Joey Ingelhart

During the last few months, Iâve coated a number of US-based oil and gasoline shale exploration and manufacturing (E&P) firms on Looking for Alpha.

That record comprises bullish articles masking Vary Assets (RRC) and Southwestern Power (SWN) and a cling ranking on Devon Power (DVN).

This week, Iâll flip to Matador Assets (NYSE:MTDR), an E&P that makes a speciality of the western portion of the Permian referred to as the Delaware Basin. The corporate holds 150,000 internet acres unfold throughout Lea and Eddy counties in southeastern New Mexico in addition to around the state line in western Texas.

The Delaware Basin is a prolific, low cost shale area.

Whilst the precise manufacturing combine on this house varies via acreage location, wells within the Delaware portion of the Permian usually produce relatively much less oil and extra herbal gasoline and NGLs than wells positioned within the Midland Basin of the Permian additional to the east in Texas.

In This autumn 2022, 55.8% of MTDRâs overall barrels of oil identical manufacturing was once crude oil with the rest coming from gasoline and herbal gasoline liquids (NGLs). MTDR is a âtwo-streamâ corporate, reporting and providing steering on quarterly oil output whilst merely together with NGLs volumes as a part of the corporateâs reported herbal gasoline output.

The results of the latter coverage is that MTDRâs discovered gasoline costs seem increased than many different manufacturers because of the higher-value NGLs volumes produced and reported as a part of the herbal gasoline movement.

Along with its core upstream manufacturing industry phase, MTDR additionally owns vital midstream infrastructure a lot of it thru a 51%-owned three way partnership (JV) known as San Mateo.

MTDRâs midstream industry is composed of herbal gasoline and oil accumulating pipelines, gasoline processing capability, water pipelines and disposal wells. Accumulating pipelines are small diameter pipes that attach person wells to processing amenities and, in the long run, longer distance pipelines had to shipping commodities to marketplace.

The uncooked herbal gasoline movement constituted of wells is composed of herbal gasoline (methane) in addition to a mixture of different hydrocarbons like propane, ethane and butane recognized jointly as herbal gasoline liquids (NGLs). Processing vegetation are used to split NGLs from the uncooked gasoline movement on the market one at a time, continuously at increased discovered costs than natural methane.

After all, generating shale calls for using one way referred to as hydraulic fracturing. Briefly, this comes to pumping massive amounts of water and sand right into a neatly underneath immense force. This procedure creates cracks or âfracturesâ that facilitate the glide of oil, gasoline and NGLs in the course of the reservoir rock and right into a neatly.

The fracturing procedure calls for a considerable amount of contemporary water, which is briefly provide in sure spaces of america together with the Delaware Basin of the Permian. MTDRâs water-related infrastructure strikes produced water to wells to facilitate fracturing, and gets rid of water that flows again out of a neatly after fracturing for disposal.

The midstream industry is a ways smaller than MTDRâs core manufacturing industry but it surelyâs nonetheless vital for 2 causes.

First, MTDR is in a position to use its personal infrastructure to procedure gasoline it produces, provide water for its drilling operations and accumulate produced oil and gasoline volumes from wells. The other can be for MTDR to pay a 3rd get together for those products and services, which has a tendency to be dearer for the operator than the use of their very own pipeline and processing capability. So, proudly owning midstream property is helping MTDR keep an eye on prices and ensure get admission to to an important infrastructure.

2d, MTDR earns revenues from 0.33 events for using their midstream property. Those are mission-critical products and services and infrastructure for E&Playstation. That is why the earnings movement from midstream property is continuously in comparison to a toll sales space â the extra third-party volumes MTDR handles, the better its charges. By means of the use of a few of its extra midstream capability to serve different firms, MTDR provides an extra, extra strong earnings supply to its source of revenue observation.

No two E&Playstation are alike. Even names that produce in the similar area or box could have other mixes of commodities, charge buildings and hedging insurance policies that experience a dramatic have an effect on on valuations.

Alternatively, thereâs something many US-based E&Playstation proportion presently â restricted anticipated manufacturing development, in particular for crude oil, in 2023. In that regard, Matador Assets sticks out:

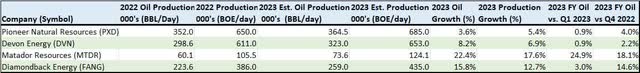

Manufacturing Expansion Estimates for Choose E&Playstation (Bloomberg)

That is a ways from an exhaustive record of US E&Playstation. Alternatively, Iâve incorporated knowledge for Matador Assets in addition to 3 different better E&Playstation with vital publicity to the Permian Basin.

Specifically, my desk comprises knowledge for 2022 oil manufacturing in barrels consistent with day (bbl/day) in addition to overall manufacturing in barrels of oil identical consistent with day (boe/day). Iâve additionally incorporated the mid-point of controlâs most up-to-date steering for full-year 2023 oil, and overall, manufacturing.

The general columns display 2023 manufacturing development in share phrases for crude and on an oil identical foundation. Iâve measured development in comparison to 2022 manufacturing overall in addition to moderate day by day output in This autumn 2022 and Q1 2023.

Maximum US E&Playstation, even the ones generating from the Permian Basin, the cheapest-to-produce shale oil box in america, predict solely modest manufacturing development for 2023.

Thereâs just right explanation why for that:

Increase, Bust and Shareholder Returns

Modest manufacturing development isn’t a damaging. Certainly, many people with revel in looking at the crowd wince on the very considered E&Playstation ramping up their capital spending (CAPEX) looking for manufacturing development.

Consistent with america Power Data Management (EIA), overall US oil manufacturing ramped up from 5.593 million bbl/day in mid-2011 to a height of about 13 million bbl/day in early 2020.

This era marked the shale growth when maximum US manufacturers sought speedy manufacturing development at any charge. Manufacturers have been keen to outspend money flows via borrowing cash, or issuing inventory, to fund increased CAPEX and drilling task.

The end result was once the dramatic development in US manufacturing I simply defined. Alternatively, there was once a heavy charge for shareholders: Maximum manufacturers didn’t generate constant loose money glide or go back vital capital within the type of dividends and proportion buybacks.

There was once quite a few development, however meager profitability.

This shale growth hyper-growth segment started to fall apart as oil costs collapsed beginning in overdue 2014, rendering a lot shale-focused drilling task unprofitable. And by the point of the 2020 COVID lockdown-driven cave in in world call for and commodity costs, the borrow-and-grow technique of the growth years was once already in large part lifeless.

Maximum US manufacturers, in particular better E&Playstation, started switching to another industry style that some have dubbed âShale 2.0.â The speculation is unassuming â moderately than concentrated on development in barrels produced without reference to charge, maximum US shale manufacturers search to maximise loose money glide, environment their capital spending in response to a sober, conservative view of the commodity value outlook and their charge construction.

