skodonnell

Post Function

The ProShares S&P 500 Dividend Aristocrats ETF ( BATS: NOBL) offers equal-weight direct exposure to 66 large-cap business with 25+ year performance history of increasing their dividend payments. NOBL is a popular option for dividend development financiers, with $11.36 in properties under management. Nevertheless, it’s not optimum. Formerly, I revealed issues about development and appraisal and discovered other large-cap dividend ETFs provided a more appealing mix.

Rather of purchasing NOBL and paying its fairly high 0.35% charge each year, I ask readers to think about skimming the list for the highest-potential stocks. To help, I have actually ranked each hanging on 5 elements: development, appraisal, dividends, incomes, and success. I motivate readers to download this interactive workbook that utilizes Looking for Alpha information to see how I shortlisted simply 10 Dividend Aristocrats that I think will outshine moving on. There’s much details to evaluate, so let’s start.

NOBL Analysis

Market Introduction: Recognizing The Benefits And Drawbacks

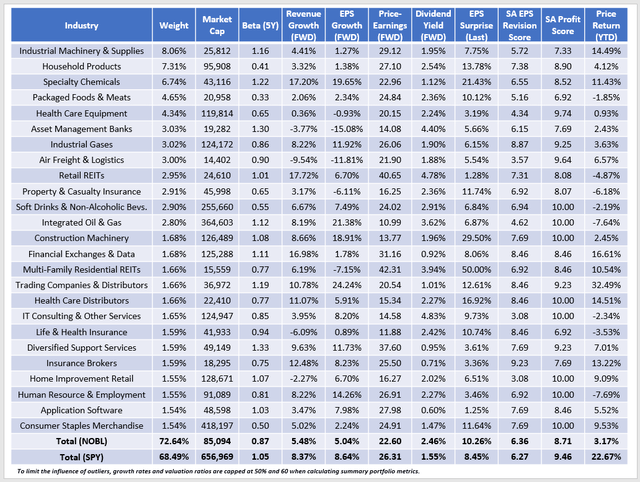

Prior to we start, let me rapidly show NOBL’s problems by comparing its principles to the SPDR S&P 500 ETF ( SPY).

The Sunday Financier/ Looking For Alpha

NOBL picks from the lower end of the S&P 500 Index, as suggested by its $85 billion market capitalization vs. SPY’s $657 billion. Likewise, its 0.87 five-year beta recommends it’s less unpredictable than the more comprehensive market. When it comes to the 5 elements, NOBL has 3-4% less predicted sales and incomes development compared to SPY, trades 3-4 points less expensive on forward incomes and routing capital, yields 0.91% more (0.65% after charges), is a bit below par on success, however has strong incomes momentum (incomes surprises and modifications). It’s impressive how its constituents are underperforming SPY by 19.50% YTD, so that need to provide you a concept of how inadequately the marketplace views these Dividend Aristocrats.

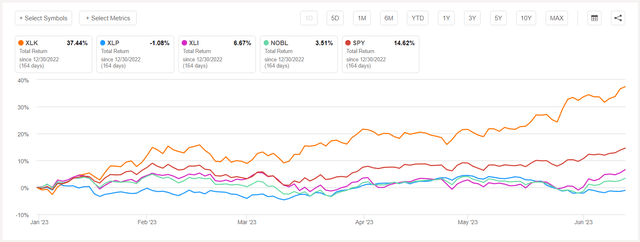

One factor is NOBL’s requirement for more innovation stocks. The 25-year requirement is excessive to conquer, and I anticipate this to remain the exact same for the foreseeable future. Customer Staples and Industrials are NOBL’s biggest sectors at 23% each, and the chart listed below assists discuss why NOBL is routing SPY by 11% YTD.

Element # 1: Development

On the “Weightings” worksheet, I determined and weighted development based upon 12 sub-factors, as follows:

- 5Y Income CAGR: 5%.

