hapabapa

Tencent ( OTCPK: TCEHY) reported a strong set of Q2 2023 outcomes, although the Chinese Tech giant dissatisfied versus Refinitiv agreement quotes. In amount: Tencent’s income for the June quarter was up 11% YoY, building up to RMB 149.21 billion; Revenue attributable to investors was reported at RMB 26.17 billion, up 41% YoY.

Looking beyond Q2 2023 reporting sound, I argue that Tencent equity continues to be valued wonderfully, trading at a EV/ EBIT of ~ 14x. On the background of lower EPS forecasts through 2025, nevertheless, I cut my fair-value target rate to $47.23/ share.

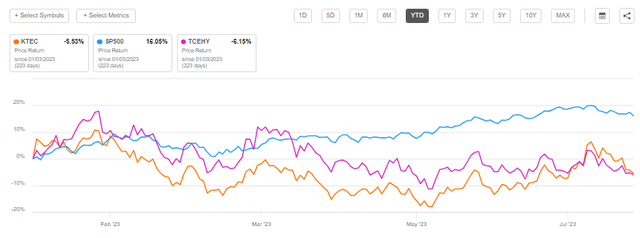

For recommendation, Tencent shares have actually underperformed YTD vs. the Hang Seng innovation criteria, in addition to the U.S. stock exchange. Because January 2023, TCEHY shares are down about 6%, as compared to a loss of 5% for the KraneShares Hang Seng TECH Index ETF ( KTEC) and a gain of 16% for the S&P 500 ( SP500).

Total Strong, However Frustrating Q2

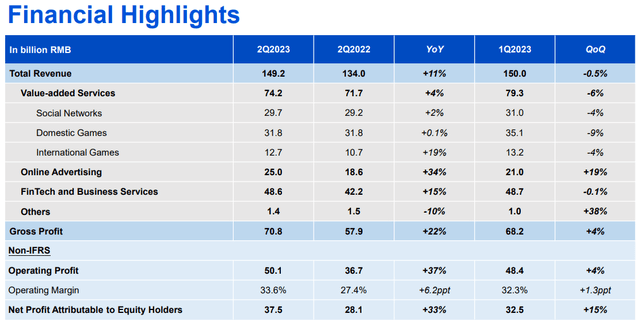

Thinking about the tough macro background in China, Tencent’s outcomes for Q2 2023 were in fact rather strong, in my viewpoint; nevertheless, the business still missed out on agreement quotes on both topline and revenues, according to information gathered by Refinitv. Throughout the duration from April to end of June, China’s biggest innovation corporation created about RMB 149.2 billion of sales, which compares to RMB 134 billion for the very same duration one year previously (up 11% YoY). Experts, nevertheless, have actually predicted Q2 sales in the variety RMB 151 to 155 billion.

With regard to success: Tencent’s gross revenue leapt to RMB 70.8 billion, up 22% YoY vs. the RMB 57.9 billion tape-recorded in the very same duration one year previously; Tencent’s operating earnings can be found in at RMB 50.1 billion, representing a boost of 37% YoY vs. Q2 2022, respectively.

On a sector basis, Tencent took advantage of a dive in marketing charge earnings, which was up 34% YoY, as health care, e-commerce, and travel saw an increase in need following the COVID repopening tailwind. Tencent’s core revenue center, nevertheless, that includes Social Networks and Games, stayed flat vs. Q2 2022– and in fact reduced QoQ by about 6%. In my viewpoint, there are 2 significant factors for Tencent’s weak efficiency in Games: First, financiers need to think about that the Q2 2022 criteria was increased by COVID lockdowns pressing individuals to inside home entertainment; Second, I wish to explain Tencent’s weak pipeline of brand-new video game launches throughout 2022, as Chinese authorities froze the approval procedure for lots of Tencent titles. For recommendation, Tencent’s International Games department was up 19% YoY.

Development Out, Worth In

Assessing Tencent’s Q2 2023 outcomes, I believe it is reasonable to state that the tech giant’s performance history of emerging 20%+ CAGR has actually most likely pertained to an end. Nevertheless, what Tencent is losing on its development appeal, the business is getting on worth.

Financiers need to think about that Tencent is wonderfully broadening margins on OPEX discipline and is now producing an approximated, annualized running capital of around RMB ~ 200-220 billion. Designing a sensible RMB ~ 20-25 billion upkeep CAPEX on Tencent’s asset-light organization operations, financiers might therefore fairly anticipate RMB ~ 190-210 billion of distributable capital.

Comparing Tencent’s approximated distributable capital to the business’s business worth of RMB ~ 3.2 trillion recommends a x16 numerous, or a ~ 6.2% yield. This yield, coupled with a CAGR 2-3% terminal development approximated, would reward Tencent equity holders with a 8-9% return.

