Dhaka stocks experienced a fall on Sunday as financiers opted for offering shares for understanding short-term gains amidst political stress in the nation ahead of the nationwide election, market operators stated.

A short-term post ponement of the gazette notice on the ‘bancassurance’ standards likewise resulted in a substantial decrease in costs of shares of the insurance provider on the day, stated EBL Securities in its everyday commentary.

The federal government apparently on July 18 authorized the strategy to present ‘bancassurance’, a system making it possible for the sale of insurance coverage items through the banking channel in the nation.

Financiers had actually formerly responded favorably to the notice that led to a rise in share costs of insurance provider in the previous number of trading days, market operators stated.

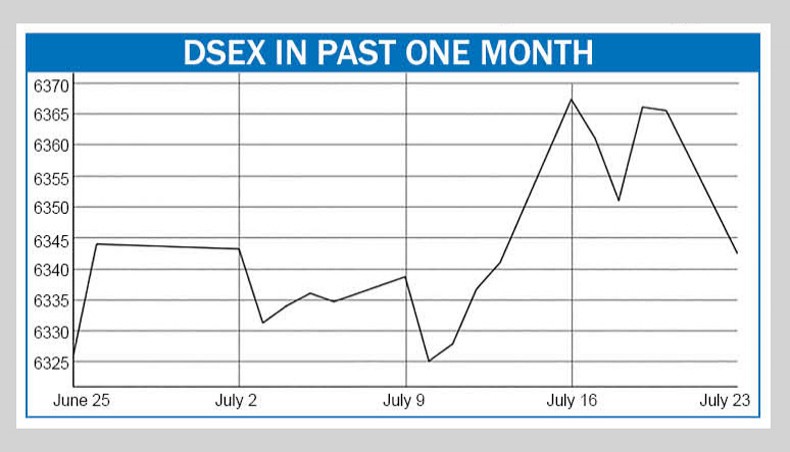

DSEX, the essential index of the Dhaka Stock market, stopped by 23.04 points, or 0.36 percent, and settled at 6,342.56 points on Sunday after losing 0.56 points in the previous trading session.

The turnover on the DSE reduced to Tk 746.16 crore on Sunday compared to that of Tk 947.02 crore on July 20.

The marketplace began increasing at the start of Sunday’s session, however it ultimately shut down.

Increased political activities raised issues amongst financiers relating to the marketplace pattern, stated market operators.

The primary opposition Bangladesh Nationalist Celebration on Saturday revealed a ‘grand rally’ in the Dhaka city for July 27 to push house their one-point need for holding the next basic election under a neutral federal government.

The nation’s economy has actually likewise been having a hard time in current months with different difficulties, consisting of high inflation, dollar crisis and energy crisis, which has actually kept the marketplace silenced.

Out of the 345 problems traded, 44 advanced, 142 decreased and 159 stayed the same on Sunday.

EBL Securities in its everyday market commentary stated, ‘The marketplace handled to stay flat throughout the very first hour of the session, however subsequent selling pressure continued to install throughout the trading flooring, triggering the core index to dip into red area as financiers chosen profit-booking and securing their funds from the ailing market.’

Insurance coverage sector stocks dealt with a substantial hit owing to the financiers’ response to the momentary post ponement of the gazette notice on the bancassurance standards, which formerly sustained a short-term rally in the insurance coverage stocks, it included.

On the sectoral front, food problems put in the greatest turnover, followed by fabric and engineering stocks.

The DSE Shariah index lost 4.23 points, or 0.30 percent, to close at 1,378.94 points on the day.

The DS30 index, nevertheless, lost 24.78 points, or 1.12 percent, to end up at 2,172.00 points.

Alif Industries Limited, Pragati Life Insurance Coverage Ltd, Gemini Sea Food Ltd, Heidelberg Cement Bangladesh Ltd, Peak Foods Limited, Vocalist Bangladesh Limited, Tradition Shoes Ltd, CVO Petrochemical Refinery Limited, Bangas Ltd and Wonder Industries Ltd were the leading 10 gainers considering their closing costs on the day.

Rupali Life Insurance Coverage Business Limited, Khan Brothers PP Woven Bag Industries Limited, Western Marine Shipyard Limited, Midland Bank Limited, Far Chemical Industries Limited, Fu Wang Food Ltd, Central Pharmaceuticals Limited, Olympic Add-on Limited, Continental Insurance Coverage Ltd, Yeakin Polymer Limited were the leading 10 losers considering their closing costs on the day.

Fu Wang Food Ltd topped the turnover chart with its shares worth Tk 39.96 crore altering hands on the day.