Kelly Sullivan

Financial Investment Thesis

A year earlier, Meta ( NASDAQ: META) was having a hard time due to Apple’s ( AAPL) personal privacy modifications, which sent out the stock crashing 75%. However quick forward to today, Meta is up 150%+ year to date and is practically back to its all-time highs.

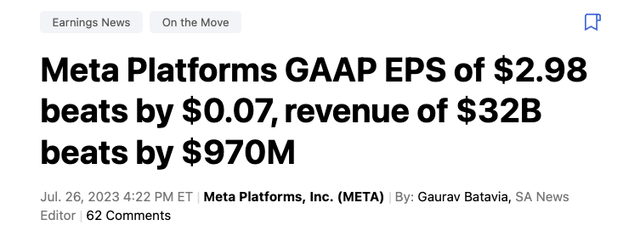

And just recently, the business published blowout Q2 profits outcomes, which saw the stock making another 52-week high.

Earnings is speeding up, margins are enhancing, and the outlook looks intense ahead.

This marks among the most amazing turn-around stories, covering simply a couple of quarters.

However the rally might have gone a little too far in my view, so a minor pullback might be on the horizon.

Development

In Q2, Meta beat expert expectations on both profits per share and profits, by 7 cents and practically $1 billion, respectively.

After publishing 3 successive quarters of profits decreases in 2022, Meta is back in development mode with profits speeding up by 11% yoy, producing $32 billion of Earnings in Q2. The go back to development was because of simpler YoY compensations in addition to a strong healing in international marketing need.

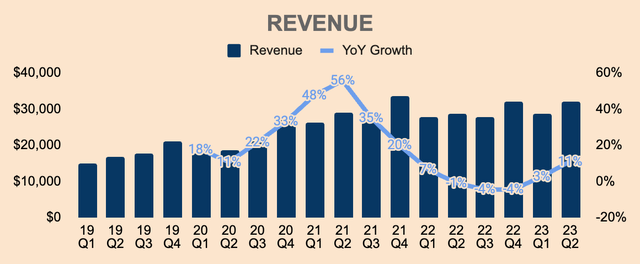

Meta produces the majority of its Earnings from marketing, and as you can see, Marketing Earnings from its Household of Apps was having a hard time in the bulk of 2022, due to the Apple iOS personal privacy modifications, competitors from other social networks platforms like TikTok, in addition to the fast development of Reels, which practically moved users attention far from higher-monetized surface areas like Feeds or Stories.

Nevertheless, things are improving with FoA Earnings speeding up back to development mode. In Q2, FoA Earnings was $31.7 billion, which is up 12% YoY, due to strong advertisement need in the e-commerce sector.

In Q2, advertisement impressions increased by 34% YoY while the typical cost per advertisement reduced by 16% YoY. The boost in advertisement impressions was driven by fast development in less fully grown markets in addition to Reels, which both have lower money making, which is why the typical cost per advertisement dropped YoY. That stated, I anticipate money making to enhance with each passing quarter.

