For the ones of you with pals or circle of relatives who’ve been satisfied that thereâs not anything flawed with the financial system or that the United States buck is strong and âthe entiretyâs going to be okââ¦this video is for you. As a result of what seems to be shares within the inexperienced is if truth be told simply the insiders getting out and promoting to those that donât know any higher. In reality the insiders have already gotten outâ¦theyâve bought to the institutional traders who purchased in at nosebleed ranges in your behalf -IRAs, 401Ks 403Bs, Pensions, ETFs, Mutual Budget, Variable Annuities, and on and on. Itâs no other than a bait-and-switch Ponzi scheme that makes you imagine itâs running till it totally falls aside. Those wealth transfers occur ahead of the issues turn into evident to the general public. For those who do your analysis youâll see itâs already came about numerous occasions all the way through historical past. For those who donât see it on TV it doesnât imply itâs now not taking place, there simply hiding it from you. What occurs subsequent is it will get too pricey to cover, then the most obvious disaster hits and itâs too past due for everybody ready. Donât be the individual ready.Iâll provide an explanation for the entirety theyâre now not telling you and the way you steer clear of the entice that many of the public is already falling into.

CHAPTERS:

0:00 Itâs Already Taking place

2:34 Bond Investors Mentioning Demise of Ahead Steerage

5:37 Hawkish Pause

10:09 The Fedâs Credibility Factor

12:02 Jerome Powell Believers?

15:47 International Mess

17:20 Saudis Turning Their Again

18:49 Donât Use QE

24:08 Self belief in Main Establishments

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

00:00:00:01 â 00:00:30:17

For the ones of you with pals or circle of relatives who’ve been satisfied that there’s not anything flawed with the financial system or that the United States buck is strong and the entiretyâs going to be Okey dokey. Smartly, somewhat in truth, this video is for you and them, as a result of what seems to be shares going up is if truth be told simply the insiders getting out and promoting to the general public and those that donât know any higher.

00:00:30:19 â 00:01:08:29

In reality, the insiders have already gotten somewhat a little bit out they usuallyâve bought to whoâs going to shop for it. Letâs see, the placeâs the institutional traders who make investments cash in your behalf? They usually purchased them at nosebleed ranges IRAs 401k 403b pensions, ETFs, mutual, all that rubbish. And on and on it is going. Itâs no other than a bait and turn Ponzi scheme that makes you imagine itâs running till it totally falls aside.

00:01:09:01 â 00:01:38:02

Those wealth transfers came about ahead of the issues turn into evident to the general public. For those who do your analysis, youâll see itâs already came about that over 4800 occasions all the way through historical past. For those who donât see it on TV, it doesnât imply itâs now not taking place. Theyâre simply hiding it from you. What occurs subsequent is it will get too pricey to cover and sufficient wealth has been transferred.

00:01:38:04 â 00:02:12:03

Then the most obvious disaster hits and itâs too past due for everybody thatâs been looking forward to it. Please donât be that individual thatâs ready. Iâll provide an explanation for the entirety theyâre now not telling you and the way you steer clear of the entice that many of the public is already falling into. Bobbing up, Iâm Lynnette Zang, leader marketplace analyst right here at ITM Buying and selling, a complete carrier, bodily gold and silver broker.

00:02:12:06 â 00:03:03:20

However what we truly concentrate on are customized methods. After all, youâve were given actual cash as a basis this is totally out of doors of the device and subsequently out of doors of central financial institution and govt keep an eye on, which is truly what you want to do at the moment as a result of you may recall and for those who havenât will, weâll put the hyperlink down. So you’ll be able to see remaining yr, remaining summer season when the Federal Reserve after which all it was once if truth be told the Financial institution of England first, then the Federal Reserve, then the ECB, however globally all central banks gave up marketplace self belief in them that you may recall that the way in which that that came about was once the Federal Reserve, proper?