- 3Y Income CAGR: 5%.

- TTM Income Development: 5%.

- FWD Income Development: 10%.

- 3Y EBITDA CAGR: 5%.

- TTM EBITDA Development: 5%.

- FWD EBITDA Development: 10%.

- 3Y EPS CAGR: 5%.

- TTM EPS Development: 5%.

- FWD EPS Development: 10%.

- 3Y Overall Properties CAGR: 5%.

- Looking For Alpha Development Rating: 30%.

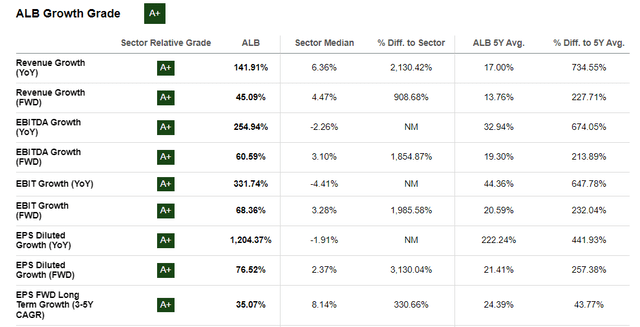

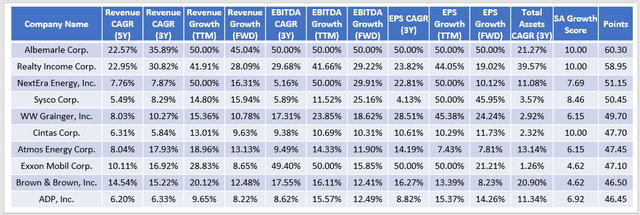

The Looking For Alpha Development Rating is weighted the most due to the fact that it currently includes numerous other sub-factors, functioning as a “check” of sorts. Based upon these weightings, Albemarle ( ALB) scored the greatest. Here is a sample of the metrics Looking for Alpha utilizes to determine the Specialized Chemicals business’s “A+” Development Grade.

Acknowledging that every financier is various and will appoint various weightings than I have, I purposefully made the workbook interactive. Please change these sub-factor weightings as you choose on the “Weightings” worksheet. Later, you can go to the “Development” worksheet and re-rank the Dividend Aristocrats in the last column. I have actually set it up so that the best-ranked business is # 1, and the worst-ranked is # 66. Lastly, to lower the effect of outliers, I have actually likewise set a 50% cap on all development metrics. It’s the exact same method I utilize when determining summary metrics for ETFs, as figures like the above 1,204.37% diluted incomes development can quickly alter outcomes.

I have actually noted the subsequent 9 leading development Dividend Aristocrats listed below. They consist of Real estate Earnings ( O), NextEra Energy ( NEE), Sysco ( SYY), W.W. Grainger ( GWW), Cintas ( CTAS), Atmos Energy ( ATO), Exxon Mobil ( XOM), Brown & & Brown, and Automatic Data Processing ( ADP).

The Sunday Financier/ Looking For Alpha

In overall, these 10 stocks have the list below typical rate attributes:

- YTD Rate Return: 3.25%.

- 3Y Overall Return: 84.84%.

- 5Y Overall Return: 100.30%.

- 10Y Overall Return: 343.64%.

- Rate vs. 50D SMA Rate: 2.73%.

- Rate vs. 200D SMA Rate: 1.56%.

I’ll determine these exact same numbers for the leading 10 business on each element, and we can utilize that details to assist comprehend which aspect is preferred both in the brief- and long term.

Element # 2: Worth

On the “Weightings” worksheet, I determined and weighted worth based upon 8 sub-factors, as follows:

- TTM Price-Sales: 10%.

- TTM Price-Cash Circulation: 10%.

- TTM Price-Book: 5%.

- TTM Price-Earnings: 5%.

- FWD Price-Earnings: 20%.

- TTM Business Value-EBITDA: 10%.

