arild lilleboe

XPRO Gains Momentum

In my previous post, I went over Expro Group Holdings’ ( NYSE: XPRO) methods. In current times, a cyclical uptrend in overseas and worldwide activity will benefit XPRO in the coming quarters. The product rate stability has actually enhanced its production-related activities. Much better prices, expenses, and capital discipline can lead to margin growth and greater money generation. A steady stockpile of $2 billion shows numerous brand-new tasks and job extensions in the worldwide markets.

The main difficulty in Q2 was the non-productive time for the LWI (Light Well Intervention), which led to non-reimbursable expenses. However this can remedy in the coming quarters. The stock is fairly valued with a modest benefit versus its peers. I believe the favorable aspects will exceed the challenges. So, I update it to a medium-term “purchase.”

Expense Decreases And Difficulties

XPRO’s present service design partly depends upon worldwide and overseas energy activity. The business must take advantage of the tailwind in the next a number of years due to the fact that overseas rig count and worldwide activity are on a cyclical uptrend. The business has actually justified its operations to decrease assistance expenses. It has actually likewise understood the expense synergy targets. It concentrates on property usage and increasing the drilling and conclusion activity to attain a much better activity mix.

The main difficulty in Q2 was the non-productive time for the LWI systems. The hold-ups led to non-reimbursable expenses in Q2. Throughout the quarter, it dealt with the running problems with the LWI system, and the management thinks it must solve slowly. The business is increasing costs which will begin showing in 2H 2023. This, plus the expenses and capital discipline, is anticipated to enhance its operating utilize and lead to margin growth and greater money generation.

How Will The Marketplace Affect Its Outlook?

XPRO’s management approximated that approvals of the variety of overseas tasks in 2023 and job sanctions will increase till 2030. Manufacturers will seek to increase production as product costs support. This will promote the business’s production-related activities, consisting of well circulation management, well intervention, and the stability of line of product. There is likewise growing need for plug and desertion options for the decommissioning market in Europe. A boost in expedition and appraisal in standard shales, increased carbon capture, and storage tasks suggest a favorable long-lasting outlook for the business.

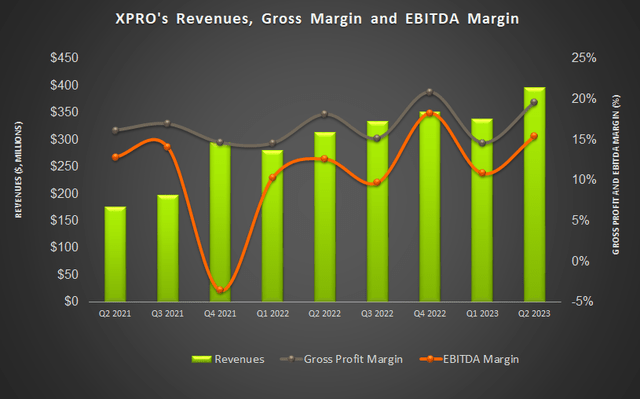

Throughout Q2, XPRO caught $300 million in brand-new work orders. It has a steady stockpile quarter-over-quarter, totaling up to $2 billion. Its Eni Congo job is on time, and the center can end up being functional in 1H 2024. Based upon the robust order reservation, in FY2023, its changed EBITDA can reach $1.5 billion while the EBITDA margin can hover around the 20%- mark. This shows a year-over-year margin growth of 400 basis points.

Recognizing The Headwinds

In the near term, XPRO has a couple of margin headwinds. The LWI-related non-productive time represented 150 basis point margin contraction in Q2. The business likewise embraced a conservative technique on the margin from the onshore pretreatment center in Congo. The job led to a 150 basis point margin contraction in Q2. Nevertheless, success on both these accounts is anticipated to enhance over Q3 and Q4.

The Q2 Motorists

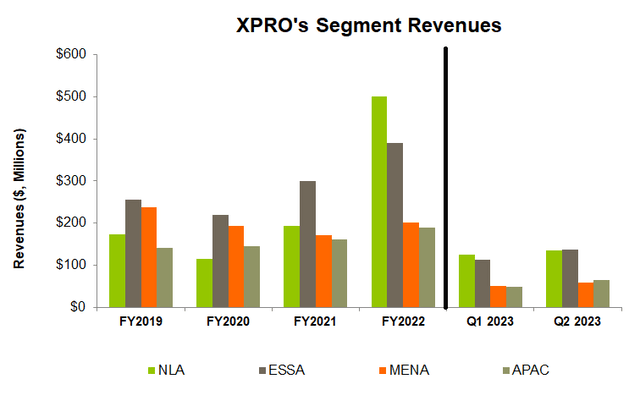

From Q1 to Q2, the business’s earnings increased by 17%. Geographically, the Asia Pacific (or APAC) department signed up the steepest increase (34% up) throughout this duration, followed by Europe and Sub-Saharan Africa (or ESSA) (21% up). North and Latin America, on the other hand, moved most sluggishly (7% up). Increased subsea direct hydraulic drill stem screening, well screening, and downhole tasting added to the APAC area’s development. In Ghana, where the business has actually been running given that 2012, it got a subsea bundles agreement extension totaling up to $50 million in Q2.