00:03:03:20 â 00:03:35:21

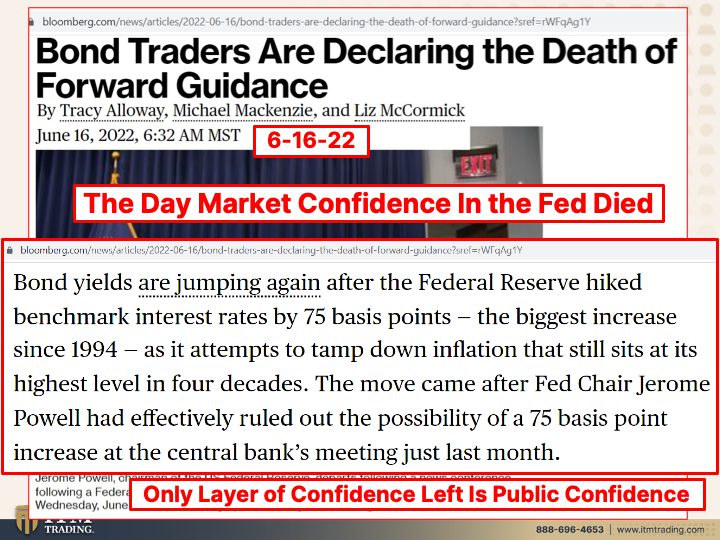

Since 2008, ahead steering has been a key device for central banks. So that they inform the markets, leap in, the markets say how top and that ahead steering telling the markets what theyâre going to do enabled the markets to get into place to profit from it. So that they stored telling them weâre going to do 50 foundation issues, 50 foundation issues, 50 foundation issues, after which bet what, on June fifteenth and 2022, they did 75 foundation issues.

00:03:35:23 â 00:04:19:08

Now, that won’t look like an excessive amount of to you, however somewhat in truth, that was once sufficient for the marketplace lack of self belief within the Fed. And as you’ll be able to see from the headline bond merchants are putting forward the demise of ahead steering and itâs best gotten worse with all of the ones losses now held within the banks and within the companies after 15 years of 0 rate of interest coverage and and rather a lot and a number of loose cash, bond yields are leaping once more after the Federal Reserve hiked benchmark rates of interest through 75 foundation issues.

00:04:19:15 â 00:04:50:00

The most important building up since 1994 because it makes an attempt to tamp down inflation that also sits at easiest on the easiest degree in 4 a long time. The transfer got here after Fed Chair Jerome Powell had successfully dominated out the opportunity of a 75 foundation level building up on the central financial institutionâs assembly simply remaining month. I used to be amazed that they made this truly silly selection.

00:04:50:00 â 00:05:16:22

Personally, it was once a silly selection coverage misstep and gave away that self belief as a result of thereâs just one layer left and thatâs the general public self belief within the central banks, and thatâs declining too. So that is the setup. It is a key, key date and seriously necessary that you just get this as a result of this complete device through design is a Ponzi scheme.

