Douglas Rissing/iStock by means of Getty Images

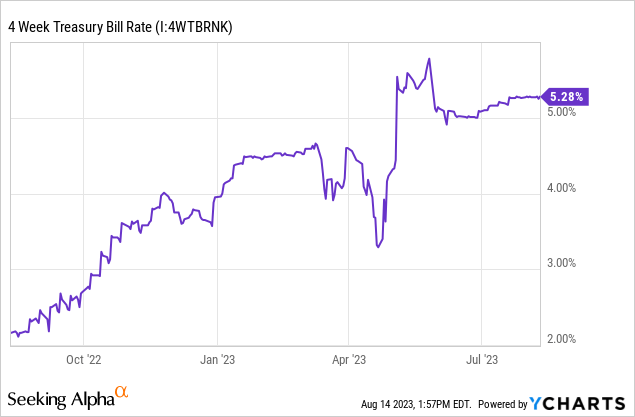

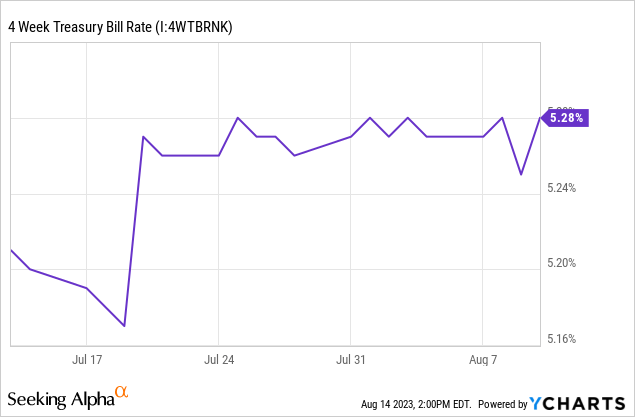

Greater Federal Reserve rates have actually caused greatly greater rates on the majority of bonds and fixed-income property classes. T-bills have actually been among the greatest recipients, with rates escalating from efficient no in early 2022, to +5.3% since today. As rates increase so does financier interest and need in these securities

Thinking About the above, believed to compose a fast post comparing t-bills with other fixed-income securities, because of current Fed walkings, and possible future cuts.

T-bills presently provide financiers competitive yields, however rather lower than those of the higher-yielding sub-asset classes, consisting of senior loans and high-yield business bonds. Credit quality and rates of interest threat/ direct exposure are both really low, resulting in an exceptionally steady share cost, with really little volatility. As t-bills are really short-term securities, they would see minimal cost boosts from lower rates, however their dividends would decrease really quickly.

In my viewpoint, the general risk-return profile of t-bills is presently rather appealing, due to their above-average yields and incredibly low level of threat. As such, t-bills are great financial investment chances, and especially appropriate for more risk-averse financiers. Financiers looking for greater yields may choose riskier, higher-yielding securities, while more dovish financiers may choose longer-term securities, to lock-in their yields.

I’ll be concentrating on the SPDR Bloomberg 1-3 Month T-Bill ETF ( NYSEARCA: BIL) for this post, however whatever here ought to use to most other t-bill funds, and to the securities themselves.

BIL – Peer Contrast and Analysis

Dividends and Dividend Development

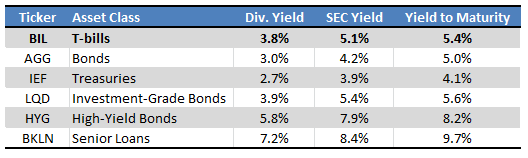

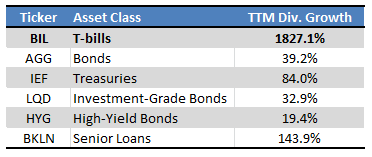

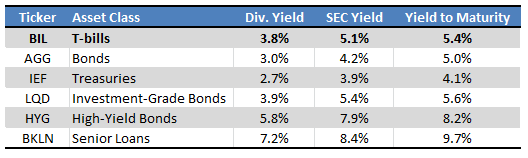

BIL’s dividends compare positively relative to the majority of its peers, with the fund yielding more than the typical bond and treasury, however less than the typical high-yield bond and senior loan. The latter 2 sub-asset classes have much greater credit threat, nevertheless. Outcomes for 3 essential yield metrics are as follows.

