Published: 7/31/23|July 31st, 2023

Travel insurance coverage isn’t an interesting subject to research study. When you’re preparing a journey, the last thing you wish to do is compare policies about theft and injuries that can happen abroad.

However, as I have actually stated prior to, when an emergency situation strikes, it’s much better to be safe than sorry.

Whether you’re taking a trip for 2 weeks or 2 months, purchasing travel insurance coverage is a must.

However what takes place when you’re chosen 2 years, not simply 2 months?

Because case, you require more than simply emergency situation protection. You require healthcare. You require protection for regular and preventive check-ups and prescription drugs, along with for damaged limbs and lost baggage.

Produced by SafetyWing, Wanderer Health is international medical insurance protection for remote employees, expats, and wanderers.

It’s both emergency situation travel insurance coverage and medical insurance coverage while you’re away. It’s very cost effective, making it a video game changer for long-lasting tourists, digital wanderers, and those living abroad.

Here’s whatever you require to learn about Wanderer Health to choose if it’s ideal for you and your itinerary.

What is Wanderer Health?

Wanderer Health is insurance coverage for digital wanderers, remote employees, and long-lasting tourists. It’s a mix of your basic emergency situation protection that all travel insurance coverage prepares deal, together with “routine” healthcare protection, such as regular gos to and preventive care.

It’s a reproduction of the type of medical insurance you may discover in your house nation, making sure that you’re cared for no matter what takes place.