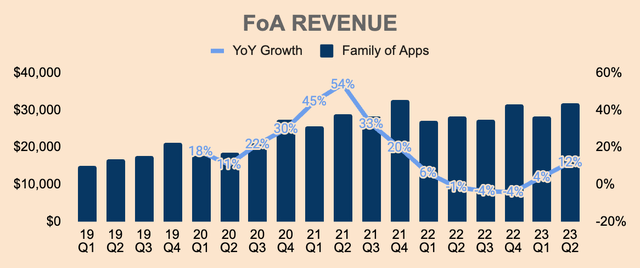

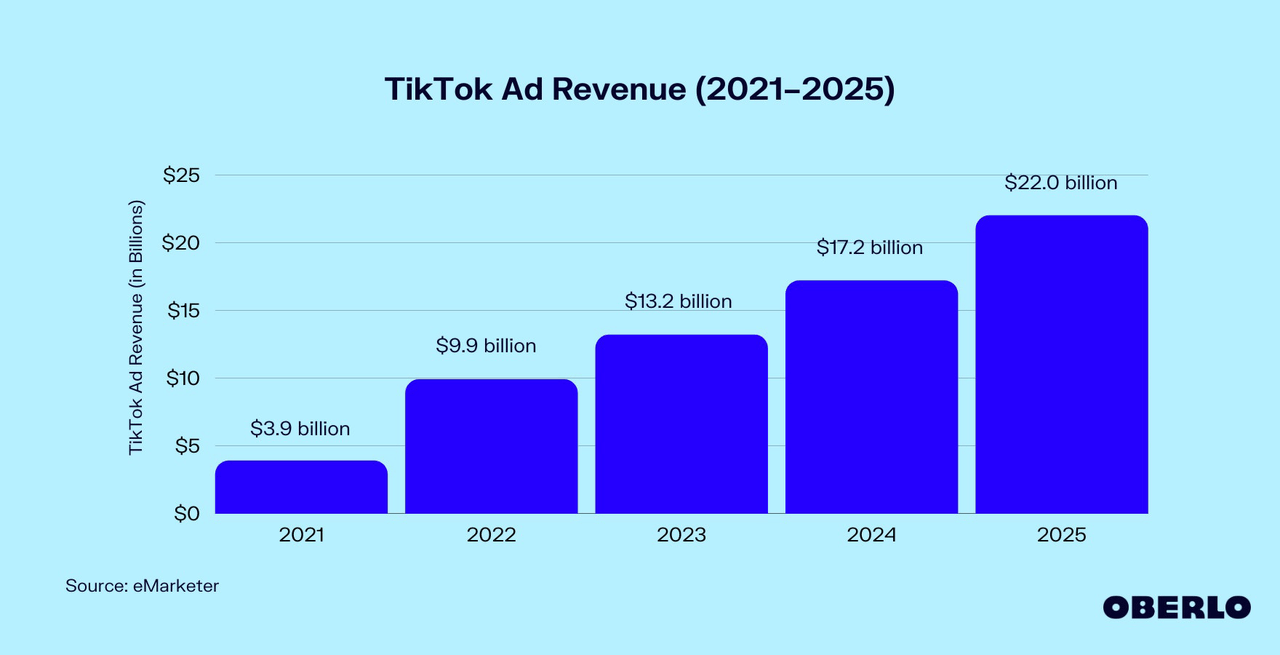

This is particularly real for Reels, which presently has a yearly profits run rate going beyond $10 billion, which is up from $3 billion last fall. Simply put, Reels engagement and money making are growing tremendously.

Reels plays go beyond 200 billion each day throughout Facebook and Instagram. We’re seeing great development on Reels money making too with the yearly profits run-rate throughout our apps now going beyond $10 billion, up from $3 billion last fall.

( CEO Mark Zuckerberg – Meta Platforms FY2023 Q2 Profits Call).

As a recommendation, TikTok produced $9.9 billion of Earnings in 2022 and is anticipated to grow to $ 22 billion by 2025, so we can most likely anticipate the very same sort of trajectory for Reels, which is going to be a significant profits factor for Meta.

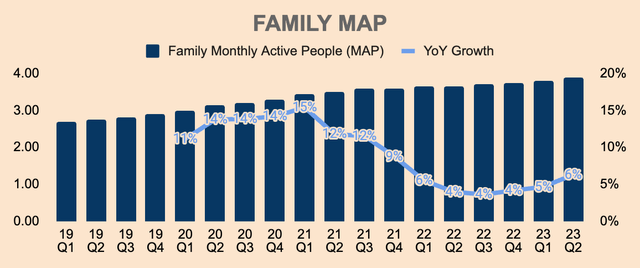

Proceeding, Household Regular Monthly Active Individuals, that includes Facebook, Instagram, WhatsApp, and Messenger, grew by 6% YoY to 3.88 billion in Q2, which actually ruins the story that “Meta is a slowing down and passing away social networks giant”.

And to offer you a bit of viewpoint of how substantial this is, 6% yoy development is 230 million users included which is approximately two-thirds of the United States population.

In addition, Daily Active Individuals as a % of Regular monthly Active Individuals stays at 79%, which reveals actually high engagement rates throughout Meta’s household of apps.

