da-kuk

By Tony DeSpirito

With all eyes on generative AI (genAI) and its transformative capacity, private financiers’ interest has actually been ignited. The market-moving development definitely has actually created a great deal of buzz – and concerns. Equity CIO Tony DeSpirito parses 3 factors for enjoyment and 3 locations for awareness.

GenAI has actually commanded attention and moved markets this year, making contrasts to the web and mobile phones for its transformative capacity. Our company believe genAI is likewise establishing to be an essential factor to market dispersion, as it has the possible to send out some organizations skyrocketing while interfering with or displacing others. We sponsored some internal dispute on the subject and use the following observations on this crucial development:

Worthwhile of enjoyment

1. Universal application

Unlike other innovation developments that had short lived popularity prior to fading to the background, we see genAI having a significant and long lasting effect. Leaders of our innovation group think its use is poised to be extraordinary relative to previous developments with a more minimal scope (e.g., 3D printing, enhanced truth, metaverse). The essential difference: GenAI is a platform with components of humanlike intelligence that offer it universal applicability that can extend throughout markets, organizations, and disciplines.

Business offering the “choices and shovels” of the AI gold rush are the preliminary recipients. The early benefits for users are most likely to take the type of expense savings – getting rid of some tasks while making people more effective at others. Later on in the AI development, we anticipate to see the introduction of brand-new revenue-generating organization designs.

2. Financial investment chance now – and for many years to come

GenAI is progressing and the awareness of its complete benefit will require time, making this a multi-decade chance. Yet business are investing genuine cash on genAI now in an effort to harness its huge capacity. In the structure stage, the financial investment chances live mostly in the innovation area. The secret is to understand where we remain in the AI lifecycle and what parts of the innovation “stack” might be placed to benefit.

Consider this: The significant financial investment in the existing web, which is powered mostly by CPU chips, will shift towards GPUs (the graphics processing systems that are enhanced for AI). We see the production of an AI-supported web driving years-long financial investment chances.

We see buying genAI as an active pursuit, offered the requirement to be active and understand where the chance is at each phase of development. An analysis of the innovation stack (revealed listed below) shows existing and possible chances – all subject to alter as genAI itself hones, smartens, and develops.

The genAI innovation financial investment stack

|

What it is |

Where to invest |

|

|

IV. Tools & & applications |

The tools to produce apps and the real instruments and apps powered by generative AI. |

Business that develop apps and the tools to produce them. Existing apps will be improved; lots of start-ups most likely to emerge. |

|

III. Information( personal & & public/free) |

The details upon whichAI designs will “believe,” procedure and produce material. |

Providers of details and analytics, and those associated with information staging. AI makes personal information better and, for that reason, better. |

|

II. AI designs( exclusive & & open source) |

The software application needed to trainAI to “believe” and do. |

Business associated with the research study and advancement of AI knowing and language designs. |

|

I. Facilities & & cloud |

The hardware and computing resources required to make it possible for AI function and development. Consists of GPUs, storage and memory. |

Cloud company constructing AI-enabled information centers; semiconductors and makers of chip production devices are crucial inputs. |

Source: BlackRock Basic Equities, September 2023.

3. Chance well beyond tech

Beyond the effects and chances in the innovation sector are the ultimate usage cases for AI that will emerge throughout the economy. Call centers will likely be changed. Somewhere else, the usages might be less transformative and more nuanced, such as an AI-powered co-pilot contributed to an existing software application bundle. We see public and personal financial investment chances from AI, with lots of early-stage chances possibly best revealed through personal financial investments.

Necessitating awareness

1. Excellent expectations

Provided high evaluations in the very first part of the innovation stack, some AI-related stocks might be susceptible to frustration, even from simply a downturn in the rate of development. A scarcity of crucial chips (GPUs) has actually enabled business that make them to briefly make an unusually high margin, presenting a danger once supply reaches require and competitors starts. Organization history is filled with stories of supply scarcities that ultimately relied on provide excess.

In basic, the early phases of an innovation buzz cycle consist of a great deal of enjoyment and speculation, yet developments in their infancy are hard to worth. Continuous tracking is needed to examine whether expectations are lined up to the monetary and essential truths. Concerns around the unidentified however unavoidable policy of AI worldwide likewise make complex the calculus.

2. Construct it and they will come?

In previous cycles, brand-new innovations were not constantly completely used after the structures to support them were developed. AI’s universality might make this time various. Another crucial component to the performance of AI for business and companies is information. While AI designs can be trained on public information, that information need to be improved with the exclusive kind to make choices for a specific organization. This is a location where lots of companies are hamstrung due to inadequate, messy, or siloed information, possibly slowing or restricting AI uptake.

3. Capital chasing after the unidentified

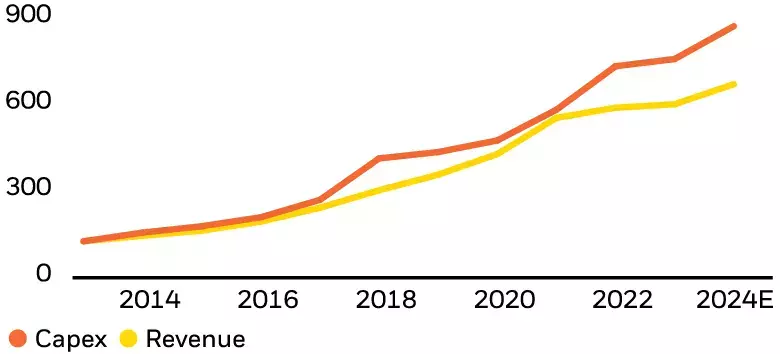

Capital investment on genAI have actually increased in advance of the earnings it produces, as displayed in the chart below. A crucial concern is whether business will follow through and utilize the services to sustain the wave of costs. A few of the early financial investment might make up FOMO (worry of losing out) – business do not wish to fall back if they stop working to buy a winning development. However organizations will need to examine whether AI, for the efficiency improve it uses, deserves constant costs – investing less on buzz and more on ROI (roi) estimations.

Investing for an (ultimate) AI payday

Hyperscale information centers, capex and earnings, 2013-2024

Source: BlackRock Basic Equities, Aug. 4, 2023. Chart reveals the aggregate quantity of yearly capex invested and earnings created amongst the 8 biggest cloud business worldwide for their financial investment in big information centers to support genAI. Quotes for 2023 and 2024 are based upon agreement expert price quotes. Information is indexed and rebased to 100 since Jan. 1, 2013.

No Matter whether there is a near-term misstep, the long-lasting capacity for AI appears intense. As the quantity of information boosts and the expense of processing it boils down throughout time, we anticipate AI will continue to grow. Yet AI applications will eventually meet differing degrees of success, recommending genAI might add to dispersion throughout private business and their stock costs. For this factor, we consist of AI amongst 5 elements preferring stock choice in what we refer to as a brand-new age for equity investing

The bottom line

We see generative AI on an enhancement curve with potential customers to change organizations worldwide. Yet it is exactly due to the fact that genAI is brand-new, interesting, and progressing that it needs an active financial investment technique. As fundamental-based stock pickers, we are continuously fact-checking the financial investment case as the cycle around generative AI advances from peak expectations to knowledge and efficiency. The genAI story has actually only simply started and, we anticipate, will be composed for several years to come.

This post initially appeared on the iShares Market Insights.

Editor’s Note: The summary bullets for this short article were selected by Looking for Alpha editors.