00:05:16:22 â 00:05:49:27

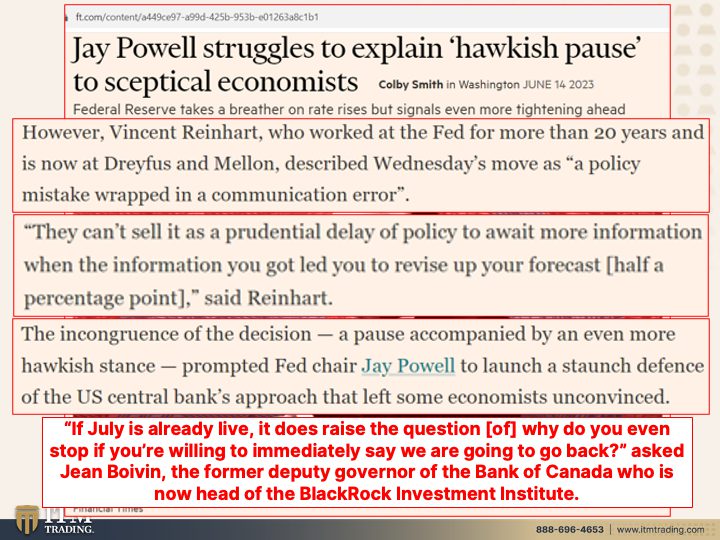

And what a Ponzi schemes want. They want t they want to key issues. They want new cash they usually want self belief. And in the event that they donât have both a kind of issues, the scheme falls aside. And bet whatâs taking place at the moment? This scheme is falling aside. Jay Powell struggles to provide an explanation for hawkish pause to skeptical economists. They used not to be skeptical till they gave that self belief piece away.

00:05:50:04 â 00:06:12:12

I do know that itâs one thing that I hammer always as a result of it’s so seriously necessary that you just if truth be told get that. So your folks and your circle of relatives that is going, Oh, no, theyâre telling us the entirety is okay. Whatâs the issue? Smartly, thatâs what theyâre reckoning on. And so whilst you assume the entirety is okay and hunky dory, do you are making any adjustments?

00:06:12:19 â 00:06:47:11

No, you don’t. You keep put. And that’s what permits the wealth switch. Thatâs what permits them to profit from you. Thatâs whatâs enabled them to profit from you all of your lifestyles with out you even understand it. That is truly itâs such a fascinating learn about. However Vincent Reinhart, who labored on the Fed for greater than two decades and is now at Dreyfus Mellon, you assume he nonetheless has some contacts on the Fed that he may have conversations with?

00:06:47:13 â 00:07:16:15

I donât know. Itâs a revolving door, isnât it, that he described Wednesdayâs transfer as a coverage mistake wrapped in a verbal exchange in error, and the Fed is suffering to provide an explanation for that hawkish pause. So the coverage mistake was once pausing as a result of weâve additionally been advised donât name this a pause, similar to donât name this QE. Smartly, a rose through some other identify continues to be a rose.

00:07:16:15 â 00:07:47:24

I donât care what you name it. And that was once surely a pause. They may be able toât promote it as a prudential extend of coverage to look forward to additional information. When the guidelines you were given led, you to revise up your forecast part a share level. So what do you do? He paused. Powell paused, however then mentioned, However there might be two extra 25 foundation level rises in rates of interest this yr.

00:07:47:24 â 00:08:19:04

In order thatâs what heâs relating to. So you’ll be able toât say that weâre simply ready to get additional information as a result of you were given the guidelines that that advised you youâve were given to lift charges extra. However this time you probably did a pause. Have been they yielding to one of the marketplace power thatâs been calling for a pause, The incongruence of the verdict, a pause accompanied through an much more hawkish stance, which means, ok, weâre now not elevating now, however weâre going to have two extra charge hikes.

00:08:19:06 â 00:08:46:10

Brought on Fed Chair Jay Powell to release a staunch protection of the U.S. central banks manner that left some economists unconvinced. That is truly a large drawback. We want they want everyone to be satisfied that they know what theyâre doing and that they’ve it below keep an eye on. And bet what? They’ve admitted that they donât perceive inflation. They do not know what theyâre doing.

00:08:46:17 â 00:09:18:10

It is a ancient second for them as a result of we’re resetting all of the financial, social and fiscal device. However, you already know, and now theyâre getting much more questions. If July is already alive, which means they already mentioned theyâre going to lift charges in July, it if July is already reside, it does elevate the query of why do you even forestall for those whoâre keen to right away say, we’re going to return?

00:09:18:12 â 00:09:48:13

Now not a excellent query. And this was once officially requested this was once requested through Gene Bolden, the previous deputy governor of the Financial institution of Canada, who’s now head of the BlackRock Funding Institute, issued. This is a revolving door between Wall Boulevard and the federal government and the central banks. And for those who assume that they depart their contacts and their impression on the door, assume once more.

