GoranQ

Summary

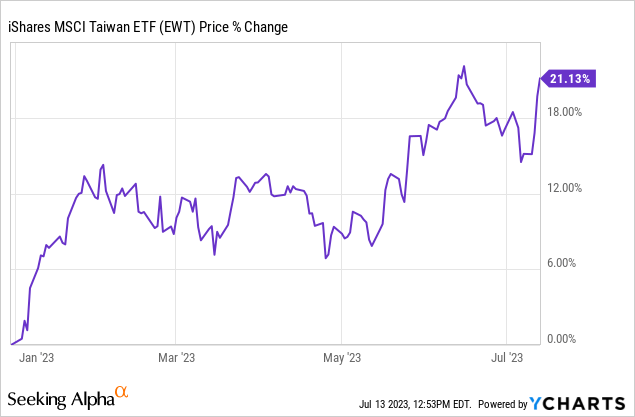

Stocks in Taiwan have actually rallied highly YTD and the long-lasting outlook for this market still looks beneficial. Taiwan is an exceptional play on increasing semiconductor need, as it has a strong international market share in this location. Optimism about this need has actually led Taiwan equities to rally significantly in 2023. Taiwan has actually outshined the S&P 500 by around 4 portion points YTD, mainly due to the fact that of the international need for semiconductors.

Nevertheless, I believe it might be best to take a wait and see method with this market, as any ongoing obstacles in international electronic devices need and/or increasing geopolitical stress with China might lead to a pullback in the stock exchange in Taiwan. In my view, South Korea uses rather comparable direct exposure to international electronic devices need, with less black swan geopolitical threats. I covered chances in South Korea in my last short article.

I believe this ETF is a great hold, however it might likewise be much better to make the most of the Taiwan Fund ( TWN) on any dips, as an increased discount rate to NAV would develop a strong entry point. Last I covered this ETF was way long back in 2015.

MSCI Status

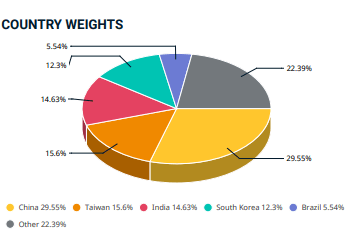

Taiwan is a popular financial investment location for emerging market and international macro focused financiers. Taiwan is the 2nd biggest nation in the MSCI Emerging Markets Index, representing over 15% of this index. MSCI has actually picked to increase its weighting in numerous indexes however has actually not had the ability to update it to industrialized market status. Its weight in the MSCI All Worlds Market is still around 1.6%.

MSCI

Taiwan will not likely be updated to industrialized market status quickly. Its weighting in emerging markets might increase if South Korea is updated, however MSCI was reluctant to do so in its most current evaluation in 2023. The primary appeal of Taiwan’s stock exchange is the nation’s semiconductor business, which actioned in to provide the marketplace when need expanded in 2022

Market Summary

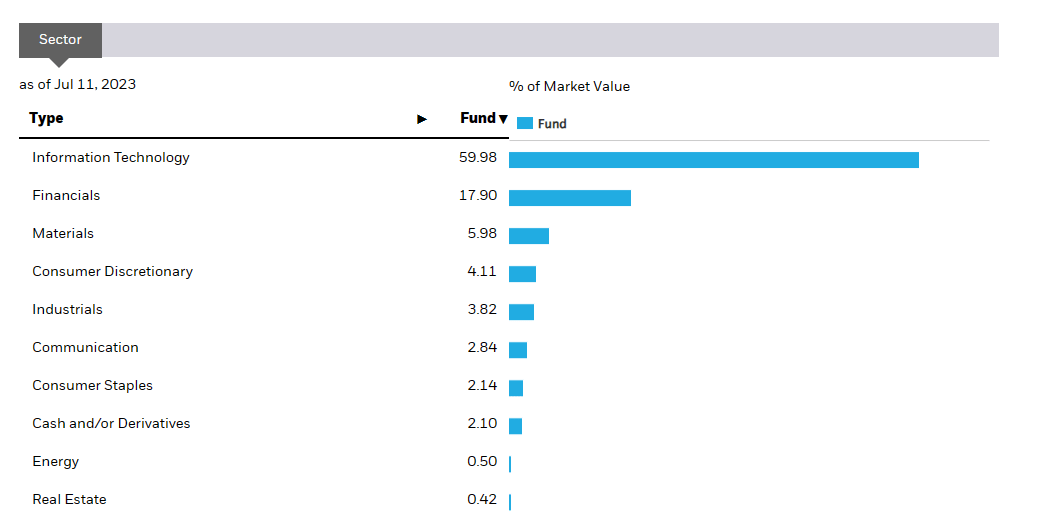

The iShares MSCI Taiwan ETF ( NYSEARCA: EWT) is most likely the very best car to think about at the minute. Most of this ETF’s leading holdings consist of infotech business.

iShares

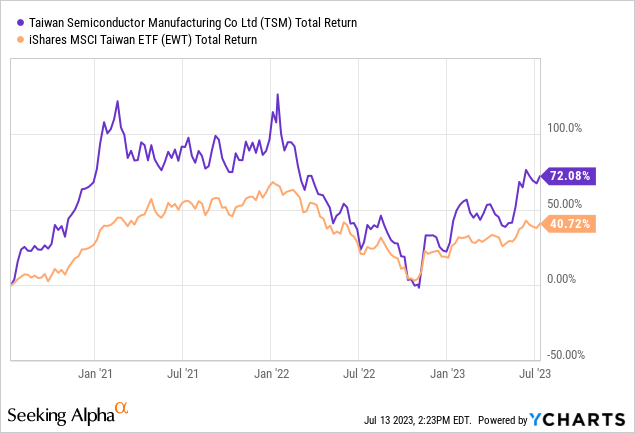

23.3% of the ETF’s properties purchased Taiwan Semiconductor ( TSM), a high development name with strong institutional ownership. Taiwan’s semiconductor market still has strong development capacity through 2031.

