Ceri Breeze/iStock Editorial through Getty Images

Dear readers/followers,

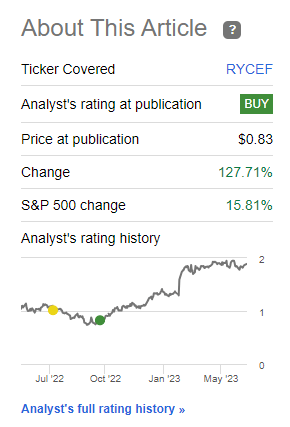

To state that I enormously included shares of Rolls-Royce ( OTCPK: RYCEY) would be incorrect and a lie. I included shares, developing a little position when I last covered the business. That was back in October, after a 50% drop, however at the time it dropped, I did not hold a favorable thesis on the business. That “BUY” ranking did not come till October. As you understand, I’m a long-lasting financier – and because that specific time, the business has actually leapt.

And by leapt, I suggest leapt.

This is my RoR for my position because that time. That’s beating the S&P 500 by more than 8x because that specific post.

Looking For Alpha Rolls-Royce (Looking For Alpha)

So, all in all, it’s reasonable to state that Rolls-Royce has actually been a definitely fantastic financial investment. Among my finest financial investments on a TTM basis. The factor I have not highlighted it more, and utilized it as my poster case for why you need to focus on my positions, is actually that I didn’t purchase much of the business at the time. I purchased some – however very little.

A 127% RoR for a $10 position is just a lot – and I’m not stating my position was $10, however it wasn’t a complete percent or 3% of my portfolio. Rolls-Royce was, as I saw it, too dangerous for that.

It stays a difficult sort of turn-around case.

Let’s take a look at what Rolls-Royce can provide us moving forward.

Rolls-Royce – Outcomes and patterns are excellent, let’s see what the business uses.

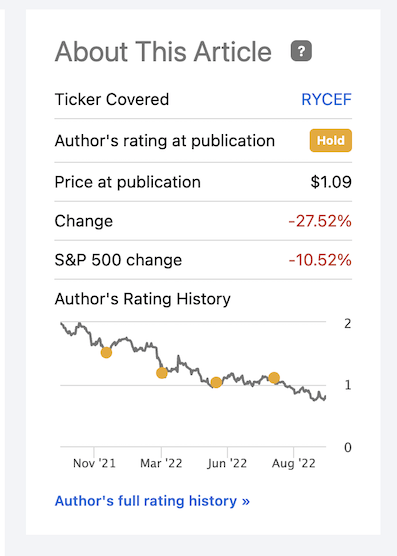

There’s another image that I wish to reveal you that a minimum of rather validates that I “understand” rather of what I am discussing. Prior to moving my position on Rolls-Royce, I had a long-published and held position of preventing RYCEF. Have a look.

Looking For Alpha Rolls-Royce (Looking For Alpha)

The reality that I went favorable was no fluke. It was that the business lastly reached a long-held level of undervaluation that I practically because the first day considered as the turning point for the business and where it would end up being attractive.

I just want I had the nerve to actually stake a strong claim in the 10s of thousands, as this would have raised my outcomes even further. And it wasn’t that I was uncertain in my last post, either – here’s particularly what I stated.

That is, I have actually never ever changed my position up previously.

Due to the fact that now it’s time to go “BUY” on Rolls-Royce.

( Source: Rolls-Royce Short Article)

After this huge climb, and particularly because the bounce, all sorts of Rolls-Royce-positive financiers have actually come out of the woodwork. Individuals that did rule out the business a “BUY” when they were low-cost, unexpectedly now think about the business among the very best things because sliced bread. This is neither weird nor the very first time this has actually taken place.

If you’re a valuation-oriented financier with a contrarian streak, you need to get utilized to the pain of owning business that 99% of the marketplace informs you are not “excellent”. Supplied you have actually done your research study, things can exercise fine, or as you can see here, much, far better than fine.

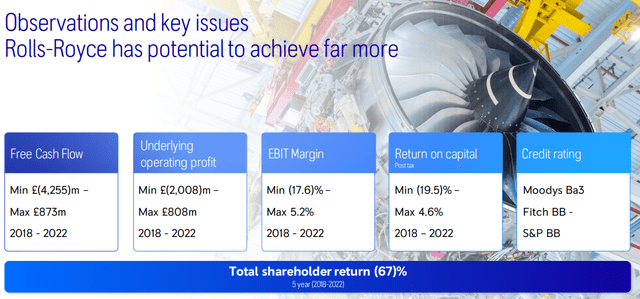

And it’s not that the present share rate implies that RYCEF has actually unexpectedly turned whatever around. The business is still in an unfavorable spiral with a 5-year TSR of unfavorable 67%. Its FCF is gradually recuperating, as is EBIT margin and ROCE/ROIC, however it’s going too far to state that there are huge indications of a brand-new dawn for the business.

