Days after Barry Sternlicht’s Starwood Capital Group defaulted on a $212.4 million home mortgage backed by an Atlanta workplace tower, Bloomberg launched an mind-blowing interview with the billionaire financier about installing distress in United States industrial property.

” We remain in a Classification 5 cyclone,” Sternlicht stated in an interview on June 28 taped for a July 25 release in an approaching episode of Bloomberg Wealth with David Rubenstein.

Sternlicht cautioned, “It’s sort of a blackout hovering over the whole market till we get some relief or some understanding of what the Fed’s going to do over the longer term.”

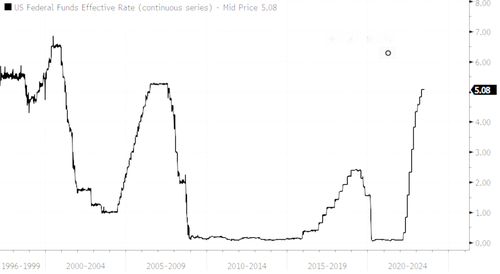

He discussed the CRE decline was stimulated by the Federal Reserve’s sixteen months of aggressive rate of interest walkings to tame inflation– and unlike previous recessions– not due to careless speculation.

In early March, throughout the local bank crisis, we penned a note that precisely mentioned tension would emerge in the CRE area, primarily in workplaces and shopping centers. The note was entitled Why Little Banks Remain In Huge Difficulty: As Hedge Funds Stack Into The New “Big Short,” The Next’ Credit Occasion’ Emerges And considering that, we have actually penned many CRE notes (a few of which are here & & here & here )about the unfolding crisis.

Tighter credit conditions following the local bank crisis in March have actually made refinancing existing structures remarkably hard for property owners and come as jobs increase.

Sternlicht remembered that his company attempted to get a bank loan for a little home not too long back. He stated his personnel connected to 33 banks, and just 2 returned with deals.

According to Morgan Stanley, the elephant in the space is a huge financial obligation maturity wall of CRE loans that amounts to $500 billion in 2024 and $2.5 trillion over the next 5 years.

As we have actually seen in San Francisco, the failure to re-finance as some residential or commercial properties sustain increasing jobs will press property owners to offer residential or commercial properties or ignore them.

Sternlicht stated there’s an extremely genuine possibility of a “2nd RTC” occasion playing out, describing Resolution Trust Corp., the federal government entity that led the effort to liquidate properties of the cost savings and loan associations that stopped working 3 years back.

” You might see 400 or 500 banks that might stop working,” he stated. “And they will need to offer. It likewise will be an excellent chance.”

Sternlicht released his property company throughout the period of RTC, acquiring multi-family systems and turning them to billionaire Sam Zell 18 months later on for triple the cost.

Sternlicht stated the Federal Deposit Insurance coverage Corp would likely start unloading CRE loans on Signature Bank’s books, which stopped working in March. He stated, “The federal government’s going to prop up the worth of that portfolio by supplying extremely inexpensive funding to it.”

* * *

Records of the interview:

David Rubenstein:

In some cases individuals are stating that the very best financial investment chance now is distressed property financial obligation– that you can purchase the financial obligation from banks at a discount rate. However do you believe it’s prematurely for that?

Barry Sternlicht:

You understand, we were gon na return an office complex. And they stated, “Well, not so quick. If you wish to, we’ll reorganize the loan. And we’ll cut the loan in half. And you put the cash in here. And we’ll take this as a junior note.” Since the banks do not desire the properties back. They’re not set as much as bring these properties. It’s not their organization.

So you’re starting to see things. We’re visiting this huge trade of the [Signature] Bank portfolio. That’s going to be a standard for market.

David Rubenstein:

A great deal of fortunes were made in the property world in’ 07- ’08 when individuals purchased distressed property. The late ’80s too, when the RTC was here. Do you see funds being formed to purchase these properties? However you believe they will not be offered for a year or more?

Barry Sternlicht:

Today you have an uncommon scenario in the property markets since everybody’s sort of taking a look at the yield curve. And it states rates will be lower later on. Everybody states, “You understand, endure till ’25. Keep your properties.” So deal volumes have actually plunged.

Unless you need to offer something today, no one wishes to offer anything today. They believe tomorrow will be rosier. So for the many part, everyone’s pressing any sales back. However what you’re seeing is when a loan is developing and a customer can’t cover the existing financial obligation service. Something’s got ta offer. Regrettably, we’re likewise a loan provider.

