FangXiaNuo

Stellus Capital Expense Corporation ( NYSE: SCM) stays a strong company advancement business option for passive earnings financiers that are worried about an economic downturn coming down on the U.S. economy in the future.

The BDC has a first-lien focus and has the possible to raise its dividend, in my view, as the business has actually placed itself to make money from increasing rate of interest.

Stellus Capital’s dividend protection weakened in 1Q-23, however just since the BDC handed passive earnings financiers a generous dividend raise. The BDC’s stock cost has actually seen a sluggish and consistent healing considering that June, however the stock itself still stays underestimated, in my view.

Very First Lien Focus Offers Economic Crisis Security

BDCs that focus mostly on first-lien financial obligation have a competitive benefit over BDCs that focus more on second-lien financial obligation, unsecured financial obligation, or equity financial investments in order to enliven their financial investment returns, especially in an economic downturn environment when loan defaults are on the increase.

Very first liens are the highest-rated kind of financial obligation and loans are usually extremely collateralized, offering the lending institution a high degree of certainty that the principal will be recuperated in case the customer experiences monetary troubles.

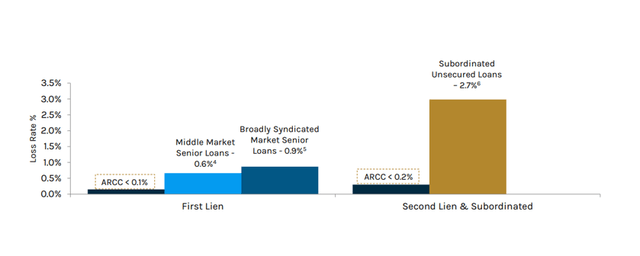

Based upon details offered by the BDC Ares Capital ( ARCC), middle market senior loans along with syndicated market senior loans had loan loss rates of less than 1% while 2nd liens and subordinated financial obligation had much greater loan loss default rates of 2.7% (efficiency duration 2007-2022). A concentration in very first liens provides the BDC a competitive benefit over other BDCs that are more greatly focused in (greater danger) 2nd liens.

Loan Loss Rates (Ares Capital Corp)

Stellus Capital mostly buys personal middle market business that create in between $5 million and $60 countless yearly EBITDA and much of those business are backed by personal equity business. Generally, business that look for financial obligation capital from Stellus Capital do so since they require funds to fund their growth, wish to get another business, or do a recapitalization.

A high degree of suggested economic crisis security is what I value the most about Stellus Capital, despite the fact that the BDC does not totally quit its equity upside.

The BDC’s overall financial investment portfolio consists mostly of senior protected financial obligation (92% of its financial obligation was either initially lien or 2nd lien at the end of 1Q-23) and equity does not play an outsized function.

Stellus Capital had $60.5 million (7%) of its financial investment portfolio (an overall of $877.5 million) bought equity, that makes Stellus Capital a defensively-oriented BDC. I am likewise delighted that unsecured financial obligation, the riskiest kind of financial obligation, represented less than 1% of the business’s portfolio worth (based upon reasonable worth).

Senior Guaranteed Financial Obligation (Stellus Capital Expense Corporation)

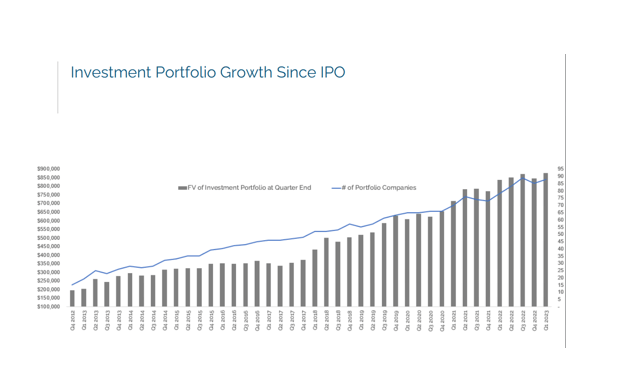

Stellus Capital’s portfolio, since 31 March 2023, consisted of 88 portfolio business and the BDC has actually seen constant and steady portfolio development over the last years. The BDC attained its greatest portfolio worth ever in 1Q-23 and will most likely report a brand-new ‘portfolio high’ for the 2nd quarter.

SCM was established in 2012 and the business handled to do well for itself throughout the Covid-19 pandemic. Even throughout this economic crisis, the BDC grew its general portfolio worth. As I stated, the long-lasting development history agrees with.

Financial Investment Portfolio Development Given That IPO (Stellus Capital Expense Corporation)

NII Kicker And Prospective For Enhanced Dividend Protection

I am singling out Stellus Capital as an appealing yield play in specific since the BDC has a big concentration in floating-rate financial obligation, which I believe will drive the BDC’s net interest earnings development progressing.

Though Stellus Capital likewise comes from brand-new loans, greater net interest earnings in a rising-rate environment is a possible NII kicker for Stellus Capital along with a lower payment ratio.

