metamorworks/iStock by means of Getty Images

Financial Investment Thesis

Vermilion Energy Inc. ( NYSE: VETERINARIAN) is priced at about 3x forward totally free capital (” FCF”) – if we presume that in 2024, Europe’s gas reaches around EUR55 MWH. This is a crucial presumption.

What follows is an evaluation of gas as crucial to a transformation that I call the 3Ds. And how Vermilion might take part in this pattern.

Why Purchase Gas?

There are 3 important patterns unfolding worldwide. I call these the 3Ds.

- Deglobalization

- Decarbonization

- Digitalization.

I state upon these at length to Deep Worth Returns members. Here’s the important summary as it relates to Vermilion.

In an unsteady geopolitical background, energy security is not a goal. It’s the political duty of federal governments to guarantee that their people get access to low-cost and reputable energy.

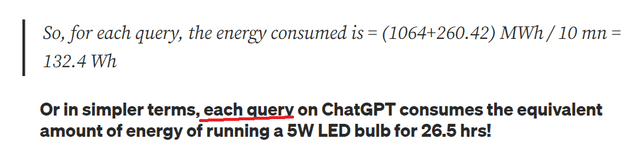

Next, when it comes to ChatGPT there are a great deal of presumptions around. Some presumptions indicate as much as 175K houses worth of energy in one month, to run ChatGPT for a month. While another example states that each inquiry of ChatGPT utilizes considerable quantities of power.

Why do I bring this up? To describe that we require a great deal of electrical energy.

In the coming couple of years, we will see an enormous ramp-up in digitalization. From charging our electrical cars, or EVs, with electrical energy to clever gadgets in our home (for instance, my refrigerator informing me that I have not taken in enough green veggies today), to running AI to improve efficiency.

All the while, we are actively trying to minimize our reliance on coal. Gas has about 40% less carbon than coal. For this reason, making gas is thought about to be a bridge fuel as we make every effort towards net no by 2050. However I’m uncertain that’s grounded in truth. While I’m not an environment activist, some things are simply sound judgment, I desire a much better world.

However regretfully, gas is far more than a bridge fuel. It is among the important parts of our energy shift. Gas and nuclear power are the 2 base load energy that can permit us to welcome periodic renewable resource sources.

The Vital Usage of Gas

A great deal of individuals think that gas is just utilized in winter season. However this is incorrect. Gas is utilized to make electrical energy. Yes, heating, however cooling, too.

Here’s a quote from EIA,

The world deals with a looming ‘cold crunch.” Utilizing ac system and electrical fans to remain cool represent almost 20% of the overall electrical energy utilized in structures worldwide today

Gas is extensively utilized for electrical energy generation. And the more the world digitizes, the more gas (plus nuclear and all other energy sources) we require. The energy shift that’s underway is sluggish.

The greatest usage of petroleum can’t be changed with renewable resource. That’s a truth. You can’t fly/ freight worldwide individuals/ product while bring a windmill on the plane/ship.

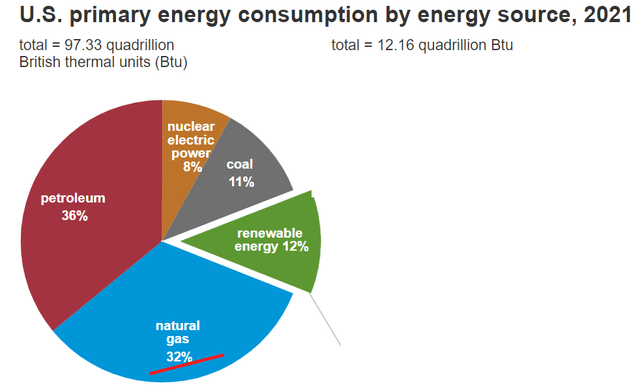

On The Other Hand, for all the sound and capital expense that renewable resource gets, we are discussing 12%. For that to get to double, we are going to need an enormous quantity of financial investment.

