In this video, Lynette explores the after-effects of the LIBOR shift and exposes the worrying vulnerabilities prowling underneath the surface area.

Discover why the worldwide monetary system is on the verge of instability and how you can safeguard your wealth and get ready for the approaching crisis. Do not lose out on this vital info!

CHAPTERS:

0:00 LIBOR & & SOFR

1:58 USD LIBOR Shift

6:48 Tradition Agreements

11:21 Revolving Credit & & Trading Assets

17:52 Physical Gold

SLIDES FROM VIDEO:

RECORDS FROM VIDEO:

So June 30th and the death of LIBOR has actually come and it has actually gone and there has actually been dead silence. So does that indicate whatever went hunky dory with the outright greatest experiment in history? Well, I do not believe so. I believe there’s a lot going on that they do not desire us to be familiar with. And I believe that eventually in the future, however they’ll cover it up with something else or perhaps they will not. They have actually got to blame something or another person. Trigger they do not ever take the blame. However this is their fiasco and we’re gon na need to handle it. So let’s discuss what’s occurred with LIBOR and SOFR, turning up.

I’m Lynette Zang, Chief Market Expert here at ITM Trading a complete physical. Trigger if you do not hold it, you do not own it, no matter your individual understanding. Simply does not hold up in a law court. And let me inform you, with whatever that’s occurring and with things that are occurring that you can’t see, you much better have your wealth security. You much better have food, water, energy, security, barterability, wealth conservation, neighborhood and shelter in location due to the fact that the time to do it is prior to you require it, not later on. You do not have that chance later on.

