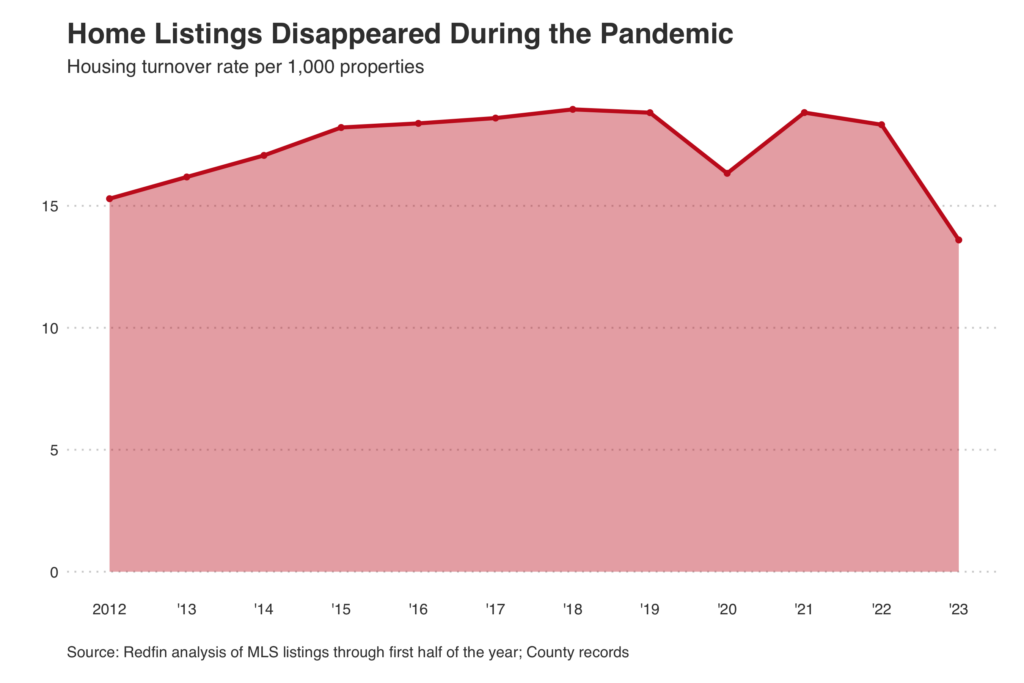

- 14 of every 1,000 houses altered hands in the very first half of 2023, compared to 19 of every 1,000 throughout the exact same duration in 2019. The pandemic homebuying boom diminished supply, and it hasn’t been renewed since property owners are hanging onto their fairly low home loan rates.

