franckreporter

Financial investment short

The case for designating to U.S. equities stays blended when thinking about several financial investment horizons. The Fed’s choice to pause its treking cycle in the other day’s policy conference is a crucial aspect that will assist equity returns over the coming 12 months. Evaluations, market, breath, and technicals need to likewise be thought about. In addition, the contrast of U.S. stocks to their international sets is something that needs to be greatly weighed into any financial investment thinking.

Currently we have actually seen equity markets rally in the short-term following the policy conference for November. The concern financiers must now ask themselves on the tactical side is, where do I park my hard-earned capital, and what are the most engaging financial investment chances over the coming 12 months to 3 years? Long-lasting, in my viewpoint, domestic equities still stay the most engaging case for the compounding of wealth. Nevertheless, a more thoughtful analysis need to be finished on the geographical allotments for equities.

Large-cap stocks have, for the a lot of part, been the significant wealth developers over the previous years for U.S. financiers (and worldwide for that matter). This stays real over the previous 12-month duration too, with the “stunning 7” business holding up the broad indices over the October ’22 to August ’23 rally.

For those looking for varied direct exposure to a big choice of domestic large-cap stocks– however without the extreme concentration in tech– the Lead Large-cap Index Fund ( NYSEARCA: VV) is one offering that might be thought about.

The fund invests throughout a varied index of big U.S. equities, which consist of around 85% of the overall U.S. market price. It has $26.8 Bn in AUM and charges a cost ratio of 4bps on this. Dividends, which are paid quarterly, presently yield 1.5% on a routing circulation of $3.00 per share.

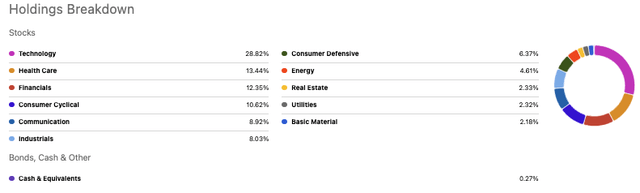

Among the more engaging elements with VV, is that its weighting throughout sectors appears more well balanced than surrounding large-cap funds. The allowance to health care and financials, at 13.5% and 12.4%, respectively, are significant elements. Additionally, the leading 10 holdings of the fund consist of ~ 30% weight, and it has 544 holdings in overall. This, as annualized turnover is just 3%, c. 90% lower than similar peers.

Figure 1.

VV tracks the CRSP U.S. big Index, and has a tracking mistake of 0.86% over the last 3 years, putting it in the leading percentile of funds tracking large-cap constituents.

Like most of the broad indices, it just recently broke its 200DMA in September/October, and it has actually been trading listed below its 50DMA considering that July, when equity markets started to roll over. Regardless of blended viewpoints on the outlook for domestic equities over the coming 12– 18 months, my judgement is that large-cap U.S. stocks still use an engaging long-lasting risk/reward calculus, which requires VV’s addition into a tactical equity allowance in the long account of a long-lasting financier’s portfolio, in my viewpoint.

As such, my suggestions throughout all 3 financial investment horizons is as follows:

Basic–

- Short-term (next 12 months)- Neutral; Beginning assessments still high vs. peers and macroeconomic crosscurrents stay a threat to equity markets. No stating on what the Fed might do beyond ’23 too. Development stocks continue to be hammered too.

- Medium-term (1-3 years)- Bullish; Sales + incomes development forecasts stay extremely robust in the U.S., together with GDP forecasts. Nevertheless, there stays an argument of elements and sizing at this moment– worth elements might continue to exceed in an ongoing selloff. However, the scope for ongoing advantage in the coming years is engaging in my view.

- Long-lasting (3+ years) – Bullish – Long-lasting U.S. development stays engaging, and one can not mark down the speed of development, market performance, and value of U.S. capital markets. I am bullish over the long term.

Technicals–

- Short-term (coming days to weeks): Bullish; enhancing short-term technicals which are revealing bullish turnaround off October lows, possibility to collect short-term benefits. Beyond this, variety trade is supported vs. directional view.

- Medium-term (coming weeks to months): Neutral; no verification to anticipate a bullish relocation right now. Might alter if equity markets rally post Fed numbers.

