golibo

Financial Investment Thesis

Perion Network Ltd. ( NASDAQ: PERI) continues to provide strong potential customers, and yet its share cost has actually just recently taken a little breather. Nevertheless, I argue that this breather is foregone conclusion, that stocks do not relocate straight lines. This is not since Perion has actually had any incidents in execution.

Rather, compared to almost all other adtech business I follow – and I follow lots of – Perion continues to favorably impress me.

Appropriately, I think that over the next twelve months, we’ll recall to Perion at $32 per share and consider it a deal entry point.

Fast Wrap-up,

In my previous analysis, I stated,

The most amazing element is its evaluation, with the stock priced at 8x this year’s EBITDA. Perion’s earnings development rates are set to impress, with the possibility of attaining 20% CAGR by the end of Q4 2023.

I argue that experts’ earnings expectations for Perion are thought about conservative, and are most likely to be upward modified quickly.

I continue to think that Perion will leave Q4 2022 with a 20% CAGR and go into 2024 versus a much easier similar base, with a less burdensome macro environment.

Why Perion?

Perion is an Israel-based innovation business that concentrates on providing marketing options. Its worth proposal depends on offering organizations with reliable tools to boost their digital marketing methods and enhance consumer engagement throughout different online channels. Perion’s options incorporate cross-channel optimization and innovative style, allowing brand names to get in touch with their target market in impactful methods.

Like a number of its peers, with Perion the holy grail of marketing is to offer precise quantifiable outcomes. The much better quality the precision of the adverts, the more big clients will want to spend for Perion’s platform.

And this leads me to talk about Perion’s most significant consumer, Microsoft Marketing ( MSFT), that includes Bing Advertisements. Perion has a collaboration with Microsoft Marketing that includes offering innovation and services to boost the efficiency of Bing Advertisements. Perion’s function in this context consists of tools for enhancing advertisement shipment, enhancing targeting abilities, and boosting the total efficiency of marketing campaign on the Bing platform.

Perion is associated with the supply side of digital marketing. It offers marketing options and engagement platforms that assist publishers and app designers enhance their advertisement stock and monetize their digital homes efficiently. This puts Perion in the world of supply side platforms (SSPs) within the digital marketing environment.

Think of the digital marketing world as a huge market. On one side, you have the sellers, who are sites, apps, and other digital locations that have area for advertisements. These sellers wish to generate income by revealing advertisements to their visitors. Now, on the other side, you have the purchasers, who are business that wish to market their product and services.

In the middle, there are platforms called SSPs (Supply Side Platforms). These platforms assist the sellers (sites and apps) handle and offer their advertisement area to the purchasers (marketers). It resembles a matchmaker that links the ideal advertisements with the ideal locations to reveal them. SSPs make certain that the sellers get the most cash for their advertisement area, and the purchasers get the very best areas to reveal their advertisements to the ideal audience. So, remaining in the world of SSPs indicates becoming part of this matchmaking procedure in the digital marketing world.

With this structure in mind, let’s talk about Perion’s outlook.

Perion’s 2024 Might See 20% CAGR

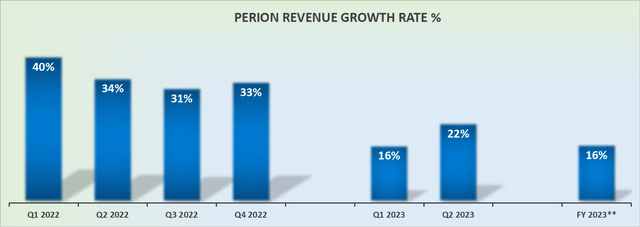

PERI earnings development rates

In my previous analysis, I stated:

Perion masterfully teases out to financiers that its outlook for 2023 is most likely to be upwards modified, offered the strength of its H1 2023 efficiency.

We didn’t have concrete figures at the time, all we understood was that Perion’s 2023 outlook indicated its profits growing by 15% y/y in 2023.

