up financing requirements, Fannie Mae economic experts stated in their newest month-to-month financial and real estate projections

” While house sales experienced a big bump in February following a pullback in home mortgage rates … current home mortgage application information recommend that last month’s level of house sales will be short-lived,” Fannie Mae economic experts stated. Continuous banking instability “might impact the schedule of jumbo home mortgages and property building and construction loans due to the high concentration of those originations originating from little and midsized banks.”

Forecasters with Fannie Mae’s Economic and Strategic Research study Group released their newest month-to-month projection Friday, however the numbers were settled on March 13– simply days after the failures of Silicon Valley Bank and Signature Bank and more than a week prior to the Federal Reserve’s March 22 conference.

Financial experts at the home mortgage huge state current turbulence in the banking sector includes some unpredictability to their projection however does not essentially alter their standard outlook.

Fannie Mae economic experts have actually been forecasting a 2023 economic crisis because last April However stronger-than-expected financial information have actually pressed back the expected start of the economic crisis from the 2nd quarter to the 2nd half of this year, they stated.

” No matter how the banking turbulence plays out, we continue to anticipate house sales activity to stay suppressed for the rest of 2023,” Fannie Mae economic experts stated in commentary accompanying their projection. “Even if home mortgage rates were to draw back to 6 percent, price stays extremely constrained. Furthermore, most current home mortgage debtors will continue to have rates well listed below existing market rates. This ‘lock in’ impact, where existing house owners are reluctant to quit their low home mortgage rates, stays a strong disincentive to relocate to a brand-new house.”

Source: Fannie Mae Real Estate Projection, March 2023

Fannie Mae forecasters now anticipate 2023 house sales to decrease by 18 percent to 4.627 million. Sales of existing houses are anticipated to fall by 20 percent to 4.019 million, with sales of brand-new houses dipping by 5 percent to 608,000.

While house sales are on track for a stronger-than-expected very first quarter, Fannie Mae economic experts anticipate a bigger contraction later on in the year.

” Lots of property buyers who might have been waiting on the sidelines appear to have actually leapt in as existing house sales increased 14.5 percent in February, decently more than we anticipated based upon previous boosts in home mortgage application information,” Fannie Mae economic experts stated. “Nevertheless, current home mortgage activity indicate that level of house sales being short-lived, and we anticipate lower numbers in March.”

Next year, the current projection is for house sales to rebound 7 percent to 4.955 million, driven by 8 percent development in sales of existing houses to 4.34 million.

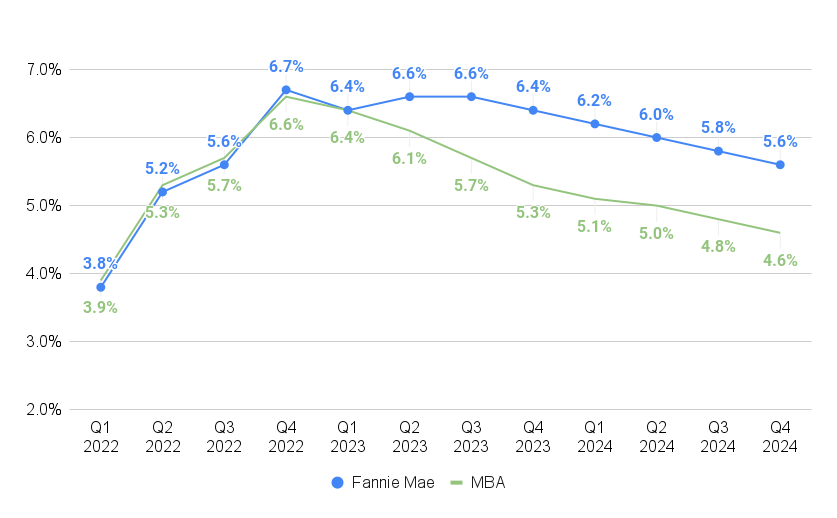

Source: Fannie Mae and Home loan Bankers Association projections

While Fannie Mae economic experts had actually anticipated rates on 30-year fixed-rate home mortgages to typical 6.6 percent throughout the 2nd and 3rd quarters, that projection was finished prior to rates boiled down in the consequences of the Federal Reserve’s very first conference following the failures of Silicon Valley Bank and Signature Bank.

Fed policymakers voted to raise the short-term federal funds rate by 25 basis points on Wednesday, however Federal Reserve Chair Jerome Powell stated occasions in the banking system over the previous 2 weeks are most likely to lead to tighter credit conditions for families and organizations. Policymakers will wish to see the current information prior to treking rates once again, Powell stated.

