travelpixpro

Covered call techniques have actually not been a winning portfolio play up until now in 2023. With constant stock exchange gains and decreasing volatility, merely owning an index outright through an inexpensive ETF has actually been the method to go. And today, with the VIX in the low to mid-teens, it is difficult to get much included earnings offering choices. Could that will alter, though? We are getting in that time of year when volatility can kick up.

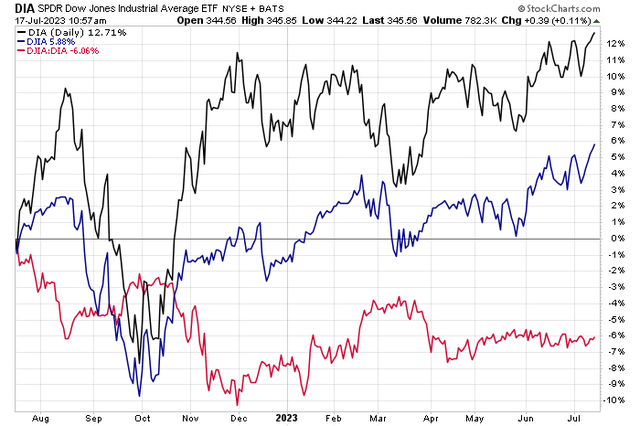

In the meantime, however, I simply have a hold ranking on the International X Dow 30 Covered Call ETF ( NYSEARCA: DJIA). I see some indications of fatigue on the chart of the Dow 30, however suggested volatility is so low that the earnings yield from composing calls is modest. Notification in the overall return efficiency chart listed below that the SPDR Dow Jones Industrial Average ETF Trust ( DIA) has actually quickly beaten DJIA over the in 2015, though the 2 have actually carried out about in line over the previous 3 months.

1-Year Overall Returns: DJIA Loses Ground to DIA

For background, DJIA looks for to produce earnings through covered call writing, which traditionally produces greater yields in durations of volatility, according to the company The ETF anticipates to make circulations on a regular monthly basis while the viewed advantage to financiers is that the fund composes call choices on the Dow Jones Industrial Average, conserving financiers the time and possible cost of doing so separately.

DJIA is a rather brand-new item, with shares starting to trade back in February of in 2015. You’re going to pay about half a portion point more for DJIA compared to owning simply the index ETF – its overall cost ratio is 0.60% since July 14, 2023. Holding 30 stocks and derivatives bundles, it is not all that liquid thinking about the 30-day typical bid/ask spread is high at 0.32%, per International X. The circulation yield has to do with 5.4% over the last 12 months and overall possessions under management amounts to $77.7 million.

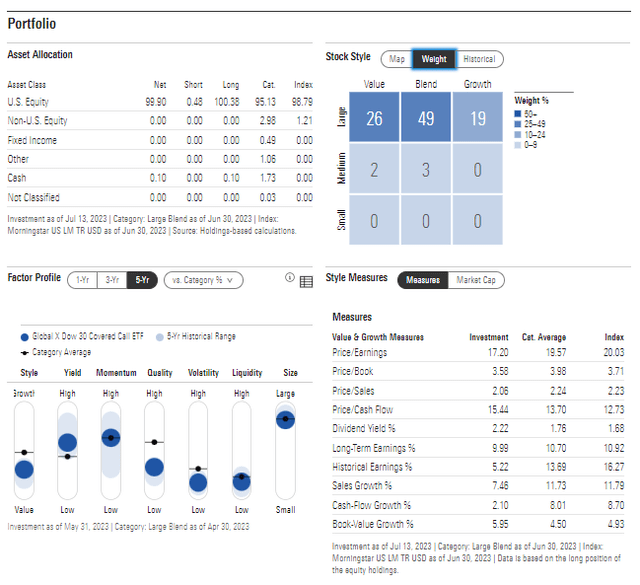

Going into the portfolio, information from Morningstar expose that the equities in DJIA are large-cap in nature with simply 5% thought about mid-cap. What is various about the Dow 30 instead of the S&P 500 is that the previous is more oriented towards the worth design whereas the latter is growth-heavy, as you can see in the Design Box listed below. The equities’ weighted-average price-to-earnings ratio on a 2022 basis is sensible at 16.0 and DJIA’s equity beta is rather low at simply 0.52 while its basic discrepancy is modest at 13.8%.

