Michael M. Santiago

Intro

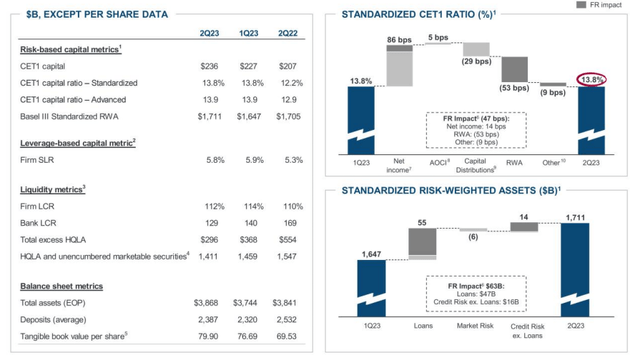

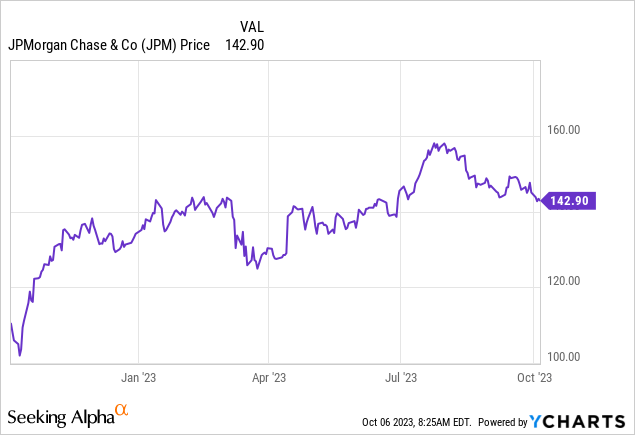

JPMorgan Chase ( NYSE: JPM) is a home name in the monetary sector. With a market capitalization of around $415B and an around the world brand name acknowledgment, the bank is viewed as a leader in its sector. Its monetary efficiency is strong, and although there’s a push from United States regulators requiring the banks to fortify their capital ratios, JPMorgan should not have any troubles to minimize the overall quantity of risk-weighted properties by securitizing a part of its loan portfolio That method, the quantity of RWA declines and the CET1 capital ratio increases even if no extra capital is produced.

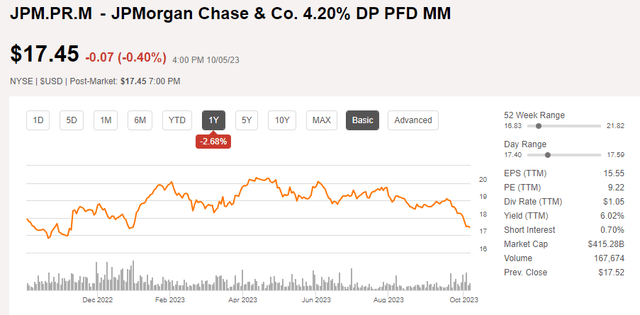

In this short article, I will be acting on the Series M chose shares. I went over that series practically 2 years ago however as the rate of interest have actually increased, the favored share rate has actually boiled down and the reliable yield has actually increased.

The bank still is an earnings device

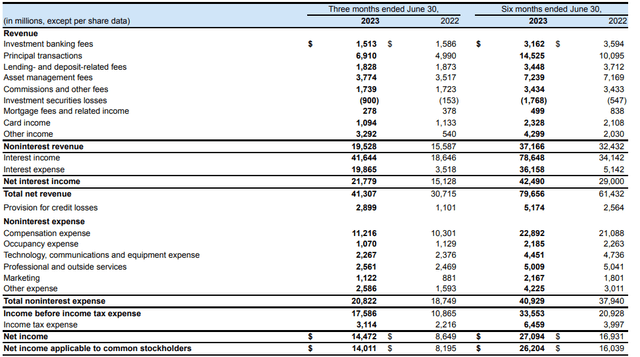

Prior to digging deeper into the favored equity offerings by JPMorgan, I certainly wished to make certain the monetary efficiency of the bank is still strong. The bank will report on its 2nd quarter next week, so I needed to recall at its Q2 efficiency.

