The 4% guideline runs out date, however not in the method you believe it is. It in fact is too conservative.

I’m describing the retirement costs guideline that was made well-known by a 1994 short article by monetary coordinator William Bengen He got to this guideline by taking a look at the historic efficiency of U.S. stock and bond markets, computing what continuous inflation-adjusted quantity you might withdraw from your portfolio each year and, even in the worst case, not lack cash over a 30-year duration.

There have actually been many research studies over the last few years recommending that this 4% guideline is method too expensive. One research study, which I went over last fall, took a look at more history than Bengen, consisting of for non-U.S. markets, and discovered that a 1.9% guideline would be more sensible.

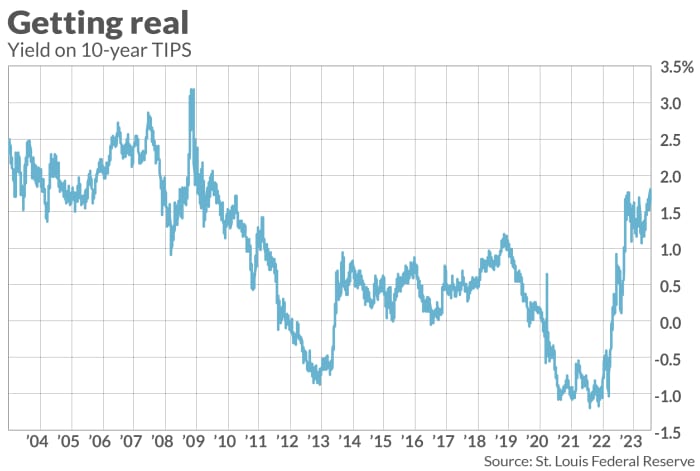

Most importantly, nevertheless, this history does not show what senior citizens can get by purchasing inflation-protected federal government bonds, which are a fairly current production. The very first U.S. federal government inflation-protected bond (IDEAS) was presented in 1997, for instance. Presently, considered that pointers are yielding more than at nearly any other time considering that 2011, you can secure a 4.3% inflation-adjusted costs rate for the next thirty years that is practically ensured.

To evaluate, pointers pay interest above and beyond CPI inflation Presently, for instance, a 30-year pointers yields 1.64%. By purchasing and holding it till maturity, your ensured return is 1.64% much better than inflation, no matter how high or low inflation might be along the method.

The crucial to securing a 4.3% costs rate is to construct a suggestions ladder, with a various bond developing in each year.

Allan Roth, the creator of Wealth Reasoning, a financial investment advisory company, gets the credit for developing this method. In an interview, he informed me that performing the ladder has actually ended up being a lot much easier considering that he presented the method last fall. That’s thanks to a totally free site called TIPSLadder, which enables you to custom-build a theoretical pointers ladder by going into in a variety of specifications– such as the length of time you desire the ladder to last, just how much inflation-adjusted earnings you desire the ladder to produce each year, etc. The site then produces a list of precisely which pointers you require to acquire, together with accurate quantities, which you would then require to your broker to perform.

If purchasing specific pointers bonds of several maturities appears too difficult, you might pay a monetary coordinator to hold your hand while you speak with your broker. Roth informed me that while he does not build pointers ladders, he wants to get on the phone with customers while they speak with their broker, making certain their particular ladders are carried out properly. He informed me that the procedure takes around thirty minutes.

If even that is too difficult, you can hope that a shared fund or ETF gets developed that will permit you to acquire such a ladder with a single deal. Roth just recently started prompting the production of such an automobile, and Morningstar’s John Rekenthaler has actually gotten on board too Nevertheless, Roth informs me that, up until now, he is not familiar with any such fund or ETF that is being prepared.

You might not wish to wait too wish for that to take place, nevertheless. The secret to securing a 4.3% costs rate is that pointers yields remain as high as they are presently. As you can see from the accompanying chart, those yields have actually been a lot lower much of the last 20 years. Over the last 5 years, in reality, they were unfavorable half of the time.

So the marketplaces are offering us an uncommon chance to get the ultimate victory on history.

Mark Hulbert is a routine factor to MarketWatch. His Hulbert Scores tracks financial investment newsletters that pay a flat charge to be examined. He can be reached at [email protected]