This business has actually been among the crucial chauffeurs of the ETF’s strong efficiency in the previous 3 years.

Financial Outlook is Hazy

Taiwan is a considerable nation in Asia, which stands apart based upon its greater GDP per capita of more than $30,000 and advanced export structure. For several years, purchasing Taiwan has actually been an indirect play on China’s production development, as Taiwan exports the lion’s share of its items to China and other Asian nations. Worldwide chip need in 2022, paired with supply concerns, brought Taiwan into the international spotlight over the last few years.

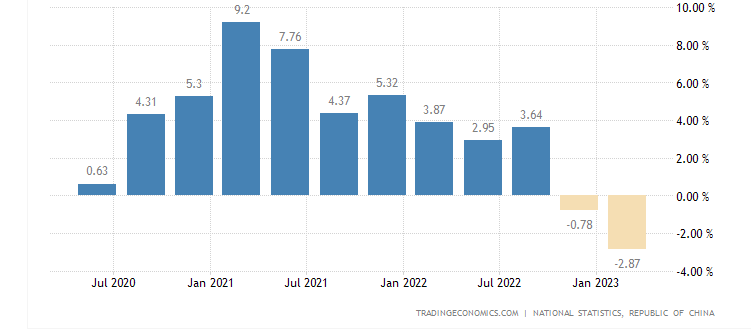

Development in 2023 will not likely be really strong, as decreasing tech exports have actually led to a financial downturn in current quarters. Taiwan slipped into an economic crisis in Q1 2023, as development decreased by 2.87% YoY

Trading Economics

This is a brand-new pattern, as Taiwan’s economy carried out extremely well in 2021-2022 in spite of the international financial downturn (4.6% in 2021).

Electronic devices exports started to deteriorate in the 2nd half of 2022 and early 2023 due to weakened need from China, the United States and the European Union. While some experts have actually been positive about need returning online from China in 2023, slower development in Europe has actually been a brand-new source of issue. The EU formally slipped into an economic crisis this June, although the area just contracted by 0.1%.

To make matters worse, lower than anticipated need from China this June triggered Taiwan’s exports to drop to a brand-new 14 year low China’s PMI contracted for the 3rd successive month and was just 49 in June Taiwan’s stock exchange would not react well to subsequent bad development arises from China in H2 2023.

Exports represent around 70% of the nation’s GDP, and its leading export locations consist of the following: Mainland China and Hong Kong (40%), ASEAN nations (13%), United States (12%), Europe (9%) and Japan (7%). Economic obstacles in the United States and the European Union will have a strong, however fairly minimal effect, while development in Asia will affect Taiwan more.

Threats and Outlook

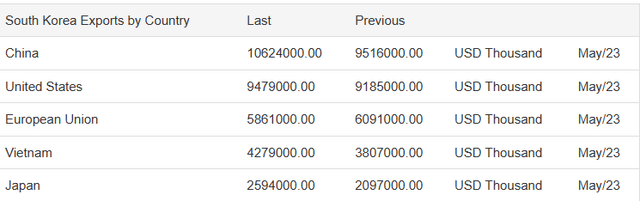

Taiwan is a vital emerging market that has strong efficiency in spite of all of the international financial obstacles in the previous 3 years. South Korea is one criteria to take a look at.

South Korea’s economy is greatly based on China’s development also, however it likewise uses more varied direct exposure to the EU and United States.

The current weaker need from China in June is another reason that it might be much better to wait this out for a number of quarters. China’s Q2 2023 GDP was 6.3% YoY, which was somewhat listed below agreement development of 7.3%. JP Morgan cut its 2023 development projection to 5%, from 5.5%.

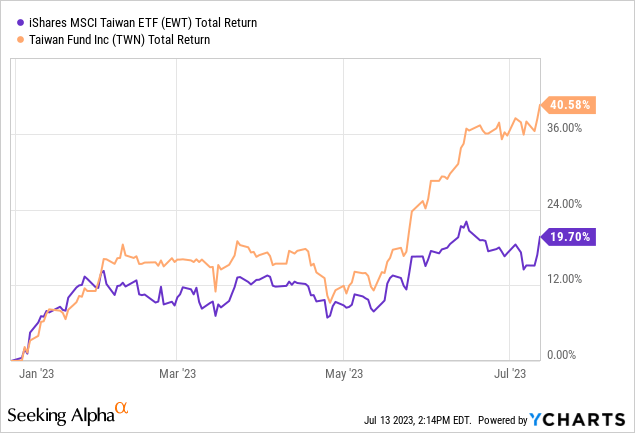

The Taiwan Fund (TWN), a closed end fund, might be more unstable in this environment. It is likely a much better concept to build up shares of this closed end fund throughout any pullbacks in the market in 2023. This closed end fund’s discount rate has actually dropped listed below 20% on several events in between 2020-2022.

The iShares MSCI Taiwan ETF is likely a more secure bet in this environment if you wish to keep direct exposure, as it will likely experience smaller sized drawdowns throughout any possible pullbacks in 2023-2024.

I am waiting on any possible pullbacks later on in H2 2023 and will think about other markets in Asia over Taiwan for the time being.