As you can see below, JPMorgan reported a net interest earnings of $21.8 B That’s a boost of around 40% compared to the 2nd quarter of in 2015 and it’s a little greater than the net interest earnings in the very first quarter of this year. That’s motivating as the net interest earnings is a crucial chauffeur of the net revenue.

That being stated, JPMorgan likewise has a really considerable financial investment banking and possession management department, so its incomes profile is really various from a “typical” industrial bank which primarily needs to rely on the net interest earnings and in some cases the gain on the sale of loans and charge card earnings. The earnings declaration listed below programs JPMorgan produced about $19.5 B in non-interest earnings while it invested $20.8 B on non-interest expenditures. This indicates the bank is practically recovering cost on simply the non-interest earnings which’s a really comfy position to be in.

In truth, the pre-tax earnings increased to $17.6 B thanks to the lower net non-interest expenditures and the greater net interest earnings. As you can see above, the $17.6 B currently consists of the effect of a $2.9 B loan loss arrangement in spite of that arrangement having to do with 20% greater than in the very first quarter of this year. After taking the pertinent taxes into account in addition to subtracting the earnings attributable to the minority investors, JPMorgan reported a net revenue of $14B. This represented an EPS of $4.76 and pressed the H1 EPS to $8.86. I can’t state this was a surprise as in my previous short article I had actually currently argued the bank’s typical stock might provide a much better overall return viewpoint than the favored shares as JPM finished the purchase of the First Republic Bank properties.

The favored share yields are supporting

I have actually been watching on numerous of JPMorgan’s favored share problems however about 2 years ago I focused on the Series M chose shares ( NYSE: JPM.PR.M).

In the 3rd quarter of 2021, JPMorgan released 80 million systems of its Series M chose shares. The M-series are a non-cumulative favored show a yearly favored dividend of 4.20% annually which leads to $1.05 per share, paid in quarterly installations. The 80 million systems have an overall worth of $2B, so this was a reasonably large problem by JPMorgan as the bank was certainly benefiting from the low rate of interest on the monetary markets.

While the yield of 4.20% was certainly low and I eventually handed down starting a long position, the circumstance has actually altered quite considerably over the previous 18 months. As the rate of interest on the monetary markets began to increase, the marketplace rates of set earnings securities began to reduce and the Series M chose shares were no exception.

The Series M chose share is presently trading at $17.45 for a yield of around 6%. That’s still low, however this security is – similar to numerous other set earnings securities – an intriguing call alternative on the normalization of rate of interest. Simply as an example, if the marketplace just needs a favored dividend yield of, state, 5.25% from JPMorgan by the end of next year, this favored share will be trading at $1.05/ 0.0525 = $20 for a 14.6% capital gain. Naturally, there are no assurances in life however this kind of set rate chosen shares provide an intriguing possibility to hypothesize on lower rate of interest moving forward.

Financial investment thesis

I have actually held back on purchasing non-cumulative favored shares released by banks for numerous years however I just recently began purchasing the Wells Fargo ( WFC) busted favored share Series L ( WFC.PR.L). Not due to the fact that the yield is extremely high, however due to the fact that I expect the rate of interest on the monetary markets to level off in the next couple of years which would lead the way for a capital gain on the set rate chosen shares.

That likewise holds true for JPMorgan’s favored shares. A 6% favored dividend yield isn’t amazing, that holds true. However if you anticipate a 100 bp decline in the expense of capital (reducing from 6% to 5% on the favored equity), there’s a capacity for a 20% capital gain down the roadway. And even if that just emerges in 3 years from now, the overall annualized return would still be a high single digit number.

I presently have no position in JPMorgan’s favored shares however I’m keeping a close eye on the share rate efficiency.