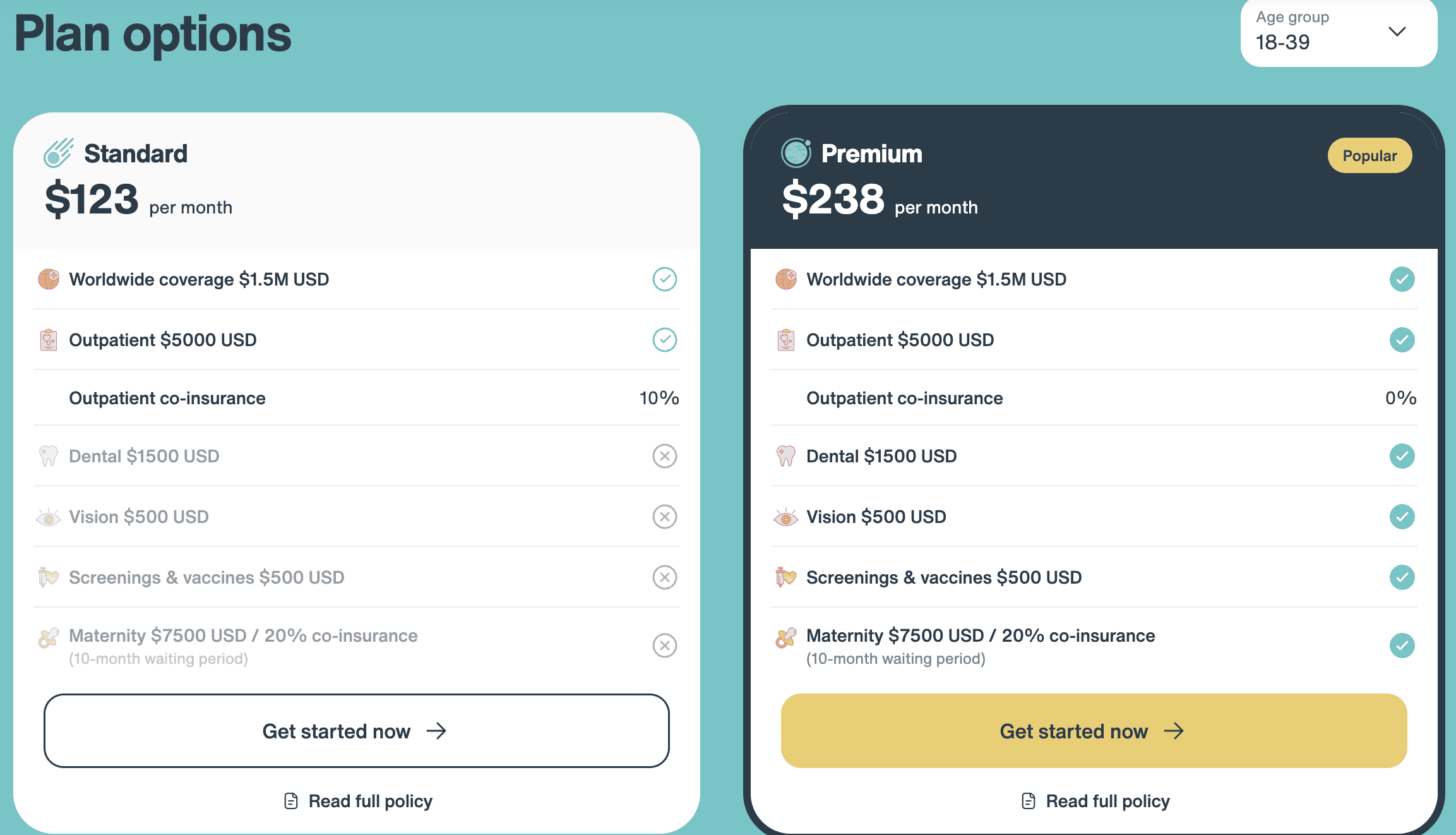

Presently, there are 2 tiers: Requirement and Premium. The primary distinctions (as you can see in the image listed below) is that Premium uses higher protection: oral approximately $1,500 USD, vision approximately $500 USD, vaccines approximately $500 USD, and maternity expenses approximately $7,500 USD.

You can find out more and compare the strategies here

How is Wanderer Health Different from Routine SafetyWing Protection?

Travel insurance coverage need to be considered “emergency situation insurance coverage.” If you break a leg or lose a bag or get stuck in a cyclone, travel insurance coverage can assist.

Wanderer Health, nevertheless, covers both emergency situations and routine healthcare. That indicates you can get assistance– and get compensated– for emergency situation and non-emergency occasions.

There are a couple of other distinctions to keep in mind when comparing Wanderer Health with SafetyWing’s basic travel insurance coverage (called Wanderer Insurance coverage):

- Wanderer Heath covers those approximately age 74 (vs. 69 for Wanderer Insurance Coverage)

- There is no deductible with Wanderer Health (it’s $250 USD with Wanderer Insurance Coverage)

- Claims are managed in 10 days (rather of 45 with Wanderer Insurance Coverage)

- Protection for one’s house nation is consisted of (that expenses additional with Wanderer Insurance coverage)

Another crucial distinction is that, unlike for routine travel insurance coverage, Wanderer Health candidates need to be authorized. You can’t simply purchase a strategy and be on your merry method, as the insurance coverage group requires to evaluate your application, together with any case history and/or pre-existing conditions. They might likewise ask for extra medical notes or files.

Furthermore, pre-existing conditions might not be covered, and there are some candidates that might not have the ability to be covered. (Pre-existing conditions are seldom covered under routine travel insurance coverage.)

I do not enjoy that some individuals are most likely to be evaluated out, however I comprehend it provided the expense of healthcare worldwide. I presume, because this was simply presented, that as things development and the swimming pool of candidates boosts and the business sees how this works, they will open it approximately increasingly more individuals.

Who is Wanderer Health For?

If you’re going out on a journey for a couple of weeks or a couple of months, Wanderer Health isn’t for you. Routine travel insurance coverage (like SafetyWing’s Wanderer Insurance Coverage) will more than suffice.

However if you’re going to be away for a year or more and wish to ensure you have appropriate health protection for both mishaps and regular care, then Wanderer Health is for you.

In other words, if you’re a digital wanderer, expat, or long-lasting tourist, this is the strategy I ‘d suggest for you. Here’s a take a look at what is covered:

