Sundry Photography

As a few of you might understand, Zebra Technologies ( NASDAQ: ZBRA) has actually belonged of my individual portfolio for over a year. Still, in my current efforts to focus my portfolio on my finest concepts, I chose to offer out of the business on July 10th at $306 per share or a 5% loss. In this post, I’ll review my errors in examining Zebra and what I anticipate from the business in the future. While I offered the business, I still wish to follow it as it is a premium business. It is constantly challenging to confess errors, however being open about them is an important part of investing.

This is not my very first Post Mortem; take a look at my others and what I gained from them:

My preliminary thesis

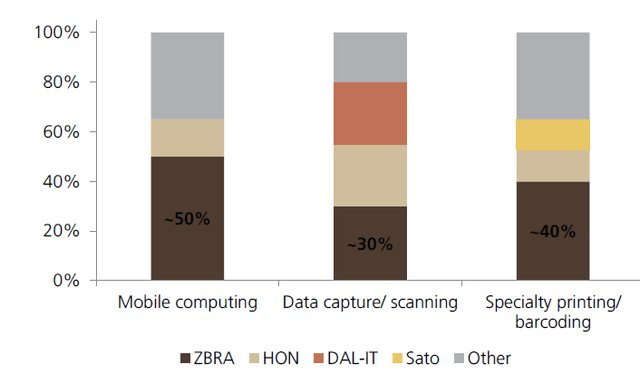

I initially covered Zebra Technologies on Looking For Alpha in Might 2022 and purchased my very first shares around the exact same time. I was drawn to the stock by an excellent long-lasting tailwind from the storage facility automation and maker vision markets. These are development chances for Zebra. Additionally, they have a wonderful market share in mobile computing, information capture/scanning and specialized printing/barcoding, with Honeywell ( HON) being the leading rival.

Zebra Technologies market share (UBS)

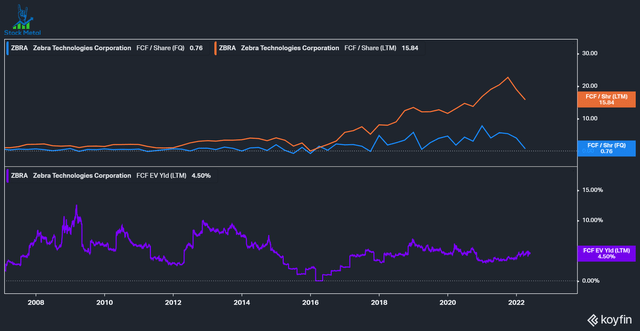

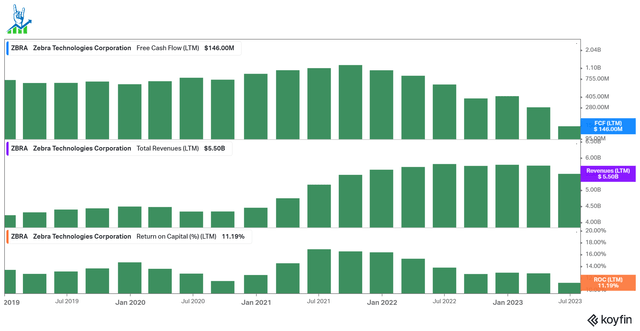

I was drawn to the exceptional advancement of Free money streams, however even back in 2022, we might see that Zebra was past its peak. Margins were broadly constant, however the capital allowance looked excellent: Concern in internal financial investments or acquisitions fulfilling internal obstacle rates to increase the item portfolio, with a 1.5-2.5 times take advantage of and opportunistic share buybacks. Returns on Capital were at 15%, an excellent worth. The stock traded at 15 times forward profits and a 4.5% FCF yield, while I anticipated FCF development to continue at a teenagers rate. In hindsight, that was method too positive and didn’t think about the involved dangers.

Zebra past Free capital advancement (Koyfin)

Where it failed

Cyclicality

In my entire review and individual notes, I did not discuss the cyclicality of being greatly exposed to retail and commercial clients. Over the last years, we saw an excellent financial environment and Zebra grew well, however in 2022, principles began to degrade. Zebra mainly offers to suppliers, with 3 primary suppliers representing 50% of sales. This leaves them extremely susceptible to destocking after stock was hurried throughout the pandemic.

We can see that totally free capital did not grow however scrubby rapidly. This was mainly attributable to increasing stock levels, the settlement payments to Honeywell and other working capital modifications. Nevertheless, even after changing those, we saw adjusted money streams plunge to $450 million for the last twelve months. EBIT and gross revenue margins remained constant with a minor wear and tear so that the bull case might be a go back to historical money conversion.

Zebra capital wear and tear (Koyfin)

Improving income quality

My bull thesis consisted of the constant shift from hardware sales to services and software application sales. This would neutralize cyclicality and make profits more steady and foreseeable. While clients may postpone purchasing brand-new gadgets, they would not stop utilizing the existing ones so rapidly. Zebra has more software application engineers than hardware engineers, which I liked, however hardware sales represent 79% of income. While the sales mix continued to move, it was not significant adequate to neutralize the cyclical nature of business. Rather, I chose to put my cash into Napco Security ( NSSC), a business with a comparable technique of enhancing software application sales. Unfortunately, I contributed to Napco prior to it dropped to an accounting concern At Napco, repeating sales are proliferating and are anticipated to reach 50% of income in the next couple of years.

