PM Images

OppFi ( NYSE: OPFI) has actually traded rangebound in between $2.90 and $1.80 for the last 1 year, with the financing platform just recently reporting financial 2023 second-quarter revenues that saw double beats on earnings and revenues. OppFi reported earnings of $ 122.5 million set versus a $276 million market cap that is a long method far from the $800 million go-public appraisal it achieved in the summertime of 2021 when it consummated its merger with a blank check business. OppFi would form among the numerous fintech companies that would welcome this go-public technique however who have all given that skilled high losses on the back of the Fed starting its fastest rate of financial tightening up in years with a Fed funds rate now presently sitting at 5.25% to 5.50%.

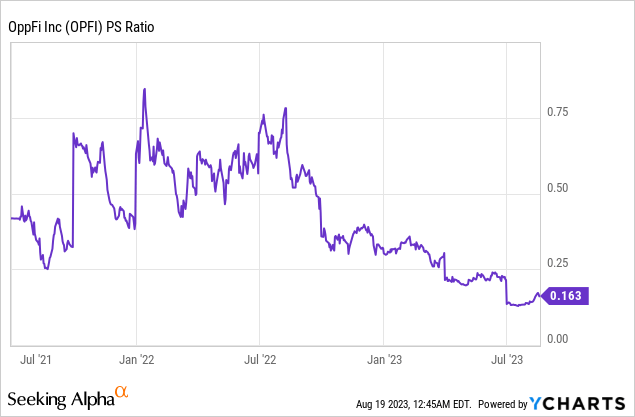

OppFi’s sales multiple has actually collapsed, with the ticker presently switching hands at a 0.16 x price-to-sales ratio, even versus 13.5% year-over-year earnings development for its 2nd quarter. Seriously, this ratio encapsulates the present stock exchange zeitgeist, where rising yields have actually pressed risk-off belief on small-cap fintech business like OppFi to historic record lows. To be clear, every $1 of earnings made by OppFi in the summertime of 2023 is being equated into approximately 16 cents of market cap, below the summertime of in 2015 when every $1 of earnings was equated into 75 cents of market cap.

Double Beats Imply Long Selloff Overdone

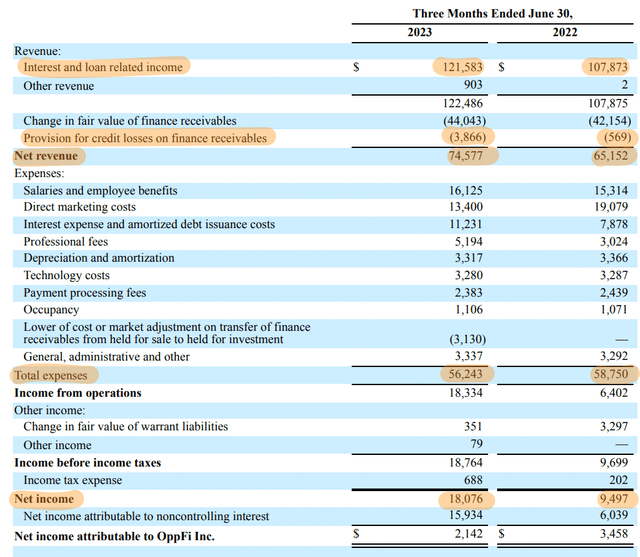

OppFi taped a $5.44 million beat on agreement earnings price quotes, with earnings for its 2nd quarter being available in at $122.5 million. Net earnings can be found in at $ 74.58 million, up from $65.15 million in the year-ago duration, as overall costs dipped by $2.5 million from its year-ago figure. OppFi had the ability to press through a decrease in direct marketing expenses to counter broad expense increases from expert costs and interest costs. Overall costs as a portion of overall earnings fell by 16% over its year-ago compensation.