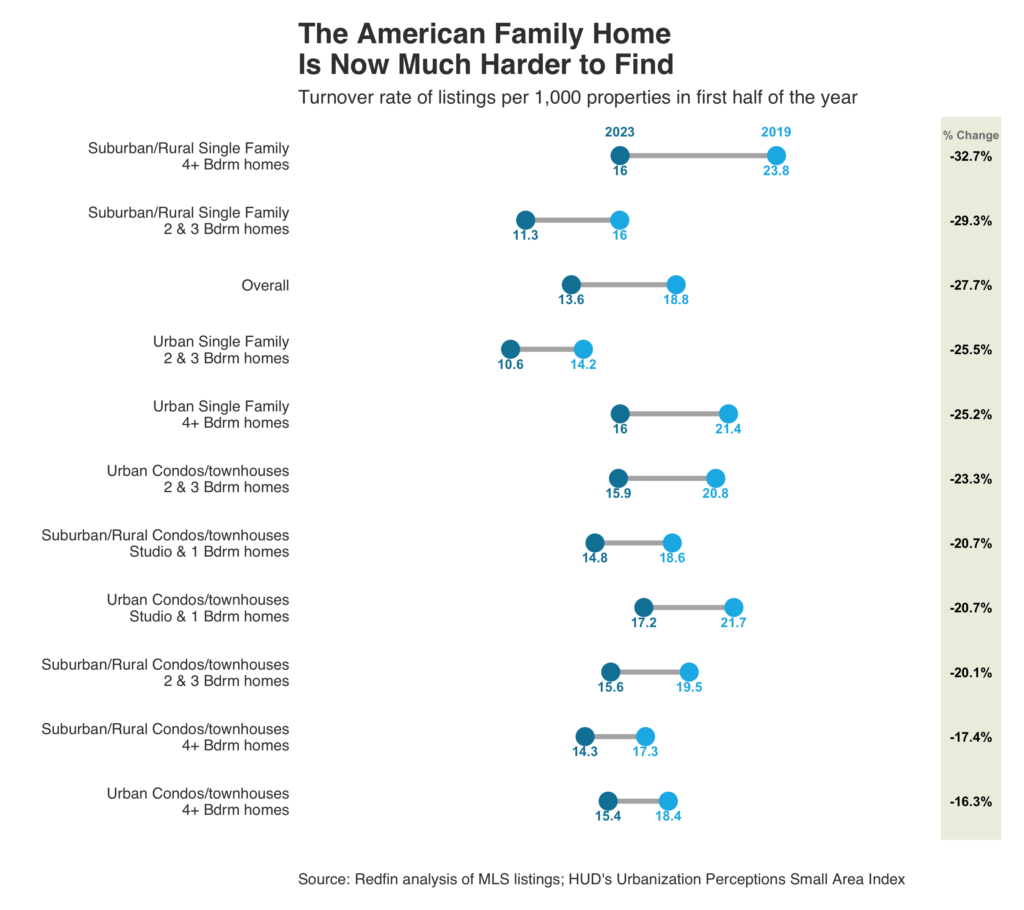

- The turnover rate for big rural homes has actually decreased a lot more. 16 of every 1,000 rural houses with a minimum of 4 bed rooms have actually committed a brand-new owner in 2023, below 24 of every 1,000 in 2019.

- Smaller sized single-family houses in city locations are hardest to discover. Simply 11 of every 1,000 two-and three-bedroom city houses have actually altered hands in 2023.

- California has the slimmest pickings of any U.S. state, with practically 6 of every 1,000 houses in San Jose offering in 2023, comparable to the low turnover rates in Oakland, San Diego and other California cities.

- Newark, NJ, Nashville and Austin property buyers have the simplest time discovering houses, fairly speaking, with more than 20 of every 1,000 houses in each of those cities offering this year.

Approximately 14 of every 1,000 U.S. houses altered hands throughout the very first 6 months of 2023, below 19 of every 1,000 throughout the exact same duration of 2019 and the most affordable turnover rate in a minimum of a years. That indicates potential property buyers have 28% less houses to pick from than they did prior to the pandemic overthrew the U.S. real estate market.

That’s according to a Redfin analysis of real estate turnover comparing the very first 6 months of 2023 with the very first 6 months of 2019 throughout various house and community types. We’re utilizing turnover as a procedure of real estate schedule; it suggests how frequently houses alter hands in an offered location. This analysis consists of general for-sale real estate turnover and breakdowns based upon community type and house type. See completion of this report for more information on approach.

The pre-pandemic turnover rate kept in mind above (approximately 20 of every 1,000 sellable houses alter hands in the very first half of a year) is relatively common for the modern-day real estate market, however a more active market would have a rate more detailed to 40 or 50 of every 1,000.