DJIA Portfolio & & Aspect Profiles

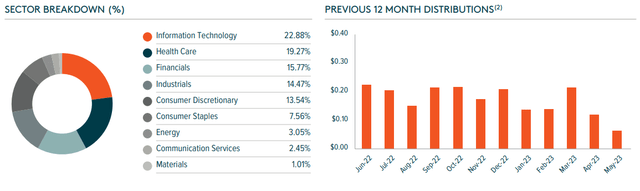

DJIA holds a high quantity in the Infotech sector, however it is still underweight compared to the SPX. Likewise discover how the month-to-month circulation rate has actually been decreasing recently as volatility in the market has actually run softer. Less bang for your Dow-30 dollar, it appears.

DJIA: Month-to-month Circulations Turning Lower

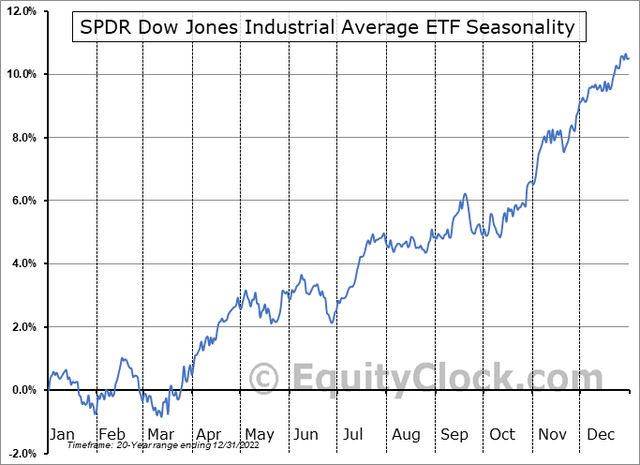

Seasonally, the Dow Jones Industrial Average itself tends to combine from late July through early in the 4th quarter, according to efficiency information patterns from Equity Clock This is a time infamous for volatility and corrections, so it might be a chance to offer upside contacts the index when volatility increases (and alternative rates increase), so watch for a prompt entry into DJIA over the coming weeks must a stock exchange dip emerge.

DIA Seasonality: Sideways Action Through Early October

The Technical Take

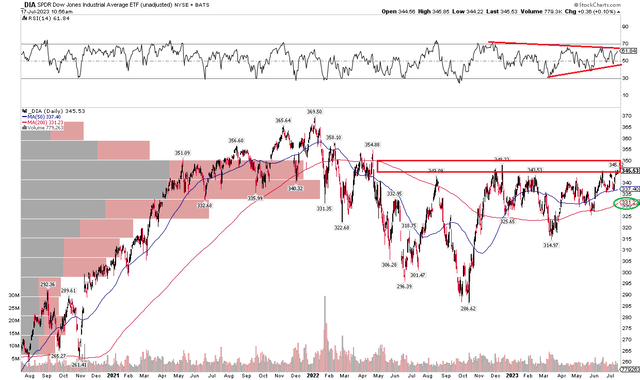

So I opted for an analysis of the DIA Dow 30 ETF to identify a technical view on DJIA. Notification in the chart listed below that DIA has actually experienced a resistance zone from $343 to $348. I believe we might see a time out here as we get in a harder stretch on the calendar, traditionally speaking. Likewise, the RSI momentum gauge at the top of the chart reveals a debt consolidation, that informs me an ultimate breakdown or breakout will be even more crucial to identify where DIA’s rate goes. However with an increasing long-lasting 200-day moving average, the bulls appear to have the reins here. Advancing my assertion for a winding DIA share rate has high volume by rate as seen on the left side of the chart; there is much blockage at existing levels.

All that together, a covered call method (like DJIA) makes good sense, however volatility is so low that it is difficult to make up for deviating much from DIA itself. In the meantime, I am a hold technically.

DIA: Holding Below Resistance, Momentum Coiling

The Bottom Line

DJIA’s raised cost ratio and general patterns in the Dow 30 itself make me reluctant to release a buy ranking on the DJIA today. If we see a tick-up in suggested volatility to, state, 18%, that would be a more beneficial time to offer calls and gather a larger premium yield.