peshkov/iStock by way of Getty Pictures

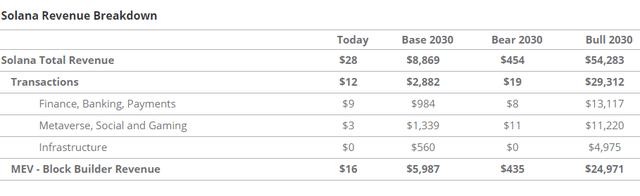

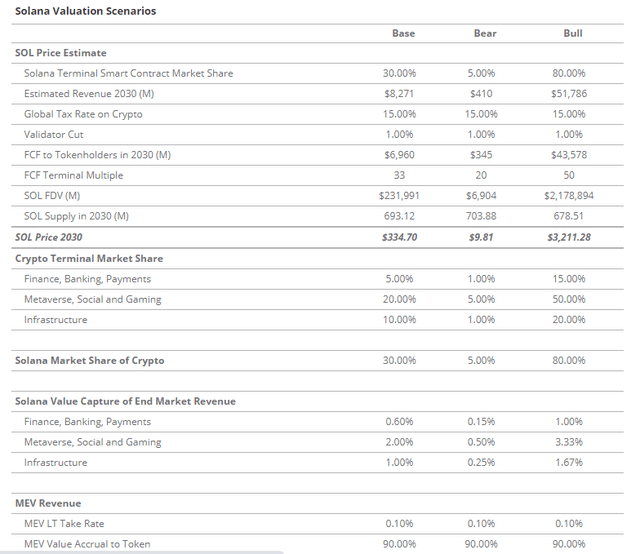

Through 2030, our Solana valuation situations undertaking a SOL worth starting from a bearish $9.81 to a bullish $3,211.28, anchored via numerous marketplace stocks and income estimations throughout key sectors.

Please observe that VanEck will have a place(s) within the virtual asset(s) described beneath.

The aim of good contract platforms (SCPs) is to host programs that supply their customers the power to interact in effective, uncensorable financial process whilst minimizing hire extraction on the ones financial actions via 3rd events. Whilst many blockchains exist nowadays, the person base of all blockchains is tiny in comparison to those that interact in trade off-chain. More or less 5.5M distinctive addresses are lively on a daily basis on SCPs, and round 44M every month. On the other hand, it’s most likely those figures dramatically overstate usership as a result of many customers regulate more than one addresses. Despite the fact that we take them at face worth, those figures examine poorly to the 2B customers who engage with Fb (META) on a daily basis and the 431M who use PayPal (PYPL) each and every month. The explanation why blockchain adoption hasn’t been sooner already is as a result of blockchains are clunky to make use of, and there may be little to do at the chain but even so change worth and hypothesis. For crypto to reach popular adoption and develop its $1.3T marketplace cap, it must have a so-what for folks and companies who don’t seem to be decentralization maxis or libertarian zealots. It wishes a killer software. And the chain that hosts that killer software stands to profit immensely from the process generated via that app. On this observe, we style a situation during which Solana (SOL-USD) is the primary blockchain to host a unmarried software that onboards 100M+ customers.

Per month Energetic Customers of SCPs

Supply: Token Terminal, Dune, as of 10/25/2023. Previous efficiency is not any ensure of long run effects. No longer meant as a advice to shop for or promote any securities named herein.

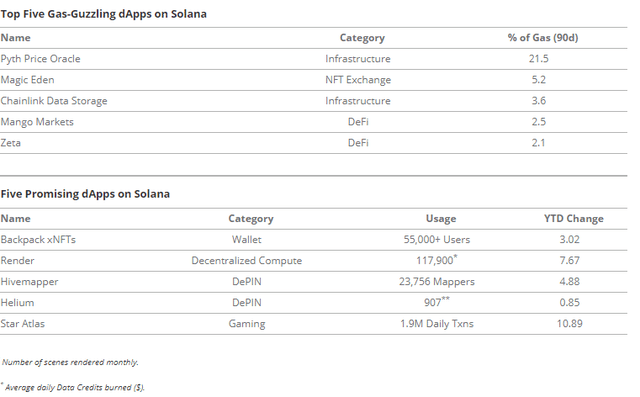

Solana’s possible starts with its founding staff’s good fortune in mixing radical experimentation with carried out science to monumentally toughen blockchain scaling. Whilst different chains have selected scaling paths that cleverly circumnavigate the restrictions of disbursed ledgers, Solana has as an alternative selected to push to the boundaries of technological feasibility issues and paintings backward from there. The Ethereum (ETH-USD) ecosystem and plenty of others have selected a modular imaginative and prescient the place other blockchains specialize within the core purposes of a layer 1 chain. Alternatively, Solana has plowed forward, looking to wring better transaction throughput via optimizing each and every part of its personal blockchain to be hyper-efficient. Because of this, Solana is hugely extra succesful than any of its legacy competition relating to blockchain processing functions. Parallel to this, however a lot more importantly, Solana has translated its pioneering spirit into an ecosystem philosophy of risk-taking and techno-optimism. Solana has spawned numerous attention-grabbing experiments that come with blockchain-optimized cell phones, NFTs that include programs, and consumer-focused merchandise like decentralized mapping and automotive knowledge assortment. Extra so than another ecosystem, folks development initiatives in Solana are developing issues that can supply a tangible have an effect on on on a regular basis lifestyles.