Many E&Playstation like Devon and Pioneer Herbal Assets (PXD) have additionally unveiled plans to tie shareholder returns at once to profitability, paying a base dividend plus supplemental variable distributions in response to quarterly money flows.

To give protection to money flows, US manufacturers have in large part spoke back to the sell-off in oil and herbal gasoline costs from ultimate yrâs height via reducing their drilling plans for 2023:

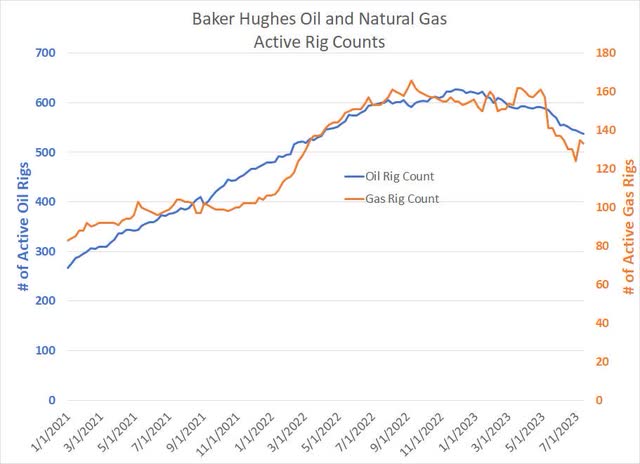

US Oil and Fuel Rig Counts (Baker Hughes, Bloomberg)

This chart displays the collection of rigs actively drilling for oil (blue line) and herbal gasoline (orange line) in america for the reason that finish of 2020. Amid a broader restoration in oil and gasoline costs in 2021-22, US manufacturers ramped up their drilling task, albeit at a extra restrained tempo than was once commonplace sooner than the shale bust.

The herbal gasoline rig rely peaked in September 2022 and manufacturers have shed 33 rigs since that point, identical to just about a 25% decline from ultimate yrâs highs. For oil, the rig rely peaked in November and manufacturers have laid down 90 rigs since that point, a greater than 14% lower.

It takes time for a neatly to be drilled, fractured, and put into manufacturing, so the have an effect on of a falling rig rely, and the related decline within the overall collection of wells drilled and fractured, takes time to turn up within the type of flat-to-falling manufacturing. That lagged have an effect on is the principle explanation why youâre nonetheless seeing some manufacturing development for the full-year 2023 in comparison to 2022 from some US shale manufacturers. Alternatively, take a look at the column in my desk appearing full-year 2023 manufacturing development in comparison to Q1 2023 and development is lower than 1% for each Pioneer and Devon at the oil facet.

Even the 2 manufacturers in my desk appearing significant development in manufacturing this yr â Diamondback (FANG) and Matador (MTDR) â are each making the most of the have an effect on of new acquisitions. Alternatively, in MTDRâs case, the $1.6 billion acquisition of Advance Power Companions finished in mid-April is a extra transformational deal.

As well as, as Iâll give an explanation for in only a second, I be expecting the manufacturing tailwind from MTDRâs Advance acquisition to ultimate thru 2024 as neatly.

Alternatively, simply because MTDR sticks out as an oil manufacturing development tale doesnât imply Iâm converting my method for valuing the E&P.

Loose Money Go with the flow is Nonetheless King

For each and every of the E&Playstation Iâve written about on Looking for Alpha this yr Iâve adopted the similar fundamental procedure, making a style of the corporateâs manufacturing and prices in response to control steering. I then use that style to estimate doable loose money glide in response to conservative commodity value projections and use the ones estimates to derive a reduced money glide goal for the inventory.

Simply because MTDR is rising manufacturing adjustments little â Iâm nonetheless searching for successful manufacturing development that may make stronger the next valuation for the inventory.

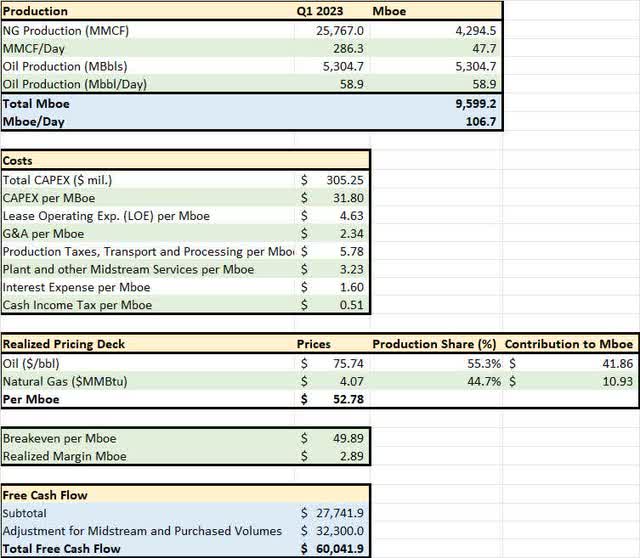

So, letâs get started with a take a look at MTDRâs ends up in Q1 2023:

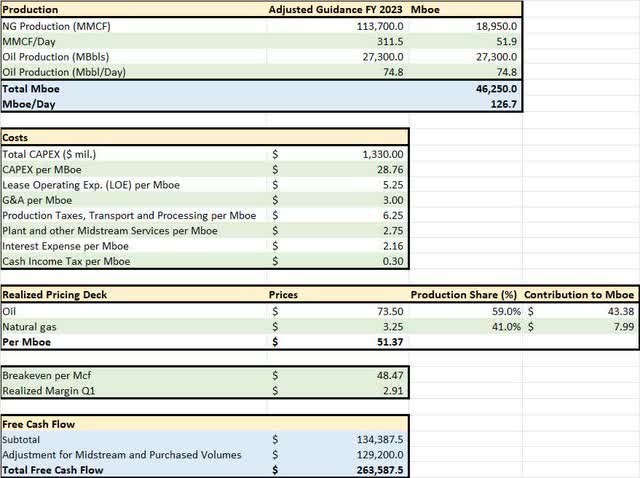

MTDR Q1 2023 Loose Money Go with the flow Fashion (MTDR Q1 2023 Effects, 10-Q and Presentation Slides)

This desk lays out MTDRâs ends up in Q1 2023.

A couple of issues to notice right here. First, MTDR introduced the purchase of Advance Power Companions on January 24, however the deal didnât shut till April 13, after the tip of Q1 2023. So, the consequences introduced for Q1 come with no volumes from Advance.

2d, as I famous previous, MTDR has two industry segments, the upstream E&P industry and the midstream pipelines and processing industry. Whilst MTDR breaks out capital spending and bills associated with its midstream industry, itâs difficult to split those two companies for research as a result of theyâre so built-in â MTDRâs upstream industry advantages from its possession of midstream property and the mum or dad corporate additionally advantages at once from third-get together midstream revenues.

