Sundry Images

As a few of you might know, Zebra Applied sciences (NASDAQ:ZBRA) has been part of my non-public portfolio for over a 12 months. Nonetheless, in my contemporary efforts to pay attention my portfolio on my highest concepts, I determined to promote out of the corporate on July tenth at $306 according to proportion or a 5% loss. On this article, I’m going to replicate on my errors in inspecting Zebra and what I be expecting from the corporate one day. Whilst I bought the corporate, I nonetheless need to apply it because it is a top quality corporate. It’s at all times difficult to confess errors, however being open about them is an important a part of making an investment.

This isn’t my first Submit Mortem; take a look at my others and what I realized from them:

My preliminary thesis

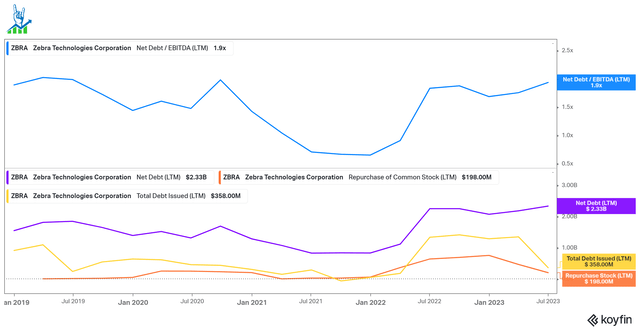

I first lined Zebra Applied sciences on Looking for Alpha in Would possibly 2022 and purchased my first stocks round the similar time. I used to be interested in the inventory via a excellent long-term tailwind from the warehouse automation and device imaginative and prescient markets. Those are enlargement alternatives for Zebra. Moreover, they’ve an improbable marketplace proportion in cellular computing, knowledge seize/scanning and forte printing/barcoding, with Honeywell (HON) being the main competitor.

Zebra Applied sciences marketplace proportion (UBS)

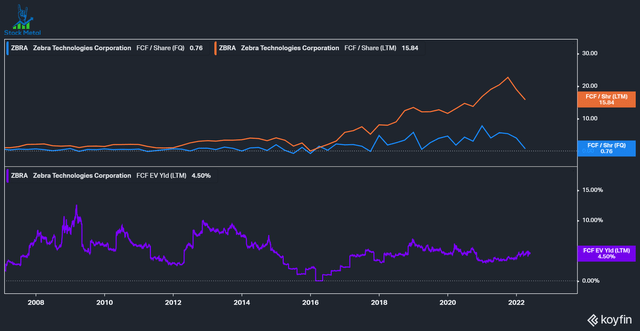

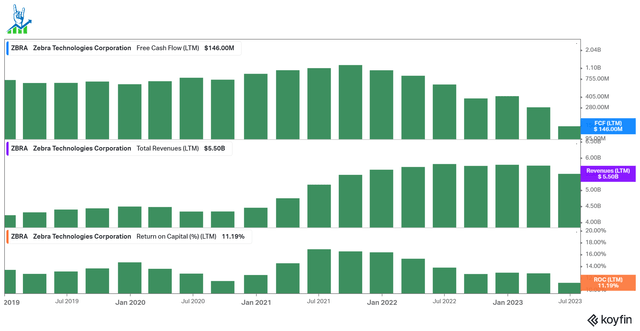

I used to be interested in the superb building of Loose money flows, however even again in 2022, shall we see that Zebra was once previous its top. Margins have been widely constant, however the capital allocation seemed superb: Precedence in inner investments or acquisitions assembly inner hurdle charges to extend the product portfolio, with a 1.5-2.5 instances leverage and opportunistic proportion buybacks. Returns on Capital have been at 15%, a excellent worth. The inventory traded at 15 instances ahead income and a 4.5% FCF yield, whilst I anticipated FCF enlargement to proceed at a teenagers price. In hindsight, that was once manner too constructive and did not imagine the related dangers.

Zebra previous Loose money waft building (Koyfin)

The place it went fallacious

Cyclicality

In my entire write-up and private notes, I didn’t point out the cyclicality of being closely uncovered to retail and business consumers. Over the past decade, we noticed a excellent financial atmosphere and Zebra grew neatly, however in 2022, basics began to become worse. Zebra essentially sells to vendors, with 3 primary vendors accounting for fifty% of gross sales. This leaves them very at risk of destocking after stock was once rushed throughout the pandemic.

We will be able to see that unfastened money waft didn’t develop however deteriorated briefly. This was once essentially because of expanding stock ranges, the agreement bills to Honeywell and different running capital adjustments. On the other hand, even after adjusting the ones, we noticed adjusted money flows plummet to $450 million for the final one year. EBIT and gross benefit margins stayed in keeping with a slight deterioration in order that the bull case generally is a go back to ancient money conversion.

Zebra money waft deterioration (Koyfin)

Making improvements to earnings high quality

My bull thesis incorporated the continual transition from {hardware} gross sales to services and products and instrument gross sales. This is able to counteract cyclicality and make revenues extra strong and predictable. Whilst consumers would possibly prolong purchasing new gadgets, they would not forestall the use of the present ones so briefly. Zebra has extra instrument engineers than {hardware} engineers, which I favored, however {hardware} gross sales account for 79% of earnings. Whilst the gross sales combine endured to shift, it was once now not significant sufficient to counteract the cyclical nature of the industry. As a substitute, I determined to position my cash into Napco Safety (NSSC), an organization with a an identical process of bettering instrument gross sales. Unfortunately, I added to Napco sooner than it plummeted to an accounting factor. At Napco, habitual gross sales are rising impulsively and are anticipated to achieve 50% of earnings in the following few years.