Solana’s Means: Usability

The likelihood of a blockchain community web hosting the following “killer apps” hinges upon that chain’s talent to make the usage of that software speedy, handy, and obtainable. The extra succesful the blockchain, the simpler the surroundings for a person. The important thing query is measuring blockchain talent and figuring out how that interprets into useability. A well-liked metric, transactions according to 2d (TPS), is an insufficient size this is simply manipulated. Realistically, blockchain groups can toughen this metric via many methods, together with converting the volume of information every transaction incorporates, forgoing the ordering of transactions, and restricting what portions of a ledger a transaction can exchange. Actually, the most efficient metric to really measure blockchain capability isn’t transactions according to 2d (TPS) however is as an alternative knowledge throughput.

Information throughput comes to a blockchain consuming, processing, and ordering knowledge after which agreeing on that knowledge’s have an effect on at the blockchain’s ledger. Information throughput is made up our minds via measuring the volume of information that may be won and carried out via a blockchain over a given period of time. The extra knowledge a blockchain can translate into ledger updates over a time increment, the simpler. Because it stands, Solana’s knowledge throughput exceeds that of another blockchain in life. Actually, Solana’s knowledge capability exceeds that of maximum deliberate blockchains, and Solana’s subsequent vital instrument improve referred to as the Firedancer improve, guarantees to exceed Solana’s present capability via an element of 10. Whilst we don’t fake to know the way a lot knowledge the following killer software’s blockchain must ingest and procedure, we consider that 100M+ customers doing the rest on-chain will push blockchain scalability to its limits.

Information Throughput Comparisons MB/S

Supply: Frictionless Capital, SCP House Pages as of 10/25/2023.

Solana interprets this knowledge throughput capacity into fixing issues that customers care about. Solana allows sooner comments to the person than maximum different chains as it provides steady processing of transactions. As an example, Ethereum works via pooling incoming transactions from customers in necessarily a ready room referred to as the mempool. Ethereum validators (block developers within the new paradigm) then pick out transactions from the pool in line with the associated fee introduced via every transaction and get them organized. Each and every 12 seconds, transactions are then achieved, and the block containing the transactions is beamed to the remainder of the Ethereum community. Because of this, Ethereum processes transactions at discrete periods. This can be a considerably slower approach of processing transactions than Solana’s which results in longer wait occasions for the person. On Ethereum, customers will have to watch for this whole procedure to spread prior to they know their transaction is entire. Ceaselessly, that is measured in mins. Solana, in contrast, starts operating on processing the transaction immediately, and the turnaround is roughly 2 seconds.

Apps on Solana

To make the person revel in even higher, Solana has additionally created a singular function referred to as Native Rate Markets. If a blockchain is an information pipeline from customers to the blockchain’s ledger, Solana’s Native Rate Markets are necessarily interior sub-pipelines that permit knowledge to go with the flow from other customers to more than one portions of the ledger concurrently. This solves a core drawback of Ethereum and different blockchains, as overuse of 1 software on Ethereum’s pipeline slows down all different programs. As an example, if many customers are looking to mint an NFT on Ethereum, the ensuing congestion prevents different customers from borrowing on Aave (AAVE-USD). Within the context of a killer software, customers want in an effort to persistently engage with the blockchain. In contrast, Solana can phase the ones other pipelines the usage of Native Rate Markets to fee other costs in line with call for. This permits for lots of programs to have get entry to to Solana even if one software is experiencing heavy utilization. That is specifically necessary since the capability of a killer software may just depend on simultaneous interplay with many alternative programs. Moreover, with the ability to alter native rate markets to worth various kinds of transactions is also the important thing to Solana adjusting its worth in line with the use case. This may occasionally permit Solana to worth transactions otherwise in line with every’s financial worth. Native Rate Markets can provide the killer software builders better precision in assessing its prices.

Solana vs. Ethereum: Contrasting Philosophies

Solana used to be constructed via Qualcomm (QCOM) engineers who carried out their experience in bettering cellular community capability to construct a extremely performant blockchain. The foundational idea of the Solana staff is to construct a community that assumes consumer-grade computing energy grows with Moore’s Legislation and networking bandwidth expands along it. In consequence, Solana is engineered to make the most of {hardware} developments extra without delay than competition.

We see this because the mindset of optimism that believes in a long run of abundance and development. The core trust of the Solana staff is that blockchains must make blockspace, or the volume of information that matches onto a series in a period of time, very affordable. Of their view, this unlocks the power of instrument engineers and marketers to affordably take a look at new use instances for blockchain. This sharply contrasts with the view that Ethereum has advanced its industry from that of promoting reasonable blockspace on a daily basis to that peddling pricey blockspace that secures consumer-facing blockchains. Within the Ethereum paradigm, good fortune hinges upon ETH being the foremost (and best) collateral to safe all blockchains. The preliminary pitch for Solana used to be for it to transform a “Decentralized Nasdaq.” Although that narrative nonetheless has possible, the release of attention-grabbing non-financial person programs reminiscent of Hivemapper, Render, and Helium has expanded the belief of Solana’s functions.