00:09:48:16 â 00:10:21:26

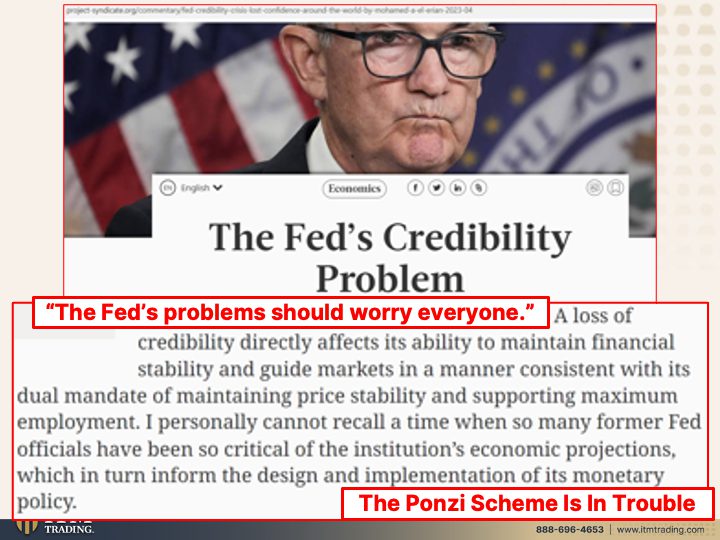

So right here we’re listening to from earlier those who have been on this realm that are actually in Wall Boulevardâs realm, they usually donât agree with the Fed as a result of who is aware of extra about how the central banks paintings and people who have been central bankers or those who learn all of the crap that they put out. So they have got an actual credibility drawback. And because all Ponzi schemes are primarily based upon self belief and their credibility, this is a actual drawback.

00:10:21:28 â 00:10:50:24

The Fedâs issues must concern everybody. I agree, as a result of thatâs the one factor thatâs conserving the device in combination. A lack of credibility at once impacts its talent, which means the Fedâs talent to take care of monetary steadiness and information markets in a fashion in keeping with its twin mandate of keeping up value steadiness, which is which is if truth be told holding inflation low sufficient that you just donât ask for more cash.

00:10:50:27 â 00:11:19:19

Thatâs what value steadiness is and supporting most employment. In order that way youâre keen to paintings for much less and not more cash, although nominally it will glance extra. However youâre keen to paintings for much less cash. I in my view can’t recall a time when such a lot of former Fed officers had been so crucial of the establishments financial projections, which in flip tell the design and implementation of its financial coverage.

00:11:19:26 â 00:11:43:27

And bet what? That is true. All over the place the sector, as Iâve simply proven you. And weâll display you once more in only a 2d. And through the way in which, for those who havenât subscribed but, you want to subscribe. Hit that bell. Weâll mean you can know once weâre occurring. However you want to understand whatâs taking place beneath the outside, as a result of in fact, the Ponzi scheme is in hassle.

