Justin Sullivan

Williams-Sonoma, Inc. ( NYSE: WSM) runs as an omnichannel specialized merchant of different items for house. It provides cooking, dining, and amusing items to name a few.

We began protection on this merchant somewhat more than a year back, in June 2022, with an preliminary “hold” score. The main factors for our neutral view were:

- Strong monetary basics, consisting of margin efficiency.

- Appealing appraisal, integrated with a safe and sustainable dividend and a considerable share buyback program.

- Considerable macroeconomic headwinds, consisting of customer self-confidence and inflationary pressures.

Because this writing, the company’s stock rate has actually increased by more than 31%, surpassing the more comprehensive market, which has actually advanced somewhat more than 21% in the exact same amount of time.

Today, we will be reviewing our preliminary thesis and provide an upgraded view, thinking about the most recent advancements in the macroeconomic environment, while likewise discussing some company-specific elements that might affect WSM’s monetary efficiency in the coming months and quarters.

Macroeconomic environment

Because our very first writing, the macroeconomic environment has actually enhanced meaningfully. Today, our focus will be on the customer self-confidence, on the inflation rate and on the health of the real estate market in the United States.

Customer self-confidence

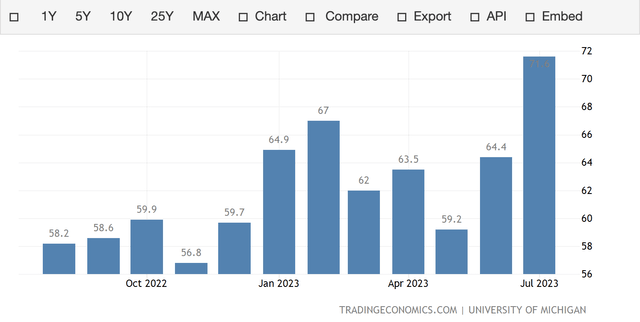

Because its lows in 2022, customer belief in the United States has actually enhanced substantially. So why does it matter when speaking about WSM’s organization?

Customer self-confidence is typically dealt with as a prominent financial sign, which might signify specific modifications in the costs habits of the customer. A high, or enhancing reading indicates that individuals are ending up being rather more specific about their monetary outlook and about the state of the more comprehensive economy in general. This might cause more costs as individuals are most likely to be happy to provide cash for non-essential, discretionary, long lasting products.

This might cause greater need for WSM’s items in the coming quarters.

U.S. Customer self-confidence (tradingeconomics.com)

At the exact same time, the company has actually simply been devalued to “underperform” by Barclay’s, pointing out depressed customer costs, which is most likely to have an unfavorable influence on the Q2 incomes figure.

Incomes per share for the 2nd quarter are anticipated to come in almost 30% lower than a year previously, according to agreement price quotes and 13 of the last 19 EPS modifications have actually been to the drawback.

Crucial to keep in mind: the exact same short article highlights that 20 of 25 Wall Street experts still have Hold, Purchase or Strong Buy rankings on the stock. We tend to concur more with these experts. In our viewpoint, a downgrade to “underperform” is not especially unexpected, particularly when we likewise take a look at the Q1 incomes outcomes, however at this moment in time our company believe it is a bit too late.

Prior to leaping onto the next area, we want to discuss another company-specific aspect that we believe might cause greater need and greater sales figures for WSM. This is the current insolvency filing of Bed Bath and Beyond. This likewise develops space for possibly opening brand-new shops and increasing footprint in the future to catch a bigger share of the marketplace.

Among the elements that can have an impact on belief is really the inflation rate. So let us take a look at it a bit more in information now.

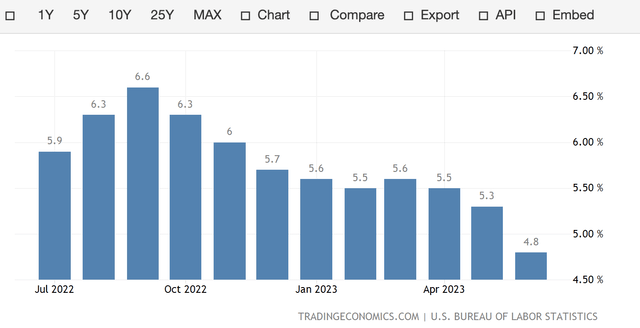

Inflation rate

The core inflation rate has actually been dropping quickly from the 2022 highs, mainly sustained by the Fed’s aggressive rate walkings.

U.S. Core inflation rate (tradingeconomics.com)

Falling inflation is most likely to benefit WSM’s organization, not just since it may have a favorable influence on customer costs, however likewise since it might cause favorable advancements in regards to input expenses and SG&A costs. If so, this might cause margin growths in the coming months, benefitting the bottom line outcomes of the company.