The Solana staff, to their credit score, has been open-minded in use instances for Solana’s ground-breaking generation. They have got tried to deliver blockchain to the cell phone thru their SMS or Solana Cell Stack, which permits builders to create blockchain programs for mobile phones. Solana’s experimentation has even led them to create their very own cell phone this is optimized to make use of blockchain. Although Solana Cell used to be criticized as a distraction from Solana’s core venture, It demonstrates Solana’s want to resolve fundamental core person issues. It’s this determination to the shopper that has helped Solana ink partnerships with Shopify, Visa, and Google to discover new use instances for Solana and spice up its ecosystem.

Solana Developer Marketplace Proportion – SCP Monolithic Chains

Solana Developer Proportion. Supply: Artemis XYZ as of 10/25/2023. Previous efficiency is not any ensure of long run effects. No longer meant as a advice to shop for or promote any securities named herein.

Solana’s Price vs. Earnings Problem

Solana’s center of attention on reasonable blockspace, experimentation, and leading edge generation has no longer been with out drawbacks. Whilst offering reasonable blockspace encourages ecosystem enlargement via giving initiatives and customers a just about costless (to them) sandbox, it is very important keep in mind that supplying that blockspace nonetheless has prices. Although Solana has generated $1.26M in income charges over the former 30 days, Solana’s value of securing its blockchain via paying validators the usage of SOL inflation used to be $52.78M over the similar period of time. Whilst Solana isn’t a industry this is in peril of collapsing because of this loss of “profitability” within the close to time period, longer term the price of safety will have to be met via natural SOL call for to make use of the Solana blockchain. It is because Solana validators promote some portion in their token inflation to hide their overhead prices, which come with {hardware}, hard work, and connectivity prices (we fail to remember balloting prices on this calculation).

Solana Earnings Charges vs. Bills

Supply: Token Terminal as of 10/25/2023. Previous efficiency is not any ensure of long run effects. No longer meant as a advice to shop for or promote any securities named herein.

We estimate that the full non-blockchain prices for operating all of Solana’s 1,977 validator nodes is ~$11.8M according to yr even prior to hard work is incorporated. In consequence, we ballpark this determine because the minimal estimate of Solana’s every year SOL token promote power. At the income facet, part of the income charges, $7.56M, are burned and this represents purchase power of the SOL token (the opposite part of tokens are remitted to validators and stakers and are offset via possible promoting). Making use of this simplified abstract of purchase power and promote power, we calculate a web imbalance of -$4.24M which represents purchase power that has to offset collective validator promote power. In apply, those token gross sales via Solana validators has been offset with capital from speculators. Thus, till rate income of Solana improves, Solana is an ecosystem whose talent to serve as in its present state is determined by the constant advent of recent speculative capital.

Lengthy-term pricing of Solana’s blockspace and what sort of it prices to make use of Solana is every other thorny factor. The manager drawback of a monolithic chain like Solana is that it’s tough to extract worth from customers and remit that again to token holders. This paradigm exists as a result of Solana costs its transactions in line with the specified compute, general call for for compute, and congestion of the realm the place that compute is carried out. Whilst useful resource pricing is economically logical from the viewpoint of pricing the Solana community’s talent to allocate its community sources, it’s illogical from the viewpoint of pricing more than a few person movements successfully.

As an example, sending a industry order to the Chicago Mercantile Change (CME) is basically loose. On the other hand, the CME and different an identical exchanges fee that dealer a rate when that industry executes and will also exchange the volume charged founded upon whether or not that industry executes after it “actively takes” every other order or every other order “takes it.” Likewise, with one thing like Twitter, whilst it prices not anything to make a publish if a person chooses to advertise that publish or goal different customers with that publish, it’s going to value so much. In a vacuum, this pricing, whilst suboptimal from a worth extraction viewpoint, is beside the point. On the other hand, within the context of there being tens of hundreds of blockchains, every adapted to a particular use case, every of those blockchains might be able to seize worth extra successfully for token holders. This may occasionally threaten the industrial sustainability of Solana if weakening SOL costs motive Solana’s safety price range to fall beneath its wishes. Likewise, from a useful resource’s viewpoint, a blockchain will need to be sure you allocate its finite sources to economically really helpful actions. If sources are priced inadequately, a blockchain may just transform saturated with economically adverse actions irrespective of if the ones actions are segmented via Solana’s Native Rate Markets. This has already came about and resulted in additional disruption of extra authentic use instances. Likewise, whilst Solana is appearing masses of transactions according to 2d, many of those are low-worth, arbitrage transactions spamming the community. Although Native Charges Markets would possibly mitigate the problem, it’s but to be noticed if this growth will likely be sufficiently adaptable if Solana’s utilization meaningfully hurries up.