00:11:43:29 â 00:12:19:09

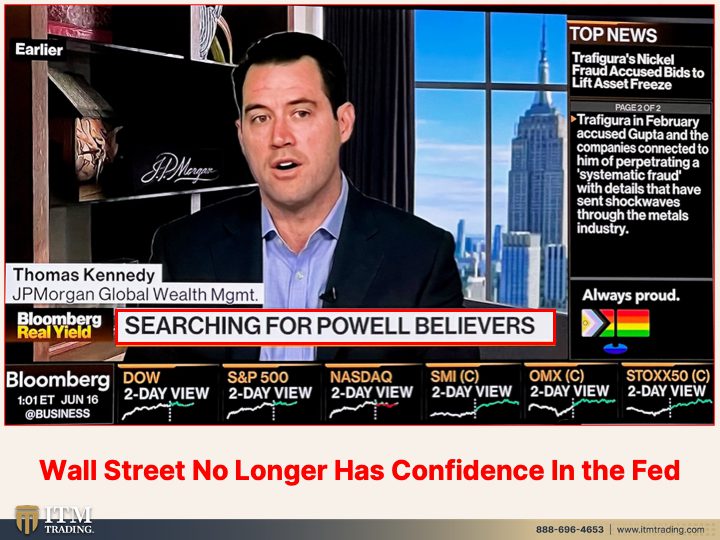

What do you wish to have to enter it with this rubbish that loses all price or this? Thatâs been cash for tens of millions of years. The Ponzi scheme is maximum surely in serious trouble or even particularly whilst you see on Bloomberg or CNBC in search of Powell believers, I couldnât imagine that I noticed that headline. Nevertheless it simply is going to turn you that certainly one of their key equipment, Key equipment.

00:12:19:09 â 00:13:08:13

And what are their key equipment? K. Rates of interest, which have been held at 0 for 15 years. And now as they are trying to lift them and albeit, you’ll be able to return traditionally and you’ll be able to see each and every unmarried time they attempted to lift them, what did it do? It driven us right into a recession, forcing the central banks to drop rates of interest 5 and a part, 5 and 3 quarters p.c to, quote unquote, stimulate extra borrowing and spending, as a result of this Ponzi scheme is de facto dependent upon a relentless building up of debt, now not reversing that, now not paying that debt off, however developing an increasing number of and extra of it, which, you already know, you’ll be able to have a look at any of the ones

00:13:08:13 â 00:13:33:17

graphs and you’ll be able to see that governments are nice at construction debt. However even there, I donât care. You must be a central authority, you need to be an organization, you’ll be able to be a person. All of the rules of finance if truth be told paintings the similar for all people. The variation is, is that we willât move within the again room and create a complete bunch extra of these things.

00:13:33:19 â 00:13:58:18

We willât do this. Itâs referred to as counterfeiting. However bet what? It is a counterfeit of this. This has used some one position. That is used globally in each and every sector. What do you wish to have? You need the counterfeit that they keep an eye on and they are able to take from you at will. Or do you wish to have the actual factor thatâs invisible to them? The selection is yours.

00:13:58:20 â 00:14:13:09

However the commentary is somewhat transparent. Wall Boulevard not has self belief within the Fed, and we’re in a a lot more bad position than we have been.

00:14:13:11 â 00:14:55:22

America wishes world self belief to take care of its international reserve foreign money standing. We have been able to offer it away again within the past due 1760s, early seventies, and that thatâs when Henry Kissinger, Secretary of State, went to Saudi Arabia and created the petro buck. And it was once that petro buck the place for those who have been going out of doors of your borders as a central authority, an organization, and surely as a person, for those whoâre going out of doors of your borders, you had no different possibility however to shop for stuff like oil, lumber, metal, drugs, no matter, with US greenbacks.

00:14:55:24 â 00:15:25:19

What an enormous merit for us as a result of that created a synthetic marketplace for greenbacks. For those who needed to hang them and buck denominated belongings. So the sector must agree with us for the reason that international can take us down. And somewhat in truth, this has been taking place an increasing number of briefly the place greenbacks don’t seem to be utilized in world industry as a lot. I believe the present degree or probably the most present degree I noticed was once 47%.