Fund Filings – Chart by Author

A fast description of the 3 yield metrics above.

BIL sports a 3.8% dividend yield, due to the fact that it has actually paid 3.8% in dividends these previous twelve months. Said figure is a bit lower than dominating t-bill rates, as rates were lower twelve months earlier.

Information by YCharts

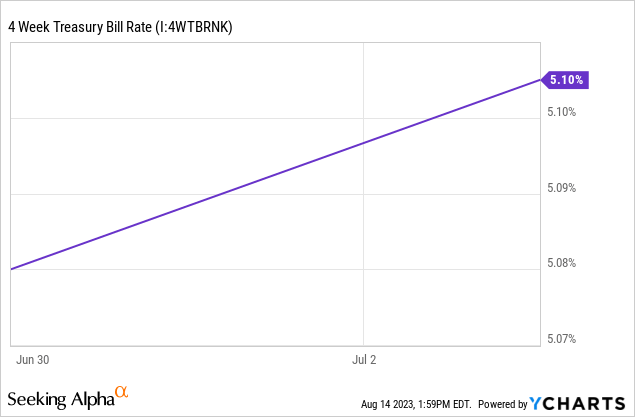

BIL sports a 5.1% SEC yield due to the fact that it got 5.1% in earnings last month. Simply put, t-bill rates were at 5.1% last month.

Information by YCharts

BIL sports a 5.4% yield to maturity, as the fund’s underlying holdings are anticipated to return 5.4% annualized if held up until maturity. Simply put, t-bill rates presently stand at 5.4% (technically a bit lower, however close sufficient).

Information by YCharts

Dividend yield, SEC yields, and yield to maturity metrics are very important for financiers to think about. BIL’s dividends look appealing in all 3 metrics.

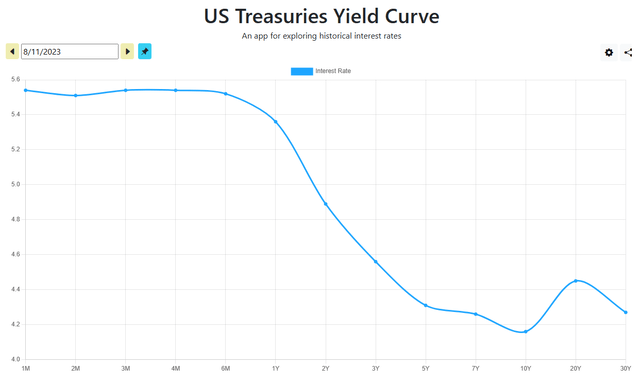

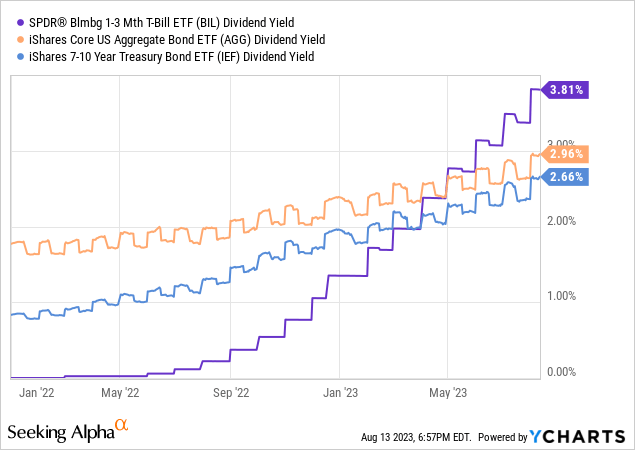

BIL’s dividends look especially appealing today as the yield curve is inverted, with short-term securities, like t-bills, yielding more than longer-term securities, like the majority of other bonds.