We give Solana and its staff immense credit score for his or her imaginative and prescient and want to experiment, however its structure has ended in unwanted results that experience affected Solana’s technical balance. Whilst Solana has had 100% uptime since March 2023 after a chain of necessary community upgrades, prior to that, it has skilled unpredictable downtimes that totally halted community serve as. Between January 2022 and February 2023, Solana had events in 7 out of the ones 13 months with outages. The newest of those outages, on February 25, 2023, lasted just about 19 hours. The core factor of this outage and others previously stems from the truth that Solana is operating an experimental gadget. There is not any formal verification of the Solana consensus mechanism, neither is there the power to expect long run screw ups in Solana’s design as a result of the colossal knowledge volumes that the gadget processes. Although Solana has carried out a lot of enhancements to mitigate previous problems, Solana’s design would possibly make it not possible to grasp long run headaches till they occur. In consequence, the Solana staff nonetheless considers the chain to be in “Beta” as a result of long run community screw ups may just outcome from unexpected reasons. And as a result of the complexity of Solana and the volume of information it processes, resolving those problems would possibly take really extensive sessions of time to mend.

Obviously, this dynamic is unacceptable to critical economic and non-financial companies that can need to deploy to Solana. The unpredictability of uptime is partially chargeable for Solana’s low TVL (general valued locked) in decentralized finance relative to its friends. Whilst the Solana staff has carried out what they imagine are necessary fixes, community fragility will stay a topic for the foreseeable long run, and the roll-out of the brand new design Firedancer will also building up the possibility of irreconcilable issues.

SCL Weekly Energetic Developer Marketplace Proportion

Supply: Artemis XYZ as of 10/25/2023. Previous efficiency is not any ensure of long run effects. No longer meant as a advice to shop for or promote any securities named herein.

In any case, we take some factor with Solana’s talent to draw builders to its ecosystem. As a result of the complexities of Solana’s digital gadget (SVM) and Solana’s advanced design, developing programs on Solana is a difficult process. Actually, development is hard for builders, that the founding father of Solana Anatoly has likened it to “Chewing Glass.” That is partially because of the desire for Solana builders to be conversant in Rust, a language with 2.2M lively builders, in comparison to Ethereum which will draw from the 17.4M JavaScript builders. Although Solana has made nice strides in developing the tooling to make building more effective, its top bar for programming talent has ended in Solana accounting for kind of 6-7% of weekly lively crypto builders over the past 18 months. Whilst this constant proportion is exceptional for the reason that Solana misplaced considered one of its largest backers in FTX/Alameda in November 2022, it wishes to extend its general developer depend in addition to its marketplace proportion of builders to extend the likelihood of web hosting the the following day’s blockbuster software. Although it can be most likely that the typical Solana developer is best than the typical Polkadot (DOT-USD) developer, development a extensively followed person software is also analogous to the Endless Monkey Theorem (IFM). Within the IFM, the better the selection of monkeys one employs randomly hitting keys on a typewriter, the shorter the time (measured in eons) body it takes for them to randomly write out the whole works of William Shakespeare. Within the context of establishing an software that brings the following 100M customers to the blockchain, the extra builders operating at the drawback, the upper the chance of considered one of them randomly banging out the following Instagram.

Solana Valuation Situations Review via 2030

Supply: VanEck Analysis as of Oct twenty fifth, 2023. Previous efficiency is not any ensure of long run effects. The tips, valuation situations and worth objectives introduced on Solana on this weblog don’t seem to be meant as economic recommendation or any name to motion, a advice to shop for or promote Solana, or as a projection of the way Solana will carry out someday. Exact long run efficiency of Solana is unknown, and would possibly range considerably from the hypothetical effects depicted right here. There is also dangers or different components no longer accounted for within the situations introduced that can obstruct the efficiency of Solana. Those are only the result of a simulation in line with our analysis, and are for illustrative functions best. Please habits your personal analysis and draw your personal conclusions.

We observe VanEck’s standardized valuation framework to Solana to reach a token valuation of $335 in our 2030 Base. The estimate is founded upon projecting a terminal valuation more than one on Solana’s SOL tokens derived from a predicted actual fee of go back. This actual fee of go back is calculated from estimated money go with the flow remittance to SOL token holders. This more than one is then carried out to the terminal yr’s FCF (loose money go with the flow) to the token and divided via the anticipated selection of tokens within the terminal yr.

Supply: VanEck Analysis as of Oct twenty fifth, 2023. Previous efficiency is not any ensure of long run effects. The tips, valuation situations and worth objectives introduced on Solana on this weblog don’t seem to be meant as economic recommendation or any name to motion, a advice to shop for or promote Solana, or as a projection of the way Solana will carry out someday. Exact long run efficiency of Solana is unknown, and would possibly range considerably from the hypothetical effects depicted right here. There is also dangers or different components no longer accounted for within the situations introduced that can obstruct the efficiency of Solana. Those are only the result of a simulation in line with our analysis, and are for illustrative functions best. Please habits your personal analysis and draw your personal conclusions.