- Long-lasting (coming months): Neutral; still a lot of space to cover to get us back in longer-term pattern.

Net-net, thinking about a long-lasting financial investment horizon, I rate VV a long-lasting buy based upon the elements raised here today.

Figure 1a.

Talking points

- Fed on time out for the time being

The huge news today was the Federal Reserve leaving rate of interest the same at its policy conference for November, marking the second time it had actually chosen to hold the FFR constant. Nevertheless, the Fed’s chair, Jerome Powell, wasn’t so positive on the rates/inflation gain access to, keeping in mind that there is still work to be performed in bringing the level of inflation down, which additional rate walkings aren’t not be off the table at future policy conferences.

Power was priced quote mentioning, ” I will state that we’re not positive this time that we have actually reached such a position, we’re not positive that we have not”, describing whether monetary conditions had actually reached a limiting level sufficient level. Discuss unpredictability and covering both ends.

Nevertheless, he likewise said that “[y] ou’re close to completion of the cycle. That was the impression, I think since September. It’s not a guarantee or a prepare for the future”.

What this indicates for equity markets stays to be seen in the short-term. However something is for sure– stock exchange did delight in the news, with the S&P 500 futures rallying around 60 points from the open as I compose. In reality, all markets are up on the day. This might be the turning point for large-cap equities, although more time will be required for the marketplace to absorb the information. In my viewpoint, if there is another time out at the next policy conference, this might be bullish for equities in the large-cap area. I would motivate all financiers to pay extremely attention to the marketplaces’ action to this most current policy conference to determine what may occur progressing.

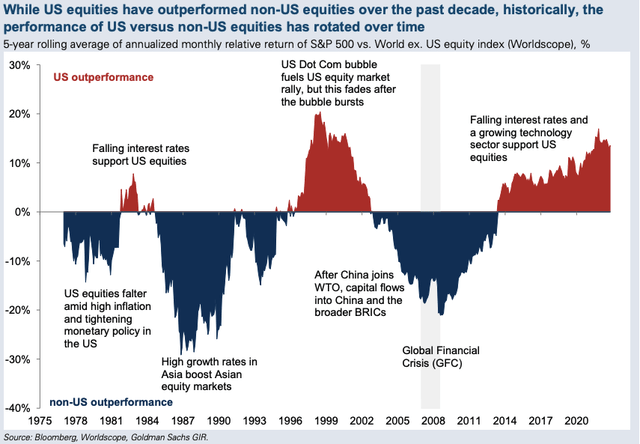

- U.S. vs. non-U.S. allowance dispute continues to roll on

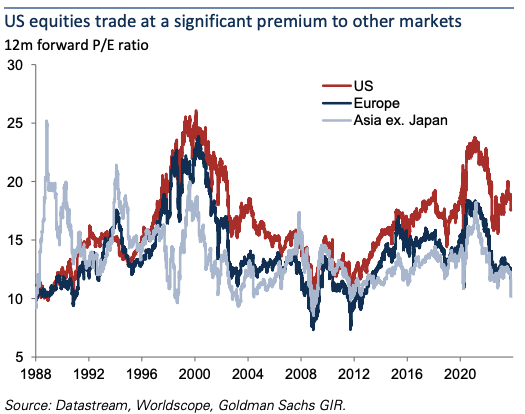

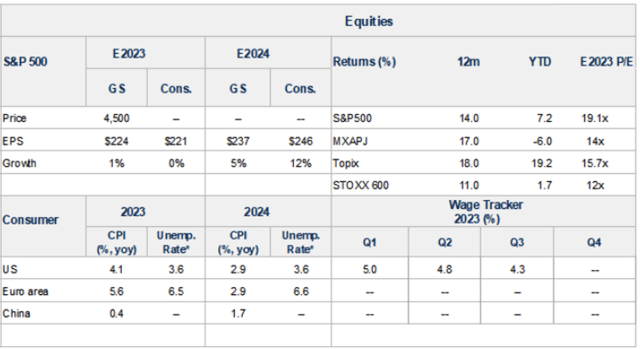

The dispute on whether to continue designating to domestic versus ex-U.S. equities continues well into the back end of the year. It’s no doubt that U.S. stocks have actually delighted in a duration of considerable outperformance versus their European and Asia-Pacific equivalents. With tightening up monetary conditions in The United States and Canada in basic, there is scope to possibly designate to European-based names and Japanese stocks. For example, the European index’s trade at a considerable discount rate to their American equivalents, which might reinforce the next 12 months’ returns. On the other hand, U.S. indices are still priced at a premium to both international peers and historic averages over the last couple of years, as seen in the figure listed below.