OppFi Fiscal 2023 2nd Quarter Kind 10-Q

This implied earnings can be found in at $18.08 million, up a substantial 90% year-over-year with a non-GAAP adjusted EPS of $0.19 pounding agreement price quotes by $0.15 to drive among OppFi’s finest quarters for success. The business had the ability to minimize marketing expenses per financed loan by 23% versus net originations throughout the quarter, which fell by 11% from its year-ago compensation. What’s the play here? OppFi’s present appraisal is not cognizant of growing profits and favorable EPS, and this might represent a chance to the belong side as soon as market belief turns favorable. Nevertheless, the risk-off belief that has actually driven the business’s appraisal to tape-record lows is set to stay sticky as long as inflation stays above the Fed’s 2% target rate. The kind of interest that underpinned the previous sales multiple would particularly be hard to duplicate versus the specter of a difficult landing.

Balance Sheet Versus Macroeconomic Headwinds

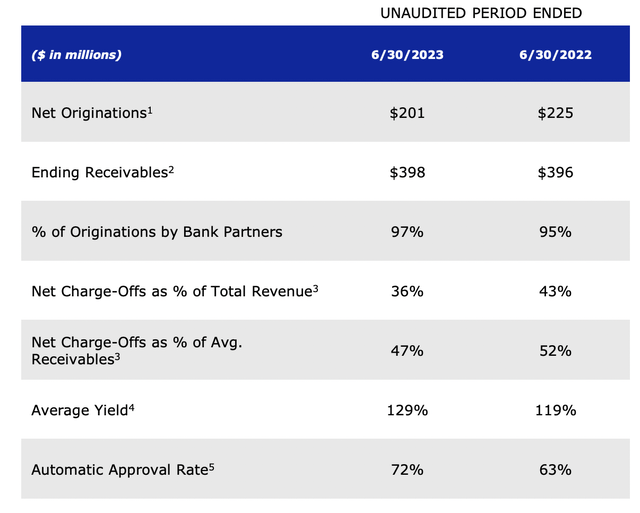

OppFi Fiscal 2023 2nd Quarter Discussion

This danger of an economic crisis is increased versus OppFi’s concentrate on lower credit quality customers. OppFi’s net charge-off rate as a portion of overall earnings did fall 17% from 43.5% in its year-ago compensation to 36.2% in the current 2nd quarter. The business rotated in 2015 to tightening its financing design and lowering its financing criteria to move its consumer blend far from the lower end of credit quality. This enhancement in credit efficiency saw end receivables stay stable at $ 398 million since completion of the 2nd quarter. Even more, OppFi’s overall delinquency rate decreased by 10% with its overall very first payment default rate falling 23%. Its typical yield was enhanced by 1000 basis indicate 129% versus this enhancement in credit efficiency.

Economic downturn projections are likewise being called back in reaction to strong work figures and retail sales. J.P. Morgan is no longer anticipating a United States economic crisis in 2023 with Goldman Sachs cutting the possibility of an economic crisis next year to 20% from a previous 25% position. OppFi is verifying assistance for full-year 2023 earnings to come in at $ 500 million to $520 million. This would represent development of approximately 10% to 15% over 2023 and is set versus the agreement of $507.90 million. Changed earnings assistance was likewise raised to $29 million to $35 million, from a previous variety of $24 million to $30 million.

The danger here stays a spike in net charge-offs versus what stays broad macroeconomic unpredictability and volatility. Presently, strong financial indications might turn with the trainee loan payment reboot in October, among numerous possible headwinds to deal with the United States economy. OppFi’s balance sheet held money and equivalents, consisting of limited money, of $62.1 million with an overall financial obligation of $331.9 million since completion of the 2nd quarter. The business likewise has access to $537.1 million in overall capability to money receivables, more enhanced by a handle Atalaya Capital to upsize its revolving credit center to $ 250 million This stays a hold, with a buy ranking contingent on net charge-offs staying low as we get in the possible end of the Fed’s rate walking cycle next year.