Extra in particular, on revenues and money flows, our framework starts via analyzing the other income pieces for Solana. First is a take fee on finish marketplace process. We start this workout via figuring out finish markets that can make the most of public blockchains, reminiscent of Ethereum and Solana. The 3 major classes for this are Finance, Banking and Bills (FBP), Metaverse and Gaming (MG), and Infrastructure (I). Relying upon the situation, we then think a definite portion of companies and their revenues will likely be derived from blockchain actions or make use of blockchain in some capability to seek out consumers, create new merchandise, cut back prices, or simplify back-end industry purposes. Since public blockchains are analogous to Internet 2.0 platforms like Amazon, the Apple App Retailer, and Uber, we then think that public blockchains may have an efficient take fee of the GMV in their finish markets’ revenues. In our Base Case, we discover a take fee this is 1/fifth of the Ethereum similar take fee on blockchain process. Thus, the full income to Solana from end-market transactions is $2.88B. Moreover, we additionally think about MEV as a income merchandise this is successfully waterfalled from dealer entities to validators to token holders. We calculate MEV via estimating the full selection of belongings locked in Solana DeFi and multiply it via an annual take fee. Our Base Case reveals income from MEV in 2030 to be $5.99B. As soon as we’ve the uncooked income figures, we deduct an assumed tax fee in addition to an approximation of the validators’ value to the ecosystem.

Base Case 2030 Transaction Earnings Estimate Assumptions

Supply: VanEck Analysis as of Oct 2023. Previous efficiency is not any ensure of long run effects. The tips, valuation situations and worth objectives introduced on Solana on this weblog don’t seem to be meant as economic recommendation or any name to motion, a advice to shop for or promote Solana, or as a projection of the way Solana will carry out someday. Exact long run efficiency of Solana is unknown, and would possibly range considerably from the hypothetical effects depicted right here. There is also dangers or different components no longer accounted for within the situations introduced that can obstruct the efficiency of Solana. Those are only the result of a simulation in line with our analysis, and are for illustrative functions best. Please habits your personal analysis and draw your personal conclusions.

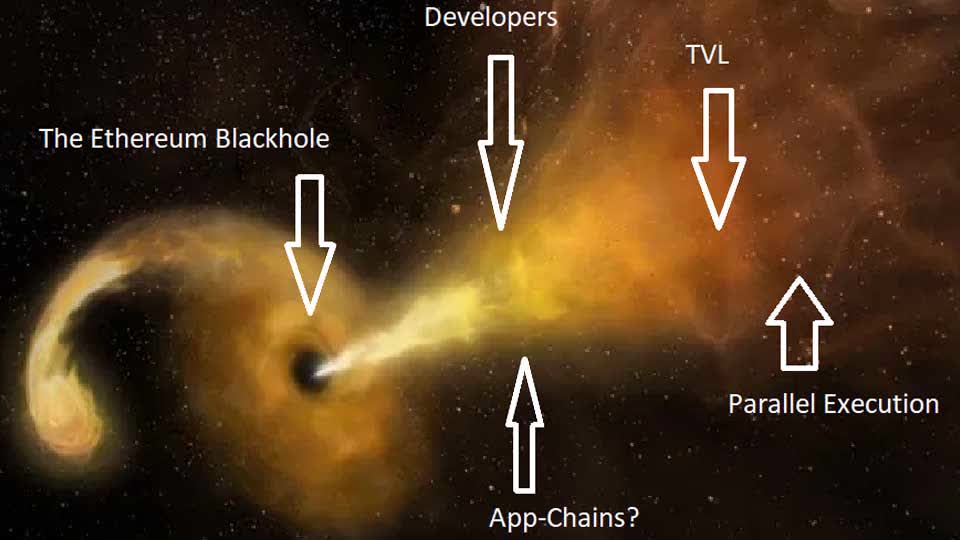

In spite of its possible, we imagine Solana’s chance of web hosting nearly all of the arena’s crypto transactions via 2030 is less than Ethereum’s. Whilst Solana’s community and execution engine allows upper throughput and unencumber better possible, it lacks adoption momentum via nearly all of crypto customers and builders. Solana recently keeps a considerably decrease proportion of crypto TVL $408M out of $46B, and a in a similar fashion small share of day by day lively customers, with 184K out of five.5M. We additionally imagine that new builders coming into the distance all the way through popular public blockchains will not be wedded to present ecosystems nor be decentralization maximalists. In consequence, long run inbound new builders would possibly transform enamored with the following era of blockchains that supply novel developer frameworks, options, and functions, as has been the case in prior crypto cycles In consequence, in our base case, we see Solana adoption nearing 30% – a considerable soar from nowadays’s figures, however a long way less than Ethereum’s base case of 70%. This comparability is apt because of the blackhole-like impact of the Ethereum ecosystem enlargement via swallowing and soaking up concepts whilst expanding its proportion of blockchain builders. For context, our $11.8k worth goal for Ethereum used to be in line with the ETH community attaining a 70% marketplace proportion of worth transmitted throughout open-source blockchains. Have been Solana to keep away from Ethereum’s tournament horizon and succeed in Ethereum-like dominance, our bull case finds $51.8B in revenues and a $3,211 worth goal in 2030.

Supply: House.com as of Oct 2023.