The Fed’s more dovish position was mainly anticipated; and by Thursday, rates on 30-year fixed-rate home mortgages had actually currently been up to 6.34 percent– down half a portion point from a 2023 high of 6.84 percent on March 8, according to rate lock information assembled by Optimum Blue

Fannie Mae economic experts acknowledged that the current sharp drop in long- and intermediate-term rates of interest suggests their home mortgage rate projection might undervalue the capacity for rates to come down this year and next.

In a March 20 projection, economic experts at the Home loan Bankers Association anticipated rates on 30-year fixed-rate loans will balance 5.3 percent throughout the last 3 months of the year and slide to 4.6 percent by the 4th quarter of 2024.

Lower rates might likewise supply a tailwind for house sales and home mortgage originations, Fannie Mae economic experts stated. However lower rates will not be of much assistance if debtors can’t get loans in the very first location.

” While we do not understand how lasting the existing banking issues will be, banks have actually obtained a record quantity from the Fed’s discount rate window over this previous week, while Federal Mortgage Bank advances have actually likewise risen,” Fannie Mae economic experts cautioned. “This is a clear indication of liquidity tension amongst lots of local banks who might be dealing with deposit run pressure. We expect this will support, however it is most likely to lead to higher hesitation to provide as banks look for to protect liquidity. “

If that takes place, Fannie Mae jobs that property buyers looking for jumbo home mortgages be amongst those most impacted. Since February 2022, jumbo loans surpassing Fannie Mae and Freddie Mac’s adhering loan limitation (presently $726,200 in the majority of parts of the nation) represented around 12 percent of all loans stemmed.

” Unlike adhering loans, which are mainly funded through mortgage-backed securities (MBS) by means of capital markets, the jumbo home mortgage area is nearly completely moneyed by means of the banking sector, and some local banks are more focused in jumbo home mortgage financing than others,” Fannie Mae forecasters cautioned. “Continuous liquidity tension might restrict house funding and for that reason sales in the associated market sectors and locations with high jumbo concentration.”

In the long run, tightening up of financing requirements at midsized local banks might likewise slow the building and construction of houses and homes.

” Like jumbo home mortgage financing, building and construction and advancement loans both for single-family building and construction and multifamily building and construction are greatly funded by local and neighborhood banks concentrating on this location,” Fannie Mae forecasters kept in mind. “Little and midsized banks, specified as those with less domestic possessions than the leading 25 banks, represent around two-thirds of overall bank-financed business realty loans. We would for that reason anticipate a drag on real estate starts and multifamily property sales.”

Purchase home mortgage financing anticipated to agreement by 25 percent

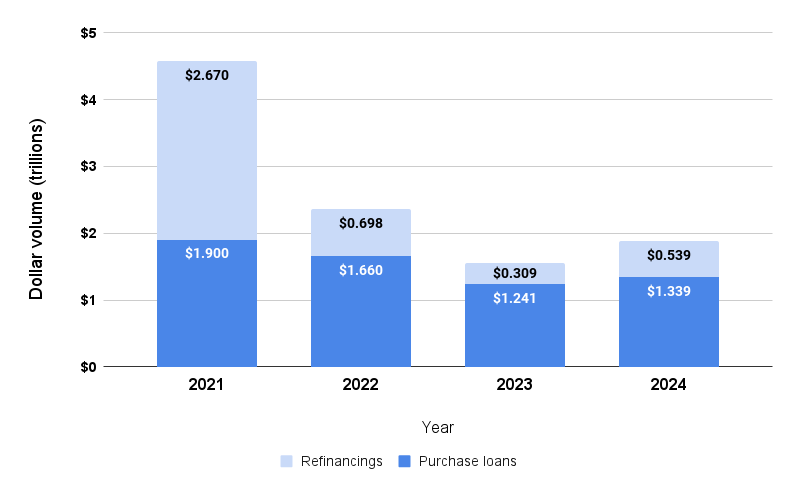

Source: Fannie Mae Real Estate Projection, March 2023

The possibility of a downturn in house sales triggered Fannie Mae economic experts to cut their projection for 2023 purchase loan home mortgages by $76 billion to $1.241 trillion. That would represent a 25 percent drop from a year earlier.

While Fannie Mae is forecasting that purchase loan originations will rebound by 8 percent next year, to $1.339 trillion, that’s $106 billion less than the projection provided in February.

Thanks to in 2015’s significant increase in home mortgage rates, home mortgage refinancing volume is anticipated to diminish by 56 percent this year to $309 billion, however grow by 74 percent next year to $539 billion.

With home mortgage rates down because that projection was assembled, Fannie Mae economic experts state home mortgage originations might be available in more powerful than anticipated.

Get Inman’s Bonus Credit Newsletter provided right to your inbox. A weekly roundup of all the greatest news on the planet of home mortgages and closings provided every Wednesday. Click on this link to subscribe.