So, each items of MTDRâs industry are coated in my desk above.

Letâs run thru one of the crucial extra vital line pieces within the desk.

The highest segment offers with MTDRâs Q1 2023 manufacturing with regards to oil and herbal gasoline volumes produced; as I famous previous, MTDR comprises NGLs volumes as a part of the gasoline manufacturing movement. Iâve additionally reported overall Q1 2023 manufacturing within the type of barrels of oil identical (BOE), the use of the normal conversion issue of six thousand cubic toes of herbal gasoline to 1 barrel of crude oil.

Additionally, via conference, Iâm the use of the Roman numeral âMâ to indicate 1,000 and âMMâ for 1 million (1,000 instances 1,000 equals 1 million).

In Q1, just a little over 55% of MTDRâs output was once crude oil with the remainder from herbal gasoline, which in MTDRâs case way herbal gasoline and NGLs.

The second one segment of the desk gifts the corporateâs prices. CAPEX of $305.25 million in Q1 2023 is composed basically of the price of drilling and finishing (fracturing and hanging into manufacturing) new wells with solely round $14 million directed at spending associated with the corporateâs midstream property. Iâve additionally reported that CAPEX on a $/boe produced foundation â MTDRâs Q1 2023 CAPEX involves $31.80 consistent with boe.

Hire running bills (LOE) are prices related to keeping up and generating oil, and gasoline from present wells. Manufacturing taxes, transportation and processing would come with taxes paid in response to the worth of oil and gasoline constituted of wells (no longer source of revenue taxes) in addition to the price of transporting commodities to marketplace and cash paid to procedure herbal gasoline into methane and barrels of NGLs.

Youâll additionally observe that further line merchandise titled âPlant and Different Midstream Services and products.â Those are basically the prices of working the corporateâs processing vegetation and keeping up its present base of accumulating pipelines and connected apparatus. Whilst this does indirectly relate to MTDRâs core industry of manufacturing and promoting oil and gasoline, itâs nonetheless vital â a few of this charge may well be attributed to dealing with MTDRâs produced volumes whilst some can be in make stronger of third-party volumes and generates actual midstream earnings and source of revenue for MTDR shareholders.

The rest prices are most likely acquainted to maximum traders together with common and administrative (G&A) bills, hobby bills and source of revenue taxes, all expressed on a $/boe foundation.

The 0.33 segment of my desk displays the real discovered costs MTDR won for its oil and gasoline manufacturing in Q1 2023.

The corporate discovered a worth of $75.74/bbl for its oil output in Q1; since MTDR had no vital oil hedges in Q1, thatâs the real value it won and not using a hedge adjustment.

For gasoline, the corporateâs unhedged value was once $3.93/Mcf with hedges boosting that to $4.07/mcf. If that appears just a little prime relative to depressed gasoline futures costs in Q1 2023 recall that MTDRâs reported gasoline volumes additionally come with some NGLs pricing uplift; in Q2 2023, MTDR guided for its gasoline volumes to promote for a top class of between +$0.25/mcf and +$1.25/mcf to benchmark Henry Hub gasoline costs.

To create a discovered value with regards to barrels of oil identical, I merely multiplied discovered costs via their relative proportion of Q1 2023 manufacturing.

Placing this all in combination, the sum of all money prices â basically for the E&P phase but additionally vital sums for the midstream industry as I simply defined â involves $49.89/boe in Q1 2023 in comparison to a discovered value of $52.78/boe and a money margin of $2.89/boe. Multiplying that margin via overall manufacturing yields a coarse estimate of loose money glide of $27.75 million in Q1.

Alternatively, recall that this money glide breakeven comprises some prices associated with the midstream phase. In the meantime, my calculation of revenues from oil manufacturing â BOEs of manufacturing produced multiplied via discovered pricing â comprises not one of the revenues related to dealing with third-party midstream volumes. The ultimate strains modify loose money glide for midstream cashflow and bought volumes, which represents herbal gasoline MTDR purchases and resells at a markup.

All advised my Q1 2023 loose money glide estimate is ready $60 million.

Loose money glide isnât a GAAP measure, so other firms outline it in several techniques. Alternatively, MTDR reported Q1 2023 loose money glide of $57.24 million and a few analysts on Wall Boulevard calculated Q1 2023 FCF as prime as $63 million in response to the similar file. So, this style seems to be a just right approximation.

Letâs step the research ahead for 2023 as a complete.

Money Go with the flow Fashion for 2023

As I famous previous, MTDRâs acquisition of Advance Power Companions was once introduced again in January and closed in mid-April.

Throughout the corporateâs This autumn 2022 profits name hung on February 21, 2023 control presented some steering for 2023 manufacturing and prices that incorporated the deliberate ultimate of this deal in Q2 2023.

By the point the corporate reported Q1 2023 effects on April 25, MTDR had solely owned Advance for approximately two weeks. Control did be offering some extra qualitative updates to its 2023 steering, however didnât trade the real outlook steering desk for 2023.

So, to start out I constructed a easy style for 2023 money flows in response to that steering; later, Iâll modify a few of these assumptions in response to controlâs extra qualitative remarks at the Q1 2023 name:

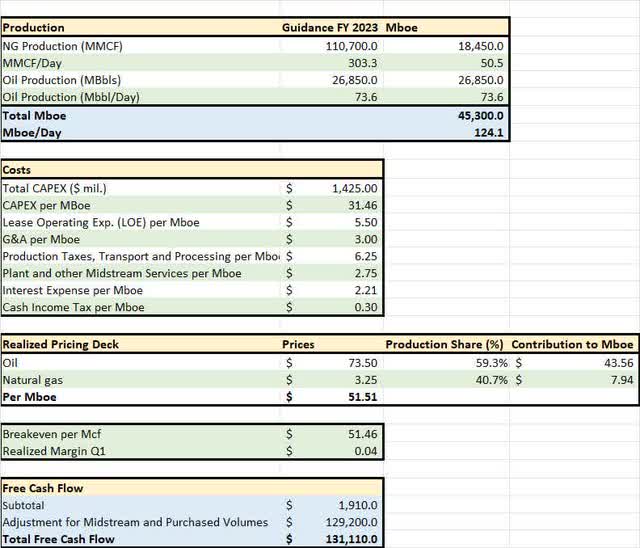

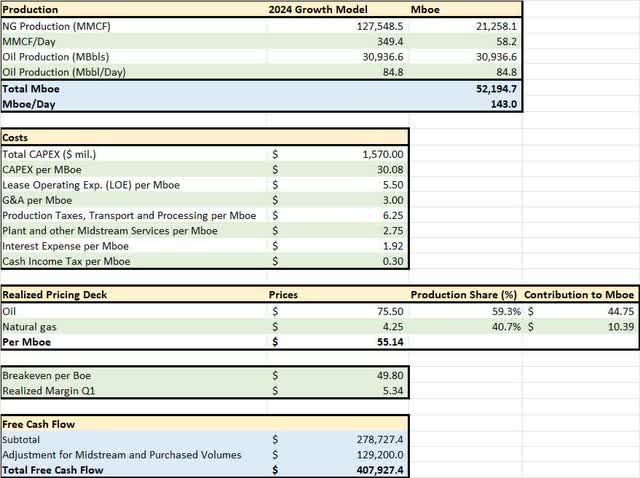

MTDR Loose Money Go with the flow Fashion for 2023 (MTDR Q1 2023 Income Press Unlock)

This desk makes use of the similar structure to that introduced for Q1 2023 above, so the road pieces will have to be in large part acquainted.