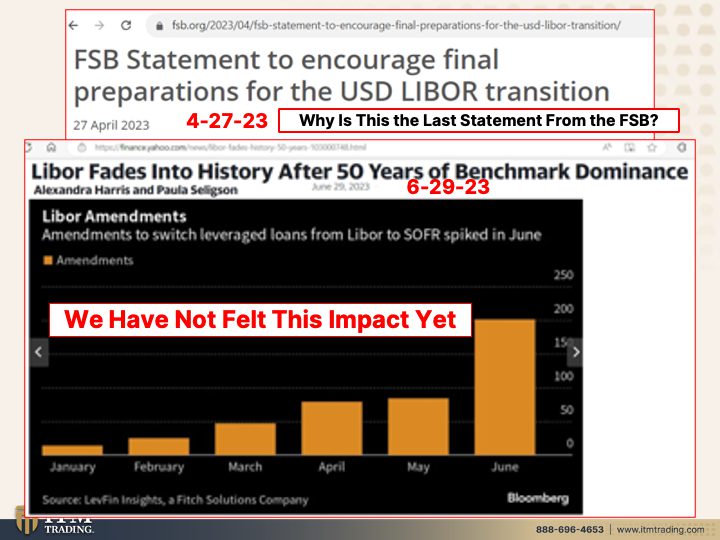

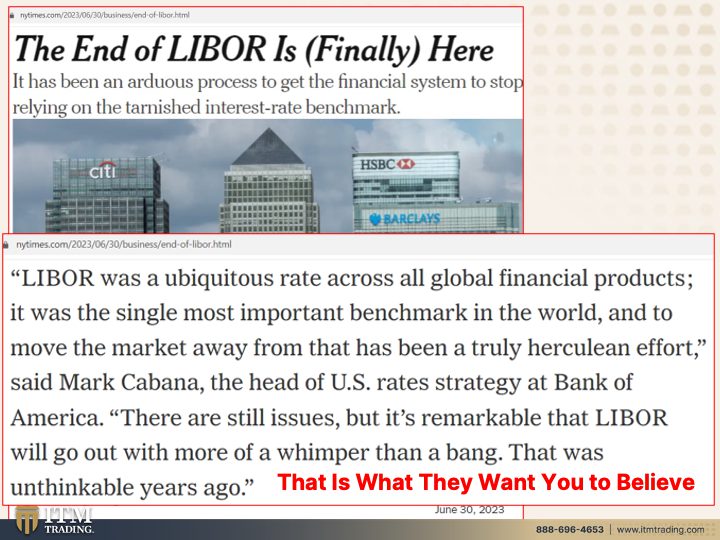

So let’s discuss what took place due to the fact that wow, the FSB, which is the governmental company that was aiding with this entire shift and handling it, the last declaration that they made was, when was that? Oh, April 27th, 2023. And they are motivating last preparations for that shift. However can you inform me why this is the last declaration from the firms that are handling this shift? Why isn’t their declarations approximately there approximately June 30th? And how about right after? Wow, we had a success due to the fact that they were speaking about the test back in October of 2020 on the 80 trillion in derivatives that they were moving. They discussed it, they discussed it. They discussed it on after the day of the shift, dead silence. And 3 weeks later on they came out and they delayed it. So they are informing you prepare yourself for that shift. Now, yes. In June, as you can see, there was an enormous shift in modifications to change from take advantage of loans from LIBOR to SOFR. However did they get all of them done? No, they did not. And I’ll reveal you what they have actually established to assist that. However let me inform you, the structure that we are resting on, that the worldwide monetary system is resting on, has actually ended up being that far more unsteady. I’m not even gon na state delicate at this moment. It is delicate. Now with this, it is totally unsteady. And let me inform you, we have actually not felt the effect yet. I do not wan na feel the effect in an unfavorable method. How about you? So there, it simply fades into history. Trillions, quadrillions of agreements connected to the shift, the assessment on each and every single among those agreements has actually altered, however it simply fades into history. Wow. Isn’t that great? And it has actually been a tough procedure to get the monetary system to stop depending on the stained rates of interest standard. Heck yes. In reality, they needed to remove LIBOR in the start of 2022 in order to get more compliance due to the fact that the marketplaces did not wish to comply. Considering that once again, the assessment of all of these agreements that that shift happened altered to the advantage of some and the hinderance of others. LIBOR was a common rate throughout all worldwide monetary items. You get that all worldwide monetary items, it was the single crucial standard worldwide. And to move the marketplace far from that has actually been genuinely a herculean effort. Oh my goodness. Now there are still problems, however it’s amazing that LIBOR will go out with more of whimper than a bang. That was unimaginable years earlier. Think what? It’s unimaginable today. Perhaps I’m incorrect. I indicate, I am definitely not in the middle of whatever and all of these conversations, I definitely am not privy to any info that honestly you are not privy to. However when you take a property or an instrument, a criteria that was utilized in each and every single agreement financial obligation instrument worldwide and shift it and alter it, and after that have it vanish, do you truly believe it’s going out with a whimper, a whimper now?

So you do not relate the modifications that were made to the crisis that looms big ahead of us due to the fact that it does. You can’t simply make those modifications. However this is what they desire you to think. This is understanding management. This becomes part of the reason that a great deal of individuals do not rely on traditional media due to the fact that they have a program. So what are they expecting? They’re expecting crickets. That’s what they’re expecting.