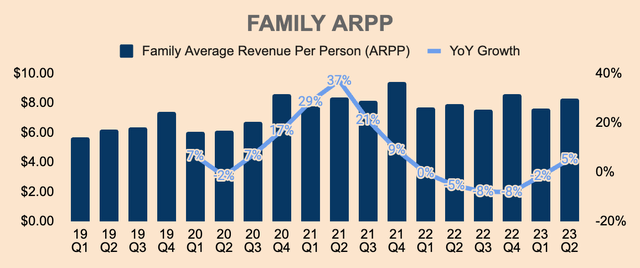

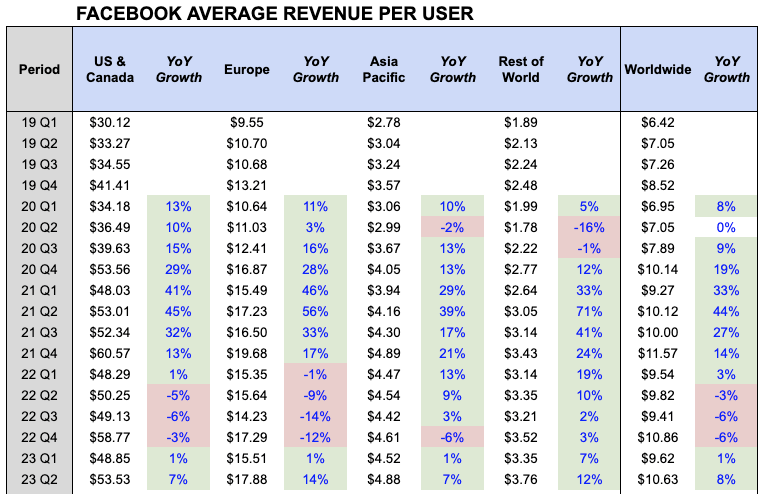

Here, you can see how Household Average Earnings Per Individual has actually trended over the last couple of quarters. In Q2, ARPP was $8.32, which is up 5% yoy, due to much better advertisement supply and need characteristics, in addition to Reels money making getting.

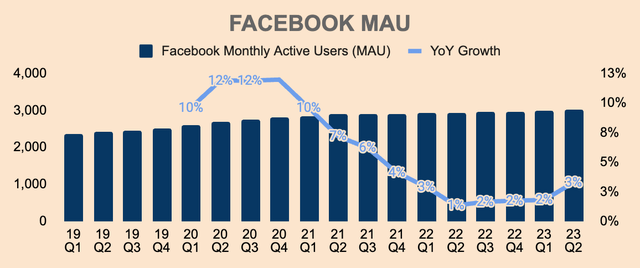

In addition, Facebook Regular monthly Active Users, which just consists of figures from Facebook, grew by 3% in Q2, to somewhat more than 3 billion Facebook users, which once again ruins the story that “Facebook is dead”.

Facebook’s Average Earnings Per User is likewise speeding up, with a Worldwide ARPU of $10.63, which is up 8% yoy, driven by strength throughout all areas.

There’s still a big difference in ARPU when we take a look at them on a geographical basis, which implies an enormous chance for Meta to increase money making in areas beyond The United States and Canada given that there are a lot more individuals outside the area.

Looking For Alpha

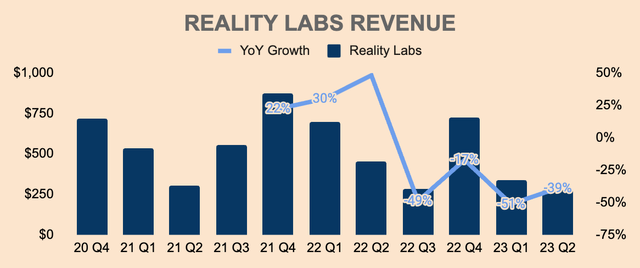

Proceeding the Truth Labs, the RL section produced $276 countless Earnings in Q2, which is down 39% YoY, which is rather worrying considered that the business has actually invested lots of cash into the metaverse.