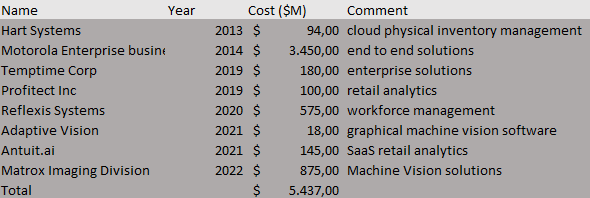

Absence of M&An info

Zebra has actually been rather aggressive with M&A over the last years, however they barely share details about the acquisitions’ development. The business just reports in 2 sections: EVM (Business Exposure and Movement) and AIT (Property Intelligence & & Tracking). These supply little details and make it tough to see if pricey acquisitions like Matrox exercise. I would choose that financier relations be more transparent with financiers, particularly as principles degrade.

Zebra acquisition history (Aggregated by the author with information from Zebra IR)

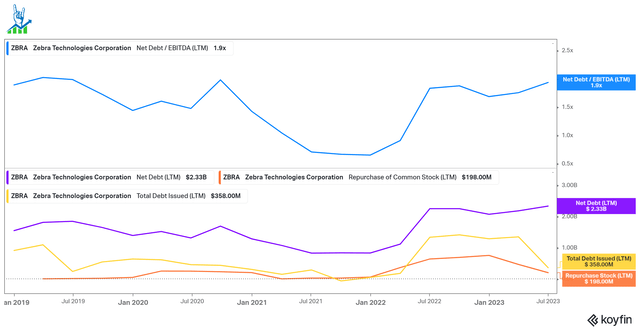

Increasing financial obligation

Due to the weak point in capital, Zebra needed to lever the balance sheet with over a billion in financial obligation handled given that I began my position. The take advantage of level is still alright at 1.9 x, however the business requires to begin creating money streams once again to handle it. Much of the obtained cash entered into buybacks, which did not work out, while principles weakened faster than management anticipated.

Zebra Financial obligation advancement (Koyfin)

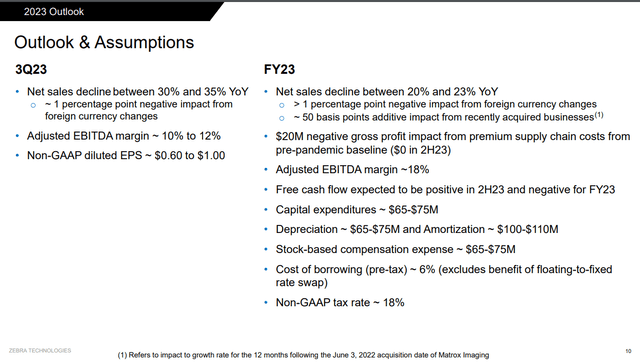

Deteriorating outlook

The FY23 outlook for Zebra weakened quickly over current quarters. In Q4 2022, Zebra directed for FY23 with net sales in between -3 and +1% and a 22-23% AEBITDA margin with $650 million in Free Money Flows for the year. Listed below, we can see the upgraded outlook after 2 quarters. Sales outlook totally collapsed to a 20-23% decrease, AEBITDA margin is anticipated to be 400-500 bps lower and Totally free capital is anticipated to be unfavorable for the complete year. This demonstrates how quickly and strongly principles weakened and how bad the cyclicality struck Zebra.

FY 23 outlook (Zebra Q2 discussion)

Appraisal is alright

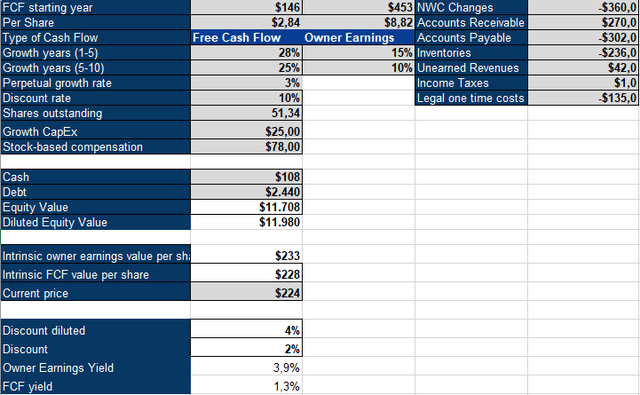

To value Zebra, I’ll utilize an inverted DCF design. I changed FCF with net working capital modifications and included the settlement payments. This leaves us at $453 million in owner profits. Zebra would need to grow Owner profits by 15% over the next 5 years, followed by 10% the following 5 years. This does not appear impractical if the macro remains in their favor once again and suppliers go back to equipping their stocks. I just recently began to increase my discount rate on cyclical business to represent the included danger; I began my financial investment in Zebra at a 10% discount rate, so I’ll keep it for this appraisal, however remember that a person might be more conservative and utilize a greater discount rate. I will continue to follow the business from a range and see how it handles to reverse the principles. I discovered a lot from my financial investment in Zebra and handled to get out with just a 5% loss. I will rank Zebra a hold since it stays an excellent company.