Nikada/iStock by means of Getty Images

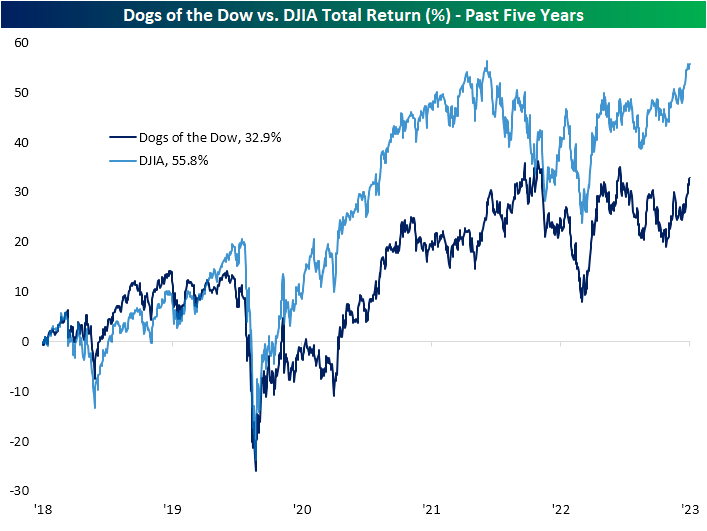

With the Dow coming off of a historical winning streak recently, listed below we sign in on the efficiency of the index vs. the Canines of the Dow. The Canines of the Dow is a stock-picking technique that purchases the index members with the greatest dividend yields at the end of a year, and holds them through completion of the next year.

On an overall return basis, the Dow’s current winning streak has actually been an advantage to both the general index and the Canines alike. That stated, the gains to the previous have actually brought the index up near 2022 highs on an overall return basis, while the Canines of the Dow has much more to go provided the general weak point of dividend-oriented equities just recently.

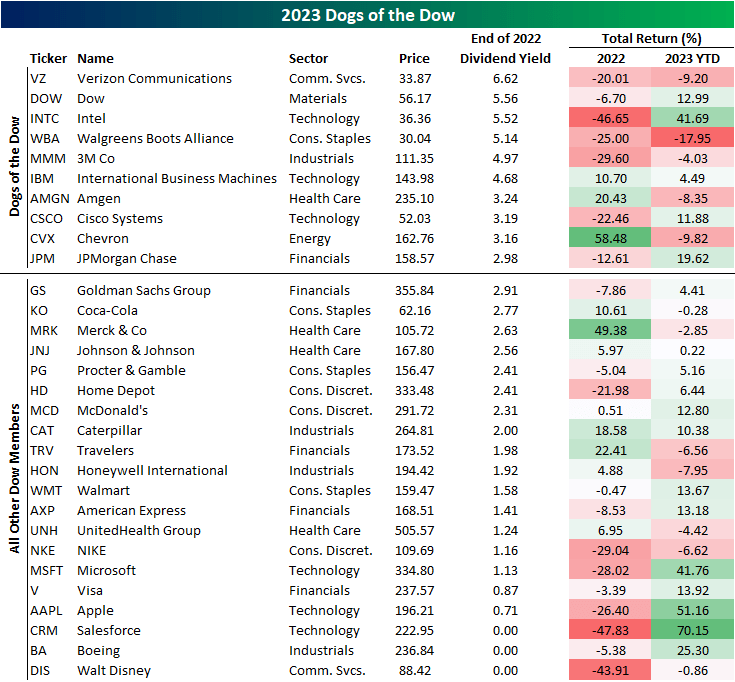

In the table listed below, we reveal the returns of this year’s Canines of the Dow and all other specific Dow members. The Canines of the Dow are host to a few of the stocks with the worst efficiency this year like Verizon ( VZ) and Chevron ( CVX), nevertheless, there are likewise a number of huge winners like Intel ( INTC) which has actually returned almost 42% YTD or JPMorgan Chase ( JPM) which has actually almost published a 20% return.

Nevertheless, the greatest gains in the index have actually originated from non-Dogs. In reality, the biggest gains this year have actually been from those with the most affordable or no dividend yields at the end of in 2015 like Boeing ( BACHELOR’S DEGREE), Salesforce ( CRM), or Apple ( AAPL).

Editor’s Note: The summary bullets for this post were picked by Looking for Alpha editors.