BIL’s dividends have actually seen much more powerful development because early 2022, when the Fed began to trek, too. Development remained in big part due to beginning with a really low base, nevertheless.

Looking For Alpha – Chart by Author

BIL’s greater dividend development is likewise obvious in the fund’s greater dividend yield. BIL’s yield increased from successfully 0.0% in early 2022 to 3.8% since today, a much bigger boost than that of the typical bond and treasury.

Information by YCharts

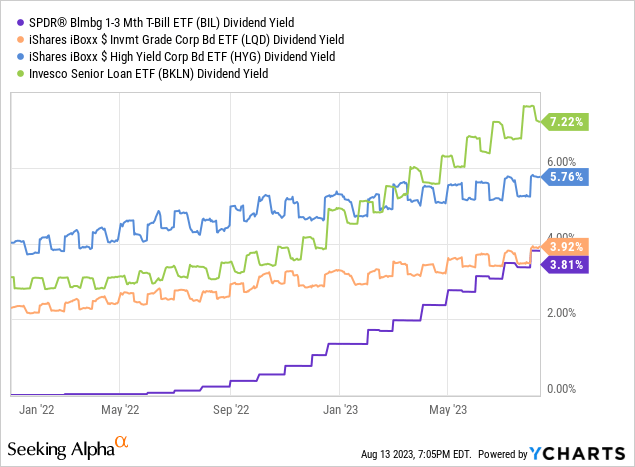

Dividend yield development was greater than investment-grade and high-yield bond funds too, however a bit lower than that of senior loans. Harder to parse on the chart too.

Information by YCharts

BIL’s relatively strong dividends are a crucial advantage for the fund, and an essential benefit relative to peers. Financiers can attain greater earnings, however just by selecting securities with much greater credit threat. Which brings me to my next point.

Credit Danger

BIL buys t-bills, which are securities provided by the U.S. Federal Federal government, the greatest, most credit-worthy organization worldwide. Credit threat is successfully nil, as are default rates, disallowing an extraordinary U.S. default. Due to this, BIL ought to see minimal losses throughout declines and economic downturns, exceeding high-yield bonds and senior loans. On the other hand, the fund does not have the flight-to-quality result of treasuries, specifically longer-term treasuries, therefore need to underperform these securities throughout economic downturns.