- TTM Business Value-Sales: 10%.

- Looking For Alpha Worth Rating: 30%.

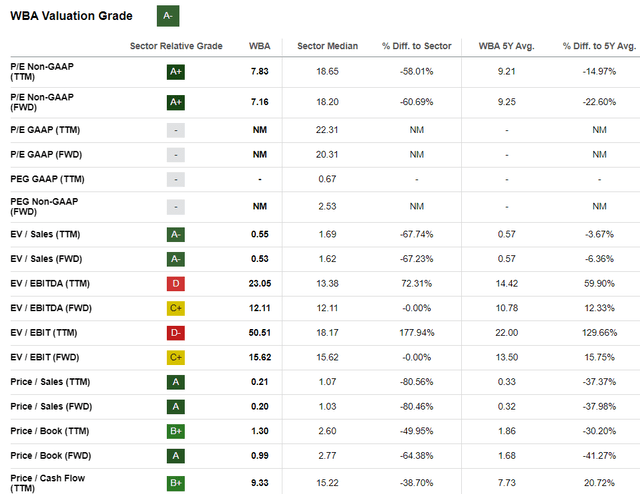

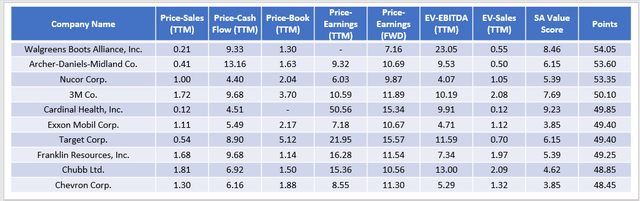

Based upon these elements, Walgreens Boots Alliance ( WBA) was the premier Dividend Aristocrat worth business. Below is a sample of the metrics Looking for Alpha utilizes to determine WBA’s “A-” Appraisal Grade.

I have actually noted the next 9 leading worth Dividend Aristocrats listed below. They consist of Archer-Daniels-Midland ( ADM), Nucor ( NUE), 3M ( MMM), Cardinal Health ( CAH), Exxon Mobil ( XOM), Target ( TGT), Franklin Resources ( BEN), Chubb ( CB), and Chevron ( CVX). I have actually topped these ratios at 60 for appraisal rankings, comparable to Morningstar’s method.

The Sunday Financier/ Looking For Alpha

The rate averages discussed previously for this group of stocks are as follows:

- YTD Rate Return: -5.67%.

- 3Y Overall Return: 82.84%.

- 5Y Overall Return: 53.46%.

- 10Y Overall Return: 116.14%.

- Rate vs. 50D SMA Rate: -0.89%.

- Rate vs. 200D SMA Rate: -3.64%.

These rate data for the top-value stocks are all even worse than the averages for the development stocks. It’s one piece of proof that development stocks are preferred, however especially, the 5- and ten-year overall returns figures are 47% and 227% lower. For that reason, these worth stocks have actually been that method for a long period of time. They might get better, however you might require a long period of time horizon.

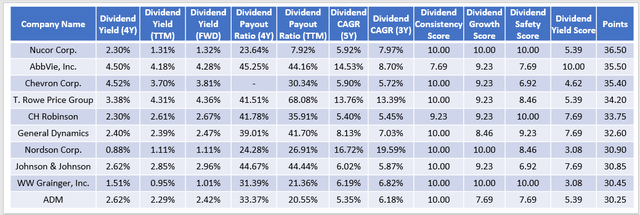

Element # 3: Dividends

On the “Weightings” worksheet, I determined and weighted dividends based upon 11 sub-factors, as follows:

- 4Y Typical Dividend Yield: 5%.

- TTM Dividend Yield: 5%.

- FWD Dividend Yield: 10%.

- 4Y Typical Dividend Payment Ratio: 10%.

- TTM Dividend Payment Ratio: 10%.