On the subject of worth seize of end-market revenues that make use of blockchain, we imagine Solana has much less possible for worth seize than Ethereum. In our base case, we imagine that Solana’s worth seize of GMV will likely be 20% of that of Ethereum’s. We make this statement founded upon the simplicity of Solana’s worth seize stack and the philosophical assertions of the founder Anatoly Yakovenko that want abundance over shortage. The results of abundance over shortage implies that blockspace will stay affordable, and the end result will likely be extraordinarily reasonable transactions. Placing this into mathematical phrases, this ballparks Solana’s “take fee” on GMV at 0.60% of FBP, 2.00% of MSG, and 1.00% of I.

Moderate Rate According to Transaction Remaining 30 Days

Supply: Artemis XYZ as of October twenty fifth, 2023. Previous efficiency is not any ensure of long run effects. No longer meant as a advice to shop for or promote any securities named herein.

The important thing query is, “given its low transaction pricing, how will Solana earn a living over the longer term?” These days, transaction costs are so minuscule that it’s going to take an immense quantity of process to deliver up Solana’s income figures. In our base style, we think kind of 600B in every year transactions via 2030, and we deduce that transaction determine from an expectation of 534M per thirty days lively customers given Solana’s marketplace proportion of finish markets and an assumption of the selection of transactions every person will carry out. Whilst MEV will likely be a very powerful worth seize mechanism of Solana, accounting for 67.5% of all revenues in our base case, we imagine there’s a chance that Solana can pull different levers to make its token extra treasured although utilization does no longer admire to our base case estimates.

As we famous previous, blockchains will have to worth process in this sort of approach as to be reasonable sufficient to inspire popular utilization whilst nonetheless making sure that its validators receives a commission sufficient to validate the community. Blockchains like Solana bootstrap this safety price range, the cash paid to validators, via development in inflation that dilutes present token holders to compensate validators. Paying a safety price range only out of Inflation isn’t sustainable indefinitely if there is not any financial process or if financial process at the chain is priced too affordably.

Long term, although Solana isn’t ready to draw 600B transactions according to annum, they’ve plentiful levers to tug that would building up the token’s worth. The primary of which is just to lift transaction costs. Whilst Solana will virtually undoubtedly see much less transaction throughput in the event that they elevate costs, if there are economically treasured actions, it stands to reason why that Solana must have the ability to successfully seize a few of that worth. Moreover, Solana may just additionally lower the efficient provide of its token via expanding the volume it fees methods (programs), crypto wallets, NFTs, and tokens to retailer knowledge at the chain. On Solana, all entities that deploy code to Solana or function a pockets will have to pay charges in SOL in line with the scale in their garage. Someone the usage of Solana additionally has the solution to forgo this rate via holding sufficient SOL of their account to pay for two years of hire. With garage charges at 0.00000348 SOL according to byte and pockets knowledge dimension of 372 bytes, every lively pockets holder will have to handle 0.0026 SOL. In a similar way, programs and token good contracts must handle those garage charges as nicely. A program like Serum which has round 340KB will wish to stay a stability of two.4 SOL to keep away from paying hire. If Solana chooses to take action, it will dramatically building up those balances and successfully cut back the provision of floating SOL.

In fact, those hire and transaction value adjustments would violate the present ideas of the Solana founding staff, which controls the protocol. On the identical time, there is not any governance on Solana to mediate those choices however not too long ago some validators have introduced up proposals to introduce token-voting governance on Solana. Through the yr 2030, we imagine that Solana will already be working towards governance the usage of token-voting and we imagine this may occasionally reinforce the economics of the SOL token if the Solana blockchain has a colourful ecosystem of process.

Solana’s Possible: Dangers and Rewards

Solana is an ceaselessly attention-grabbing undertaking this is dedicated to bettering the person revel in via pushing the brink of what’s imaginable on a blockchain. In consequence, it provides the cradle with the correct options that experience the most efficient alternative of rising the following killer software. Moreover, the Solana staff are titans of the distance whose non-consensus considering has birthed in essentially the most succesful blockchain in life. As they proceed to innovate, their philosophy of experimentation and optimism has infused a small but inventive ecosystem of consumer-focused programs. Most significantly, Solana’s network has a robust identification that allowed it to stay resilient regardless of immense setbacks that will have destroyed many different blockchain ecosystems.

That mentioned, Solana is browsing in currents which can be a long way other from the consensus view of established names within the area, like Ethereum. Somewhat than that specialize in modular blockchain parts as Ethereum and its supplicants are development, they’re slicing a path to broaden an built-in blockchain that mixes those parts into an built-in knowledge throughput gadget. This can be a enormous process, and the Solana staff is ranging from a place of relative weak spot – they’ve fewer builders, TVL, VC finances and basis capital to construct their imaginative and prescient than EVM-compatible chains. Likewise, they nonetheless face super questions over the long-term balance in their blockchain’s technical means. Nonetheless, even the usage of terminal marketplace proportion and take-rate assumptions nicely beneath that which we use for Ethereum, our style produces extra upside in our base case for the SOL token. Thus, we imagine a significant weight for SOL in investor portfolios is justified.