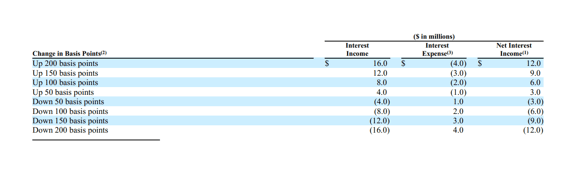

Roughly 97% of the BDC’s financial obligation financial investments were made in floating-rate loans and underwent rates of interest floorings, at the end of the very first quarter. This aggressive floating-rate direct exposure is set to drive Stellus Capital’s net interest earnings in a rising-rate environment. According to the business’s 10-Q report, a 100 basis point boost in essential rate of interest is set to include another $6 million in net interest earnings to the business’s bottom line.

Modification In Basis Points (Stellus Capital Expense Corporation)

Dangers Impacting The Financial Investment Thesis

Cooling inflation and the reserve bank drawing back from rate walkings would be negatives for my financial investment thesis as greater possible internet interest earnings is the primary reason I contributed to my position in Stellus Capital in the last month. A wear and tear of the BDC’s portfolio quality would likewise be an unfavorable advancement.

On the contrary, a strong hiring circumstance would support my argument for purchasing BDCs with aggressive floating-rate financial obligation positioning. Though non-farm payrolls increased just 209,000 in June, which was listed below price quotes, the labor market stayed tight with a joblessness rate of 3.6%. This bodes well for extra rate walkings.

Stellus Capital’s Payment Ratio Deteriorated In 1Q-23 However Might Enhance Progressing

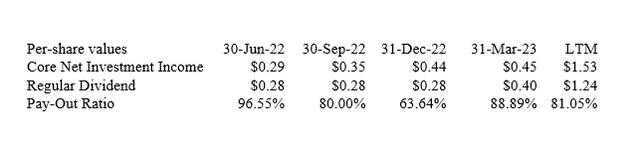

Stellus Capital has actually seen a boost in its dividend payment ratio in 2023 with the payment ratio leaping rather drastically from 64% in 4Q-22 to 89% in 1Q-23.

The increase in the payment ratio, nevertheless, was mostly due to an enormous boost in the routine dividend (which leapt from $0.28 per share to $0.40 per share) that straightened the BDC’s dividend with its underlying net financial investment earnings. With an LTM payment ratio of 81%, Stellus Capital likewise has possible to take in a possible hit to net financial investment earnings, in my view, in case loan defaults increase.

Progressing, Stellus Capital might experience greater net financial investment earnings if the reserve bank walkings rate of interest in action to a strong hiring circumstance.

With joblessness being listed below 4%, the U.S. economy takes pleasure in complete work. Additional rate walkings should, for that reason, lead to greater net interest earnings along with a better dividend payment ratio which, in turn, might cause another dividend raise.

Dividend (Author Developed Table Utilizing BDC Info)

Stellus Capital Is Wonderfully Valued

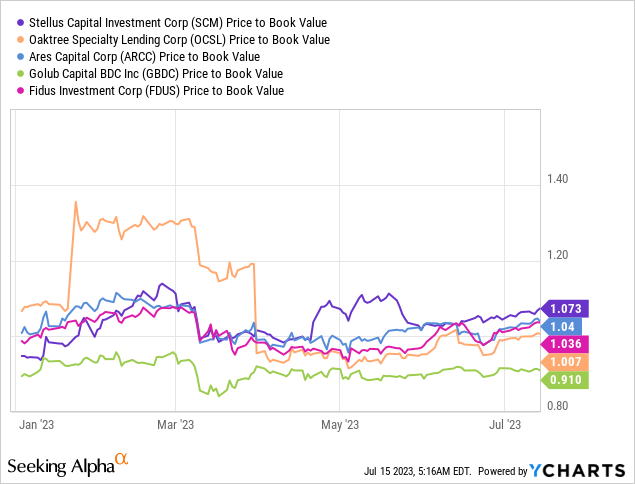

Stellus Capital’s net possession worth was $13.87 per share at the end of 1Q-23 and with the stock trading at $14.33, the BDC’s assessment currently shows a 7% premium to net possession worth. The premium is neither big nor little, in my view, and other equivalent BDCs cost comparable NAV multiples.

Considering the BDC’s aggressive placing with regard to floating-rate loans, I believe that SCM might ultimately trade at a 10-15% premium to net possession worth, suggesting a reasonable cost variety of $15.26-15.95 per share.

My Conclusion

Stellus Capital, in my viewpoint, not just provides an 11.2% yield however likewise upside possible. The realisation of the BDC’s net interest profits capacity in a rising-rate environment may close the worth distinction.

Stellus Capital likewise provides economic crisis security as its financial obligation portfolio is defensively placed in senior safe loans. Equity direct exposure stays little, which restricts the danger of a financial investment going sour.

I would likewise keep in mind that the boost in Stellus Capital’s payment ratio in 1Q-23 did not show a modification in NII potential customers. Rather, the BDC straightened its dividend with its underlying development in net financial investment earnings.