- 5Y Dividend CAGR: 10%.

- 3Y Dividend CAGR: 10%.

- Looking For Alpha Dividend Consistency Rating: 10%.

- Looking For Alpha Dividend Development Rating: 10%.

- Looking For Alpha Dividend Security Rating: 10%.

- Looking For Alpha Dividend Yield Rating: 10%.

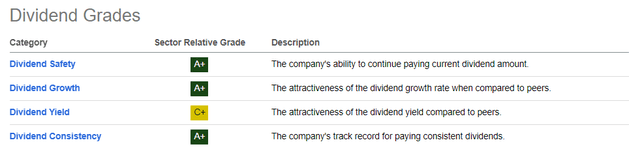

Based upon these elements, Nucor ( NUE) was the premier Dividend Aristocrat dividend business. The list below grades added to this high ranking.

Nucor yields simply 1.32%, however it has a low 7.92% dividend payment ratio, and has actually increased dividends by 7.97% over the last 5 years. These figures may not impress you, however as a suggestion, you can constantly put less focus on the Dividend Grades above in the “Weightings” worksheet. The staying 9 leading dividend stocks are AbbVie ( ABBV), Chevron, T. Rowe Rate Group ( TROW), C.H. Robinson Worldwide ( CHRW), General Characteristics ( GD), Nordson ( NDSN), Johnson & & Johnson ( JNJ), W.W. Grainger, and Archer-Daniels-Midland ( ADM).

The Sunday Financier/ Looking For Alpha

The rate averages for this group of stocks are as follows:

- YTD Rate Return: -1.83%.

- 3Y Overall Return: 85.56%.

- 5Y Overall Return: 71.67%.

- 10Y Overall Return: 214.31%.

- Rate vs. 50D SMA Rate: 0.73%.

- Rate vs. 200D SMA Rate: -1.04%.

There is some overlap in between the dividend and worth elements. Nevertheless, these shorter-term outcomes are much better than the premier worth stocks, so the element deserves some factor to consider. Still, there are some bad entertainers here. In specific, T. Rowe Rate Group and C.H. Robinson Worldwide have actually hardly recovered cost over that duration.

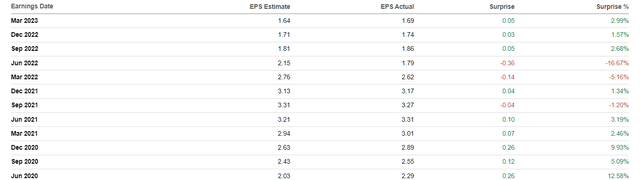

It’s a suggestion that even if a stock appears inexpensively valued does not indicate the marketplace has it incorrect. In T. Rowe’s case, one most likely factor is that the business last reported a double-digit sales surprise 3 years earlier.

It’s difficult to get delighted with outcomes like these, particularly after the big June 2022 miss out on accompanied by $14.7 billion in net customer outflows. The business outshined NOBL post-pandemic through 2021 however lost 42% the list below year. I associate much of this to the uninspired incomes surprise figures above, so let’s include that next.

Element # 4: Incomes

On the “Weightings” worksheet, I determined and weighted incomes based upon 3 sub-factors, as follows:

- Last Quarterly Income Surprise: 25%.

- Last Quarterly EPS Surprise: 25%.

- Looking For Alpha EPS Modification Rating: 50%.

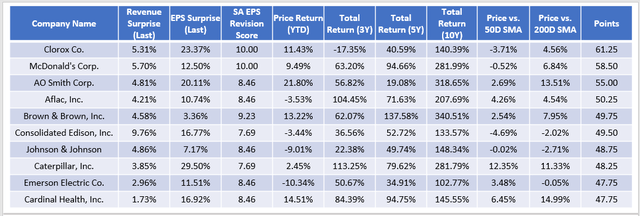

Clorox ( CLX) was the premier incomes stock amongst the Dividend Aristocrats due to the fact that it beat agreement sales and incomes expectations by 5.31% and 23.37% last quarter. McDonald’s ( MCD), A.O. Smith ( AOS), Aflac ( AFL), Brown & & Brown ( BROTHER), Consolidated Edison ( ED), Johnson & & Johnson, Caterpillar, Emerson Electric, and Cardinal Health complete the leading 10 incomes stocks.