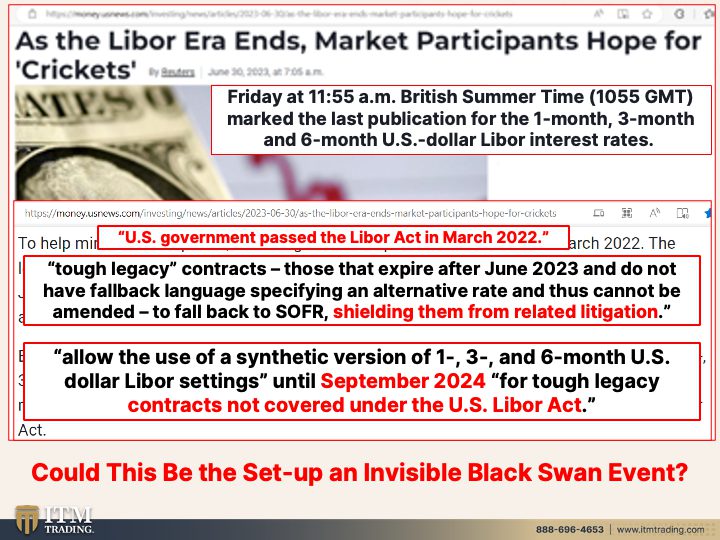

So Friday at 11:55 AM am British summer, mark the very first publication for the one month, the 3 month and the 6 month United States dollar library rate of interest done, gone to assist lessen interruptions. The United States federal government, and we have actually discussed this prior to perhaps Randy, you can put some links that I have actually done about the LIBOR in the, in the description listed below. Okay, so in March of 2020, the United States federal government passed the LIBOR act. Okay, well, all right, they passed that act. What was this truly about? The legislation SH enables an approximated 16 trillion of hard tradition agreements. Now that 16 trillion is simply the marketplace assessment. It does not show the real worth that is at threat, which might be in the quadrillions because a great deal of these acquired agreements are leveraged quickly a thousand to several. And the tradition agreements are agreements that have been around for a very long time, right? As long as whoever released those agreements, generally in between 2 or 3 entities. So there’s truly no market for them anyhow, right? And as long as the costs are paid, they can keep these agreements drifting. It’s when they stop paying these agreements that we are visiting this enormous surge. However those are the tradition agreements. A great deal of these agreements existed prior to 2008. You can’t close them out due to the fact that of the effect that they would have on the remainder of the market. So they passed this legislation that enables an approximated 16 trillion of hard tradition agreements, which are tho those that end after June, 2023. Trigger I do not truly even have an expiration. A great deal of them and do not have fallback language defining an alternative rate and hence can not be changed. So there’s truly absolutely nothing that they can do other than to pass legislation that guards these entities. So JP Morgan City, Goldman Sachs, all these entities from lawsuits. So, all right, is that truly gon na fix the issue? Well, it fixes part of the issue. Perhaps it likewise enables the usage. So what they did was, because they didn’t wan na come out and delay this shift, they simply made a peaceful modification and they permit the usage of artificial variation of the one 3 and 6 months United States LIBOR settings till September, 2024. So approximately 14 months after the shift, right? And after that those hard tradition agreements that are not covered on the LIBOR act. So at first, all right, they’re covering whatever, however do you see how they have the ability to keep that surge that is most likely occurring under the surface area that we can not see from emerging to the surface area and drawing your attention? They do not desire your attention there. And if adequate time passes, you are not going to correspond it. What do they state in practically every piece they compose? We like our policy choices and how it unfolds to the general public. We like that time in between it and we like another person to present it so that the general public does not correspond what is occurring back to the source. Simply put, back to the reserve banks, back to the banking system. This is no various, however it might definitely be the setup to a black swan occasion due to the fact that a black swan occasion is something that no one can see coming. Now the individuals can see this coming, however the general public does not see what’s occurring underneath the surface area.

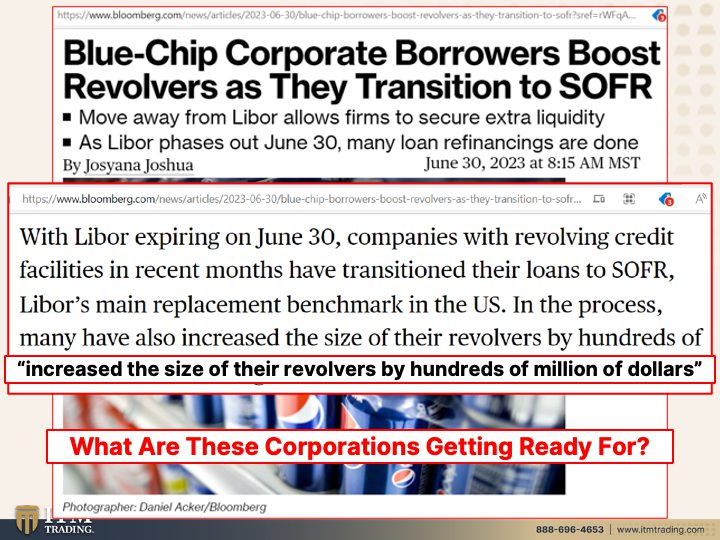

So what takes place? Well, the blue chip business customers improve revolvers. And we aren’t, oops, we are not speaking about this type of a revolver. We’re speaking about revolving loans. Move far from LIBOR enables company to protect additional appearance liquidity. Hmm, isn’t that fascinating? With LIBOR ending on June 30th. Business with revolving credit centers in current months have actually transitioned their loans to SOFR. Okay, well, they’re expected to do that. That part’s all right. However LIBORs primary replacement standard in the us that’s the SOFR at the same time, lots of have actually likewise increased the size of their revolvers by numerous countless dollars. Well, primary, if the SOFR rates of interest is lower than the LIBOR rates of interest, then that provides some space to increase their loaning. However this to me appears like a setup due to the fact that they understand a significant crisis is coming, a liquidity crisis and they’re preparing yourself for it.