The business’s changed EBITDA increased dramatically (73% up) sequentially in Q2 in spite of the LWI-related margin headwinds. A more beneficial activity mix and lower assistance expenses triggered operating earnings to enhance.

Money Streams And Liquidity

In 1H 2023, XPRO’s capital from operations turned favorable compared to unfavorable CFO a year back, led by an increase in earnings in the previous year. Nevertheless, its complimentary capital stayed unfavorable due to the boost in capex. In FY203, greater earnings and much better working capital management must result in greater capital. The business kept its FY2023 capex assistance the same from the previous quarter.

Since June 30, XPRO had no financial obligation. Its liquidity was $311 million on June 30. In 1H 2023, it invested $10 million in share repurchases.

What Does The Relative Appraisal Imply?

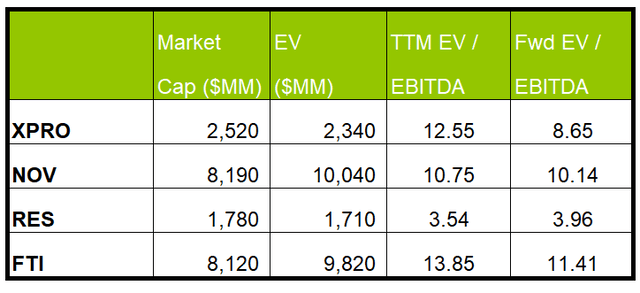

Author Developed And Looking For Alpha

XPRO’s forward EV/EBITDA numerous (8.7 x) is anticipated to contract versus the present EV/EBITDA numerous (12.6 x). The rate of contraction is much steeper than its peers’ ( NOV, RES, FTI) typical fall. This usually suggests a greater EBITDA development, which can equate to a greater EV/EBITDA numerous. The stock’s present numerous is greater than its peers’ average of 9.4 x. Relatively, nevertheless, XPRO’s EBITDA development is steeper. So, the stock is fairly valued with a modest benefit versus its peers.

Target Cost And Expert Score

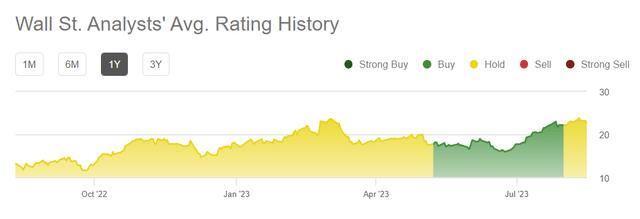

In the previous 90 days, 2 Wall-street experts ranked XPRO a “Buy.” 4 experts ranked it a “Hold,” while none advised a “Offer.” The agreement target rate is $25.6, which has a 12% upside prospective at the present rate.

Why Am I Updating?

I was fairly positive about XPRO in my previous post. Its vessel-deployed LWI systems were succeeding, while the business’s acquisition of DeltaTek Global increased its penetration into the Gulf of Mexico, West Africa, and Asia Pacific. Nevertheless, a northern hemisphere activity downturn and consumer spending plan restrictions held it back. I composed:

The stockpile of overseas deepwater tasks will broaden its high-end TRS and Subsea landing stream capability. Greater costs will cause brand-new expedition activities in a number of locations, promoting need for the business’s items.

In Q3, the North Sea and other worldwide areas can see activity increase. The activity downturn in the northern hemisphere, and consumer spending plan restrictions still dominate. Regardless of that, greater overseas energy production must assist its well circulation management, well intervention, and the stability line of product. The business’s expense management efforts will likewise enhance its margin. So, I am updating it to a “buy.”

What’s The Handle XPRO?

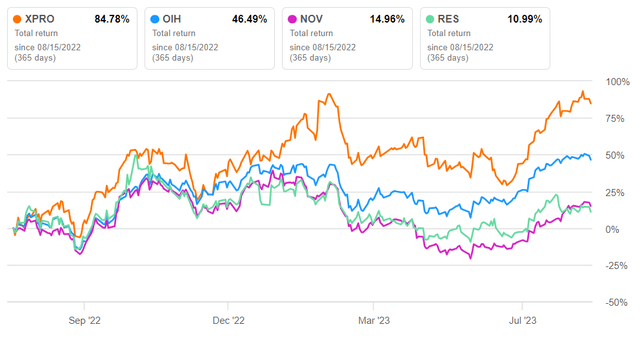

With greater approvals of the variety of overseas tasks, I anticipate the job sanctions will increase till 2030. It has actually likewise forayed into carbon capture operations. In Q2, its earnings and changed EBITDA increased substantially, specifically in the APAC area, which reveals the momentum on its side. So, the stock exceeded the VanEck Vectors Oil Solutions ETF ( OIH) in the previous year.

However the business’s unfavorable complimentary capital can issue financiers. Much better operating capital management can enhance capital in the coming quarters. Provided the relative appraisal, financiers may wish to “purchase” the stock for healthy returns in the medium-to-long term.