Real Estate

On the other hand, the real estate market is still not in the very best shape. Many indications reveal that there is considerable space for enhancement from the present levels.

Structure allows, which is a leading sign of brand-new real estate supply, have actually meaningfully decreased from the 2022 levels. Existing house sales have actually likewise decreased compared to the previous year, nevertheless, brand-new house sales have actually rather enhanced.

The Fed’s rate walkings are playing an essential function in the health of the real estate market. Greater rate of interest imply that home mortgages are ending up being more costly, for that reason the need for them are softening. As many people purchase their residential or commercial property with a minimum of some quantity of take advantage of, this advancement likewise affects the need for real estate systems. Looking forward, nevertheless, we do not think that the Fed will keep treking the rates much greater, and for that reason are thoroughly positive about the enhancements in the real estate market in the coming quarters.

So why does the health of the real estate market matter for WSM’s organization? Well, when individuals buy a brand-new house, they might begin investing in possible upgrades, or they might upgrade specific locations to much better fit their requirements or match their tastes. These things in basic cause a greater need for house providing items and for that reason likewise for WSM’s items.

All in all, as the state of the real estate market plays an essential function in forming the need for WSM’s items, we are rather mindful moving forward regardless of the possible enhancements.

Company-specific factors to consider

Success

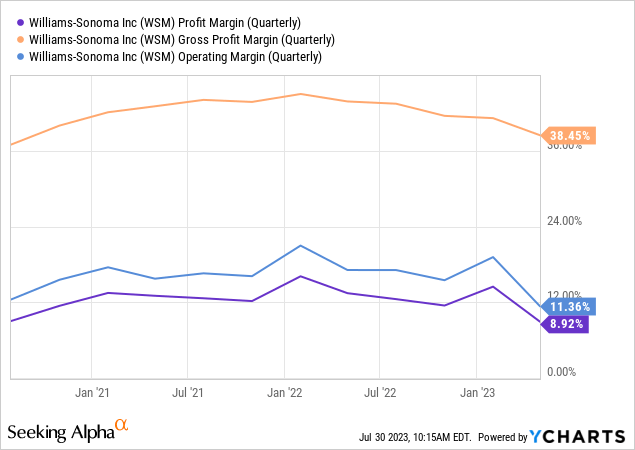

While throughout 2021 and 2022 the company has actually handled to keep its margins fairly steady, in the last noted quarter, the margins have actually somewhat contracted.

The company has actually noted a number of consider their newest 10-Q, which have actually been adding to this unfavorable advancement of the gross earnings margin:

- greater input expenses, ocean freight, detention and demurrage due to the effect of supply chain disturbance and worldwide inflation pressures.

- greater outgoing consumer shipping expenses due to out-of-market shipping and shipping numerous times for multi-unit orders.

- greater tenancy expenses arising from incremental expenses from our brand-new warehouse on the East and West Coasts to support our long-lasting development, which was partly balanced out by the greater rates power of our exclusive items, our continuous dedication to give up website broad promos and our store optimization efforts.

They have actually likewise elaborated on what has actually been driving the modification in the SG&A costs:

This boost in rate was mainly driven by deleverage due to reduce sales along with exit expenses of $15.8 million and decrease in in-force efforts of $8.3 million amounting to $24.1 million, partly balanced out by a decline in marketing expenditures and general expense discipline.

Even more, the earnings margin has actually likewise been injured by the greater efficient earnings tax rate, compared to the previous duration:

The efficient tax rate was 23.6% for the very first quarter of financial 2023 compared to 21.5% for the very first quarter of financial 2022. The boost in the efficient tax rate is mainly due to less excess tax advantage from stock-based payment in financial 2023.

Looking forward, we want to see the decrease reverse. Due to the falling inflation rate, the moderating product costs, the reducing supply chain disturbances and the enhancing customer self-confidence this might even be possible in the coming quarters.

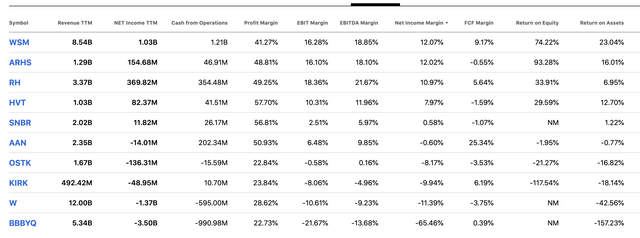

In spite of this decrease, WSM stays among the most successful companies in the house providing retail market, according to a number of success steps.