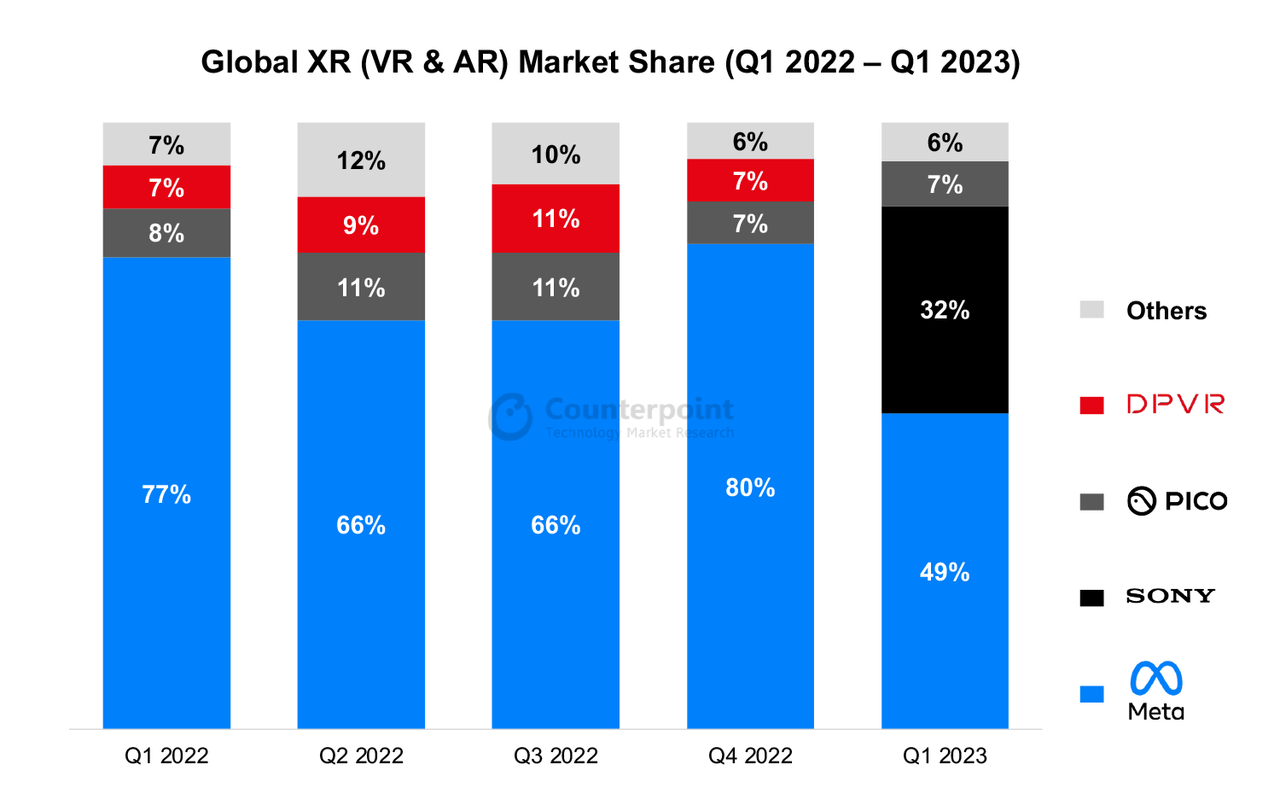

A significant reason that Truth Labs sales are down is because of the just recently released Sony PlayStation VR2, which is Sony’s follower to its 2016 PlayStation VR headset.

As you can see, Sony took enormous market share from Meta, which saw Meta’s share decrease to simply 49% in Q1.

That stated, the metaverse is still in its early phases so Meta’s RL profits will be rather unpredictable, however progressing, VR and metaverse adoption must continue to grow, which must be a tailwind for Meta’s RL Section.

All in all, Meta’s go back to development mode is actually motivating to see. In specific, development in its social networks company is reaccelerating, which is an unbelievable turn-around provided the difficulties that Meta dealt with over the last couple of years.

At the very same time, the business is investing greatly in AI, which is currently enhancing general user engagement and money making.

And not forgetting to point out, the business is still laser-focused on establishing the next-generation social networks platform through the metaverse. So all in all, an actually excellent quarter for Meta.

Success

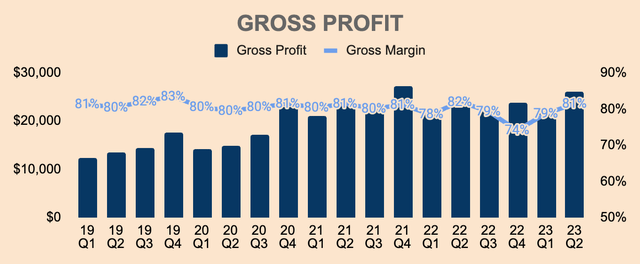

Relying on the success of the business, Meta produced $26.1 billion of Gross Earnings, which is an 81% Gross Margin.

As you can see, Gross Margin has actually been enhancing over the last couple of quarters and is now back to its previous levels of about 80%. Keeping such a high Gross Margin implies strong rates power, strong need for its items, and high profits capacity for financiers.

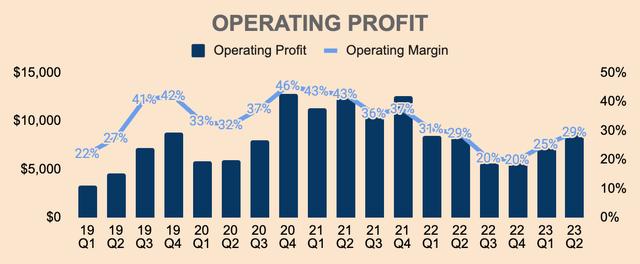

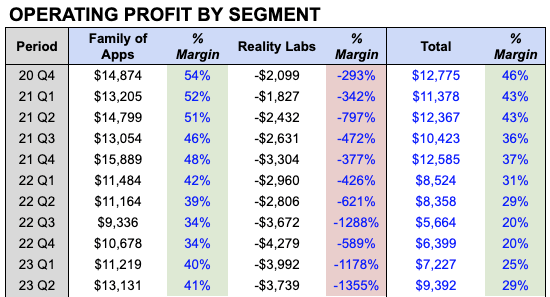

Operating Earnings is likewise enhancing, which was $9.4 billion in Q2, representing a 29% Operating Margin.

This consists of accumulated legal costs of $1.87 billion and reorganizing charges of $780 million, so without these costs, Running Margins would have been much greater.

That stated, Margins are trending in the ideal instructions, mostly due to layoffs. Since completion of Q2, Meta has about 71,000 staff members, which is down 7% sequentially from Q1.

