Roland Magnusson/iStock Editorial by means of Getty Images

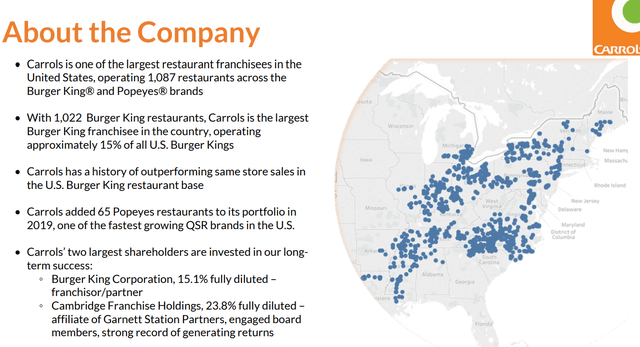

Carrols Dining Establishment Group, Inc. ( NASDAQ: TAST) runs more than 1,000 “Hamburger King” dining establishments in the U.S. as one of the biggest independent franchisees together with a smaller sized variety of “Popeyes” places. This is a stock we formerly covered, highlighting improving conditions compared to substantial disturbances returning to the depths of the pandemic.

The upgrade here has a look at the current quarterly report specified by strong restaurant-level patterns and firming margins, declaring a bullish case for the stock. In spite of the difficulties in the last few years, our view is that TAST is well-positioned to emerge more powerful with a favorable long-lasting outlook and course to more powerful success.

TAST Incomes Wrap-up

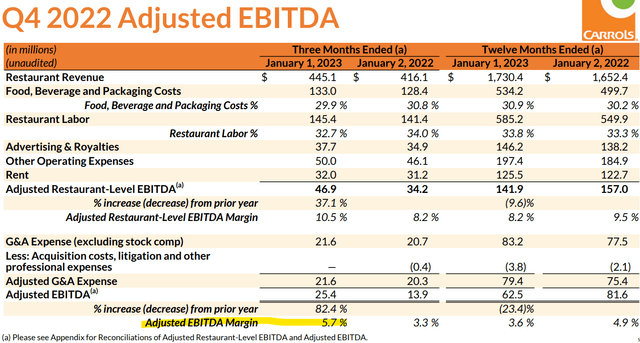

TAST reported a Q4 non-GAAP EPS loss of -$ 0.05, although this narrowed from a -$ 0.15 lead to the duration in 2015, and was likewise $0.16 ahead of price quotes. Dining establishment profits at $445.1 million climbed up by 7% y/y and was likewise above expectations.

The story has actually been the strong similar dining establishment sales, up 6.2% for the Hamburger King places and 9.2% for Popeyes. Throughout the quarter, costs connected to food, drink, and product packaging expenses, together with dining establishment labor, have actually decreased as a portion of profits.

Management describes that the adjusted EBITDA margin at 5.7% this quarter, up from 3.3% in the duration in 2015, is based upon not just alleviating product input inflation however likewise higher versatility in the labor force. For context, there was a duration in late 2021 when snack bar were handling staff member lacks in a remarkably tight labor market. Those characteristics have actually passed.

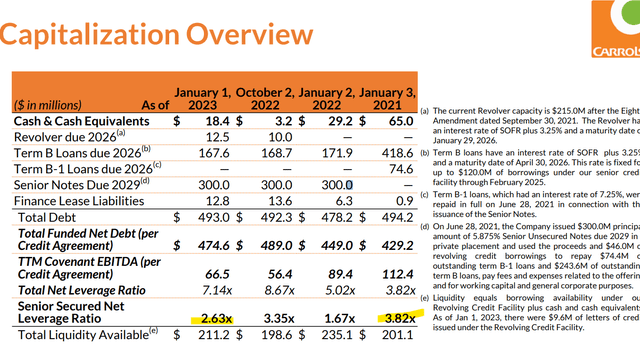

If we take that Q4 changed EBITDA figure of $25.4 million, the annualized level at $100 million starts to look a lot much better than the full-year financial 2022 outcome of simply $62.5 million. The ramification here is for a constricting take advantage of ratio which has actually been the primary knock on the stock returning to the additional financial obligation the business handled throughout the pandemic.

Carrols Dining establishment Group ended the quarter with $18.4 million in money, up from $3.2 million the previous quarter. The senior guaranteed net take advantage of rate enhanced to 2.6 x from 3.4 x in the quarter prior and as high as 3.8 x at the end of 2020. In numerous methods, this continuous deleveraging that can speed up through 2023 is among the strong bullish tailwinds for the stock.

While management is not offering monetary assistance targets, remarks in the news release predicted some optimism recommending an extension of the current patterns over the next a number of quarters.