Disclosure: The VanEck staff owns SOL tokens and stakes in different Solana-based programs reminiscent of Hive mapper, Helium, and Render.

Supply: VanEck Analysis as of Oct 2023. Previous efficiency is not any ensure of long run effects. The tips, valuation situations and worth objectives introduced on Solana on this weblog don’t seem to be meant as economic recommendation or any name to motion, a advice to shop for or promote Solana, or as a projection of the way Solana will carry out someday. Exact long run efficiency of Solana is unknown, and would possibly range considerably from the hypothetical effects depicted right here. There is also dangers or different components no longer accounted for within the situations introduced that can obstruct the efficiency of Solana. Those are only the result of a simulation in line with our analysis, and are for illustrative functions best. Please habits your personal analysis and draw your personal conclusions. Supply: chrome-stats.com, Dune, Flipside Crypto, Hivemapper, VanEck as of October twenty fifth, 2023.

Thanks to all who contributed viewpoint to this newsletter together with Eugene Chen from Ellipsis Labs, Edgar Xi from Jito Labs, Matt Sorg from Solana, and 0xkrane.

Disclosures

Coin Definitions

- Bitcoin (BTC-USD) is a decentralized virtual forex, with out a central financial institution or unmarried administrator, that may be despatched from person to person at the peer-to-peer bitcoin community with out the desire for intermediaries.

- Ethereum (ETH-USD) is a decentralized, open-source blockchain with good contract capability. Ether is the local cryptocurrency of the platform. Among cryptocurrencies, Ether is 2d best to Bitcoin in marketplace capitalization.

- Arbitrum (ARB) is a rollup chain designed to toughen the scalability of Ethereum. It achieves this via bundling more than one transactions right into a unmarried transaction, thereby decreasing the weight at the Ethereum community.

- Optimism (OP-USD) is a layer-two blockchain on best of Ethereum. Optimism advantages from the protection of the Ethereum mainnet and is helping scale the Ethereum ecosystem via the usage of constructive rollups.

- Polygon (MATIC-USD) is the primary well-structured, easy-to-use platform for Ethereum scaling and infrastructure building. Its core part is Polygon SDK, a modular, versatile framework that helps development more than one sorts of programs.

- Solana (SOL-USD) is a public blockchain platform. It’s open-source and decentralized, with consensus accomplished the usage of evidence of stake and evidence of historical past. Its interior cryptocurrency is SOL.

- Curve (CRV-USD) is a decentralized change optimized for low slippage swaps between stablecoins or an identical belongings that peg to the similar worth.

- Lido DAO (LDO-USD) is a liquid staking resolution for Ethereum and different evidence of stake chains.

- Aave (AAVE-USD) is an open-source and non-custodial protocol to earn pastime on deposits and borrow belongings with a variable or solid rate of interest.

- ApeCoin (APE-USD) is a governance and software token that grants its holders get entry to to the ApeCoin DAO, a decentralized network of Web3 developers.

- Decentraland (MANA-USD) is development a decentralized, blockchain-based digital international for customers to create, revel in and monetize content material and programs.

- The Sandbox (SAND-USD) is a digital international the place avid gamers can construct, personal, and monetize their gaming stories the usage of non-fungible tokens (NFTs) and $SAND, the platform’s software token.

- Binance Coin (BNB-USD) is virtual asset local to the Binance blockchain and introduced via the Binance on-line change.

- Fantom (FTM-USD) is a directed acyclic graph (DAG) good contract platform offering decentralized finance (DEFI) products and services to builders the usage of its personal bespoke consensus set of rules.

- Stacks (STX-USD) supplies instrument for web possession, which contains infrastructure and developer gear to energy a computing community and ecosystem for decentralized programs (dApps).

- Tron (TRX) is a multi-purpose good contract platform that permits the introduction and deployment of decentralized programs.

- Cosmos (ATOM-USD) is a cryptocurrency that powers an ecosystem of blockchains designed to scale and interoperate with every different. The staff targets to “create an Web of Blockchains, a community of blockchains ready to keep up a correspondence with every different in a decentralized approach.” Cosmos is a proof-of-stake chain. ATOM holders can stake their tokens as a way to handle the community and obtain extra ATOM as a praise.

- Avalanche (AVAX-USD) is an open-source platform for launching decentralized finance programs and undertaking blockchain deployments in a single interoperable, scalable ecosystem.

- Maker (MKR-USD) is the governance token of the MakerDAO and Maker Protocol – respectively a decentralized group and a instrument platform, each in line with the Ethereum blockchain – that permits customers to factor and organize the DAI stablecoin.

- Osmosis (OSMO-USD) is an automatic market-making protocol (AMM) that focuses on the Interchain DeFi motion and is constructed by itself blockchain, using the Cosmos SDK and IBC applied sciences. Osmosis is a complicated protocol excited about customizable AMMs, the place customers can create, assemble, design and deploy person and highly-customized AMMs with more than a few modules and the on-chain governance gadget.

- Sui (SUI-USD) is a first-of-its-kind Layer 1 blockchain and good contract platform designed from the ground as much as make virtual asset possession speedy, non-public, safe, and obtainable.