The Sunday Financier/ Looking For Alpha

The typical rate metrics you see above are as follows:

- YTD Rate Return: 4.66%.

- 3Y Overall Return: 57.65%.

- 5Y Overall Return: 67.53%.

- 10Y Overall Return: 210.12%.

- Rate vs. 50D SMA Rate: 2.28%.

- Rate vs. 200D SMA Rate: 5.89%.

These are the very best short-term rate metrics yet. It’s not a surprise due to the fact that incomes drive short-term outcomes. I suggest utilizing these data to prevent purchasing business on their method down.

Element # 5: Success

Remember NOBL’s weighted typical 8.71/ 10 Success Rating from the very first table. This rating is just typical, and numerous dividend ETFs, consisting of SCHD, score well above 9/10. Greater success offers business an edge in market recessions. In addition, these business likely have more versatility to increase dividends even when times are difficult. One criticism I have with NOBL is that numerous holdings are sluggish growers. Just 25% have a double-digit five-year dividend development rate compared to 52% for SCHD. NOBL likewise consists of numerous business that apparently raise dividends to keep Dividend Aristocrat status. I choose merit-based boosts, which’s something more typical to highly-profitable business.

On the “Weightings” worksheet, I determined and weighted success based upon 9 sub-factors, as follows:

- TTM Gross Revenue Margin: 5%.

- TTM EBITDA Margin: 5%.

- TTM EBIT Margin: 5%.

- TTM Earnings Margin: 5%.

- TTM Free Capital Margin: 10%.

- TTM Return on Properties: 15%.

- TTM Return on Equity: 15%.

- TTM Return on Overall Capital: 15%.

- Looking For Alpha Success Rating: 25%.

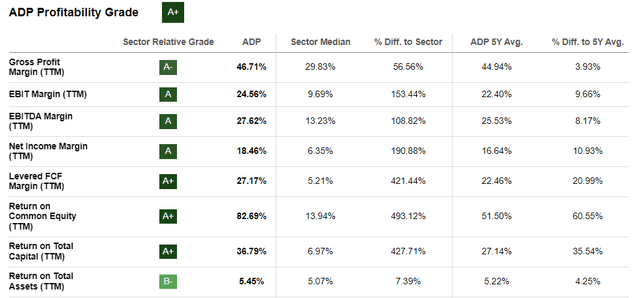

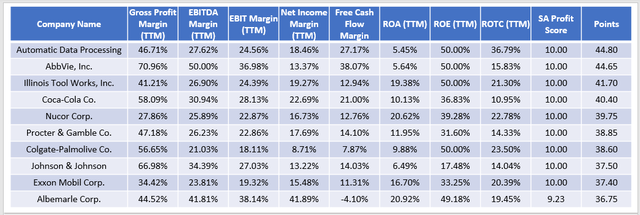

Like the development metrics, I have actually topped numerous success metrics at 50% to restrict the impact of outliers. Under this weighting system, Automatic Data Processing was the premier stock. Here are some metrics Looking for Alpha utilizes to determine ADP’s “A+” Success Grade.

The staying leading stocks are AbbVie, Illinois Tool Functions ( ITW), Coca-Cola ( KO), Nucor, Procter & & Gamble ( PG), Colgate-Palmolive ( CL), Johnson & & Johnson, Exxon Mobil, and Albemarle.

The Sunday Financier/ Looking For Alpha

The rate averages for this group of stocks are as follows:

- YTD Rate Return: -1.47%.

- 3Y Overall Return: 96.79%.