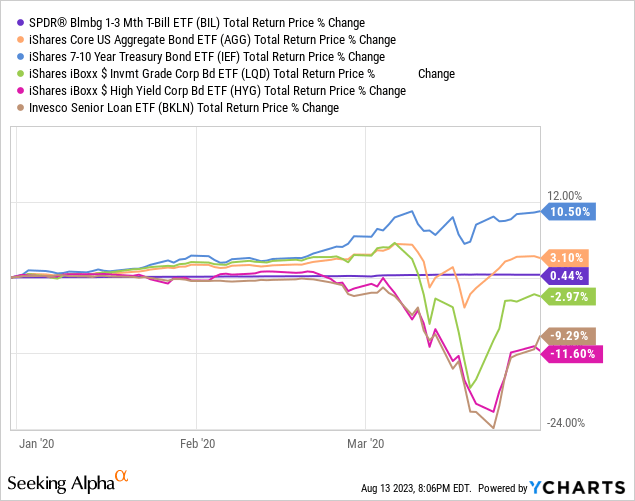

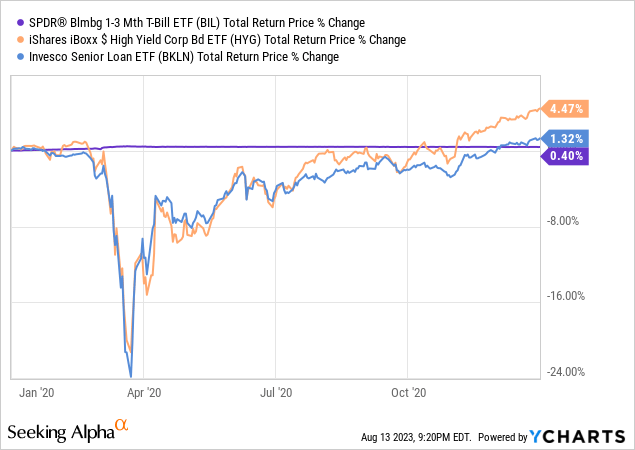

As an example of the above, BIL saw gains of 0.44% throughout 1Q2020, the beginning of the coronavirus pandemic, and the most current economic crisis. Losses were non-existent, even from peak to trough, and overall returns significantly exceeded those of its riskier peers. Gains were rather weak, and lower than those of treasury index funds, and broad-based mutual fund (which invest rather greatly in treasuries too).

Information by YCharts

BIL’s high credit quality is a considerable advantage for the fund, and a crucial benefit relative to a few of its peers. More bearish financiers may choose longer-term treasuries, specifically those looking for to hedge their equity direct exposure, nevertheless.

Rates Of Interest Danger/ Direct Exposure

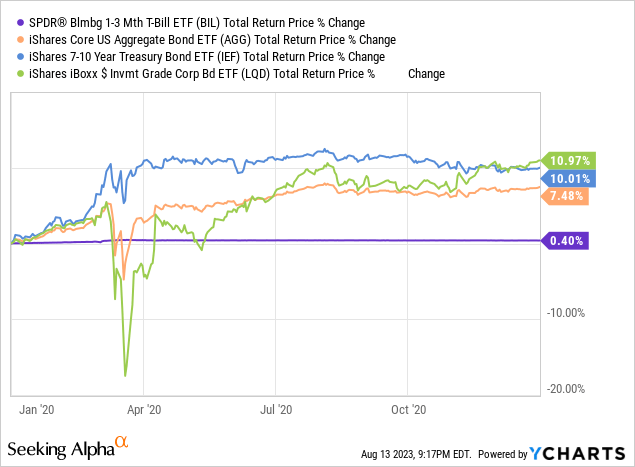

BIL buys t-bills, securities with really low maturities, period, and rates of interest threat/ direct exposure. All of these are considerably lower than average, lower than the majority of other bond sub-asset classes, however approximately equivalent to senior loans.

Fund Filings – Chart by Author

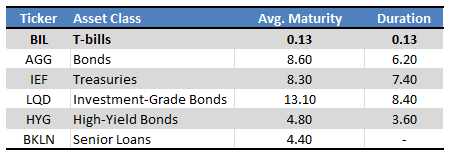

Lower period implies lower losses when rates of interest are increasing, with BIL exceeding the majority of its peers because early 2022, when the Fed began to trek. Senior loans have actually a little surpassed, nevertheless, although with much greater volatility.

Information by YCharts

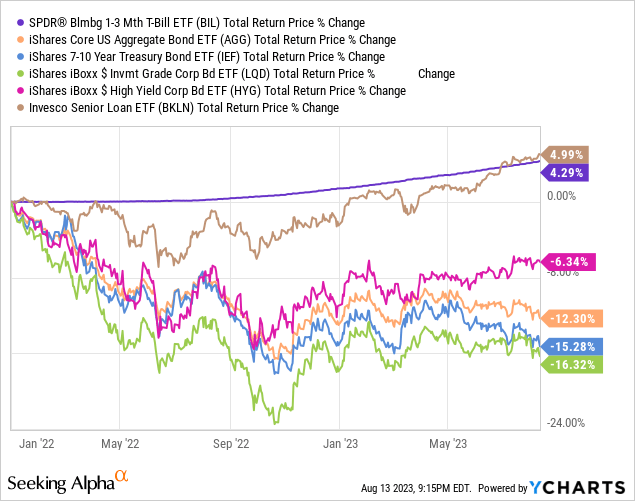

Corollary of the above is that BIL ought to see much lower gains when rates of interest reduce. Due to the effect of volatility, credit threat, and rate spreads, it is really tough to determine a specific time period throughout which this happened (and absolutely nothing else). BIL did see much lower gains than its investment-grade peers throughout 2020, when the Fed slashed rates to fight the pandemic, nevertheless.