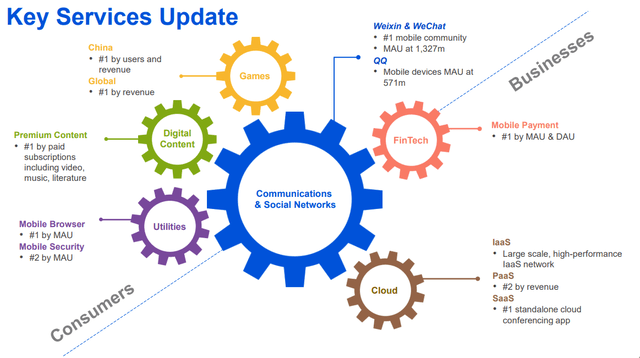

Now, I would likewise like to explain that the above calculated capital need to be extremely sustainable in time, offered Tencent’s strongly-moated organization operations safeguarded by network impacts: Since June 30th, Tencent owns China’s # 1 social networks platform, # 1 mobile payment platform, # 1 video gaming platform, and # 1-2 position in Cloud.

Evaluation Update: Lower Target Cost

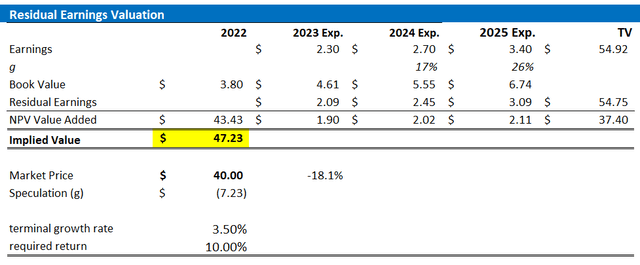

Assessing Tencent’s Q2 report, I upgrade my EPS forecasts for the Tech giant in line with expert agreement modification, according to information gathered by Bloomberg: Appropriately, I now anchor on EPS equivalent to $2.3 for FY 2023, vs $2.55 approximated formerly. Furthermore, I change my EPS input for 2024 and 2025, to $2.7 and $3.4, respectively.

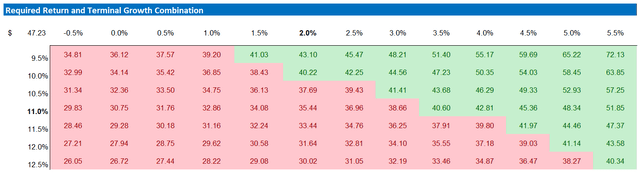

I continue to base my evaluation design on a sensible 3.5% terminal development rate (one portion point greater than approximated small international GDP development), in addition to a 10.0%, expense of equity. Undoubtedly, the expense of equity may downplay Tencent’s threat premia, offered the China-related financial investment dangers. That stated, financiers who wish to evaluate a greater expense of equity might reference the level of sensitivity table confined.

Provided the upgraded EPS forecasts as highlighted listed below, I now determine a reasonable implied share rate for TCEHY equivalent to $47.23.

Business Financials: ´; Author’s EPS Price quotes; Author’s Estimation

Below is likewise the upgraded level of sensitivity table– highlighting a beneficial threat – benefit even for greater expense of equity levels.

Business Financials: ´; Author’s EPS Price quotes; Author’s Estimation

China ADRs Remain Risky

Tencent is certainly a terrific business, running well-moated organization designs throughout running sections (e.g., Social network, Video Gaming, Cloud). Hence, I see little distinctive disadvantage threat for TCEHY.

On a more systemic-based threat evaluation, nevertheless, my main issue associates with buying business headquartered in China; particularly, to the regulative pressure that China’s tech and web giants have actually dealt with in current months/ years. Naturally, if this continuous regulative analysis continues, Tencent’s evaluation may require to be changed with a substantial threat discount rate. That stated, nevertheless, it deserves keeping in mind that the most extreme stage of the regulative clampdown in China has actually passed.

In addition to regulative issues, I would likewise like to highlight that the volatility of Tencent stock rate is highly swayed by the dominating belief of financiers towards Chinese ADRs. This indicates that even if the underlying organization basics of the business stay steady, TCEHY stock might vary based upon how financiers view the dangers connected with Chinese financial investments.

Conclusion

Tencent published a strong efficiency in Q2 2023; although both topline and bottomline missed out on agreement quotes. Looking ahead, I argue that financiers need to focus less on Tencent’s development story and value that the Tech giant is gradually transitioning towards ended up being a worth financial investment chance rather. To render the worth argument more concrete: I see Tencent producing a well-moated, distributable yearly earnings of RMB ~ 190-210 billion, which would recommend a 8-9% investor return moving forward, according to my estimations. On the background of an appealing evaluation, I continue to advise a “Buy” for TCEHY.

Editor’s Note: This post goes over several securities that do not trade on a significant U.S. exchange. Please understand the dangers connected with these stocks.