Hammad Khan/iStock through Getty Images

Intro

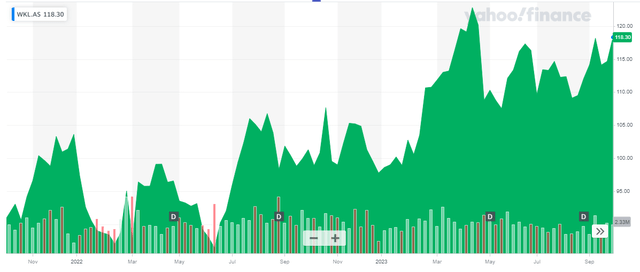

As described in my previous short article, Wolters Kluwer ( OTCPK: WTKWY) ( OTCPK: WOLTF) is among the worldwide leaders in expert info where it has actually gotten a really strong position in the health, tax and accounting and danger and compliance sector. Wolters Kluwer utilized to be simply a publishing home however hasn’t missed out on the digitalization, and the large bulk of its earnings is created through digital formats (consisting of software application and online memberships to services) which’s certainly really attractive provided the repeating nature of that earnings. That’s likewise what got my attention, however it likewise is the reason that Wolters Kluwer tends to trade at a premium appraisal and financiers require to patiently wait on this one.

Wolters Kluwer’s main listing is on Euronext Amsterdam where the stock is trading with WKL as ticker sign. The typical day-to-day volume in Amsterdam is around 400,000 shares daily. As the business has 245 shares impressive, the existing market cap is approximately 29B EUR based upon the existing share cost of simply over 118 EUR. I will utilize the Euro as base currency throughout this short article.

Complimentary capital stays strong

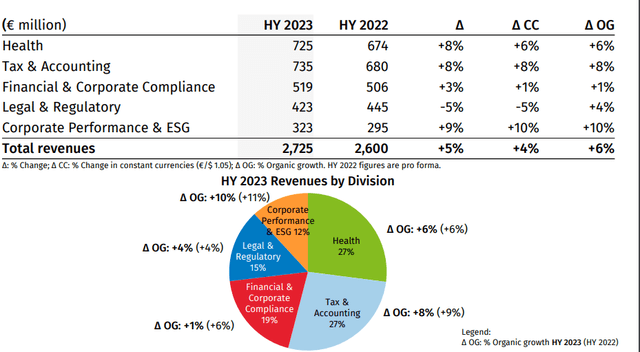

In the very first half of this year, Wolters Kluwer revealed quite remarkable development outcomes. As you can see below, health and tax and accounting still accounts for in excess of 50% of the overall earnings, and the natural development in both departments was 6% and 8%, respectively.

Wolters Kluwer Financier Relations

The overall earnings increased by about 5% while the natural development rate had to do with 6% throughout all departments.

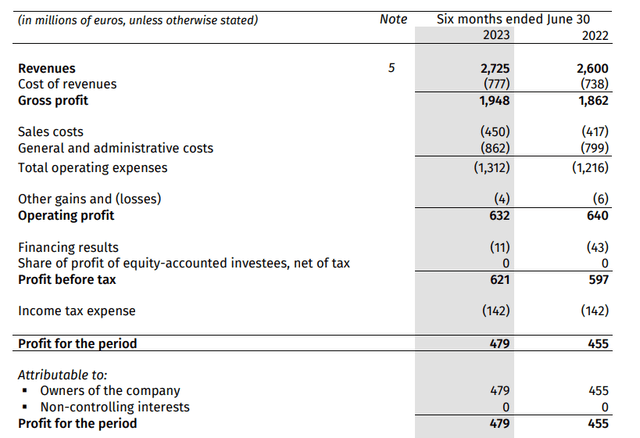

The business’s gross margins stay remarkably strong. As you can see below, the overall COGS increased by simply 37M EUR, leading to a gross revenue of 1.95 B EUR, a 4.6% boost compared to the very first half of 2022. Sadly the business needed to handle greater G&A costs and the overall business expenses increased by about 8% to 1.31 B EUR, leading to a 1% reduction in the operating revenue which was up to 632M EUR.