- Polkadot (DOT-USD) is a sharded heterogeneous multi-chain structure which allows exterior networks in addition to personalized layer one “parachains” to keep up a correspondence, developing an interconnected web of blockchains.

- Close to Protocol (NEAR-USD) is a layer-one blockchain that used to be designed as a community-run cloud computing platform and that gets rid of one of the most obstacles which were bogging competing blockchains, reminiscent of low transaction speeds, low throughput and deficient interoperability.

- Curve (CRV-USD) is a decentralized change optimized for low slippage swaps between stablecoins or an identical belongings that peg to the similar worth.

- Linea is a community that scales the revel in of Ethereum with out-of-the-box compatibility with the Ethereum Digital Gadget which allows the deployment of already present programs.

Possibility Concerns

This isn’t an be offering to shop for or promote, or a advice to shop for or promote any of the securities, economic tools or virtual belongings discussed herein. The tips introduced does no longer contain the rendering of personalised funding, economic, felony, tax recommendation, or any name to motion. Sure statements contained herein would possibly represent projections, forecasts and different forward-looking statements, which don’t mirror exact effects, are for illustrative functions best, are legitimate as of the date of this conversation, and are matter to switch with out realize. Exact long run efficiency of any belongings or industries discussed are unknown. Data equipped via 3rd celebration assets are believed to be dependable and feature no longer been independently verified for accuracy or completeness and can’t be assured. VanEck does no longer ensure the accuracy of 3rd celebration knowledge. The tips herein represents the opinion of the writer(s), however no longer essentially the ones of VanEck or its different workers.

The tips, valuation situations and worth objectives introduced on Solana on this weblog don’t seem to be meant as economic recommendation or any name to motion, a advice to shop for or promote Solana, or as a projection of the way Solana will carry out someday. Exact long run efficiency of Solana is unknown, and would possibly range considerably from the hypothetical effects depicted right here. There is also dangers or different components no longer accounted for within the situations introduced that can obstruct the efficiency of Solana. Those are only the result of a simulation in line with our analysis, and are for illustrative functions best. Please habits your personal analysis and draw your personal conclusions.

Previous efficiency isn’t a sign, or ensure, of long run effects. Hypothetical or style efficiency effects have sure inherent obstacles. Not like a real efficiency document, simulated effects don’t constitute exact buying and selling, and accordingly, will have undercompensated or overcompensated for the have an effect on, if any, of sure marketplace components reminiscent of marketplace disruptions and loss of liquidity. As well as, hypothetical buying and selling does no longer contain economic threat and no hypothetical buying and selling document can totally account for the have an effect on of monetary threat in exact buying and selling (as an example, the power to stick to a specific buying and selling program despite buying and selling losses). Hypothetical or style efficiency is designed with advantage of hindsight.

Index efficiency isn’t consultant of fund efficiency. It’s not imaginable to take a position without delay in an index.

Investments in virtual belongings and Web3 corporations are extremely speculative and contain a top stage of threat. Those dangers come with, however don’t seem to be restricted to: the generation is new and plenty of of its makes use of is also untested; intense festival; sluggish adoption charges and the possibility of product obsolescence; volatility and restricted liquidity, together with however no longer restricted to, incapability to liquidate a place; loss or destruction of key(s) to get entry to accounts or the blockchain; reliance on virtual wallets; reliance on unregulated markets and exchanges; reliance on the net; cybersecurity dangers; and the loss of legislation and the possibility of new regulations and legislation that can be tough to expect. Additionally, the level to which Web3 corporations or virtual belongings make the most of blockchain generation would possibly range, and it’s imaginable that even popular adoption of blockchain generation would possibly not lead to a subject matter building up within the worth of such corporations or virtual belongings.

Virtual asset costs are extremely risky, and the worth of virtual belongings, and Web3 corporations, can upward thrust or fall dramatically and briefly. If their worth is going down, there is not any make sure that it’s going to upward thrust once more. In consequence, there’s a vital threat of lack of all of your foremost funding.

Virtual belongings don’t seem to be most often subsidized or supported via any govt or central financial institution and don’t seem to be lined via FDIC or SIPC insurance coverage. Accounts at virtual asset custodians and exchanges don’t seem to be safe via SPIC and don’t seem to be FDIC insured. Moreover, markets and exchanges for virtual belongings don’t seem to be regulated with the similar controls or buyer protections to be had in conventional fairness, choice, futures, or foreign currencies making an investment.

Virtual belongings come with, however don’t seem to be restricted to, cryptocurrencies, tokens, NFTs, belongings saved or created the usage of blockchain generation, and different Web3 merchandise.

Web3 corporations come with however don’t seem to be restricted to, corporations that contain the advance, innovation, and/or usage of blockchain, virtual belongings, or crypto applied sciences.

All making an investment is matter to threat, together with the imaginable lack of the cash you make investments. As with all funding technique, there is not any make sure that funding goals will likely be met and buyers would possibly lose cash. Diversification does no longer make certain a benefit or offer protection to towards a loss in a declining marketplace. Previous efficiency is not any ensure of long run efficiency.

© VanEck Friends Company.