The manufacturing and value estimates have been maximum lately introduced within the corporateâs Q1 2023 profits presentation in April; alternatively, as Iâve defined, the steering was once unchanged from the unique steering issued in overdue February.

A couple of issues bounce out from this slide. Firstly, whilst crude oil accounted for just a little over 55% of Q1 2023 volumes, that is anticipated to extend to just a little over 59% for full-year 2023 manufacturing. The principle explanation why is that wells at the got Advance acreage, the place MTDR is focusing a great deal of its 2023 spending, have just a little increased oil minimize â share of manufacturing thatâs crude â than the typical MTDR neatly throughout its acreage.

Advance has about 18,500 internet acres positioned as regards to or contiguous with MTDRâs present acreage within the core of the Northern Delaware Basin. At the corporateâ Q1 presentation, MTDR reported a neatly positioned close to Advanceâs present acreage that produced 89% oil in its first 30 days of manufacturing, which is definitely above MTDRâs moderate oil minimize.

Additionally, whilst reserves are a less than excellent information to manufacturing percentages, about 73% of Advanceâs reserves are oil in comparison to 56% for MTDR as of December 31, 2022 sooner than the purchase.

Additionally remember that 2023 steering comprises one complete quarter with out Advanceâs oily output and just a little underneath 3 quarters with Advance. So, when stepping ahead to imagine 2024 output, when all 4 quarters would come with wells on Advance acreage, itâs logical to be expecting the next oil minimize. That is advisable as a result of extra oil manufacturing boosts the worth of a barrel of oil identical produced.

Iâve bumped up MTDRâs money hobby expense in comparison to Q1 to replicate the extra debt â a draw on MTDRâs revolving credit score line â the corporate took on to procure Advance. The corporate plans to prioritize reimbursement of debt associated with the deal the use of to be had loose money glide; MTDR estimates it is going to pay off about $700 million price of borrowing via year-end 2024, bringing overall debt again to just a little underneath $1.2 billion.

For the discovered pricing deck, MTDR has no final oil or herbal gasoline hedges for 2023.

MTDR doesnât supply pricing bargain estimates for the entire of 2023, however control did be offering steering for Q2 2023. The midpoint of that steering is for herbal gasoline manufacturing to promote at a $0.75/mcf top class to Henry Hub (NYMEX) benchmarks and for crude oil at a bargain of $1/bbl to West Texas Intermediate (WTI).

To derive my discovered pricing steering for 2023, I blended precise pricing reported for Q1 2023, the real moderate pricing for WTI and Henry Hub herbal gasoline in Q2 2023 (April, Would possibly and June averages in response to day by day pricing knowledge). I then carried out the Henry Hub gasoline pricing top class and WTI pricing bargain I simply defined.

For the stability of 2023 I used moderate costs up to now in July coupled with the calendar strip for the ultimate 5 months of the yr, the use of the similar pricing reductions I defined for Q2 2023. The strip is not anything greater than the typical value of oil and gasoline futures for supply within the months of August-December 2023.

After all, to account for the midstream industry I merely annualized the money glide adjustment I utilized in Q1 2023.

All advised, in response to those estimates I derive a coarse money glide estimate of about $131 million for 2023. Thatâs just a little underneath the midpoint of Wall Boulevard consensus estimates for the yr; consistent with Bloomberg, the bottom loose money glide estimate for 2023 is $65 million and the best is $416 million.

Briefly, in response to the midpoint of steerage, MTDR will battle to generate vital further loose money glide in 2023 â my modeled FCF of $131 million works out to a loose money glide yield of round 2.1% in response to the present value of the inventory. Weak spot in loose money glide is because of a mix of the drop in commodity costs and better CAPEX and running bills because of industry-wide charge inflation and the want to layer in more spending to make stronger the got Advance acreage.

The excellent news is that I see vital upside to those estimates for the stability of 2023 and important development over the following few years even on conservative pricing assumptions.

Conservative Steering

As I defined previous, MTDR revealed its first steering for 2023 manufacturing and prices in overdue February. This was once after the corporate introduced the Advance acquisition however sooner than the deal closed in mid-April. The corporate did come with the have an effect on of the deal on its 2023 steering even though, at the moment, the precise ultimate date of the deal was once unknown, so steering may well be regarded as initial.

By the point of the corporateâs Q1 2023 convention name on April 26, the Advance deal had closed however MTDR had solely owned Advance for approximately two weeks. Control didn’t replace their steering desk, even though they did come with a line within the presentation slide that they be expecting overall estimated 2023 manufacturing to be âclose to the prime finishâ in their up to now issued steering.

Apparently the loss of new, increased steering dissatisfied some on Wall Boulevard.

Control was once requested for added information about doable manufacturing development in 2023 and 2024 a number of instances throughout the Q&A portion of the decision; as well as, regardless of better-than-expected Q1 2023 manufacturing and effects, the inventory bought off 3.55% within the first buying and selling day following its Q1 2023 unencumber.

Whilst the SPDR Oil & Fuel Exploration and Manufacturing fund (XOP), a broadly adopted trade traded fund (ETF) that tracks the crowd, was once additionally down via 1.75% at the identical day, MTDR stocks nonetheless underperformed.

Regardless, if you happen to care to learn between the strains of the Q1 convention name, there was once encouraging information on prices and manufacturing development.

The first actual query at the name coated controlâs steering for drilling and final touch (D&C) prices in 2023. In particular, the corporate guided for full-year D&C prices of $1,124 consistent with foot of neatly period.

Have a look at my money glide fashions above, and also youâll see that CAPEX is the only greatest charge for MTDR similar to maximum different E&Playstation. And the only greatest part of CAPEX is the price of drilling, fracturing, and hanging new wells into manufacturing in the course of the yr â that is all summarized via that an important D&C charge consistent with foot steering.