It’s likewise still BB-rated.

Rolls-Royce IR (Rolls-Royce IR)

Some financiers that went favorable now will argue that it could not have actually been visualized, these company successes led to the share rate bounce. And they’re best – not those particularly. However unless you thought that RYCEF was basically prepared to be sliced up for parts and sold, then some sort of benefit was, as I saw it at the time, nearly a provided at some future point. That future point simply occurred to come now.

Favorable modifications have actually shown up for a long period of time for those who understand where to look – like myself. If you check out down deeply into the reports, you have actually had the ability to see that much of the business’s problems for a long time have actually been external – like SCM.

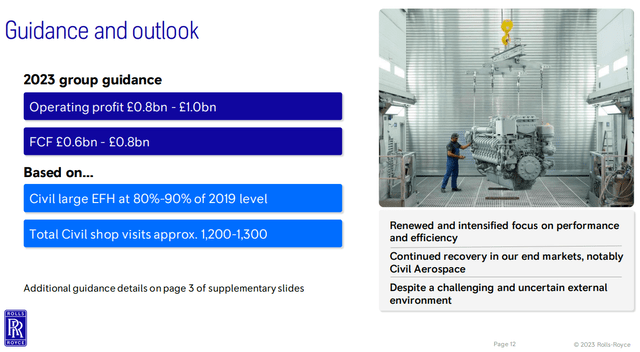

Monetary efficiency has actually remained in line with the full-year outcomes and the business provided assistance for 2023 FCF at ⤠600- ⤠800M, along with upwards of a billion pounds in operating earnings. So Rolls-Royce is no longer “simply” unfavorable, it produces favorable earnings.

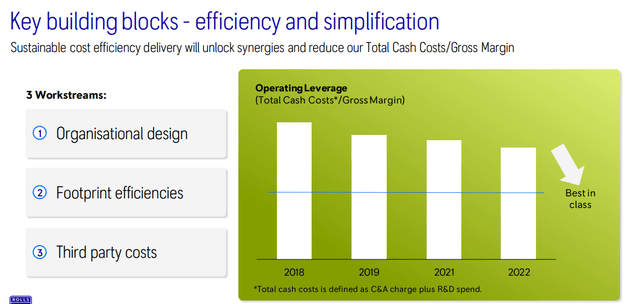

Rolls-Royce IR (Rolls-Royce IR)

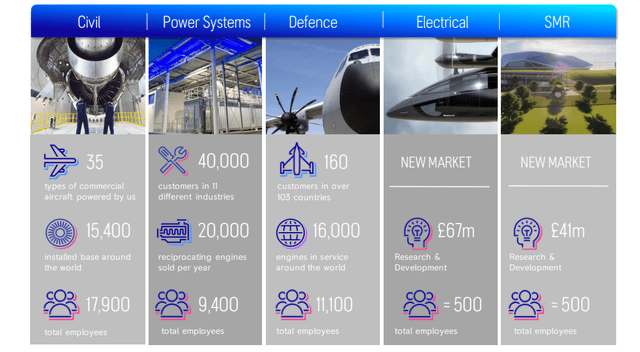

Particular underlying favorable patterns originated from Civil Aerospace with brand-new wins, consisting of the biggest-ever order of the Trent XWB-97, 68 engines plus 20 alternatives purchased by Air India. The business’s fascinating operate in defense continues, with the AUKUS sub being powered by RYCEF atomic power plants. Power systems are seeing aftermarket service need, and very high order consumption in 2022, particularly for generation services, and the business’s brand-new agreements are being granted and signed at considerably greater margins than tradition, and this is beginning to reveal.

The indications of a turn-around have actually been clear for a long time, however they’re taking shape now. Half-year 2023E outcomes will begin the 3rd of August, so we’ll get more updates then – and I anticipate, disallowing unpredicted occasions, these to be favorable.

