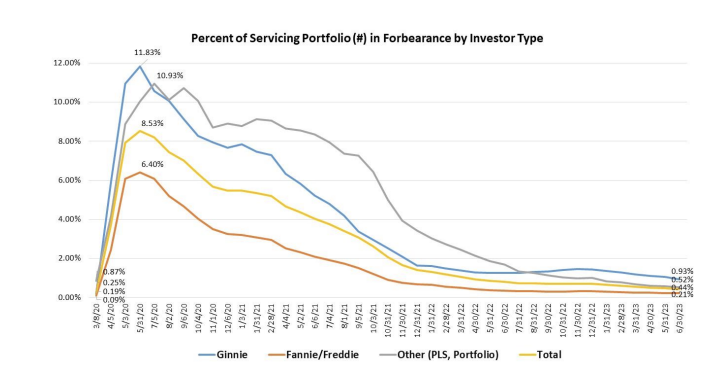

The share of home loan in forbearance reduced by 5 basis points in June 2023 relative to Might 2023 to 0.44% from 0.49%, according to the Home Loan Bankers Association‘s (MBA) regular monthly Loan Keeping an eye on Study.

Because March 2020, home mortgage servicers have actually offered forbearance to roughly 7.9 million debtors and 220,000 property owners are presently in forbearance strategies.

” Home mortgage forbearance has actually decreased since a lot of property owners have actually kept or enhanced their monetary health,” stated Marina Walsh, the MBA’s vice president of market analysis. “Current reporting by the U.S. Bureau of Labor Data reveals continued task development in June, and a 3.6% joblessness rate. The work circumstance tracks with property owners’ capability to make home mortgage payments.”

Walsh likewise included, “MBA anticipates a slowing in the economy that might generate greater joblessness and home mortgage delinquencies later on in the year. Forbearance stays a practical loss mitigation choice for property owners who might have a hard time under more difficult financial conditions.”

Arranged by financier type, the share of Ginnie Mae loans in forbearance reduced relative to the previous month to 0.93% from 1.06%. The share of Fannie Mae and Freddie Mac loans in forbearance reduced relative to the previous month to 0.21% from 0.23%. The share of other loans (e.g., portfolio and PLS loans) in forbearance reduced relative to the previous month to 0.52% from 0.58%.

Arranged by servicing portfolio volume, the share loans in forbearance for independent home mortgage banks dropped to 0.56% from 0.64% in May. The share of loans in forbearance in depositories on the other hand reduced to 0.32% from 0.34%.

The large bulk of debtors discovered themselves in such a location since of COVID-19 associated consequences (78.3%). Other significant factors were natural catastrophes (6.1%) and other short-term difficulties such as a death, a divorce, a task loss or a special needs.

In June, 34.9% of overall loans in forbearance remained in the preliminary forbearance strategy phase, while 54.5% remained in a extension. The staying 12.6% were re-entries, consisting of re-entries with extensions.

Washington, Idaho, Colorado, Oregon and California were the states with the greatest rates of debtors who were present. Mississippi, Louisiana, New York City, Indiana and West Virginia had the most affordable. Overall loans that were present (not overdue or in foreclosure) as a portion of servicing portfolio volume was flat at 96.12% from the previous month.