Information by YCharts

BIL underperformed high-yield bonds and senior loans throughout stated year too, however that was primarily due to the fund sporting really low dividends at the time.

Information by YCharts

Significantly, lower Fed rates may not always cause greater bond rates progressing, as the marketplace is anticipating a really aggressive set of rate cuts currently, and is pricing securities according.

In my viewpoint, and thinking about the above, BIL’s low rates of interest threat is a net long-lasting advantage for the fund and its financiers. More dovish may disagree.

Total Danger and Risk-Return Profile

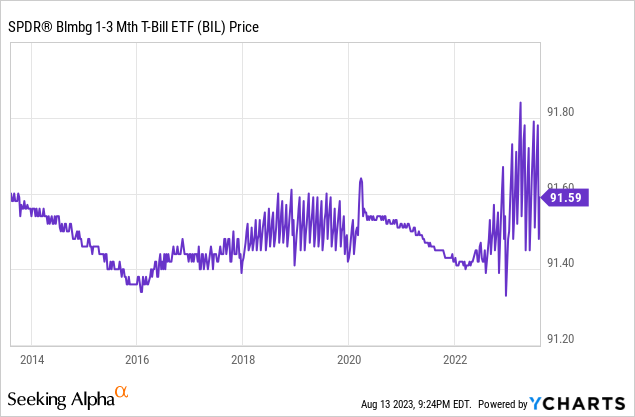

BIL’s credit and rates of interest threat are both incredibly low/ minimal, leading to an exceptionally steady fund. BIL’s share cost has actually oscillated in between $91.30 and $91.8 for the previous years, an exceptionally tight variety. The majority of the oscillations are because of (momentary) kept dividends too, and not actually a sign of property cost volatility.

Information by YCharts

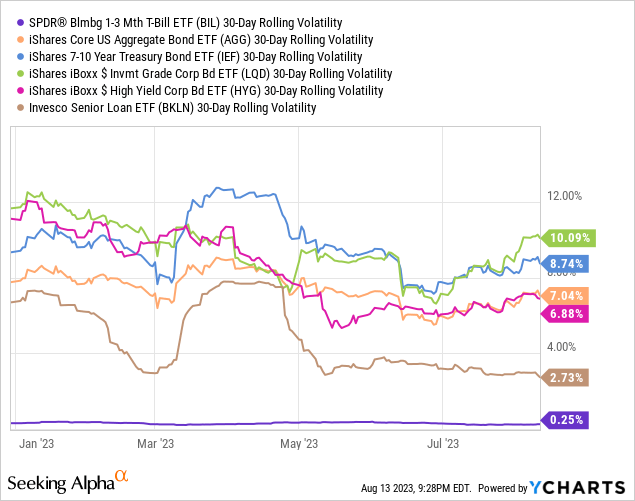

BIL’s general level of threat and volatility is much, much lower than that of its peers, a considerable advantage for the fund and its investors.

Information by YCharts

Significantly, despite the fact that BIL’s volatility is most affordable in its peer group, its dividends are sturdily above-average, as is its dividend development.

Fund Filings – Chart by Author

Thinking About the above, it appears clear that BIL has the greatest risk-return profile in its peer group, a considerable advantage for the fund and its investors. In my viewpoint, BIL’s strong risk-return profile exceeds its low rates of interest direct exposure, even after representing most likely Fed rate cuts. More dovish financiers may disagree.

Senior loans do have reasonably greater yields, however considerably higher credit threat. I do discover their general risk-return profile to be rather engaging too, although clearly more slanted towards more aggressive financiers.

Conclusion

T-bills presently provide financiers above-average yields, really low general threat, and a really strong general risk-return profile. As such, and in my viewpoint, t-bills are great financial investment chances, and especially appropriate for more risk-averse financiers.