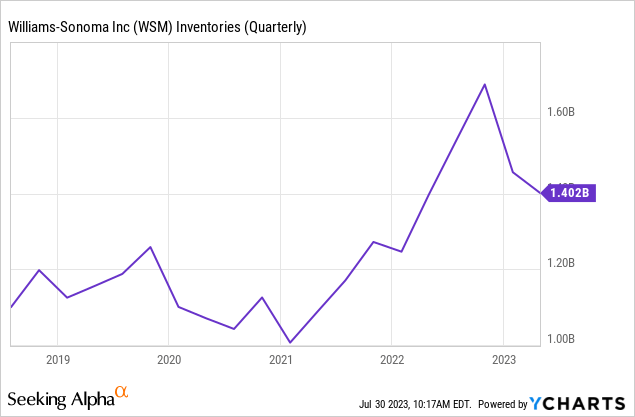

Generally, at this moment we likewise raise our issues about possible stock management issues, as outdated stock can have significant unfavorable influence on the margins. The following chart demonstrates how WSM’s stock levels have actually altered in the previous 5 years.

We are absolutely thankful to see that the levels have actually fallen substantially off of the peak, and we want to see this pattern continue.

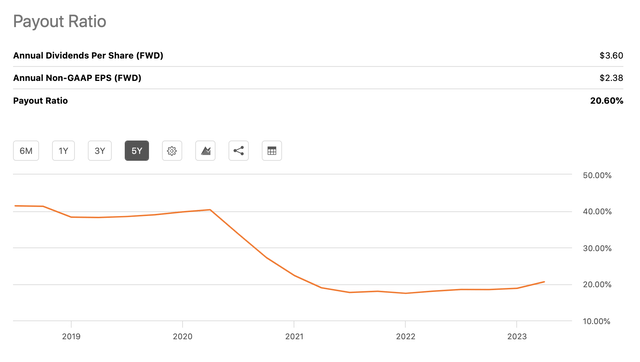

Dividends

The company has just recently stated a typical quarterly dividend of $0.9 per share, in line with the previous quantity. In spite of the decreasing sales and incomes, the dividends stay well covered and sustainable in the future. The payment ratio is presently around 20%, substantially listed below pre-pandemic levels.

Payment ratio (Looking for Alpha)

Evaluation

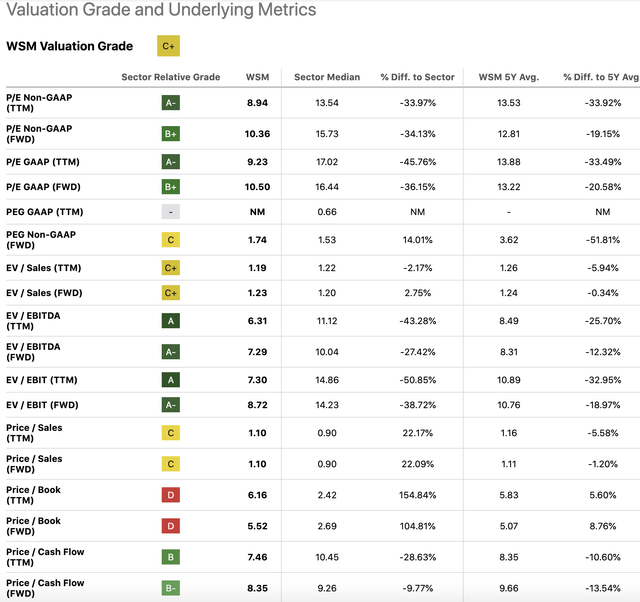

Simply as in our previous short article, we as soon as again see that WSM seems trading at a substantial discount rate compared to both the customer discretionary sector average and the company’s own 5Y averages, based upon a set of standard rate multiples.

Evaluation (Looking For Alpha)

Comparing to the customer discretionary sector might be too broad of a peer group, so we chose to have a look at the WSM in contrast with a few of its closest peers.

Compared to this peer group WSM is still costing a significant discount rate.

Conclusion

The macroeconomic environment has actually considerably enhanced because our last writing. Customer belief has actually enhanced, while the inflation rate has actually moderated. These advancements might have a favorable influence on WSM’s top- and bottom line leads to the coming quarters. Understand though, that experts have actually not been all so positive about the near-term outlook and some have actually even devalued the company’s stock to “offer”.

The company’s success stays appealing within the house providing retail market. The appraisal likewise seems appealing, particularly when thinking about the safe and sustainable dividends.

As our outlook about the general economy has actually considerably enhanced, we update WSM’s stock to “purchase”.