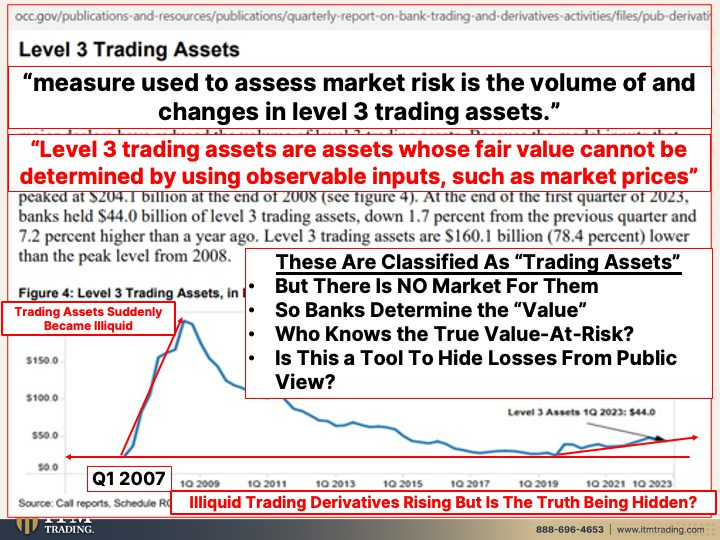

And let me reveal you more on how they’re preparing yourself for it. Since as you might or might not understand, we just recently had bank tension tests and in the oh, I’m sorry we’re, we’re gon na pertain to that. However really I believe we’re concerning that next week. And you wan na enjoy that a person too. However what these corporations and what these banks have actually done, according to the workplace of the comptroller of the currency is they have actually been the, the illiquid possessions, trading possessions have actually been increasing. Let me discuss this. They, this is a procedure, firstly, level 3 trading possessions are a procedure utilized to evaluate market threat and the volume of modifications and the level 3. So level 3 are not valuable possessions. They are possessions whose reasonable worth can not be identified by utilizing observable inputs such as market value. So what do the banks do? Oh, they are the ones that identify this. So I got a couple problems with that, right? So it resembles you entering and and stating, Hmm, well, hmm, I believe this deserves a million dollars. There’s no market for it. It really has no worth at all. So primary, when they inform you the level 3 trading possessions, how do you even understand that that’s truly the level 3 trading possessions? The volume, the worth of what they’re holding. You do not due to the fact that the banks can state that it deserves whatever they desire, all right? In addition, there is no market for them. So the truth is, is they have absolutely no market price. So the reality that you even see them increasing I believe is extremely discouraging, honestly, due to the fact that you’re revealing you how susceptible this entire monetary system is. If the banks figure out the worth, who exists managing that and stating, well is that truly the worth? How can we figure out if there’s no market price for it? You understand what the marketplace worth is absolutely no. That’s what the marketplace worth is. Who understands the real worth at threat? Since whether you’re the FDIC, the OCC, the BIS, the IMF, the FDIC, I indicate the entire alphabet soup, each and every single entity confesses that none understand the real worth at threat. So is this another among their accounting techniques and tools to conceal the real losses from public view? And by the method, I would like you to bear in mind that all of these level 3 trading possessions, the tradition possessions have actually LIBOR embedded in them. And just a few of them are safeguarded under that act. Not all of them. So can you see that below it resembles a volcano that’s preparing yourself to emerge. You can’t see the lava that’s growing below the surface area till it comes out the spout of the volcano. That’s when you see it. Well, if you’re standing there, are you gon na have adequate time to get outta the method? That’s why you prepare yourself ahead of time.

