KSChong

Q2 profits summary – Keeping a Buy Ranking on NAMS

Although we had actually composed a post just recently prior to the profits where we concentrated on the progressing landscape of LDL-c lowering treatments, we chose to compose a follow-up short article to go over the brand-new updates from the Q2 profits as brand-new information around the upcoming scientific readouts of stage 3 trials were talked about. Our company believe the 2 critical stage 3 information would be essential for financiers to follow as it will figure out if Obi can get authorized simply based upon a standalone LDL-c decrease or if CVOT information would be needed.

Q2 2023 Incomes Update: In its 2Q23 monetary report, NewAmsterdam Pharma ( NASDAQ: NAMS) showcased a favorable trajectory, echoing self-confidence in its next-gen oral CETPi obicetrapib. This prospective treatment targets a considerable unmet requirement in cardiovascular clients not able to attain their wanted LDL-C objectives through an unique CETP inhibitor that can be taken orally.

A noteworthy upgrade that was shared by the management was around over-enrollment in obi’s Ph. 3 BROADWAY trial (>> 2500 versus a target of 2400), meaning a robust international need for ingenious oral statin accessory treatments.

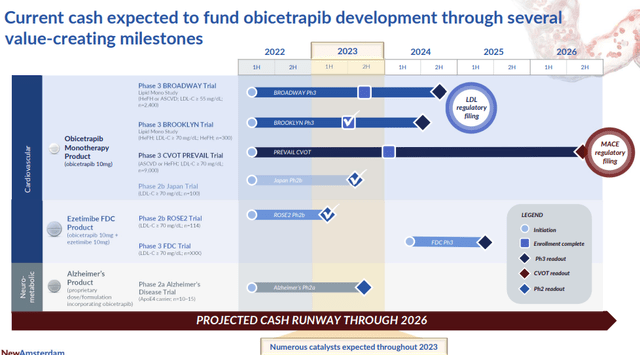

The business’s lead property Obicetrapib, presently in 3 Ph. 3 trials, is set to present top-line information from its LDL-lowering research studies in 2H24 (which the business requires for the complete approval as we have actually seen with PCKS9is). We anticipate approval of the drug by 2025-2026 and we construct conviction on the approvability if the drug’s stage 2b ROSE trial’s information holds. Although we think about that the results information is required for payer and industrial uptake (since standards would generally value CVOT results over surrogate endpoints like LDL-c), we do not think regulators would need that for approval offered that LDL-c is robust (>> 50% LDL-c decrease from standard comparable to the previous ROSE stage 2b trial.

Additionally, our company believe NAM’s robust monetary position is extremely ensuring, the business ended 2Q23 with roughly EUR384M, which must provide a money runway up till 2026 after late phase scientific readout for its stage 3 programs has actually read out (and stock to significantly value offered that the information is favorable).

Business pipeline introduction ( NAMS)

Secret Catalysts & & NAMS’s pipeline

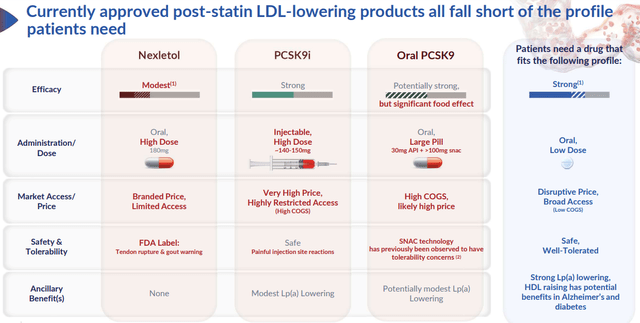

NAMS’ pipeline, especially obicetrapib, represents a groundbreaking method to cholesterol management. Registration for its critical LDL-lowering Stage III trials has actually not just been finished prompt however likewise over-enrolled, showing strong interest and prospective future uptake. The potential LDL decrease rates, specifically the prepared for ~ 60% for the combination, set obicetrapib on par with injectable PCSK9 however with the benefit of oral administration. Of note, we advise readers that the present PCSK9i’s adoption was underwhelming generally since of the marketplace gain access to (payer repayment, cost, administrative problem originating from Medicare part B (for Leqvio’s case)); as such, our company believe the oral dose type and unique system action of Obi must enable the drug’s sales to increase much quicker.

Relative table ( NAMS)

Existing PCSK9i landscape summary

Task Business Description Note Stage 2 MK-0616 Merck & & Co Once-daily oral Ph2 information at ACC 2023, ph3 prepared in H2 2023 Stage 1 AZD0780 Astrazeneca Oral A Research Study to Evaluate the Security, Tolerability, Pharmacokinetics, and Pharmacodynamics of AZD0780 in Healthy Topics – Complete Text View – ClinicalTrials.gov in healthy volunteers; information due H2 2023 VERVE-101 Vigor Rehabs One-off in vivo gene modifying Heart-1 registering in New Zealand & & UK, very first information due H2 2023; United States IND on scientific hold Preclinical VXX-401 Vaxxinity ” Long-acting” artificial peptide vaccine; target 2-4 each year Preclinical information at ACC 2023; ph1 slated for H1 2023 CTX330 Crispr Rehabs One-off in vivo gene modifying STP135G Sirnaomics SC RNAi Fallen by the wayside ION449 (AZD8233) Astrazeneca/Ionis Once-monthly SC antisense Astra not taking into ph3 following ph2 Solano information NN6435/ NNC0385-0434 Novo Nordisk Oral Business had ph2 information in Q3 2022; no longer in pipeline PBGENE-PCSK9 Accuracy Biosciences/Iecure One-off in vivo gene modifying Stopped at preclinical phase

Source: assess pharma

In regards to evaluation viewpoint, at a $500M business worth, NAMS provides an appealing undervaluation, poised for correction as significant Stage III updates method. Additionally, we like the reality that Obi’s patent security encompasses 2038, successfully doubling the NPV for its United States operations. This, together with the hit capacity to create $2B+ at peak sales and a long copyright lifecycle, seals NAMS as a fascinating financial investment, specifically for pharma with existing cardiovascular portfolios.

Dangers

While obicetrapib’s Stage IIA information for Alzheimer’s may expose favorable biomarker information in H2:23, obtaining definitive results entirely from these outcomes might be challenging for financiers. A bigger Stage IIB research study, concentrating on cognitive and practical endpoints in Alzheimer’s clients, would offer more clearness. Furthermore, NAMS’ conversations on moneying such an extensive research study stay internal, leaving unpredictabilities in its capital allowance. There’s likewise the anticipation of the initiation of the Stage III fixed-dose combination of obicetrapib and ezetimibe in Q1:24. Any prospective hold-ups or concerns here, or with the upcoming upgrade on its combination patent, might sway financier belief. Last but not least, while the targeted standard LDL levels for the Stage III CVOT (PREVAIL) research study appear appealing, it’s essential to keep an eye on the magnitude of LDL decrease and its subsequent influence on MACE advantage.

Conclusion

After an extensive assessment of NAMS’ 2Q23 profits and its appealing pipeline, integrated with the underpinned dangers, we repeat our buy score on the stock. The business’s ingenious method to cardiovascular treatment, its tactical property worth, and its monetary preparedness to browse the obstacles ahead highlight our self-confidence in NAMS. Our company believe the marketplace has actually not totally priced in the multi-billion dollar chance of an oral LDL-c decreasing treatment that can be the next generation “statin.”