Copper rates will likely be unstable on weak international need and the United States dollar’s motion, though they are anticipated to enhance in the 2nd half of 2023.

Hope stems for the red metal– utilized in building and construction, power and electrical cars– from China preparing a stimulus bundle and a drop in production in leading manufacturer Chile by 14 percent year-on-year (YoY) in May.

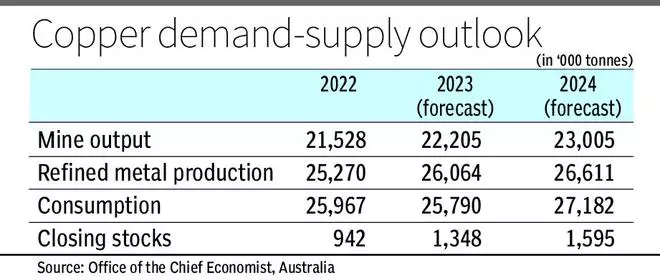

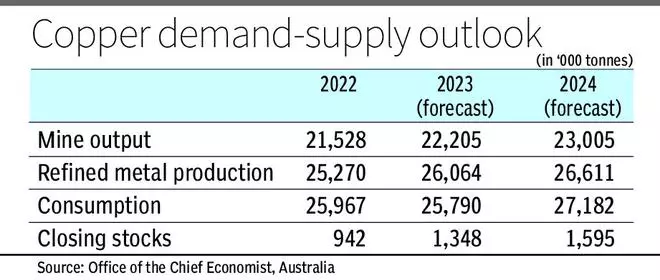

On the other hand, the Workplace of the Chief Financial Expert, Australia, has a fascinating referral to India, stating its usage is anticipated to be strong in 2023.

Chinese development pangs.

” A slower-than-expected rebound in Chinese financial development, integrated with weak building and construction activity in Western nations, is putting down pressure on copper rates. Growing need from the power and EV sectors are essential chauffeurs of copper usage over the outlook duration,” it stated in its “Resources and energy quarterly”.

According to the International Copper Study Hall (ICSG), the world improved copper balance, based upon Chinese obvious use (leaving out modifications in bonded/unreported stocks), suggested an initial surplus of about 384,000 tonnes in the very first 4 months of 2023.

” The world improved copper balance changed for approximated modifications in Chinese bonded stocks suggested a market surplus of about 514,000 tonnes,” it stated.

Cost anticipated down.

Nevertheless, the Trading Economics site stated the combined copper stockpiles throughout the London Metal Exchange (LME), Shanghai Futures Exchange and COMEX, and Chinese bonded storage facilities are down 55 percent given that March at 225,018 tonnes. This level of stockpiles represents a simple 3 days of international copper usage in 2022.

Research study experts have actually reduced their rate projection for copper in 2023 with BMI, a system of Fitch Solutions, predicting the typical yearly rate at $8,800 a tonne (versus $9,000 projection earlier) “on the back of weak international need, a repercussion of the slowing international economy and Mainland China’s service-led healing”. “Costs have actually balanced $8,750.30 in the year to date since June 19 2023, lower than the average of USD8,788/ tonne seen in full-year 2022,” the research study company stated.

Bank of America Global Research study reduced its copper rate projection to $8,788 ($ 9,427).

However the Australian Workplace of Chief Financial expert stated rates will likely rebound in the 2nd half of 2023. “Chinese policymakers have actually signified an intent to preserve development targets and might promote activity to make up for a weak start to the year. Even more, the United States dollar might deal with down pressure if the United States Federal Reserve pauses its financial tightening up program,” it stated.

Greater than pre-pandemic.

Throughout the entire year, the LME area rate is anticipated to typical $8,600 a tonne. “Need will be a more powerful chauffeur of rate than supply throughout the years, with threats manipulated to the disadvantage if the Chinese healing stalls, or significant economies experience a difficult landing,” the Australian workplace stated.

BMI supported this view stating, “Our projection of $8,800 for 2023 ways we anticipate rates to see a minor dive in the short-term, however stay under substantial pressure as weak need hammers rates.” Nonetheless, rates will stay raised relative to pre-pandemic levels, supported by tightening up exchange stocks and a somewhat weaker dollar, BMI stated.

Presently, copper for money is priced quote at $8,371 a tonne and the three-month agreement at $8,388 on the LME.

ING Believe, the monetary and affordable analysis wing of Dutch international services firm ING, stated in Might that copper has actually been weighed down by a strengthening dollar, that makes copper more costly for Chinese purchasers.

Increase in usage.

” … speculators have actually been reducing their bullish LME copper bets– the net-long position is now the least bullish in more than 19 weeks at 38,416, as weekly exchange information on futures and choices program,” it stated.

Wish for greater need from China has actually now faded with current frustrating information revealing a blended image for the world’s greatest customer of copper, ING stated.

Chinese SMM News stated copper rates are ruling high and need is weak on the usage front. Copper rates are anticipated to be extremely unstable prior to “the rate walking resolution is performed”, it stated.

BMI projection international copper usage development to increase in 2023 by 2.4 percent to 27 million tonnes (mt), amidst an irregular financial healing in Mainland China and a drag from other economies. “We keep in mind that the green energy shift will partly offset this disadvantage pressure,” it stated.

Unlikely to see 2022 highs.

The Australian Workplace of the Chief Financial expert stated international improved copper usage is anticipated to grow to 26 mt in 2023– a boost of 1.5 percent year-on-year. “Copper usage is anticipated to increase throughout the year, though disadvantage threats connected with softening international development appear,” it stated.

ICSG stated improved copper use increased 3 percent in the very first 4 months with refined copper production increasing by 8 percent.

BMI stated though rates will likely enhance from existing levels in the 2nd half of 2023, it does not anticipate a go back to the highs seen in 2022 as China’s realty sector stays in doldrums.

The Australian Workplace of the Chief Financial expert stated copper usage is anticipated to increase throughout the year, though disadvantage threats connected with softening international development appear.

.