00:15:25:22 â 00:15:58:15

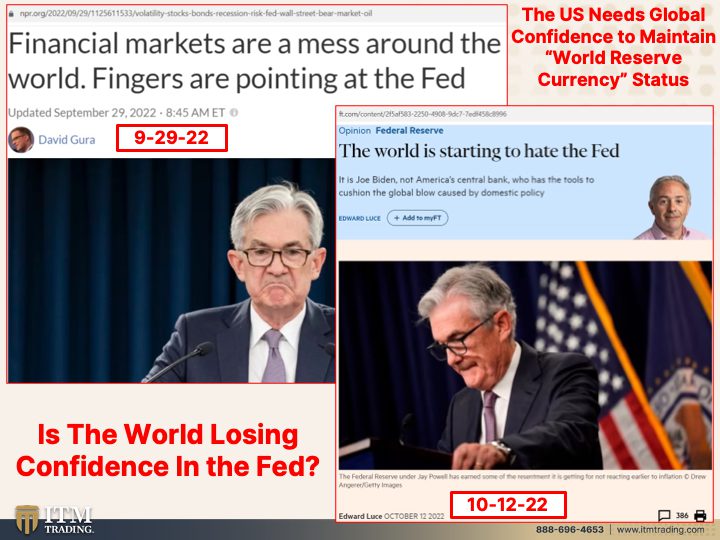

That could be a considerable decline for a foreign money that was once 100%. So are you able to see this decline and why now not? Weâve weâve truly proven our colours and the truth that weâre keen to make use of the worldwide monetary device as a device to get what we wish. So thereâs a complete bunch of items which might be taking place. However after we gave up that ahead steering, monetary markets are a multitude around the globe and hands are pointing on the Fed.

00:15:58:17 â 00:16:26:13

You assume and the sector is beginning to hate the Fed. This isn’t excellent for the reason that international can gang up on us and take that place away. And far as we pay attention, Oh no, that gainedât occur. Thereâs an excessive amount of in the market. Bet what was once created on the IMF? Itâs referred to as the Substitution Fund. They usually created that again in 69 they usually examined it in 2009 to ensure that the entire mechanism works.

00:16:26:15 â 00:16:53:28

So all of the international must do to get out of that buck centric international is to deport no matter their buck holdings are bonds, money, no matter. After which the IMF can convert them into their foreign money. The SDR, which simply stands for particular drawing rights. Itâs only a identify like some other identify. However the international has been decreasing its dependance and reliance at the buck for some time.

00:16:54:00 â 00:17:18:08

And so I donât know. At what degree does it make that shift simple? I will be able toât let you know that, however I will be able to let you know itâs in position at the moment. And when the sector loses complete self belief within the Fed will get mad sufficient at them, they were given to substitution fund actual simple to transform their holdings out of greenbacks and into the IMF.

00:17:18:10 â 00:17:48:29

SDR and our staunchest best friend, the most important reason we retained that place is popping its again on us Saudi Arabia. Theyâre taking a look to China for enterprise as you as impression wanes. Oh, my goodness. I imply, simply take into accounts this. The time has come, individually, for China to be a primary funding spouse within the Arab internationalâs building power.

00:17:49:01 â 00:18:28:10

That is Saudi Funding Minister Khalid Al Fayed. Folli Follie. Iâm sorry if Iâm butchering that mentioned in a keynote cope with on Sunday, suggesting the Arab Financial Powerhouse Act as a bridge to the remainder of the area, which means that complete oil influenced area. So the United States is shedding its impression. China is gaining its impression. Houston, We were given an issue as a result of whatâs truly taking place is we now have abused our privilege, which occurs each and every time.

00:18:28:10 â 00:19:04:05

So itâs now not a marvel, however we now have abused our impression and our our allies are shedding self belief in us and we’re shedding the sector reserve. Weâre now not the sector reserve anymore anyway. We nonetheless have the respectable identify, however thatâs it. So once we move into this subsequent disaster, the opposite factor that a complete bunch of former central bankers are announcing is donât use QE, donât do it, and I donât have any further cash in however donât do it.