Here is the reaction from the Co-Leader of Operations, Chris Calvert:

And, yeah, so the $1,124 that you simply discussed, that was once our full-year information, and that was once with a ten% to twenty% build up from provider charge inflation. That we in point of fact got to work on in December of ultimate yr. And so, we didn’t put the rest out publicly, however our D&C charge consistent with foot for this quarter surely got here in underneath that; they got here in round $1,014 consistent with foot, so we have been happy with the place we have been, and the ones efficiencies have been thru discounts in drill instances, Simul-Frac, faraway Simul-Frac.

We had roughly — in 2022, we had mainly used Simul-Frac on about 45% of our wells. We put a goal to make use of over 1/2 of our wells in 2023 to be Simul-Frac, and within the first quarter we beat that. And so, numerous this potency has come from aid at the drilling instances, higher use of Simul-Frac, higher use of twin gas. So, we are surely extraordinarily excited and happy with the paintings that we did at the capital potency facet in decreasing the ones D&C charge consistent with foot.

However something I wish to point out, at the provider charge facet, we in point of fact have not observed rather then small charge elements reminiscent of diesel gas that you simply and I spoke about in earlier conversations. We in point of fact have not observed prices come down all that a lot from the seller facet. Now we have a few our heavy-components on each drilling and final touch that have been in fact up quarter-over-quarter from the fourth quarter of 2022 until nowadays, or until the primary quarter of ’23. And so numerous the ones financial savings, in point of fact most commonly all of the ones financial savings were thru efficiencies. And that is the reason decreased drill instances, going again reusing present pads at the manufacturing facility facet, higher use of twin gas, greater partnerships with third-party operators and in particular San Mateo on the subject of water utilization, and getting greater charges on our water for stimulations. And that is the reason — we lean on our partnership with San Mateo for that.

And so it in point of fact has been a push from the operations crew to mitigate the ones provider charge inflations that now we have observed. However, like we are saying, it is in point of fact one quarter’s price of labor. And so, whilst we are happy with the place we’re, we nonetheless have so much to do on this yr. And so, the $1,124 that we put ahead within the capital steering plan, that was once put ahead in December. And we are nonetheless proud of the place that quantity is, however we are extraordinarily happy with the place we got here in within the first quarter.

Supply: MTDR Q1 2023 Income Name Transcript

Merely put, in Q1 2023, D&C prices consistent with foot got here in about $110 consistent with foot underneath the corporateâs full-year 2023 steering. Successfully what that implies is that MTDR can drill the similar collection of wells with much less CAPEX or drill extra wells, and most likely generate extra manufacturing development, with an identical quantity of CAPEX.

Even greater, this was once no longer because of a decline within the charges drilling products and services firms fee for his or her paintings and gear. Quite, the better-than-expected prices have been because of larger potency and using new neatly designs that minimize the period of time had to drill and whole a neatly.

There are a variety of elements to those potency positive aspects. One is whatâs known as âSimul-Frac.â As I discussed previous, shale wells will have to be fractured sooner than theyâre put into manufacturing, a procedure that comes to pumping basically water and sand into the neatly underneath force. This procedure is completed in levels around the period of the manufacturing horizontal phase of a neatly.

Simul-Frac necessarily comes to fracturing two horizontal wells on the identical time (concurrently) moderately than in series, the use of a unmarried fracturing fleet. A fracturing fleet is a choice of pumps, vehicles, crews and different apparatus used to fracture a neatly.

The advantage of this procedure is that it takes much less time to finish wells. That interprets to much less charge consistent with neatly and it cuts the time required from drilling a neatly to first business oil manufacturing. In 2022, MTDR fractured about 45% of its wells the use of this system and steering was once in response to greater than 1/2 in 2023 as a complete; in Q1 2023 the corporate has already exceeded that steering.

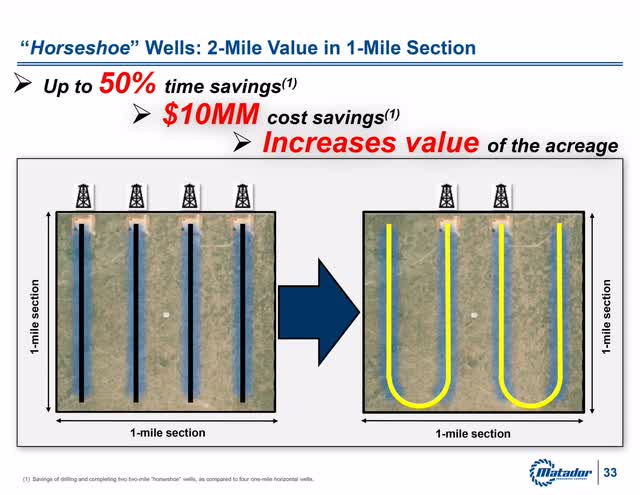

A 2d instance is what the corporate calls âHorseshoeâ wells. Right hereâs an invaluable representation from controlâs presentation at the once a year shareholderâs assembly on June 9.

An Representation of Horseshoe Neatly Design (MTDR Annual Shareholder Presentation)

Principally, a shale neatly in most cases comes to drilling a vertical phase right down to the productive reservoir rock after which sideways in the course of the reservoir. On a sq. mile segment of acreage, as a substitute of drilling 4 horizontal wells, MTDR has been experimenting with drilling two U-shaped (horseshoe formed) wells.

This protects money and time. For instance, while you drill a horizontal neatly it’s possible you’ll drill vertically down after which drill a 1 mile+ lengthy lateral segment. By means of reducing from 4 wells to 2 wells, you cut back the collection of vertical sections of neatly via one-half, which saves on the price of metal pipe.

That is not anything completely new â different operators have used horseshoe wells â and it might probablyât be used throughout all MTDRâs acreage; alternatively, the corporate estimates $10 million in charge financial savings from drilling two U-shaped wells in comparison to 4 one-mile-long horizontal wells.

Those incremental efficiencies and enhancements to neatly design are an important as they cut back prices, bettering capital potency. Briefly, they cut back the numbers within the expense segment of my money glide fashions and reduce the commodity costs wanted for an organization like MTDR to supply loose money glide.

On most sensible of this, take into account the corporateâs capital and expense steering assumed 10% to twenty% industry-wide charge inflation. That was once the norm ultimate yr as prime commodity costs boosted call for for drilling, fracturing and different products and services associated with drilling and finishing wells. Carrier operators like Halliburton (HAL) higher the costs they charged accordingly.

MTDR signifies that this provider charge inflation persevered in Q1, but it surely was once in a position to accomplish greater than anticipated thru “self-help” within the type of the potency enhancements I simply defined.

A broader decline in charge inflation is a 2d doable tailwind this yr. As I defined previous, we’ve got observed a persevered decline in drilling task since Q1 2023 and thatâs beginning to lead to some stories of decreased provider charge inflation around the {industry}. No doubt, some prices, reminiscent of the cost of diesel gas have moderated from ultimate yrâs highs.