Meta is practically made with its layoffs, so we might see Margins continue to enhance and ultimately support in the mid-30s as the year of effectiveness resumes.

And if not for the Truth Labs section, Running Margins would have been as high as 40%.

As you can see, FoA Operating Margin was 41% in Q2 and it was likewise as high as 50% a couple of years earlier.

On the other hand, the RL section is seriously unprofitable, burning around $4 billion per quarter, and since Q2, the RL section has an Operating Margin of unfavorable 1000%+.

Thankfully, Meta has the household of apps company to cover the losses from Truth Labs, and this is most likely going to hold true progressing, a minimum of for the next 3 years or two.

Author’s Analysis

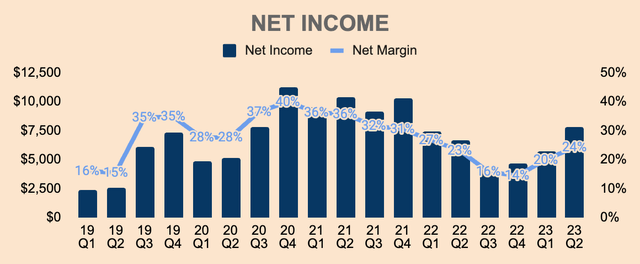

Lastly, Meta’s bottom line is likewise enhancing, with $7.8 billion of Earnings in Q2, which represents a 24% Net Margin, and this must continue to pattern upwards, probably to the mid-30s level.

There’s a clear pattern that success will go back to where it was and this must remove worries about the business’s success.

That stated, Meta is an extremely successful company with high profits capacity, and as an investor, I’m actually delighted with how well management has actually performed up until now.

Financial Health

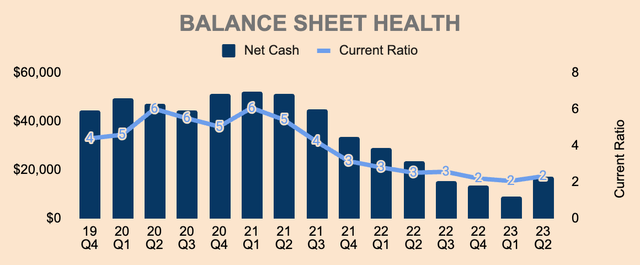

Proceeding, Meta has a strong balance sheet with $53.4 billion of Money and Short-term Investments, with an Overall Financial obligation of about $36.2 billion, which puts its Net Money position at a comfy $17.2 billion.

And although Net Money has actually dropped over the years, I believe we can see net money structure back up as the business concentrates on effectiveness.

That will be possible through strong complimentary capital generation.

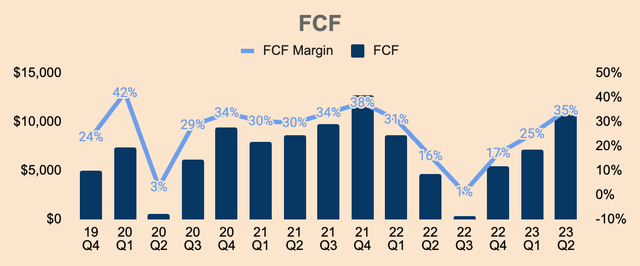

In Q2, Free Capital was $11.1 b, which represents a 35% Totally Free Capital Margin.

While Free Capital enhanced substantially, do keep in mind that this is because of a deferment of earnings taxes that will be paid in the 4th quarter, so I believe Totally free Capital Margins must dip somewhat in the next couple of quarters.

That stated, Meta redeemed $793 countless its stock in Q2, which is small compared to previous quarters, however this is sensible provided the current rally.

Nevertheless, Meta still has $40.9 billion of share buyback capability at its disposal, so I anticipate aggressive buybacks if we see a correction in the future.

Outlook

Management anticipates Q3 Earnings to be in the series of $32 to $34.5 billion, which represents a 20% yoy development if we take the midpoint assistance.

This is a velocity from Q1’s 11% development, and this reacceleration is because of a foreign currency tailwind of around 3%, simple YoY compensations, in addition to increasing money making throughout its apps.

That stated, a 20% development in Q3 is actually outstanding, which is likewise why I believe the stock is up after Q2 profits.

When it comes to costs, management anticipates full-year 2023 overall costs to be in the series of $88 to 91 billion, which is a boost from its previous series of $86 to $90 billion, due to legal-related costs and a $4 billion restructuring expense.

The business likewise anticipates Truth Labs Operating Losses to increase YoY in 2023 as the business continues to buy AI and the metaverse.

In other news, paid messaging is likewise removing, which might be Meta’s next development engine. According to Mark Zuckerberg, there are 200 million users utilizing WhatsApp Service who will now have the ability to produce Click-to WhatsApp advertisements, and the variety of companies utilizing paid messaging items has actually doubled YoY.