- 5Y Overall Return: 89.27%.

- 10Y Overall Return: 232.22%.

- Rate vs. 50D SMA Rate: 0.94%.

- Rate vs. 200D SMA Rate: -0.47%.

The 232.22% typical ten-year return figure is frustrating however is altered by the 62.14% return for Colgate-Palmolive. This business does not rank extremely extremely on the other 4 elements, so I suggest a multi-factor method when looking for the very best Dividend Aristocrats to purchase. Let’s put all this information together in the last action.

Multi-Factor Rankings

Comparable to what we provided for the sub-factors, we need to appoint weights to the main elements. You might alter these based upon what’s essential to you, however these are my tips provided present market conditions where the development element is preferred.

- Development: 30%.

- Worth: 10%.

- Dividends: 20%.

- Incomes: 25%.

- Success: 15%.

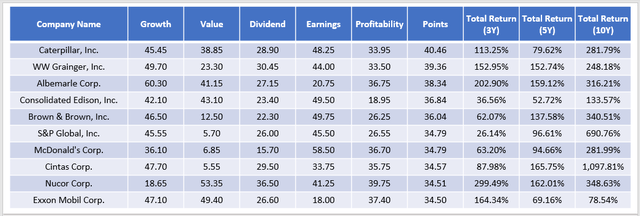

These rankings lead to the following top-ten list, that includes Caterpillar, W.W. Grainger, Albemarle, Consolidated Edison, Brown & & Brown, S&P Global ( SPGI), McDonald’s, Cintas, Nucor, and Exxon Mobil. It is necessary to keep in mind that extremely few of these stocks score inadequately on any single metric.

These 10 stocks have the following overall return data, kept in mind in the last 3 columns:

- 3Y Overall Return: 120.89%.

- 5Y Overall Return: 117.00%.

- 10Y Overall Return: 381.80%.

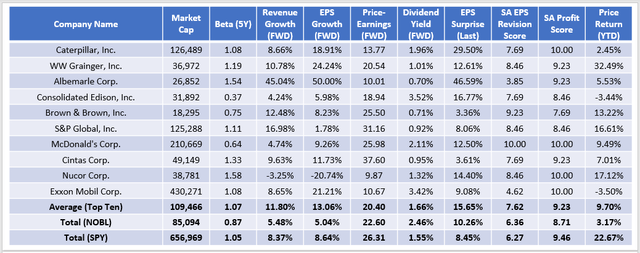

These data are the very best outcomes yet, and what’s important is that we reached this list without thinking about the historic returns themselves. Instead of evaluating for the best-performing Dividend Aristocrats, we let 5 main elements and 43 sub-factors lead us to a list of stocks that likely will be exceptional long-lasting holds. And for those questioning how these 10 stocks compare with NOBL’s general principles, think about these summary metrics listed below:

As revealed, there is enhancement in essentially every classification other than volatility and dividend yield. Nevertheless, buying these stocks conserves NOBL’s 0.35% cost ratio, so the net distinction might not matter much to you. The primary advantages are that these business have significantly more sales and incomes development, trade 2 points less expensive on forward incomes, have much better last quarter incomes surprise and incomes modification figures, and have exceptional success regardless of a reasonably low 15% appointed weighting.

Summary

This short article supplied readers with a structure for examining the strengths and weak points of the 66 Dividend Aristocrats kept in NOBL. I think elements drive efficiency and ought to be the basis of a financial investment instead of historic rate motions. Simply put, by taking this multi-factor method, you can guarantee you’re purchasing a stock for the ideal factors and not exclusively due to the fact that of a long dividend performance history. Regretfully, that’s the only value-add screen NOBL offers, and it’s inadequate.

Lastly, I motivate you to try out the workbook and select the most vital elements for you. No 2 financiers are the exact same, and please let me understand in the remarks area listed below if you would like these metrics upgraded routinely. Thank you for reading.