As we check out 2023, we are thrilled by the patterns we are seeing, both on the top-line and with input expenses, and think we are on track to provide ongoing progressive margin enhancement gradually …

In general, our company believe that the functional enhancements we continue to make, integrated with the possible favorable effects from Hamburger King’s multi-faceted strategy to enhance the brand name, put us in a strong position heading into 2023.”

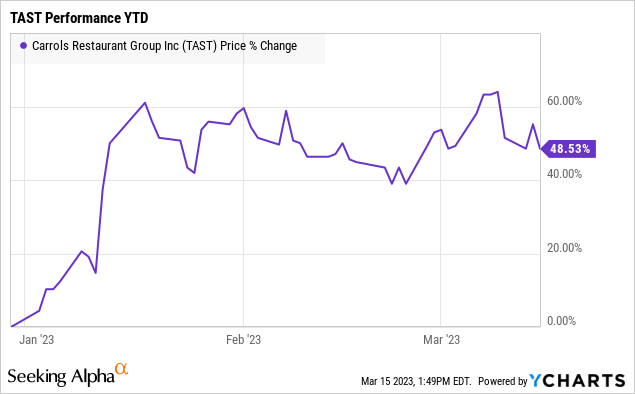

TAST Cost Projection

The very first point here is that TAST with a market cap of $120 million or around $600 million business worth stays an otherwise speculative small-cap, especially considering it’s not presently rewarding. We’re taking a bullish outlook on the stock, however simply acknowledge that continuous volatility is to be anticipated.

Fortunately here is that the operation seems turning a corner, with the tourist attraction here is that business is linked to the Hamburger King and Popeyes brand names, implying it takes pleasure in a broad level of client commitment and market acknowledgment as a benefit to the franchise design.

On this point, the moms and dad business of “Hamburger King Corporation” and “Popeyes” as subsidiaries of Dining establishment Brands International ( QSR) is amongst TAST’s biggest investors implying the long-lasting success of business remains in line with the tactical views of the bigger group.

Significantly, the business keeps in mind that Carrols’ ran places have actually traditionally outshined the wider dining establishment base as part of the appeal of the stock. We ‘d likewise state that the monetary take advantage of we kept in mind above can make the equity side especially appealing to the advantage as part of the thinking to purchase TAST over QSR.

From there, what we like about TAST is the concept that in the present market environment, snack bar ought to be a reasonably resistant sector of the customer discretionary sector as customers will constantly require to consume. An inexpensive meal at Hamburger King or Popeyes would be down the list of costs classifications customers cut even in an economic crisis compared to high-end products, travel, and leisure for instance.

To the advantage, a situation where financial conditions exceed would be favorable for even strong similar dining establishment sales and permit success to climb up even further. In general, we notice that TAST is merely underestimated as its turn-around is more based upon company-specific elements.

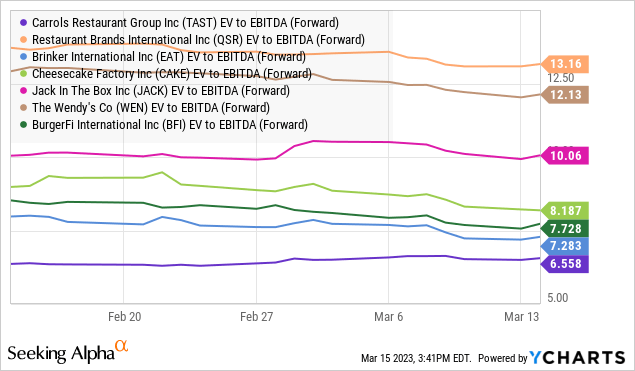

We’ll keep in mind that amongst a number of openly traded dining establishment stocks, TAST at an EV to forward EBITDA multiple of 6.6 x is well listed below a typical closer to 10x for a group that consists of QSR, Brinker International Inc. ( EAT), Cheesecake Factory Inc. ( CAKE), Jack in package ( JACK), The Wendy’s Co. ( WEN), and BurgerFi International Inc ( BFI). Bear in mind that these names each have differing organization designs, however our company believe there is space for TAST to assemble greater with the group.

TAST Stock Cost Projection

We rate TAST as a buy with a brand-new cost target of $3.00 representing an 8x EV to forward EBITDA numerous on the present agreement EBITDA quote of $90 million for the complete year 2023. This is a level the stock traded at in early Q1 2022, which might be on the table as shares develop momentum.

We wish to see another strong series of quarterly reports, validating the enhancing margins and the balance sheet position. On the other hand, weaker-than-expected outcomes consisting of softer similar dining establishment sales would likely require a reassessment of the outlook as the threat to enjoy.