Service messaging is another essential piece of our money making technique and we just recently revealed that the 200 million users of our WhatsApp Service app will now have the ability to produce Click-to-WhatsApp advertisements for Facebook and Instagram without requiring a Facebook account. This is a quite huge unlock, especially in nations where WhatsApp is frequently the primary step to bring their company online. Paid messaging is a bit previously, however it’s likewise revealing great adoption. The variety of companies utilizing our paid messaging items has actually doubled year-over-year.

( CEO Mark Zuckerberg – Meta Platforms FY2023 Q2 Profits Call)

This is an actually interesting advancement considered that WhatsApp runs a virtual monopoly in some markets, especially those in establishing nations like Indonesia and Brazil.

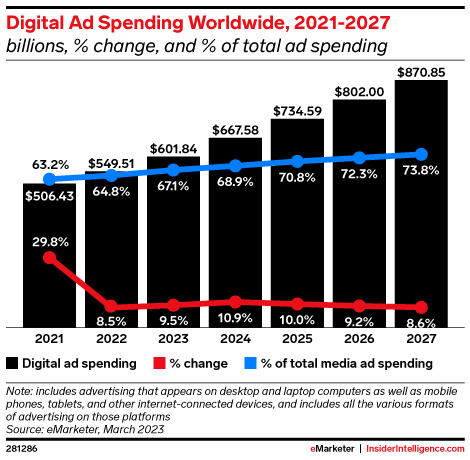

That aside, digital advertisement costs around the world is anticipated to continue to grow as the world ends up being progressively digital, with that figure broadening to $870 billion by 2027.

Naturally, this must be a tailwind for Meta as the business holds a few of the most important digital platforms on the planet consisting of Facebook, Instagram, and WhatsApp.