David Rubenstein:

Are we going to alter the method office complex are truly valued in the future since occupants aren’t going to require as much area? Or do you believe ultimately the occupants will return and the workers will return?

Barry Sternlicht:

The work-from-home phenomenon is a United States phenomenon. If you go to England or Germany, leas are up, and job rates in the leading German home markets– Berlin, Frankfort, Munich, Hamburg– are less than 5%. Individuals are back in the workplace. You and I go to the Middle East, they’re complete. We have workplaces in Asia, they’re complete. So this is a United States scenario.

In the United States you have 2 markets. The good structures will remain leased and my guess is at respectable rates. And the B and C things is going to be– perhaps fields of grain or something. It’ll be extremely quite. We’ll have all these little mid-block parks in New york city City since there will not be anything else to do with those structures.

The other feature of workplace is AI. AI is going to strike a number of these markets that have actually been huge users of workplace. So that’s sort of a huge enigma in the financial investment formula.

David Rubenstein:

Let’s expect I’m a typical individual. Where should I put my cash as a financier in property?

Barry Sternlicht:

High rate of interest are depressing the variety of single-family house systems that have actually been constructed so now you’re having an ever-increasing deficiency of property. Provided the expense of building and construction, the entire property complex– consisting of single-families for lease, multi-family, the real estate market, even property land– I believe they make fascinating financial investment chances today.

David Rubenstein:

Is it an advantage for individuals to now buy a genuine REIT?

Barry Sternlicht:

I believe property has a great location in the balance sheet of any person. In the pandemic, we raised a special-situations fund and purchased 15 names in the REIT organization, and we were up, like 70% at one point. We’re going to do that once again. And if you take a long-lasting view, a few of these are great business with the incorrect interest-rate environment. I would not even state they have the incorrect balance sheet, however they are so out of favor. There are some truly bargain out there. So if you’re smart, you might purchase some public REITs.

David Rubenstein:

What type of return should a typical REIT financier anticipate?

Barry Sternlicht:

In the home mortgage REIT, Starwood Residential Or Commercial Property Trust, we’re paying a 10% dividend. So you get that and any gratitude in the stock, and the stock’s presently trading listed below book worth. It typically trades above book worth. It utilized to trade at 1.23 times and now it’s trading at.9. So if it goes back, you’ll get a 15% return. We have actually balanced 11.3% over ten years.

David Rubenstein:

Why should someone desire a profession in property? Why is that an excellent organization to be in?

Barry Sternlicht:

You have actually got to discover specific niches, and there are a great deal of specific niches in property. And it’s extremely micro, block by block. If I didn’t have my company today, might I purchase– even in a city like New York– and renovate apartment or condos and real estate. I might earn money doing that. I have a mutual friend who’s purchased 300 houses. He turned living spaces into bed rooms, put them all on Airbnb. He’s making a fortune and utilizing Airbnb as his circulation set. It’s a huge market. There’s constantly something to do.

David Rubenstein:

You were based in the northeast part of the United States for much of your profession. You matured in Connecticut, you were born in Long Island. However you got and transferred to Miami. Why did you do that a couple of years ago? And any remorses about relocating to Miami?

Barry Sternlicht:

Well, my mommy’s down there. And I got separated. That was one factor. Modification your life, start over. There was certainly a tax advantage to doing so. And I had actually offered an interest in my company at the time. I was based in Connecticut. I was based in Greenwich, our head office existed. I took a look at my travel calendar in a typical year and I was just house for about a 3rd of it. So I didn’t believe it ‘d be that difficult to move and make that my main office. It turned I captured the wave completely.

I was an early inhabitant into Miami. And, you understand, the house costs most likely tripled there. I must have purchased whatever with my home. I would have had the best-performing property fund on the planet.

David Rubenstein:

If your mom concerned you and stated, “I have $100,000. I require to invest it someplace. Where should I invest it?” You would state where, property?

Barry Sternlicht:

Today if you take a look at my portfolio, I have a substantial quantity of money that I never ever had in the past since I’m getting 5% for the money. Pretty quickly I’m going to simply begin releasing that capital when I can see the sun coming through the clouds of the Fed’s motion. When the Fed essentially informs you they’re done, I believe property will capture an extremely firm quote.

Filling …