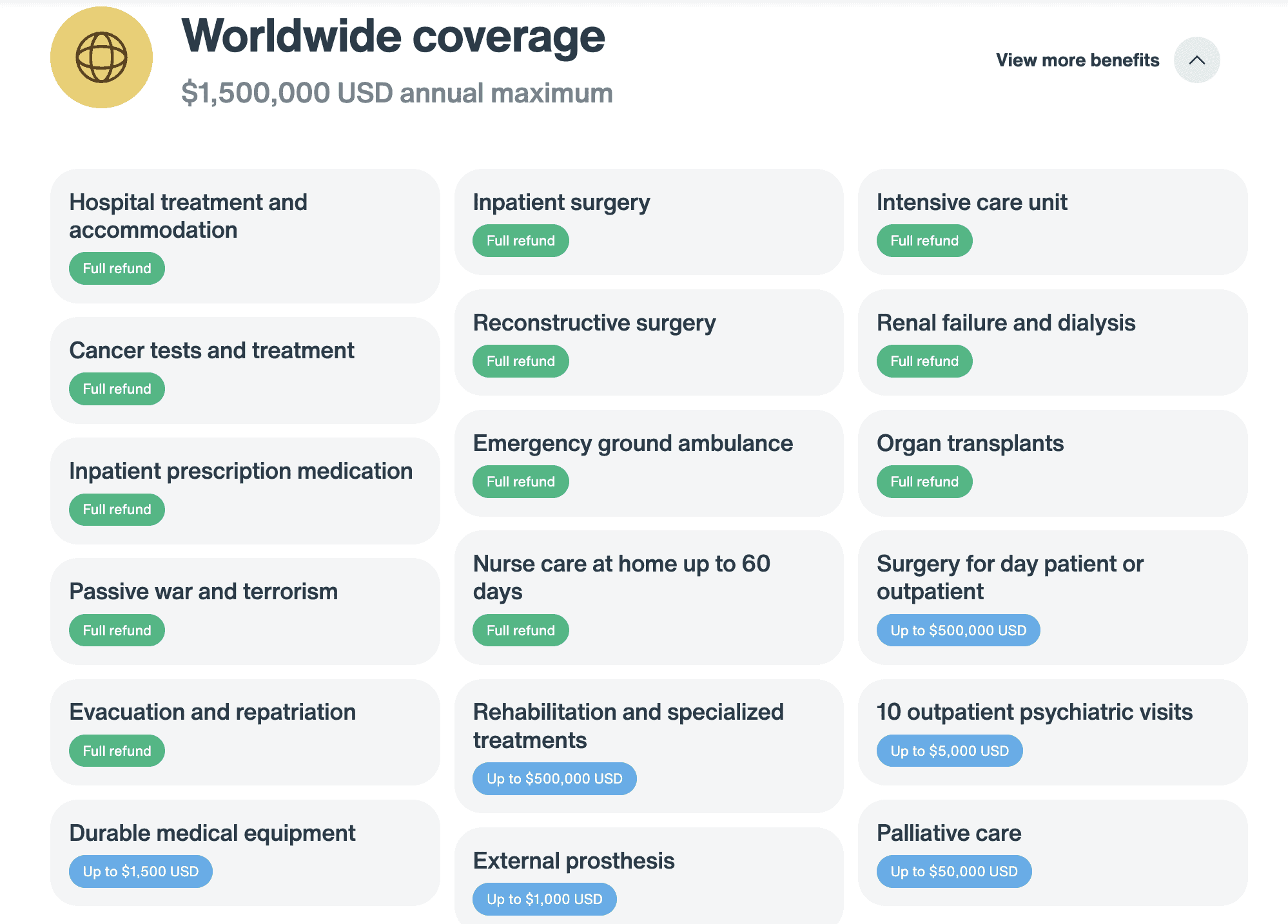

The most crucial number here is that $1,500,000 USD. Tourists utilizing Wanderer Health get $1.5 million in protection each year, which is sufficient for practically anything. Many basic travel insurance coverage prepares cover simply a couple hundred thousand dollars, so that $1.5 million casts a large safeguard and goes a long method to guarantee you’re covered no matter what takes place.

Just How Much is Wanderer Health?

If you’re 18-39, a Basic Wanderer Health insurance expenses around $123 USD monthly. For a Premium Strategy, that exact same tourist will pay $238 USD monthly.

Rates increase per age (much like with any insurance coverage), so the greatest month-to-month cost is for tourists aged 60-74, which costs $537 USD monthly for the Requirement Strategy. Once again, while that looks like a lot, it’s more affordable than the majority of other choices out there– and more affordable than paying of pocket.

To see just how much a strategy will cost for you, click on this link to get a complimentary quote

When I began backpacking, take a trip insurance coverage choices were restricted. And costly. Thankfully, we have a lot more choices nowadays– with a lot much better protection. If I was beginning once again, avoiding on another 18-month journey worldwide, Wanderer Health is precisely the type of strategy I would get. It covers the essentials along with emergency situations, and is likewise very cost effective.

I understand insurance coverage looks like an unneeded included expense, however I have actually discovered the difficult method– a number of times– that it’s an expenditure worth spending for.

Do not be inexpensive with your health. Stay covered and remain safe. You will not regret it.

Reserve Your Journey: Logistical Idea

Reserve Your Flight

Discover an inexpensive flight by utilizing Skyscanner It’s my preferred online search engine since it browses sites and airline companies around the world so you constantly understand no stone is being left unturned.

Reserve Your Lodging

You can reserve your hostel with Hostelworld If you wish to remain someplace aside from a hostel, usage Booking.com as it regularly returns the most affordable rates for guesthouses and hotels.

Do Not Forget Travel Insurance Coverage

Travel insurance coverage is something you WILL wish to purchase. It exists if you get ill, robbed, postponed, or a journey cancelled. I never ever go on a journey without it since you never ever understand what might take place. Do not avoid it. I have actually seen a lot of tourists are sorry for doing so. My preferred business are:

Wish To Travel totally free?

Travel charge card enable you to make points that can be redeemed free of charge flights and lodging– all with no additional costs. Take a look at my guide to choosing the ideal card to start. For United States homeowners, here’s how you can get points on lease too

All Set to Reserve Your Journey?

Have A Look At my resource page for the very best business to utilize when you take a trip. I note all the ones I utilize when I take a trip. They are the very best in class and you can’t fail utilizing them on your journey.