JHVEPhoto

Google ( NASDAQ: GOOGL) financiers who didn’t fall victim to the cynical prognostications back in February 2023 have actually been rewarded, as CEO Sundar Pichai and his group had a hard time at first to acquire traction in generative AI. Bearish financiers were unduly worried about Google’s capability to safeguard itself versus a renewed Microsoft ( MSFT), crazy about acquiring share in Google’s profitable search marketing area.

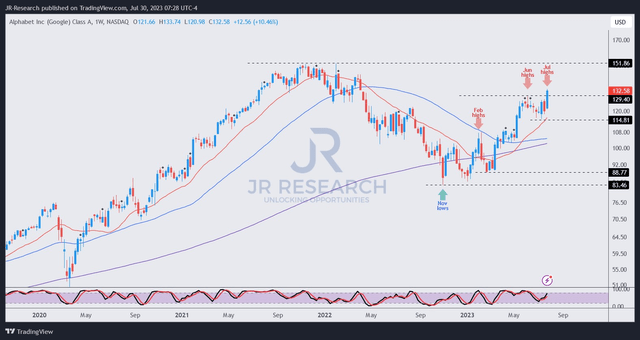

Nevertheless, Microsoft’s worthy effort to strike worry in long-lasting Google financiers has actually not worked out, as GOOGL rose just recently secured its June highs. Based upon GOOGL’s definitive breakout asserted versus a dip-buying chance in early July, I examined that GOOGL is most likely on track to recuperate its early 2022 highs.

Especially, the strength and large financial moat of Google’s organization designs have actually enabled the Mountain View-headquartered business to possibly capture up on its generative AI efforts. With the expansion of structure designs, consisting of Meta’s ( META) Llama 2 open-source LLM, the worth of OpenAI’s GPT-4 is getting significantly commoditized as Google looks primed to introduce its “ innovative” PaLM2 and Gemini LLMs throughout its community. Google’s brand-new LLMs are anticipated to “boost item performance and deal multimodal abilities.” Additionally, the business’s minimal sneak peek of its Browse Generative Experience or SGE has actually amassed “favorable user feedback, causing enhanced serving performance and faster reaction times.”

As such, I think it has actually strengthened financiers’ self-confidence in Google’s capability to enhance its generative AI abilities and continue leading from the front of the pack. Pichai advised financiers in its 2nd quarter, or FQ2 incomes call, that Google’s seven-year management as an AI-first business ought to boost its “twenty years of experience in serving appropriate advertisements.” As such, its AI management are anticipated to enhance even more Google’s abilities to enhance the significance and targeting precision in its business search questions, using “a strong structure for enhancing advertisement positionings and formats.”

Combined with Google’s robust enhancement in running efficiency in the business’s second-quarter income and incomes, it must supply more self-confidence that the worst is likely over.

As such, the bottoming in GOOGL back in early November 2022 is warranted. It recommends that market operators properly prepared for that Google’s market management ought to supply it significant firepower to gain from the advertisement market healing.

Additionally, the healing was broad-based as YouTube, Browse, and Google Other (hardware, Play, and so on) saw an inflection in their development trajectory. Combined with the continued robust development consider Google Cloud (and publishing running success), it recommends Google is well-placed to browse the AI-driven tailwinds, as Google anticipates its TAM to be broadened. Moreover, Pichai worried that Google “has more than 80 AI designs that can be equated into deep market services.” As such, it has actually opened significant chances to increase Google Cloud’s capability to “[upsell] and [cross-sell] to its set up base.”

As such, I’m not shocked that Pichai clarified in his incomes commentary that the business has actually amassed the assistance of AI start-ups, as “more than 70% of Gen AI unicorns are Google Cloud clients.” As such, Google appears really well-positioned to continue strengthening its market management throughout its community.

In Spite Of that, GOOGL is still beautifully valued at a forward EBITDA multiple of simply 12.3 x, a little listed below its 10Y average of 12.5 x. As such, while GOOGL is much less attractive than its lows in late 2022, I examined that more purchasers might still come on board, thinking about the worry of getting interrupted by Microsoft would likely dissipate gradually.

GOOGL rate chart (weekly) ( TradingView)

As seen above, I had actually prepared for a pullback from GOOGL’s June 2023 highs. Nevertheless, sellers might not require a much deeper selloff prior to dip-buyers returned in early July, most likely expecting a robust incomes release for FQ2.

As such, recently’s breakout was sustained, showing that GOOGL’s July bottom ought to supply a crucial level of assistance to continue its healing and restore its early 2022 highs ($ 150 zone).

Regardless of a possible near-term pullback, even if an incorrect advantage breakout follows in the subsequent week, I’m significantly bullish on GOOGL’s rate action, recommending purchasers ought to include strongly on possible retracements.

As such, I’m prepared to update my thesis on GOOGL.

Score: Purchase (Update from Hold).

Essential note: Financiers are advised to do their due diligence and not count on the details offered as monetary suggestions. Please constantly use independent thinking and note that the score is not planned to time a particular entry/exit at the point of composing unless otherwise defined.

We Wished To Speak With You

Have useful commentary to enhance our thesis? Found a crucial space in our view? Saw something essential that we didn’t? Concur or disagree? Remark listed below with the objective of assisting everybody in the neighborhood to find out much better!