00:19:04:05 â 00:19:31:19

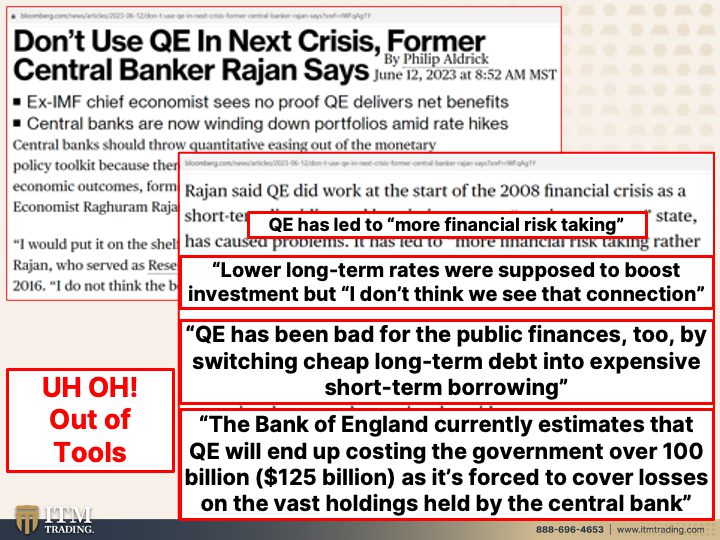

Donât do it. They see no evidence that QE delivers any web advantages. And itâs now not simply him. Thereâs a number of them which might be announcing this and central banks are actually winding down portfolios amid charge hikes, this means that that they’re liquidating the bonds that theyâre conserving on their steadiness sheet they usuallyâre taking large losses as a result of as you recall.

00:19:31:22 â 00:20:07:03

Proper, rates of interest, marketplace price. In order theyâve been pushing the ones rates of interest up, the marketplace price of the ones bonds and all debt tools had been declining. Central banks must throw quantitative easing out of the financial coverage toolkit as a result of thereâs no evidence that it results in higher financial results. Thatâs from a former World Financial Fund leader economist, And I might put it at the shelf till we work out extra about it.

00:20:07:04 â 00:20:43:14

Theyâve been the usage of since 2008, however letâs put it at the shelf till we all know extra about it, as a result of we are actually beginning to really feel the have an effect on of all of that QE. Letâs see. So he was once within the Reserve Financial institution of India from 2013 to 2016. I don’t assume the advantages outweigh the prices, Rajan mentioned. QE did paintings in the beginning of the 2008 monetary disaster as a brief time period liquidity device, however in its present semi-permanent state has brought about issues.

00:20:43:16 â 00:21:22:12

It has ended in extra monetary threat taking moderately than actual threat taking, which doesnât translate into extra actual process, however does depart the financial system extra inclined. So what heâs announcing this is all of this loose cash that that the central banks had been pushing out via QE, the firms didnât take that cash and make bigger their companies. They expanded their buying and selling, their threat taking within the inventory marketplace as a result of, hi there, the Fed is promised and now not simply the Fed, however central banks had been giving a number of loose cash out.

00:21:22:19 â 00:21:54:08

So we now have a number of IPOâs and a number of different threat taking within the monetary area, however we havenât truly grown the financial system as itâs now not going into increasing companies simply into buying and selling. K. Decrease longer term charges have been meant to spice up funding, however I donât assume we see that connection. No as a result of theyâre buying and selling theyâre simply the usage of it to industry and generate profits, to not reinforce the actual financial system.

00:21:54:10 â 00:22:34:23

QE has been unhealthy for public public budget too. By way of switching affordable longer term debt into pricey quick time period borrowing. K, so the long run debt, have a look at how this strikes up and down as rates of interest transfer. The quick time period strikes much more is impacted much more than the long term. Itâs the similar factor whilst you have a look at the actual property marketplace and the ones people which might be sitting on mortgages below 3%, are we going to be concerned to promote that space and tackle a 7% or 6% loan?

00:22:34:25 â 00:23:10:23

No. So what thatâs doing is is slowing down the financial system, now not supporting it. And thatâs what theyâre speaking about. They run the firms, refinanced long term debt into decrease coupons, however quick time period, decrease decrease coupons. And now theyâre having to refinance in a emerging rate of interest surroundings. Itâs an issue as a result of they both need to get a hold of extra or extra capital to position down as they refinance or they have got to get much less cash than they owe.

00:23:10:27 â 00:23:37:20

So are you able to see the issue? The Financial institution of England recently estimates that QE will finally end up costing the federal government over 100 billion and that be British kilos 125 billion USD because itâs compelled to hide losses at the huge holdings held through the central financial institution. Smartly, who truly can pay for that? Iâd love after they say this stuff. Itâs going to finally end up costing the federal government.