Wolters Kluwer Financier Relations

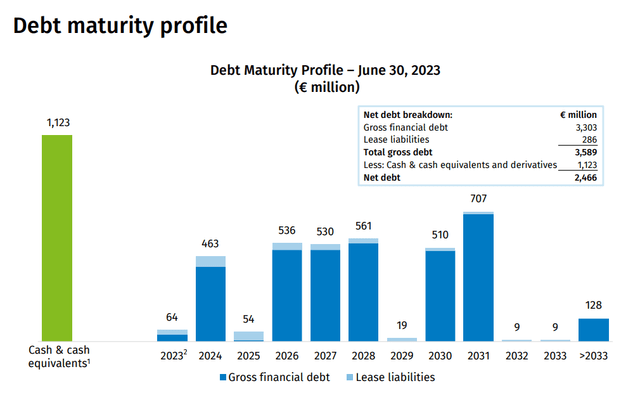

This does not imply the very first term was bad or weak. The business likewise taped a net financing expenditure of simply 11M EUR compared to 43M EUR in the very first half of 2022. The description for this enhancement is really uncomplicated. Wolters Kluwer has about 3.3 B EUR in gross financial obligation (primarily at repaired rates) however its balance sheet likewise includes in excess of 1.1 B EUR in money. And as rate of interest in monetary markets are increasing, the business is now really generating income on that money stack, which describes the extreme decrease in the financing costs.

That scenario will alter as Wolters Kluwer will need to re-finance its existing bonds. In May 2024, a 2.5% bond will need to be re-financed which will likely need to occur at a greater expense of financial obligation. However the overall rate of interest will not be outrageous: Its 2031 bonds are trading with a yield to maturity of 4.1%. So while we will see the overall quantity of interest costs increase, those boosts ought to be really workable.

Wolters Kluwer Financier Relations

So, interest earnings on the money stack was a significant aid in the very first term which’s the sole reason that Wolters Kluwer had the ability to report a 4% pre-tax earnings boost. The earnings leapt to 479M EUR which represents about 1.94 EUR per share.

In my previous short article I was concentrating on the complimentary capital profile of Wolters Kluwer. The business reported overall operating capital of 681M EUR in the very first term, however this consists of about 176M EUR in taxes although only 142M EUR was due. There likewise was a 11M EUR working capital contribution and we ought to subtract the 34M EUR in lease payments.

This implies the underlying operating capital was around 670M EUR. The overall capex was 157M EUR and this implies the underlying complimentary capital was 513M EUR. Divided over the existing share count of 245M shares, the complimentary capital was 2.09 EUR per share. Getting half a billion in complimentary capital every term sounds great however it’s not an efficiency I want to pay 30 times complimentary capital for.

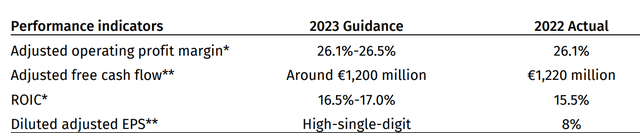

The upgraded assistance for 2023 does not alter my viewpoint. As you can see below, Wolters Kluwer had the ability to increase its full-year assistance on the back of a strong very first term and it now anticipates its EPS to come in around 8% greater than in 2015. Remember the EPS boost currently consists of the effect of an awaited 1B EUR share buyback in 2023.

Wolters Kluwer Financier Relations

The complimentary capital assistance looks strong however most likely consists of modifications in the working capital

Financial investment thesis

Wolters Kluwer is a leader in its sector, and the business is really well-managed on the functional front. Nevertheless, the primary concern is whether you ought to pay 30 times profits for Wolters Kluwer, and in the existing financial investment environment, I ‘d argue the stock is a “hold” at finest. Sure, the earnings and profits will likely continue to increase at a mid-single digit rate for the next couple of years, however the expert agreement approximates require an EPS of less than 5 EUR in 2025 which implies the existing share cost of 118 EUR would still represent 24 times the forward profits.

On The Other Hand, I’m likewise not persuaded costs a lot money on redeeming their own shares at a 3.3% complimentary capital yield and I marvel that is the very best method to assign money.

I’m on the sidelines. An excellent company, however too expensive for me.

Editor’s Note: This short article goes over several securities that do not trade on a significant U.S. exchange. Please know the dangers related to these stocks.