Final analysis: While you couple potency enhancements with the potential of provider charge inflation closer the low finish of MTDRâs +10% to +20% 2023 steering, I consider MTDR is prone to see prices underneath the midpoint in their steering vary for the yr as a complete.

So, letâs flip to the manufacturing facet of the equation. MTDR beat their Q1 2023 manufacturing steering via about 6% and guided Q2 manufacturing development estimates increased; alternatively, as I discussed previous, they didnât trade their full-year 2023 steering.

This was once the topic of numerous dialogue at the name.

CFO Brian Willey had this to mention about MTDRâs manufacturing development this yr:

That is Brian Willey, Leader Monetary Officer and President, and I am satisfied to reply to your query, and thank you for becoming a member of the decision nowadays. We’re in point of fact occupied with the Advance property. So, very strategic, nice property, easiest are compatible into our present property. And so we are overjoyed about them, and they’ve produced greater, I feel within the first quarter than we anticipated. As a reminder, we do not get credit score for that manufacturing but, as a result of we did not personal the property. However we’re excited and inspired via the truth that they produced greater than we idea.

And so, now we have had, I suppose, keys to the auto now for a few weeks, and so nonetheless early on as we power the auto right here. However we’re occupied with it. I feel, in reality, we will be able to — I will be able to flip to Chris in a minute, however I feel our completions crew began the day gone by. We switched out their completions crew to ours, and we are beginning to whole the wells. And the 21 wells you discussed, we do be expecting roughly the second one 1/2 of the yr, the ones will come on. More or less in that 0.33 or fourth quarter, as you stated. After which, as we glance to subsequent yr. Now we have 49 overall wells which are going to be in growth on the finish of the yr. 21 of the ones are going to be the wells that we are recently drilling at the Advance acreage and can be finishing later this yr. So, we think the ones to return on early subsequent yr. On the finish of the yr, we are going to finally end up with 143,000 or so on a run price. And that is the reason an excellent run price as we roughly cross into subsequent yr, and the ones 49 wells in growth will simply upload to that, together with the 21 wells which are at Advance.

So, we are in point of fact occupied with 2024. Should you take a look at simply evaluating 2022 to fourth quarter, to 2023 to fourth quarter, on a real simply BO foundation, so an oil-only foundation, that is a 40% development is what we think. And so, that units us up in point of fact neatly for an excellent 2024, each on a BO foundation, on an oil foundation, after which simply additionally on a complete BOE foundation.

Supply: MTDR Q1 2023 Income Name Transcript

Merely put, the CFO famous the corporate had solely owned the Advance acreage for approximately two weeks on the time in their name and so they have been early in integrating the corporateâs operations. Specifically, on the time of the April name, the corporate was once finishing an enormous bundle of 21 Advance wells; control famous that MTDR hasn’t ever finished greater than 13 to fifteen wells at a time.

Those wells are because of get started generating oil in Q3 or This autumn of this yr. The precise timing was once nonetheless just a little unsure and that by myself could have an important have an effect on to their annual steering; finally, if a neatly comes on-line in overdue October moderately than overdue September, thatâs about 30 days much less manufacturing incorporated in 2023 totals.

On most sensible of that, the corporate is drilling an extra 21 neatly bundle that is meant to return on-line via early 2024; alternatively, as soon as once more, the timing of the ones completions is an important. If a few of the ones wells cross into manufacturing in December as a substitute of January, that may actually have a vital have an effect on at the corporateâs 2023 manufacturing totals.

Briefly, apparently control was once being conservative via no longer boosting steering, particularly given the truth theyâd simply finalized the Advance acquisition. In reality, thatâs same old observe for MTDR as the corporate has constantly exceeded their up to now revealed quarterly manufacturing steering during the last two years.

A 2d query in regards to the corporateâs steering won an much more direct reaction in a while within the name:

Good day, Neal, it’s Glenn Stetson, EVP of Manufacturing. Yeah, thank you for the query. So, Brian discussed it, however now we have been on the helm, so that you can discuss, or within the motive force’s seat for a few weeks. So, give us just a little time, and I feel we’re going to have a pleasant replace for you in July. However we are inspired up to now, each via the prevailing manufacturing and the way the ones wells have been doing the day we took over, and that every one went in point of fact easily.

Supply: MTDR Q1 2023 Convention Name Transcript

Merely put, MTDR strongly hints they plan to replace their steering throughout their Q2 2023 profits unencumber and convention name scheduled for July 26.

I see this as an important doable upside catalyst for the inventory within the near-term as even a modest trade to CAPEX and manufacturing steering may have an important have an effect on at the corporateâs near-to-intermediate time period loose money glide outlook.

Adjusting the 2023 Fashion

Granted, none of that is concrete and there aren’t any certainties in monetary markets.

Alternatively, in my revel in control groups now and again attempt to supply extra delicate steering throughout convention calls that may assist analysts modify their estimates. The feedback Iâve simply defined counsel thatâs the case right here.

So, letâs take a 2d take a look at that 2023 money glide style with some adjusted estimates:

MTDR Adjusted 2023 Loose Money Go with the flow Fashion (MTDR Q1 2023 Steering, Creator’s Estimates)

This is similar style I introduced previous apart from Iâve higher the manufacturing steering from the midpoint of controlâs vary to the prime finish. As well as, I decreased the CAPEX and LOE estimates to the low finish of prior steering; observe this nonetheless assumes 10% general provider charge inflation for 2023.

The hot button is this modest adjustment coupled with the similar commodity value estimates just about doubles the tough money glide estimate to $265 million for 2023.

Much more spectacular is the implication for 2024 and past.

A Glance Forward

Throughout the Q1 2023 name, control additionally declined to supply explicit development steering for 2024 manufacturing (subsequent yr) even though they have been requested, in a technique or any other, via two other analysts at the name.

Alternatively, they did be offering just a little of observation across the outlook.

First up, MTDR expects the go out price of manufacturing in This autumn 2023 to be 143,000 Boe/day. Despite the fact that MTDR simply holds manufacturing at that This autumn 2023 go out price that annualizes to about 52.2 million barrels of oil identical in 2024 in comparison to the midpoint in their 2023 steering at 45.3 million Boe in 2023, a year-over-year development in manufacturing of 15.2% for subsequent yr.

2d, control indicated it hopes so that you can do extra than simply cling manufacturing consistent subsequent yr at that 2023 go out price. Additional, while you imagine MTDR already has an enormous 21 neatly bundle because of come on-line via early 2024 as I defined previous, it sort of feels manufacturing momentum, a minimum of early within the yr, can be robust.