The wild pandemic-era real estate market has actually magnified an existing scarcity of houses for sale and resulted in this year’s low turnover rate. In 2018, Freddie Mac approximated that about 2.5 million more houses required to be constructed to fulfill need, with the deficiency generally due to an absence of building and construction of single-family houses. The homebuying boom of late 2020 and 2021, driven by record-low home loan rates, remote work and a rise in financier purchases, diminished currently low stock levels. Lastly, 2022’s skyrocketing home loan rates– typical rates almost doubled from January to June– intensified the scarcity by handcuffing property owners to their relatively low rates. Some property owners have actually decided to refurbish their existing house, and some are purchasing another house however hanging onto their very first one and leasing it out to either a longterm renter or short-term visitors. Now, the supply of houses for sale is at a record low

” The fast boost in home loan rates produced an uphill struggle for lots of Americans who wish to purchase a house by securing stock and making the houses that do struck the marketplace too costly. The common house is costing about 40% more than prior to the pandemic,” stated Redfin Deputy Chief Financial Expert Taylor Marr “Home mortgage rates dropping closer to 5% would make the most significant damage in the price crisis by maximizing some stock and bringing regular monthly payments down. However there are a couple of other things that would improve turnover and assistance make houses more economical. Structure more real estate is vital, and federal and city governments can assist by reforming zoning and making the structure procedure simpler. Financial rewards, like lowering transfer taxes for house sellers and supporting significant relocations with tax breaks, would likewise contribute to provide.”

The turnover rate has actually diminished most in the suburban areas: 16 of every 1,000 big rural homes have actually altered hands this year, two-thirds as lots of as 2019

Home hunters looking for big houses in the suburban areas have actually seen the most significant drop in their alternatives. Almost 16 of every 1,000 four-bedroom-plus rural single-family houses offered in the very first half of this year, below 24 of every 1,000 that offered in the exact same duration in 2019. That indicates purchasers of that house type have 33% less homes to pick from.

The turnover rate has actually dropped for every single size house in every kind of community over the last 4 years (though purchasers will have a much easier time discovering something for sale in specific city locations, as laid out listed below). That pattern can be seen in the chart above, which shows the nationwide post-pandemic real estate turnover rate left wing and the pre-pandemic rate on the right. The length of the line in between the 2 dots suggests just how much turnover decreased from 2019 to 2023, with the most significant decreases at the top.

The turnover rate of big single-family rural houses has actually diminished most since that kind of house blew up in appeal throughout the pandemic. Remote employees gathered to the suburban areas, untethered from the workplace, and acquired big residential or commercial properties with area for grownups to work from house and kids to participate in school from house.

” New listings typically struck the marketplace on Thursdays, and I have purchasers who are excitedly inspecting their Redfin app Thursday early mornings, just to discover absolutely nothing brand-new,” stated Phoenix Redfin Premier representative Heather Mahmood-Corley “That chooses purchasers in every cost variety in every kind of community, however what individuals desire the majority of are those move-in all set, mid-sized houses in communities with extremely ranked schools. Those are hardest to discover since for individuals to purchase one, somebody requires to offer one. That’s not occurring, since many of those property owners have low home loan rates.”

The turnover rate of apartments and townhouses didn’t diminish as much as that of single-family houses throughout the pandemic, though condominium and townhouse purchasers are still about 20% less most likely to discover that kind of house than they remained in 2019.

Supply of that house type wasn’t diminished as much since there wasn’t as much need for them throughout the pandemic. In truth, lots of remote employees were offering apartments and townhouses in favor of single-family houses with more area.

Decently sized single-family houses in the city are hardest to discover: Simply 11 of every 1,000 2- and three-bedroom city homes offered in the very first half of this year

Smaller sized homes in the city have the most affordable turnover rate of all the house key ins this analysis. Approximately 11 of every 1,000 2- and three-bedroom single-family houses in city communities offered in the very first 6 months of 2023, compared to 14 of every 1,000 throughout the exact same duration in 2019.

2- to three-bedroom houses in rural communities are basically connected with their city equivalents for the most affordable turnover rate, with 11 of every 1,000 altering hands this year. That’s below 16 of every 1,000 in 2019.

Decently sized single-family houses in all sort of communities have actually long been difficult for purchasers to discover. That’s since home builders do not make a number of them any longer, and property owners tend to keep the ones that exist.