Expert Intelligence

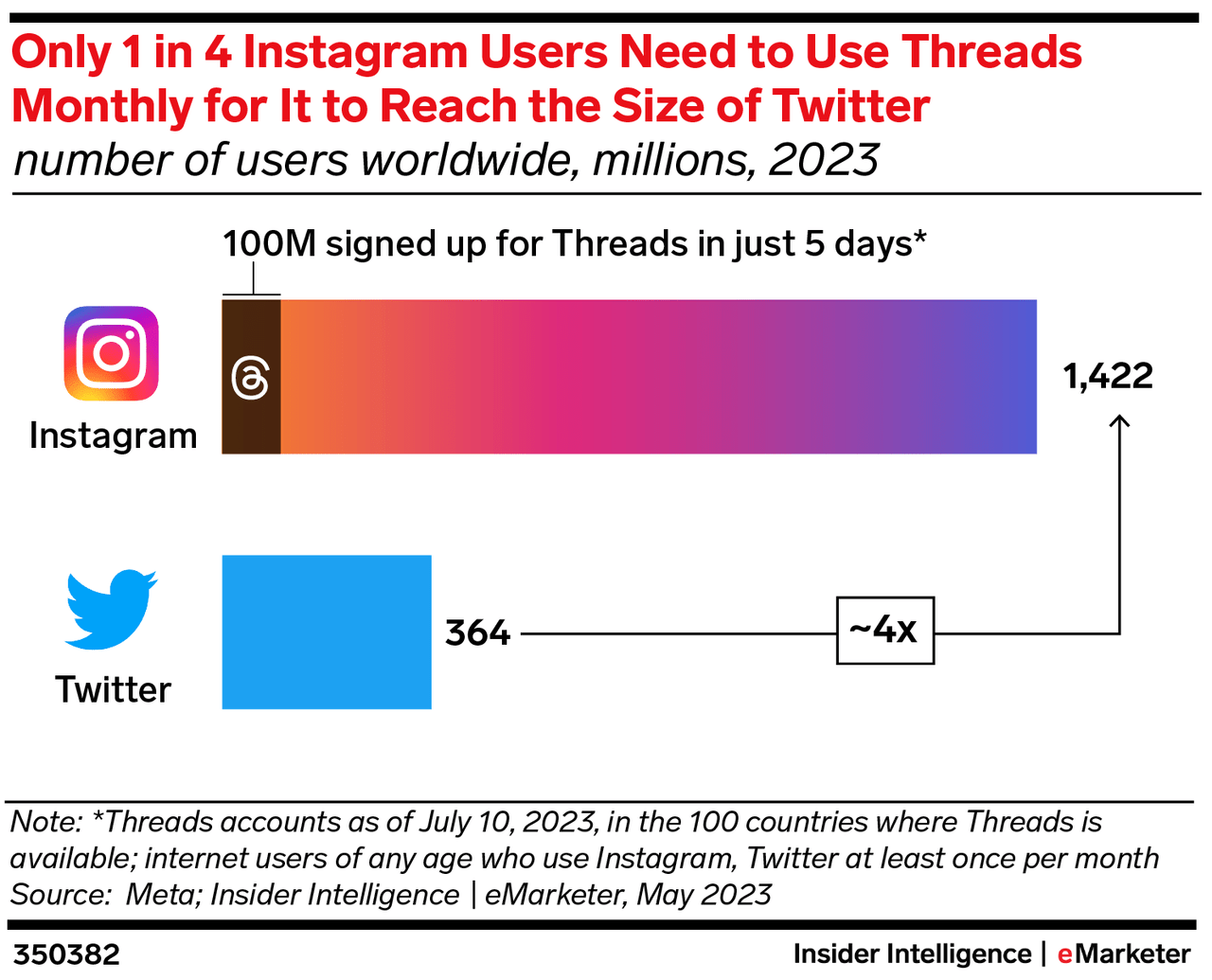

Meta likewise just recently presented its Twitter rival, Threads, which might likewise be a significant development engine for Meta one day.

It is without a doubt the fastest-growing platform today, with 100 million signups in simply 5 days The 2nd fastest app to reach 100 million users was ChatGPT, which took 2 months to get to that figure.

I question that Threads is presently generated income from, however that is the money making technique that Meta typically takes.

Initially, Meta attempts to get as lots of signups as possible. Second, they attempt to drive optimum engagement and retention within the platform. Lastly, once the platform scales, Threads can start money making.

The business ran this playbook with Instagram, Reels, and WhatsApp, and Threads will be no various.

We can have a look at Twitter to determine the Earnings capacity for Threads. In 2022, Twitter did about $4.4 billion in Earnings, with about 360 million users

Threads might exceed Twitter in regards to the variety of users and Threads might possibly provide that sort of Earnings number if Threads in fact ends up being a genuine thing that individuals in fact utilize, instead of a one-time signup, in my view.

In addition, Meta is anticipated to introduce its upgraded Mission 3 headset this fall, which I believe a great deal of customers are awaiting, so we can anticipate Truth Labs Earnings to increase in Q3 and Q4.

With that being stated, I believe there’s a great deal of interesting advancements taking place in Meta and I believe the outlook for the business is looking actually excellent.

Evaluation

Meta has actually rallied about 250% since its bottom in November, so that’s a great deal of gains in less than a year.

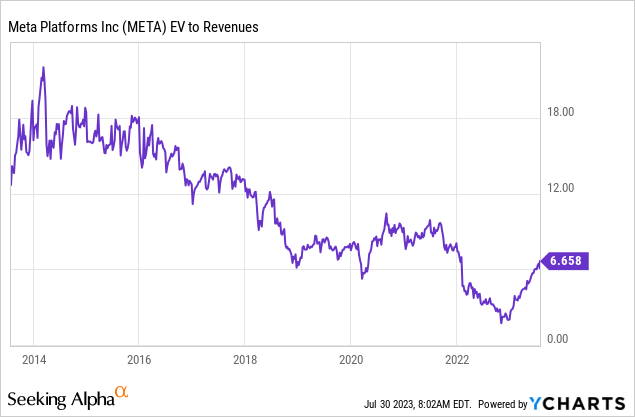

Taking a look at evaluation multiples, we can see that Meta trades at an EV/Revenue multiple of simply 6.6 x, which is well listed below its 10-year average of about 10x, so statistically speaking, Meta still looks low-cost.

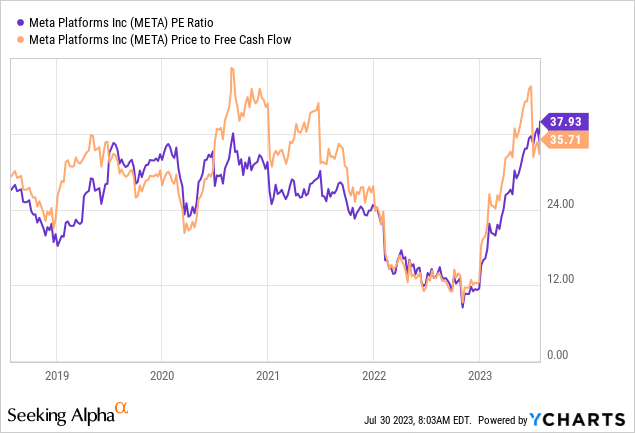

However things look pricey when we take a look at its P/E ratio and Price/FCF. As you can see, both metrics are trading at the upper end of their 5-year varieties, with a P/E ratio of 38x and a Price/FCF ratio of 34x, so certainly not low-cost at all.

So from an evaluation numerous viewpoint, I do not believe there’s much worth for Meta stock today.

