mysticenergy

Suncor Energy Inc. ( NYSE: SU) is a Canadian incorporated oil sands business, with a market capitalization of nearly $40 billion. The greater expense of oil sands suggested that the business’s share cost suffered greatly throughout COVID-19, however it’s given that handled to recuperate. The business’s strong position and increased effectiveness will make it possible for extra investor returns.

Suncor Energy’s Introduction

Suncor Energy has an outstanding and integrated property portfolio to benefit from Canadian oil sands.

Suncor Energy Financier Discussion

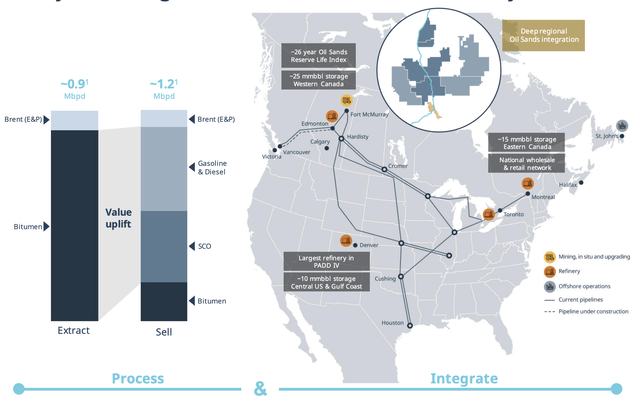

General, the business extracts 0.9 million barrels/day, mainly Bitumen (heavy crude) from the Canadian oil sands. The business boosts the worth of these properties mainly, through its midstream, refining, and downstream operations. The business’s oil sands have a 26-year reserve life index, making it possible for several years of production.

The business’s incorporated properties feature strong midstream and downstream properties. These properties, with considerable storage, make it possible for strong margins and future investor returns.

Suncor Energy’s Possessions

The business has a strong portfolio of properties. The business has 6.6 billion barrels of 2P reserves.

Suncor Energy Financier Discussion

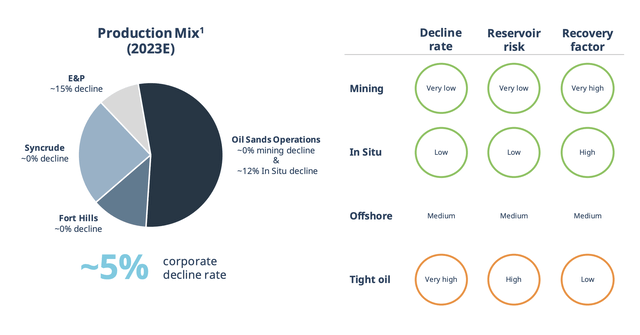

That suggests the business has a multi-decade portfolio. Throughout its portfolio, the business saw a 5% decrease rate. The business has an extremely high healing element throughout its properties, and some such as Syncrude and Fort Hills have had a 0% decrease. The business’s long reserve life here suggests that its capital commitments stay very little.

Suncor Energy Financier Discussion

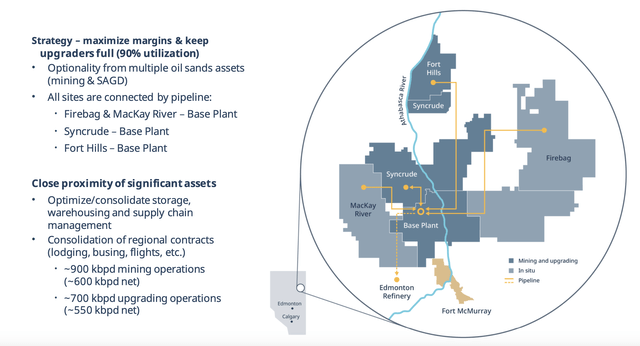

As seen above, the business has a strong portfolio of properties, with upstream, midstream, and downstream strength. The business is working to keep usage high, with 90% usage making it possible for the business’s margins to be much more powerful. The business’s properties being near each other likewise makes it possible for considerable synergies.

The business’s excellent property portfolio will make it possible for ongoing production and returns.

Suncor Energy’s Financials

Creating the business’s excellent property portfolio and strong margins, the business has an outstanding monetary position.

Suncor Energy Financier Discussion

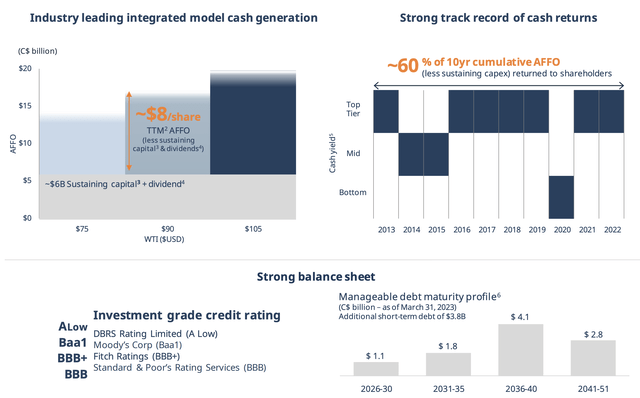

The business’s financial obligation is 0.8 x AFF0 at $80 Brent for the year (somewhat above present rates). The business’s financial obligation load is extremely workable for the business at this level and at present rates. The business’s financial obligation load from 2026-2030 is $1.1 C$ billion or $800 million USD. From 2031-2035, that’s $1.8 billion or $1.4 billion USD.

The business’s extremely very little financial obligation levels versus its market capitalization are something that it can easily pay without posturing a threat to the business. The business’s base level of capital can quickly cover its dividend of more than 5% + its sustaining capital for the business to continue its production at the very same level.

At present rates of $75 WTI, the business’s AFFI is $13 billion CAD or $7 billion CAD after sustaining capital + dividend. That’s $5 billion USD or a double-digit yield on top of the business’s dividend of more than 5%. That, integrated with a very little dividend yield, will make it possible for considerable investor returns.

Thesis Danger

The biggest danger to the thesis is petroleum rates. At present WTI rates, the business is extremely rewarding, with a double-digit return for investors. Nevertheless, at rates listed below that, the business gets less rewarding. The business has a low breakeven, however it likewise has less diversity as the marketplace moves away long-lasting from oil. That injures its capacity for returns.

Conclusion

Suncor has actually tamed the oil sands and handled to reduce its breakeven level. The business has actually increase its dividend recently and now provides a dividend of more than 5% in combination with workable sustaining capital. On top of that, the business continues to produce huge complimentary capital at a range of rates.

That suffices for the business to drive considerable extra investor returns. The business’s financial obligation load is low and workable, with very little direct exposure to increasing rate of interest. With a multi-decade reserve life powering all of this, Suncor Energy Inc. stock is an important long-lasting financial investment and a worthwhile financial investment to any portfolio.