Today’s homebuilders tend to concentrate on the sort of house that remains in need and lucrative: Larger single-family houses, which do not cost a lot more to construct than smaller sized ones however cost more cash, and apartments and townhouses, which cost less to construct. And individuals who own those starter-type houses frequently turn them into rental residential or commercial properties instead of offering when they go up to larger homes. Property owners can frequently cover their home loan and after that some when leasing this kind of house, specifically in preferable communities; that earnings coupled with the house’s worth increasing gradually incentivizes keeping instead of selling.

Homebuyers have the tiniest swimming pool of alternatives in the Bay Location: Simply 6 of every 1,000 San Jose houses have actually committed a brand-new owner this year

Northern California has the most affordable turnover rate in the U.S. Simply 6 of every 1,000 houses in San Jose altered hands in the very first half of 2023, the most affordable rate of the 50 most populated U.S. cities. It’s followed carefully by Oakland, San Diego, Los Angeles, Sacramento and Anaheim, all locations where about 8 of every 1,000 houses committed a brand-new owner.

The pandemic intensified the supply scarcity throughout California, with the turnover rate coming by a minimum of 30% in each of those cities from 2019 to 2023.

Focusing on big, rural single-family houses, California still has the most affordable turnover rate. 6 of every 1,000 houses of that type have actually offered this year in San Jose (-40% given that 2019), the most affordable rate in the country. Next come Oakland (7 of every 1,000; -43%), San Diego (8 of every 1,000; -51%), Sacramento (9 of every 1,000; -41%) and Anaheim (9 of every 1,000; -41%).

California traditionally has the most affordable real estate turnover since the state’s tax laws– specifically proposal 13— incentivizes property owners to sit tight by restricting property-tax boosts. Today’s raised home loan rates heighten that by offering property owners 2 monetary rewards to sit tight: Low real estate tax and relatively low home loan rates.

Homebuyers have the most significant swimming pool of alternatives in Newark, NJ and Nashville, where more than 23 of every 1,000 houses have actually altered hands this year

Newark, NJ has the greatest turnover rate in the U.S., with 24 of every 1,000 houses altering hands throughout the very first 6 months this year. It’s followed carefully by Nashville, TN (23 of every 1,000) and Austin, TX (22 of every 1,000). Nashville and Austin are likewise 2 of the 3 cities (together with Fort Worth, TX) with the greatest turnover for big rural, single-family houses.

Newark purchasers still have far less houses to pick from than they did prior to the pandemic, with a 42% drop in turnover given that 2019. Just New Brunswick, NJ (-49%) and San Diego (-46%) had larger decreases. Focusing on big rural homes, New Brunswick (-55%), Chicago (-54%) and New York City (-52%) had the most significant drops in turnover.

However Nashville and Austin are both amongst the 5 cities with the tiniest decreases in turnover given that 2019, publishing drops of simply 10% and 14%, respectively. When it pertains to big rural homes, Nashville and Austin have the 2nd and 3rd tiniest decreases. That’s partially due to robust brand-new building and construction in Nashville and Austin: Stock of single-family houses for sale in both metros is comprised of more than 30% recently constructed houses, compared to 22% across the country.

Just Milwaukee and Columbus, OH, which both saw general turnover stop by about 8% from 2019 to 2023, had smaller sized decreases in turnover than Nashville. Indianapolis, IN is available in 4th, with a 14% decrease. Milwaukee, Columbus and Indianapolis have fairly steady turnover since they didn’t experience big homebuying need swings throughout the pandemic.

Approach

This is according to a Redfin analysis of turnover rates, based upon MLS information, county records, and the HUD’s urbanization understandings little location index The turnover rate is specified as the variety of houses that are noted to offer divided by the overall variety of sellable residential or commercial properties (single-family, condos/co-ops, townhouses, and multi-family 2-4 system residential or commercial properties just) that exist in a specific location. The analysis compares turnover rates throughout the very first 6 months (January-June) of 2019 with the very first 6 months of 2023. This analysis was restricted to the 50 most populated urban departments in the U.S.