Figure 2.

Source: Goldman Sachs Macro Research Study

In reality, the crowd at Goldman Sachs ( GS) are similarly as blended on the viewpoint of forward U.S. equity returns. Peter Oppenheimer, The company’s international portfolio strategist, weighed into the dispute, mentioning:

T he exceptionalism of the U.S. equity market that has actually identified the post-GFC age has actually had a number of chauffeurs. Chief amongst them has actually been the collapse and international rate of interest, which has actually benefited longer, period and properties that the U.S. market has reasonably more direct exposure to, in addition to the U.S. is reasonably low weight in locations of the marketplace that struggled with substantial headwinds, like financials and product stocks.”

Oppenheimer goes on to acknowledge the success of the U.S. tech sector which incomes development in tech has actually faded considering that we presented of the “pandemic age”.

Figure 3.

Source: Goldman Sachs Macro Research Study

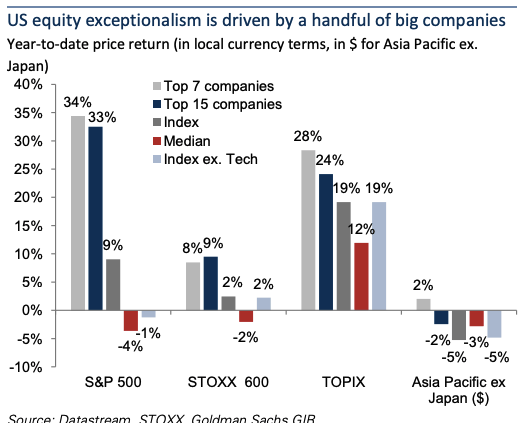

We should not ignore the concentration of the U.S. indices, either, where the “stunning 7” business continue to prop up the benchmark efficiency, as pointed out previously. The biggest 15 business on the U.S. exchanges have actually gotten around 25– 30% in worth this year to date. Nevertheless, the staying choice of stocks has actually underperformed on aggregate, underperforming money and/or investment-grade corporates.

As an outcome, the risk/reward calculus for large-cap equities stays a function of the lots of macroeconomic crosscurrents that are presently feeding into international markets. The rates/inflation gain access to, a brand-new products super-cycle, and geopolitical threats are all elements to be thought about. On this basis, integrated with the reasonably high multiples that the U.S. still commands, and a contracting equity danger premium, the case for allowance over the coming 12 months might be restricted. Beyond that, U.S. GDP projections have actually been increased regularly considering that December 2022, with the most recent projection, since September 2023, requiring a 1.8 portion point modification from December forecasts. GS’ forecasts for U.S. standards are observed in Figure 5.

Figure 4.

Source: Goldman Sachs Macro Research Study

Figure 5.

Source: Goldman Sachs Macro Research Study

- Next 12 months returns outlook blended

The other indicate think about is beginning assessments for VV, which still rest at a considerable premium to surrounding peers. The fund trades at 20.3 x incomes, ahead of the broad average of 15.2 x, and well ahead of FactSet’s 5.6 x section average. Dividend yields of << 2% and a routing payment of $0.72 are inadequate to conquer this problem. As a pointer, beginning assessments have a substantial effect on the coming 12-month returns, and with European indices trading at such compressed multiples, this might be a threat aspect for VV over this period.

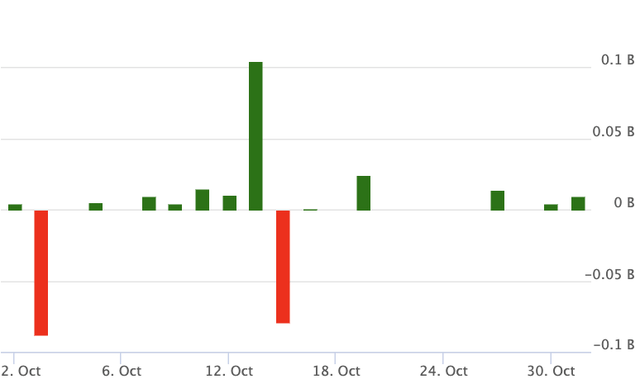

However, equity streams into the fund over the previous 12 months have actually stayed fairly favorable (Figure 6), with 2 big drawdown durations over this time. In current months, fund circulations have actually balanced favorable. With the current policy choices gone over previously, there is scope for extra capital to stream into VV in my viewpoint.