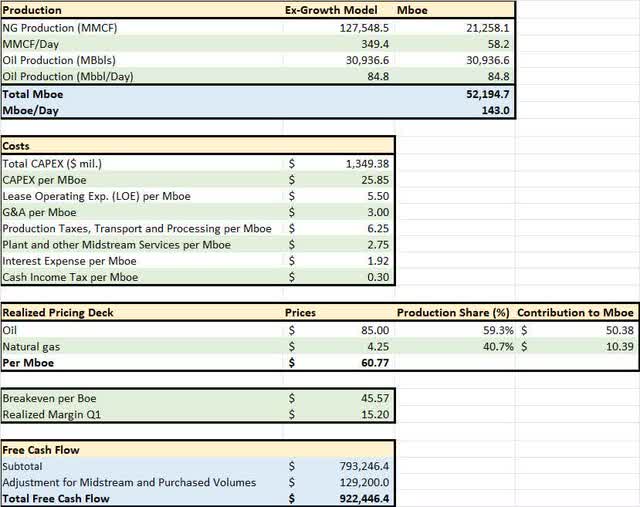

So, letâs run the style for 2024, plugging in some tough estimates in response to MTDR’s 2023 manufacturing go out price:

MTDR Loose Money Go with the flow Fashion for 2024 (MTDR Q1 2023 Steering, Creator’s Estimates)

As you’ll see, for the manufacturing estimates within the most sensible segment Iâm simply assuming MTDR is in a position to stay its manufacturing consistent on the This autumn 2023 go out price, which turns out conservative in response to controlâs observation.

I additionally boosted the CAPEX estimate for 2024 via 10% from this yrâs midpoint to $1.570 billion, which assists in keeping the CAPEX consistent with Boe round $30 consistent with barrel all-in.

For discovered costs, the 2024 herbal gasoline calendar strip â the typical value of gasoline futures for supply each month of subsequent yr â is $3.50 and Iâm making use of the similar $0.75 value top class (because of NGLs content material) used this yr pushing the discovered value to $4.25/mcf.

For oil, I simply penciled within the contemporary ultimate value much less $1/bbl. A deep dive into the commodity outlook is just a little past the scope of this text, even though I lately defined a few of my ideas in a work right here on Looking for Alpha titled âOilâs Recession Caution.â

To summarize, oil costs are neatly off their 2022 highs basically because of fears of a possible demand-chilling world financial downturn. Alternatively, consistent with World Power Company (IEA) estimates, Saudi Arabia wishes Brent oil costs north of $80/bbl simply to stability its funds and the rustic has been reducing output to prop up costs. Long term, I consider oil will want to industry round $90/bbl to incentivize ok provide to fulfill call for in a standard financial setting.

Since WTI has usually traded at a kind of $5/bbl bargain to Brent, that works out to a long-term oil value estimate of $85+/bbl. I feel thatâs conservative and, after all, the $75.50/bbl estimate Iâve plugged into my style for subsequent yr is much more conservative.

The hot button is that the use of those assumptions, MTDR may just simply be anticipated to supply over $400 million in loose money glide for 2024 as I illustrate within the desk above.

The possible upside for money flows over the long term is much more spectacular. If we use those identical assumptions apart from lift our oil value assumption for 2024 from $75.50 to $85/bbl, loose money glide implied via this style jumps to greater than $700 million. And if we think manufacturing development of 20% in 2024 year-over-year relative to this, a slight bump from assuming flat manufacturing on the This autumn 2023 moderate stage, loose money glide climbs to $800+ million.

Itâs additionally vital to take into account that MTDRâs CAPEX is prime relative to a lot of its friends on a $/boe foundation.

For instance, Devon Power has vital operations within the Delaware Basin of the Permian and in Q1 2023, the corporate reported it spent $572 million in CAPEX attributed to this area by myself. In the similar quarter, DVN produced 415 MBoe/day from its Delaware Basin Acreage. That works out to about $15.30 consistent with boe in CAPEX in comparison to greater than $30/boe for MTDR in my style above.

There are a couple of causes for that. One is that thereâs an outdated rule of thumb within the industry that itâs more straightforward (and less expensive) to develop herbal gasoline manufacturing than oil manufacturing and DVNâs oil minimize in Q1 2023 was once just a little over 50% in comparison to 59% oil for MTDR this yr.

As well as, DVNâs CAPEX estimate for Q1 doesnât come with any midstream spending while MTDRâs does. Alternatively, even though I strip out all deliberate midstream CAPEX from MTDRâs steering this yr, the midpoint of the corporateâs upstream CAPEX at $1.25 billion works out to $27.60 consistent with Boe, nonetheless neatly above DVN.

I consider an important clarification pertains to how I began this text â manufacturing development.

Merely put, some manufacturers like Pioneer Herbal Assets put up an estimate known as repairs CAPEX, which mainly represents the volume of CAPEX had to cling manufacturing kind of consistent. If an organization wishes to chop CAPEX underneath that repairs stage, they are able to maintain money glide on the expense of falling oil and gasoline manufacturing.

On the identical time, if a manufacturer needs to develop output to profit from increased commodity costs, theyâll want to drill extra wells on their acreage, which means the next CAPEX and, possibly, a upward thrust in CAPEX/Boe as neatly.

So, DVN is rising manufacturing this yr, however at a gradual tempo whilst MTDR is without doubt one of the fastest-growing manufacturers in my protection universe and itâs spending vital further sums to broaden newly got acreage. MTDR is spending neatly above repairs CAPEX whilst DVN is spending at a degree nearer to repairs CAPEX.

Close to time period, MTDRâs manufacturing development doable is prime and, as I simply defined, momentum is prone to raise thru subsequent yr. However, I believe, in the future past subsequent yr, as soon as the Advance acreage is extra totally digested, control will transition from speedy development to a extra modest tempo of building.

That may imply slower development in manufacturing, however it might additionally most likely entail an development in capital potency within the type of a drop within the corporateâs recently increased CAPEX consistent with Boe metric.

DVN is without doubt one of the extra capital environment friendly firms in the market and its acreage within the Delaware is especially prolific with regards to natgas output, so Iâm underneath no phantasm MTDRâs capital potency may just strengthen to that level. Alternatively, the transfer from 15%+ manufacturing development to a extra modest tempo of building may just undoubtedly be anticipated to cut back drilling and final touch (D&C) CAPEX/Boe from $27.60 to the low $20âs consistent with BOE.

Even an upstream CAPEX/Boe within the $22.50/BOE vary can be considerably worse than DVN, however it might have an important have an effect on on money glide technology for MTDR.