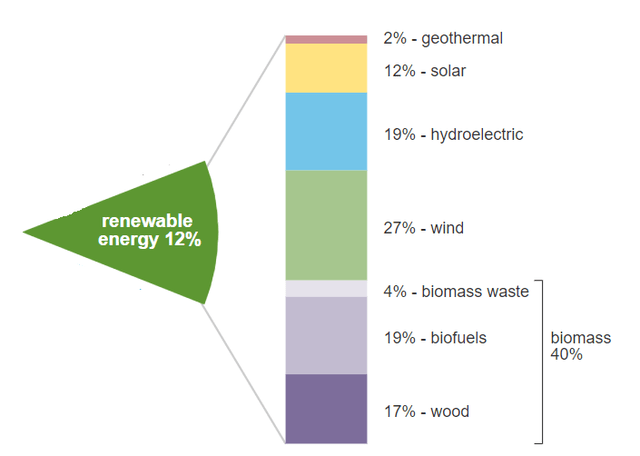

Consider this, more than 50% of the renewable resource the U.S. gets, is from hydropower and biomass (burning wood).

Why Vermilion?

I have actually followed Vermilion for a long period of time. And I think that this management group might not be a few of the very best operators worldwide, and the properties Vermilion holds might not be the very best either, see below.

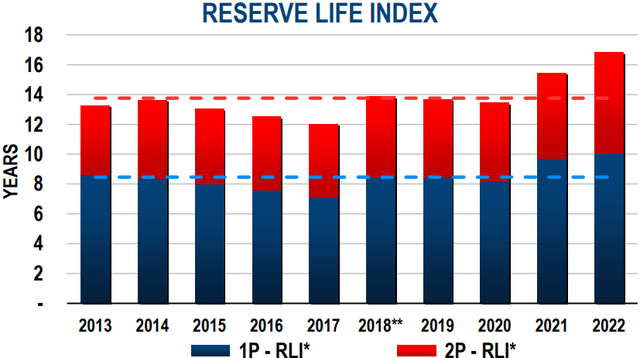

The 1P properties have around 8 years of reserve left. Anything less than 10 positions an issue.

That being stated, as I compose these words, the rate of EU’s gas is around EUR35 MHW. With that in mind, consider this:

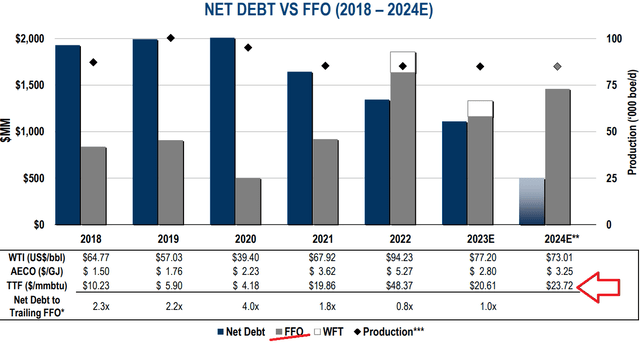

If we presume that next year costs for TTF typical around EUR55 MHW, this would see about CAD$ 1.4 billion of funds from operations.

Deduct away CAD$ 600 million for capex, and Vermilion might see around $800 countless totally free capital in 2024.

This would put Vermilion around 3x next year’s totally free capital.

Now, this is the important presumption. The rate of gas in 2024 is unidentified. I formerly thought that gas costs in 2023 would be greater than they are right now. And although the rate of TTF is leaping greater in the previous couple of days, we are still far from around the EUR50 MWH that we saw in 2021 (pre-Russian intrusion).

The Bottom Line

Vermilion is priced at 3x totally free capital, presuming Europe’s gas reaches around EUR55 MWh in 2024.

This evaluation checks out the significance of gas in the context of the 3 unfolding patterns called the 3Ds: Deglobalization, Decarbonization, and Digitalization.

Energy security ends up being a political duty in an unsteady geopolitical background, and the requirement for electrical energy magnifies as digitalization expands.

Gas plays an important function in our energy shift, functioning as a bridge fuel with lower carbon emissions and matching periodic sustainable sources.

Vermilion, although dealing with obstacles such as diminishing reserves, can take advantage of beneficial gas costs.

Nevertheless, it’s necessary to acknowledge the unsure nature of gas costs in the future, requiring mindful factor to consider of Vermilion Energy Inc. potential customers.