Now let’s take a look at this due to the fact that I desire you to see something that is vital. And returning to 2007, suddenly those possessions ended up being liquid. They were categorized as liquid approximately that point. So can you see how rapidly that can move and honestly that that shift has actually currently started. Trigger if you take a look at where those level 3 possessions were back in the very first quarter of 2007 when everyone was being informed that whatever was hunky dory. So you need to ask yourself, when do you wan na understand? Since we are all currently seeing a self-proclaimed increase in non on, on trading possessions.

Level 3 trading possessions. How can it be a trading property if you can’t trade them? Right? I desire you to keep that in mind for peace that I’m gon na do after this, by the method, on what’s occurring with the BRICS, this is considerable due to the fact that illiquid trading derivatives are increasing. However is this the reality? The response is no. They’re not gon na offer you the reality. They’re gon na understand the reality. That’s why corporations are developing liquidity. That’s why there are great deals of things that are occurring that you can’t see, however they can, that’s why worldwide reserve banks have actually purchase been purchasing more gold than they have because we had the last shift.

And speaking of gold, you have actually seen this chart previously, however this is the most existing one. Notional quantities of rare-earth element agreements, indicating gold. Now you can see just how much they have actually composed, however what I likewise increased, however what I wan na explain is these are all complete years till you get to 2023. This is simply the very first quarter. Simply the very first quarter. How simple do you believe it is to reduce what you see, which is simply another agreement in the regular. What individuals are utilized to taking a look at Wall Street and state, oh wow, that’s what gold deserves, is it? No, no, due to the fact that an increasing gold rates and indicator of stopping working currency. So they have actually offered themselves lots and great deals of tools to reduce this cost till it benefits them to do that over night revaluation. However everyone’s self-confidence has actually got ta be lost. Everyone’s there is a limitless quantity of agreement. Intangible gold, that’s no huge offer. It’s low-cost and simple. You press a button, you develop it much like you press a button and you can develop as much cash as you desire, ideal? However what does that do to the worth of what’s out there? Well, the intangible worth decreases, however the physical worth, as I have actually revealed you in other videos, is increasing due to the fact that need is going beyond supply. However for the regular public, they do not see that at all. They do not understand it. They do not understand any of it. They’re not taking a look at any of this. However thank goodness I have actually been groomed for this minute in time and I’m here to reveal you the reality. And we’re likewise gon na be speaking about what’s been happening with the BRICS countries and their existing problem of, of backing the brand-new currency with gold. Let’s discuss that a person too.

However if you have not subscribed yet, struck that button and subscribe. We’ll let you understand when we’re going live. However I’m informing you, this is the entire point of my doing this is so that you can see what’s coming and you can get ahead of it so that when this monetary tsunami waves over the world or simply ruins the world, does not ruin you or those individuals that you appreciate other you like, your neighborhood, its’ seriously crucial. So if you have not done this yet, click that Calendly link listed below, get your individual method, get your wealth guard in location. Get it in location. And if you have actually spoken with among our specialists, however you have not finished your method, get it done. I can’t inform you that whatever’s gon na collapse on Tuesday early morning at 8 35, however it could. Are you all set? If it does? Since I ‘d like everyone to be all set. Otherwise, you remain in shock. You are not prepared. And you’re gon na need to swallow the huge honk and tablet that they’re gon na pack down your throat. And I do not desire you need to take that tablet. I’m not gon na take it. I’m informing you today. Why? Since I have my gold and silver and I have food, water, security, barterability, wealth conservation, neighborhood and shelter. I desire you to have the exact same things that I have, I genuinely do. So if you like this, please offer it a thumbs up. Make certain that you share, share, share. Leave us a remark, enjoy our other videos, let us understand if you have any concerns. And till next we fulfill, please take care out there. Bye-Bye.

SOURCES:

Libor Fades Into History After 50 Years of Standard Supremacy (yahoo.com)

https://www.nytimes.com/2023/06/30/business/end-of-libor.html

As the Libor Period Ends, Market Individuals Expect ‘Crickets’ (usnews.com)

Blue-Chip Debtors Increase Revolvers as They Shift to SOFR– Bloomberg