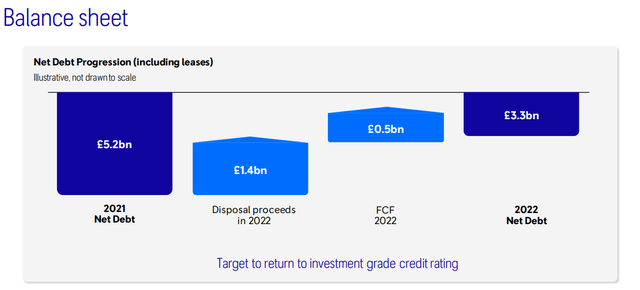

The business has actually been working to bring utilize down, and has actually been prospering in doing so, gradually chewing away at that utilize to come down to a level where they are thought about “finest in class”, and where the business might see a remediation to BBB-rating as a possibility. That absence of an investment-grade credit ranking is actually harming the business’s interest expenses and institutional financial investment appeal.

Rolls-Royce IR (Rolls-Royce IR)

Rolls-Royce, in a great deal of methods and as odd as this might sound, is in fact a great business – the “best” business. What do I suggest by this?

I suggest that the business integrates an extremely attractive tradition portfolio with lots of appealing patents, a great aerospace consumer base with customer-oriented defense agreements, then supplements this with appealing prospective development markets like SMR. If the business had actually had the ability to prevent the disastrous recession we have actually seen the previous couple of years, I believe this company might be a stalwart. And presently, I can see business’ course going back to this sort of stalwart or favorable level on a forward basis.

The net financial obligation development can be identified as particularly outstanding, all things thought about.

Rolls-Royce IR (Rolls-Royce IR)

It’s simple to forget what Rolls-Royce in fact does, and just how much it has. It’s simple to forget all the sectors the business is active in, and how “excellent” much of its markets and consumer bases are. It’s simple to forget that in the best conditions, this business is a company that might be valued 5-10x today’s level – quickly in my viewpoint.

So that you do not forget those qualities as we progress here, let me advise you with a fast illustration – from Civil to SMR, the business is discovered in numerous appealing fields.

Rolls-Royce IR (Rolls-Royce IR)

Rolls-Royce Evaluation – Complex in the face of 100%+ RoR

Whenever a business provides a triple-digit RoR in less than 8 months, it asks the concern of just how much we can get out of them in the next 8 months or 12 months. My response to this, in spite of favorable expectations, is “very little”.

The current outcomes do not totally eliminate from over 8 years of what I would euphemistically call “some mismanagement”, with absolutely no present dividend yield. Numerous experts in fact think about the business to be miscalculated at the present appraisal, which for the native LSE ticker isn’t even a complete quid per share. It’s easy to understand, since the business has yet to “show” much of its success, and much of its monetary strength metrics are still down.

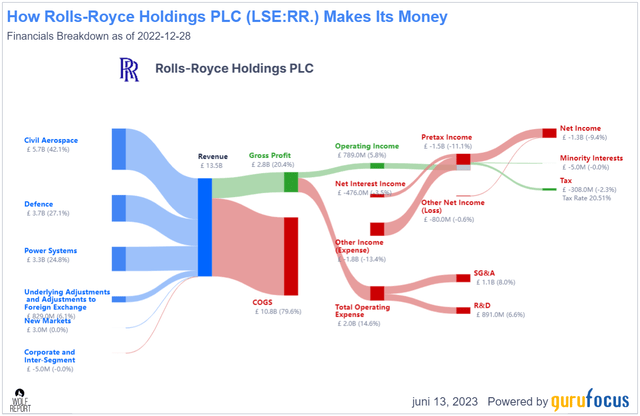

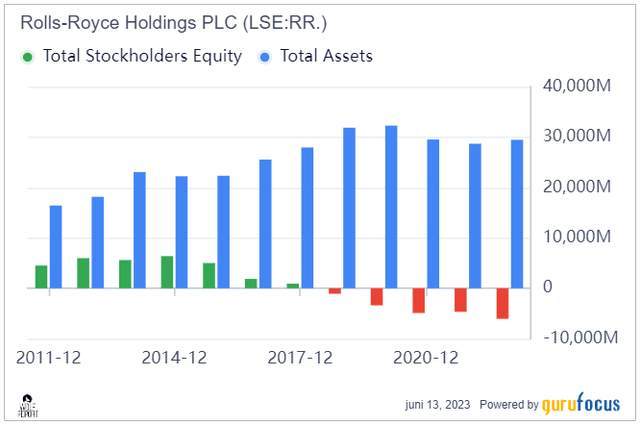

If you take a look at its revenue/net for 2022, that’s not a beautiful image – yet.