Nevertheless, Perion has ever since upwards-revised its outlook so that 2023 is anticipated to grow by 16% y/y.

For those that have actually followed Perion carefully, they’ll be extremely familiar that this business has a long history of being conservative just, to later surprise financiers.

In truth, that is among the primary arguments bears have versus Perion.

The Bear Case

Particular brief reports have actually made the case that Perion is misestimated and continue to make prolonged statements to irritate the brief argument. Here I highlight 3:

- How [Perion] creates $1.50 m and $0.30 m of earnings and EBITDA per staff member in the marketing innovation market, where the peer average is $0.53 m and $0.07 m, respectively.

- That experts have actually consistently liquidated shares.

-

Why Perion raised $230 capital from investors when rate of interest were close to 0%?

Undoubtedly, I have actually never ever comprehended the capital raise and discussed this element formerly Maybe Perion desired a specific M&A acquisition and it failed? Hard to understand for particular one method or another. Nonetheless, this capital raise is plainly something odd. And shorts are not alone because factor to consider.

On The Other Hand, the other 2 notable factors to consider can be quickly rationalized. Perion’s expense structure is for the many part outside the U.S. That would equate into a significantly lower expense basis.

And when it comes to the expert dilution because 2019, the truth of the matter is that in the previous 4 years, Perion’s share cost is up almost 10x. That’s an extremely strong boost in a brief amount of time.

And talking of Perion’s efficiency, let’s relocate to the next area.

How Perion’s Efficiency Compares

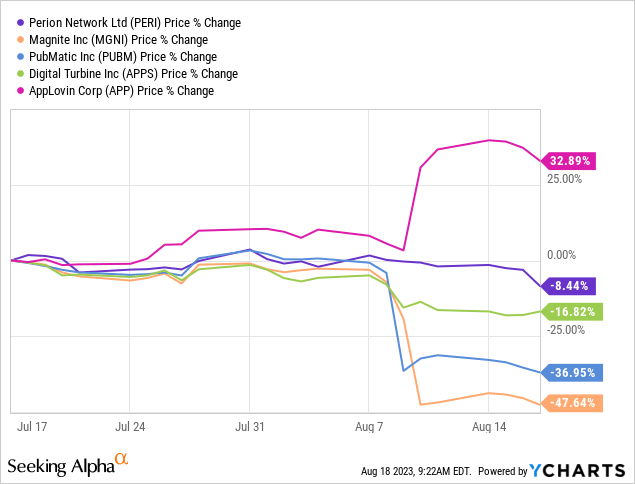

Just Recently, we have actually seen Magnite ( MGNI), PubMatic ( PUBM), Digital Turbine ( APPS), and AppLovin ( APP) report their particular outcomes. And we have actually seen many adtech business getting shot out of the sky.

All of these business saw their adtech organizations diminish to differing degrees. The one that exceeded has actually been AppLovin. Nevertheless, I have actually specified that AppLovin’s efficiency has actually been strong since of its Software application section. Which AppLovin’s Apps company is fairing simply as terribly as that of its peers, leaving out Perion. By the way, AppLovin is a stock that I’m bullish on and suggest

In conclusion, I think that paying 8x this year’s EBITDA for Perion is an engaging evaluation.

The Bottom Line

After carefully examining Perion’s current efficiency and market patterns, I securely think that the current time out in its share cost is simply a natural change instead of an indication of incidents.

In truth, compared to other adtech business I follow, Perion continues to impress me favorably.

The business’s strong evaluation and expected earnings development rates make it stick out in the digital marketing landscape.

With its history of conservative price quotes followed by favorable surprises, Perion’s capacity for a 20% CAGR by 2024 appears completely possible.

In spite of issues raised by particular brief sellers, I discover that the business’s efficiency, expense structure, and expert actions offer a strong defense to these arguments.

When compared to its market peers, Perion Network Ltd.’s constant development sets it apart, making its present evaluation at 8x this year’s EBITDA an attractive proposal.