00:23:37:23 â 00:23:59:28

Smartly, who finances the federal government? Taxpayers fund the federal government. And what youâre additionally seeing this is that central banks are out of equipment. They maintain speaking about their equipment, however they donât get particular as a result of they donât have any further equipment. Now, Iâm now not announcing they are able toât make one thing else up as a result of perhaps they completely can. I imply, I didnât see QE coming.

00:23:59:29 â 00:24:39:23

Iâm now not going to lie. Proper. So perhaps they are able toât, however they surely appear to be having issues doing so, donât they? And once more, this all is going again to self belief. For this reason they all the time check shopper self belief, inflation, self belief, expectancies, the ones varieties of issues. However for those who have a look at the exchange in American citizens self belief in primary US establishments, the adaptation between 2021 and 2022, they have got long gone down in each and every unmarried example, each and every unmarried example.

00:24:39:26 â 00:25:06:12

Self belief is declining. Thereâs slightly any self belief within the govt left banks. Now, I donât they I donât assume they did this ahead of. I believe they did this if truth be told ahead of March or this is able to most probably be decrease. However that is what we want, now not we? That is what the central banks want to have occur. And the federal government, too. They want to have public self belief within the banking sector.

00:25:06:14 â 00:25:45:11

However that self belief in all of Americanâs establishments, together with the central financial institution. Itâs at the decline. However you already know what I agree with? Thatâs what I agree with. Oh, my goodness. Bodily gold. Bodily silver. That’s what I agree with. And the way about you even says it in this invoice that has my face on it? And bodily gold and silver we agree with.

00:25:45:13 â 00:25:54:10

Do you agree with the central financial institution? Do you truly agree with them to do whatâs to your very best passion?

00:25:54:12 â 00:26:24:20

That is the type of factor you want to concentrate on as a result of that is truly whatâs taking place. Whether or not you spot it, you donât see it as a result of somewhat frankly, they are going to stay this stuff hidden till itâs too past due so that you can make a distinct selection. That is whatâs going to give protection to your freedom, that they’ve their druthers. Theyâre going to stay you within the device, rob you of the entirety in order that like the sector financial Discussion board says youâre not anything, however youâll feel free.

00:26:24:22 â 00:26:55:02

I donât assume so. So I only recently did a technical lesson on spot gold, spot silver, appearing you the other formations in order that you understand how to transport. You donât essentially have to know the nuances, however boy, you’ll be able to discover ways to acknowledge the ones patterns. And when there’s a shift in the ones patterns, that may put you in a far, a lot, significantly better place in order that no person can pull the wool over your eyes.

00:26:55:05 â 00:27:25:25

And for those whoâd like to buy certainly one of your very personal cash weapons, merchandise buying and selling cash, weapons, the Etsy hyperlink is under so you’ll be able to play Central Banker two and perhaps we will all play in combination. However for those who havenât achieved this but, let simply click on that. Are we able to hyperlink under? Get started your individual gold and silver technique, however truly your technique that will help you get right into a place to take care of your present lifestyle and profit from the alternatives that lie ahead of us.

00:27:26:01 â 00:27:48:07

As a result of thereâs all the time alternative in disaster. And till subsequent we meet, I need you to keep in mind itâs truly easy. Actual monetary shields are made up of bodily gold, bodily silver to your ownership. And till subsequent, we meet. Please be protected in the market. Bye. Bye.

SOURCES:

MARKETS JUST GOT RISKIER: Have Your Technique in Position

https://youtu.be/RVvBNsnU_io

https://www.toes.com/content material/a449ce97-a99d-425b-953b-e01263a8c1b1

https://www.toes.com/content material/2f5af583-2250-4908-9dc7-7edf458c8996

https://information.gallup.com/ballot/394283/confidence-institutions-down-average-new-low.aspx