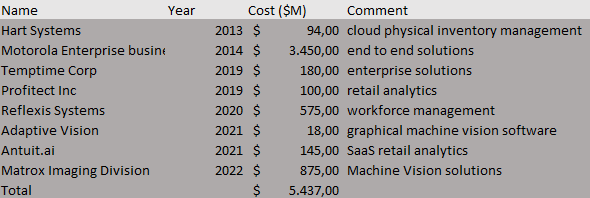

Loss of M&A data

Zebra has been moderately competitive with M&A over the past decade, however they rarely proportion details about the acquisitions’ growth. The corporate best reviews in two segments: EVM (Undertaking Visibility and Mobility) and AIT (Asset Intelligence & Monitoring). Those supply little data and make it arduous to look if pricey acquisitions like Matrox figure out. I would favor that investor members of the family be extra clear with traders, particularly as basics become worse.

Zebra acquisition historical past (Aggregated via the writer with knowledge from Zebra IR)

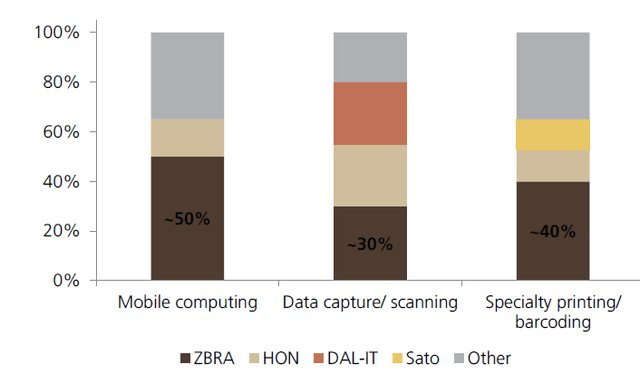

Expanding debt

Because of the weak point in money flows, Zebra needed to lever the steadiness sheet with over one billion in debt taken on since I began my place. The leverage degree remains to be k at 1.9x, however the corporate wishes to begin producing money flows once more to regulate it. A lot of the borrowed cash went into buybacks, which didn’t pass neatly, whilst basics deteriorated quicker than control anticipated.

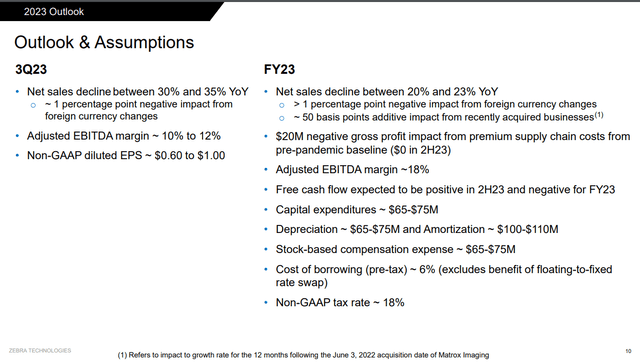

Deteriorating outlook

The FY23 outlook for Zebra deteriorated impulsively over contemporary quarters. In This autumn 2022, Zebra guided for FY23 with internet gross sales between -3 and +1% and a 22-23% AEBITDA margin with $650 million in Loose Money Flows for the 12 months. Underneath, we will be able to see the up to date outlook after two quarters. Gross sales outlook totally collapsed to a 20-23% decline, AEBITDA margin is predicted to be 400-500 bps decrease and Loose money waft is predicted to be adverse for the whole 12 months. This presentations how impulsively and violently basics deteriorated and the way unhealthy the cyclicality hit Zebra.

FY 23 outlook (Zebra Q2 presentation)

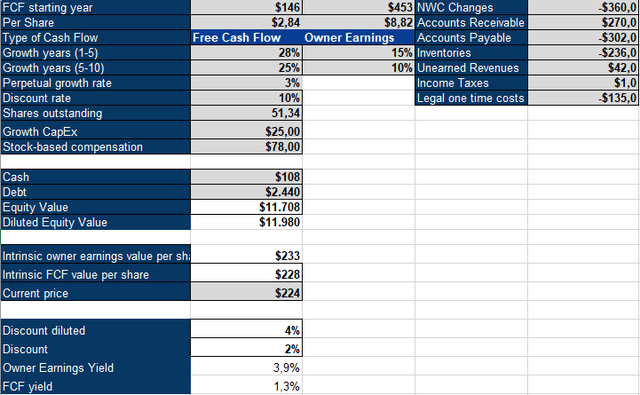

Valuation is alright

To worth Zebra, I’m going to use an inverse DCF type. I adjusted FCF with internet running capital adjustments and added the agreement bills. This leaves us at $453 million in proprietor income. Zebra must develop Proprietor income via 15% over the following 5 years, adopted via 10% the next 5 years. This doesn’t appear unrealistic if the macro is of their prefer once more and vendors go back to stocking their inventories. I latterly began to extend my bargain price on cyclical corporations to account for the added chance; I began my funding in Zebra at a ten% bargain price, so I’m going to stay it for this valuation, however remember that one may well be extra conservative and use a better bargain price. I will be able to proceed to apply the corporate from a distance and notice the way it manages to show across the basics. I realized so much from my funding in Zebra and controlled to get out with just a 5% loss. I will be able to price Zebra a hang as it stays a excellent industry.