Have a look:

Longer term ex-Expansion Fashion for MTDR (MTDR Q1 2023 Steering, Creator’s Estimates)

To create this style, I held manufacturing consistent on the 2023 go out price of 143,000 Boe/Day and penciled in long-term discovered oil costs of $85/bbl and gasoline at $4.25/Mcf. Alternatively, I decreased the upstream portion of MTDRâs CAPEX to $22.50/boe, extra in step with what may well be anticipated will have to MTDR search to easily deal with manufacturing past 2024 or develop at a extra modest tempo.

Iâve maintained $175 million in midstream CAPEX, which is in step with what MTDR expects to spend this yr.

As you’ll see, this easy adjustment to capital potency boosts loose money glide to over $900 million consistent with yr. Whilst that may be a dramatic development, itâs no longer out of line with Wall Boulevard consensus, which sees loose money glide for MTDR mountain climbing to a median estimate of $880 million via 2026 and greater than $1 billion via 2027.

Goal and Dangers

After all, deriving a elementary goal value is an workout fraught with assumptions and pitfalls, however letâs imagine the prospective upside within the inventory in response to a easy discounted money glide research.

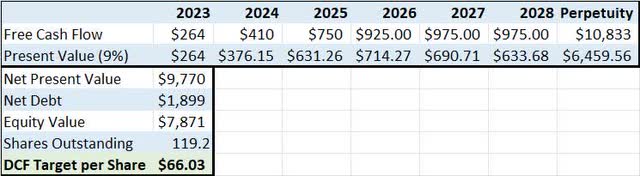

DCF Valuation Fashion for MTDR (Creator’s Estimates)

To create this estimate I used a weighted moderate charge of capital (WACC) of 9%, which is derived from a Bloomberg style that comes with the real charge of MTDRâs debt in addition to an estimated fairness charge in response to MTDRâs inventory value volatility relative to the marketplace as a complete.

I used the above-derived estimates for MTDRâs money flows for 2023 and 2024. Beginning in 2025 I guess MTDR transitions to an ex-Expansion technique, making the most of greater capital potency and strong manufacturing. This will increase my estimate of FCF to the above derived $925 million consistent with yr via 2026.

I then used the typical of my 2026 money glide estimate of $925 and the Wall Boulevard consensus for 2027 to estimate long run money flows at $975 million from 2027 and past. In keeping with present internet debt of slightly below $1.9 billion, this produces an fairness price of over $66 consistent with proportion for MTDR, nearly 27% above the present value.

If I merely use my 2026 ex-growth estimate of $925 million consistent with yr beginning in 2027, the estimated DCF continues to be as regards to $63, a top class of 20% to the present quote.

After all, there are problem (and upside) dangers to this estimate.

The obvious is commodity pricing. Iâve used a kind of $73.50/bbl estimate for oil and $3.25 for gasoline in 2023, emerging to $75.50/bbl and $4.25/mcf in 2024 and $85/bbl and $4.25/mcf thereafter. If thereâs an important world financial downturn in 2023 or early 2024 that hits oil call for, itâs believable that oil costs may just drop again into the low $70âs/bbl and MTDRâs gasoline value realizations may just drop again in opposition to $3/mcf even with the NGLs uplift.

Since MTDR has minimum hedges in position, close to time period money glide estimates are delicate to assumed oil and gasoline discovered pricing.

I additionally suppose there are upside dangers to those estimates, in particular over the long term. As I defined, the World Power Company (IEA) estimates Saudi Arabia wishes Brent oil costs north of $80/bbl to stability its funds.

So, $85 WTI as a long-term oil value assumption would possibly end up too low â for years main as much as the 2014 value cave in, costs averaged within the $90 to $100/bbl vary.

At the herbal gasoline entrance, the 2025 Henry Hub calendar strip value is in fact above $4/MMBtu presently as vital US liquefied herbal gasoline (LNG) export capability is slated to return on-line in opposition to the tip of 2025, boosting call for and costs. MTDR most often earns a $0.75 value top class to Henry Hub gasoline, so my long-term natgas assumption at $4.25 is also at the conservative facet.

The larger dangers are near-term in nature.

Specifically, the corporate is slated to file Q2 2023 profits on July 26 and, in response to vulnerable oil and gasoline pricing in Q2 2023 coupled with MTDRâs increased CAPEX spending because it integrates Advance acreage, itâs most likely Q2 2023 loose money glide can be damaging. Whilst loose money glide was once sure in Q1 2023 and is prone to rebound later within the yr as new wells are finished and manufacturing rises, Q2 2023 money glide receivedât glance encouraging in isolation and itâs imaginable that would spook some traders.

I consider the risk is manageable since the consensus on Wall Boulevard is already searching for damaging loose money glide in Q2, but it surely stays a headline possibility.

Certainly individually, Q2 2023 is prone to constitute a larger upside marvel and catalyst for MTDR stocks. Thatâs as a result of, as I defined, control has strongly hinted it might supply a extra substantive replace to its manufacturing steering in this name.

I believe, in response to Q1 2023 neatly efficiency and control observation at the name again in April, that may imply an important spice up to the midpoint of anticipated manufacturing steering and, in all probability, an early take a look at doable development we would possibly be expecting for subsequent yr.

Additional, I additionally consider the corporate may just modify its 2023 CAPEX and value steering as it sort of feels the mix of potency positive aspects and falling provider charge inflation would possibly push prices underneath its prior steering vary.

MTDR stocks have underperformed the benchmark SPDR S&P Oil & Fuel Exploration and Manufacturing ETF up to now in 2023, falling 8.2% in comparison to a three.6% decline in XOP. The principle causes come with MTDRâs loss of hedges and commodity value possibility in addition to considerations concerning the integration of Advance and the potential of prices to be increased than anticipated or manufacturing development not up to projected.

Will have to MTDR information manufacturing increased and/or prices decrease, it will have to function a catalyst for the inventory to near that efficiency hole with XOP.

After all, for power shares, in contrast to maximum firms, Wall Boulevard is terrified of development because of the damaging revel in of deficient profitability and the growth-at-any-cost shale growth years. I will have to admit, having lived thru the ones years as an power analyst, I’ve a bias in opposition to development as neatly.

Alternatively, on this case, I consider MTDR is being conservative. The Advance deal was once a just right one as acreage is contiguous with MTDRâs present operations and the corporate is desirous about repaying debt taken on to near the deal. Capital spending is prime, however thatâs to be anticipated given the dimensions of the Advance deal and the size of MTDRâs near-term development.

In keeping with steering and estimates, MTDR isnât making plans to constantly outspend money glide over the long term.

Final analysis: MTDR is an extraordinary development tale within the power patch with a reputable plan to develop manufacturing near-term whilst producing vital loose money glide in coming years even at modest commodity value assumptions. Within the near-term, I consider a most likely manufacturing, CAPEX and value steering replace at the corporateâs Q2 2023 name on July 26 generally is a vital upside catalyst for the inventory.