Rolls-Royce revenue/net (GuruFocus)

Nevertheless, enhancements are really clear. From pure basics, it’s reasonable to state I think that the business bottomed at some point in 2020. Ever since, it’s been an upward trajectory, and I think the business’s ROIC is a sign here of a considerable essential turn-around at some point in the next couple of years. That turn-around isn’t there yet. SE is still deeply unfavorable, and it will require time to reverse. Ideally, we’ll see favorable FCF this year, and I would be very stunned if that isn’t the case.

Rolls-Royce IR (Rolls-Royce IR)

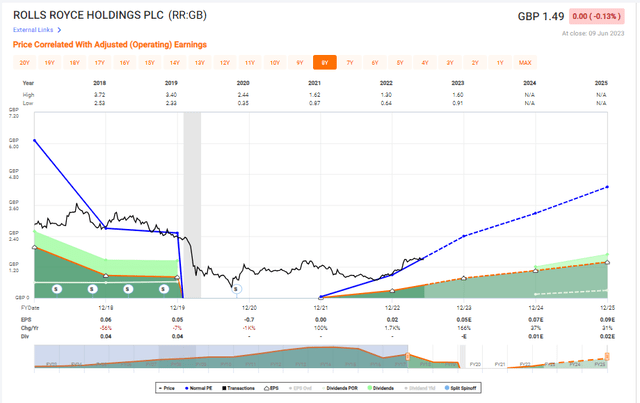

From an appraisal viewpoint, Rolls-Royce, and by that I suggest the native ticker, presently trades at a ludicrous P/E – however this is because of, you thought it, missing out on revenues. For 2023E, the price quote is an EPS on an adjusted basis of $0.05/ share, and development from there, bring back the business dividend at a cent per share in 2024E.

Rolls-Royce Evaluation (F.A.S.T charts)

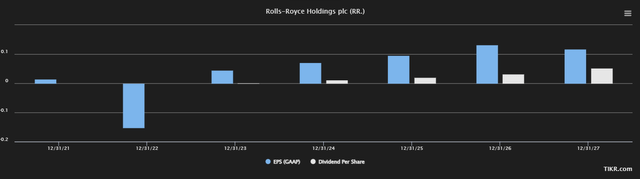

S&P International experts concur with this evaluation, with GAAP turning favorable this year, and a climb from here on, to a 2027E EPS of ⤠0.12/ share.

RR EPS/Dividend projection (TIKR.com)

That’s what I base my favorable Rolls-Royce thesis on. That ultimate turn-around. That being stated, I think about the business pricey for where it presently is. My last PT for the business was $0.85/ share for the ADR. Even if I were to increase this to $1/share, which I believe is reasonable offered the current outcomes, I believe more than that is impractical at this moment.

Based Upon that, this is my thesis for the business as it presently stands.

Thesis

In the meantime, this is my Rolls-Royce thesis.

- Fantastic company, fantastic direct exposures, fantastic duopoly gamer with some actually good basics – however with the pressures we’re seeing, and the Ukraine war, things aren’t looking much better other than for the defense sector.

- No yield and low exposure make this a no-go at all however cents on the dollar. Particularly, I ‘d wish to pay no greater than 0.5X-0.6 X to NAV with a stabilized EBIT as a base, which concerns around $1/share for the ADR.

- Since of that, I’m relocating to a “HOLD” at this time.

Keep In Mind, I’m everything about:

- Purchasing underestimated – even if that undervaluation is minor and not mind-numbingly huge – business at a discount rate, permitting them to stabilize in time and harvesting capital gains and dividends in the meantime.

- If the business works out beyond normalization and enters into overvaluation, I gather gains and turn my position into other underestimated stocks, duplicating # 1.

- If the business does not enter into overvaluation however hovers within a reasonable worth, or returns down to undervaluation, I purchase more as time enables.

- I reinvest earnings from dividends, cost savings from work, or other money inflows as defined in # 1.

Here are my requirements and how the business satisfies them (italicized).

- This business is total qualitative.

- This business is basically safe/conservative & & well-run.

- This business pays a well-covered dividend.

- This business is presently low-cost.

- This business has a sensible benefit based upon revenues development or numerous expansion/reversion.

Thank you for reading.

Editor’s Note: This post goes over several securities that do not trade on a significant U.S. exchange. Please know the threats connected with these stocks.