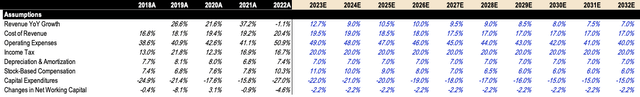

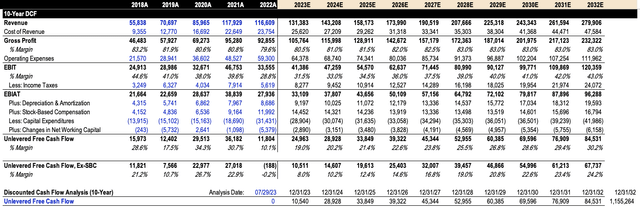

I have actually likewise done a DCF analysis on Meta and here are my essential presumptions:

- Earnings Development: for the very first 3 years, I follow expert price quotes and after that slowly reduce it to simply 7% by the end of 2032.

- Expense of Earnings: I anticipate Expense of Earnings to drop as a % of Earnings, to simply 17% by 2032, which implies a long-lasting Gross Margin of 83%.

- Operating Costs: I anticipate the very same thing for Running Expenditures, which will continue to agreement as a % of Earnings, down to simply 40%, which Meta has actually accomplished prior to in previous years. Integrated together, Expense of Earnings and Operating costs end up being about $90 billion in 2023, which is ideal in line with management’s assistance.

- Capital Investment: When it comes to capex, the business assisted for $27 to $30 billion in 2023, so that has to do with 22% of Earnings. As a result, I’m going to decrease the rate to simply 15% of profits by 2032.

With these presumptions, I forecast a $280 billion Earnings by 2032 at a Free Capital Margin of about 30% which is obtainable and sustainable in my viewpoint.

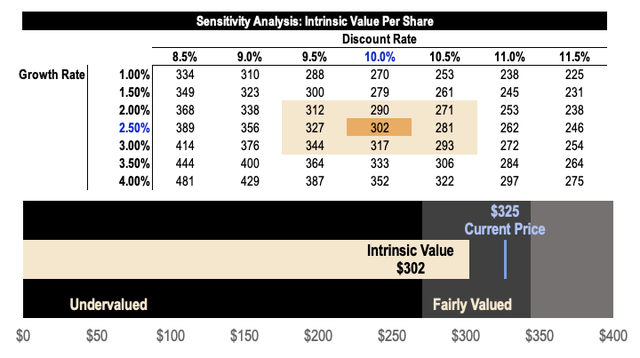

Based upon a discount rate of 10% and a continuous development rate of 2.5%, I get to an intrinsic worth per share of about $302 for Meta, which is lower than the typical expert cost target of $348.

That stated, Meta looks somewhat misestimated based upon its existing cost of $325 a share.

However what am I finishing with the stock? Most likely absolutely nothing in the meantime.

However if rates continue to rally in the next couple of months, I may cut my position at about $360, which is 20% above my reasonable worth price quote.

Dangers

Competitors

There are other platforms such as TikTok, Twitter, and YouTube that might take market share far from Meta.

Nevertheless, as we have actually seen in Q2 outcomes, Meta continues to include users to its household of apps, which implies that Meta’s brand name is simply too strong and its changing expenses are simply too expensive for users.

Nevertheless, dangers of competitors are genuine and we can’t completely overlook them.

A possible hazard for Meta would be Twitter, which just recently rebranded to X, and the factor for the rebranding is that Elon Musk wished to construct an whatever app, just like WeChat in China.

If that takes place, Meta might be in huge problem.

On the other side, Truth Labs is likewise dealing with hard competitors from Sony and Apple.

- Sony’s PlayStation has a big library of video games and die-hard PlayStation fans are most likely to buy Sony’s VR headset than Meta Mission.

- In addition, Apple released its own headset, called the Apple Vision Pro and although I believe the cost is too absurd for mass adoption, all of us understand that Apple fans are not too cost delicate when it pertains to Apple items.

Policy Modifications

This consists of policy modifications within Apple iOS or Android and even federal government policies impacting Meta. If we see significant modifications in policies and policies, Meta might take a success when again.

Conclusion

This is most likely among the very best turn-around stories ever. Zuckerberg is simply amazing. Execution is simply remarkable. And as a financier, I could not be better.

The business is back in development mode, margins are enhancing, the balance sheet is beautiful, and there are a lot of interesting advancements on the horizon consisting of Threads, Meta Mission 3, Click-to-WhatsApp, and so on.

Nevertheless, I believe the rally has actually gone a little too far, and I believe the evaluation is a bit extended. Although I’m long-lasting bullish on the business, I anticipate a minor pullback in the future prior to continuing its upward march to brand-new highs.