Figure 6.

Technical factors to consider

1. Momentum over mid to long-lasting

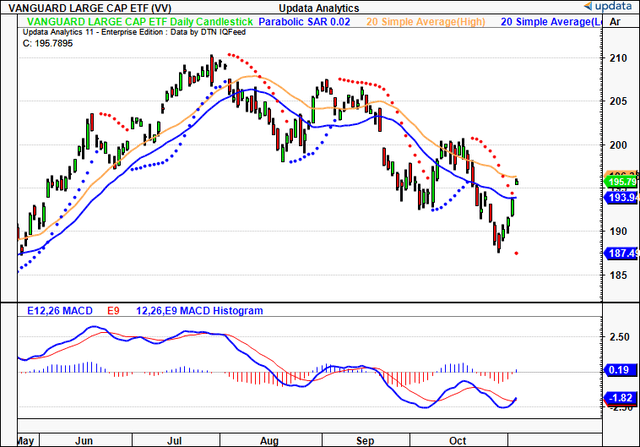

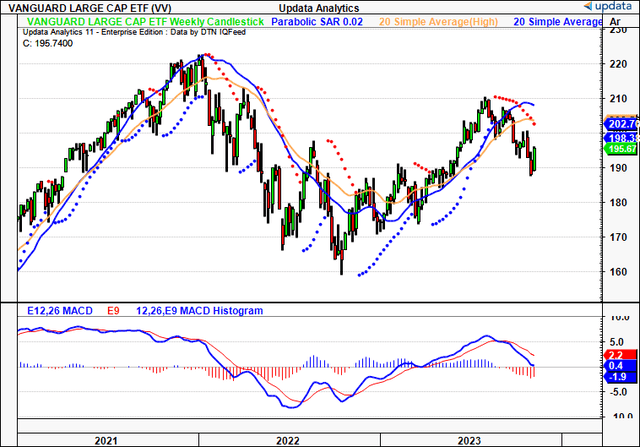

Mid and long-lasting momentum research studies are contrasted. On the day-to-day frame, financiers have actually raised the quote off VV’s 6-month lows and are now pressing it back towards September highs. Taking the 20DMA of low and high reveals VV has actually been setting lower highs and lower lows considering that August, however a break in the rate line above these varieties would be substantial. The MACD has actually been trending lower, with 2x bearish crosses considering that July.

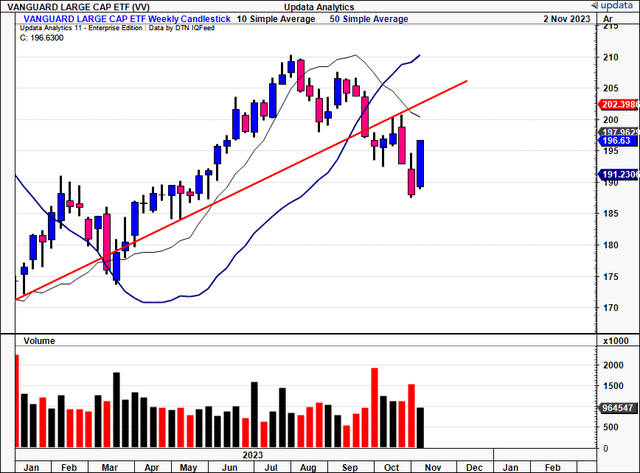

On the weekly, there’s been a bearish cross of the MACD in October, after the rally sustained from ’22–‘ 23, so longer-term momentum seeks to have actually decreased for the time being. Moving forward, you ‘d require a sharp turnaround towards the $200s to recommend we are bullish once again.

Figure 7.

Figure 8.

2. Alter, directional predisposition of rate circulation

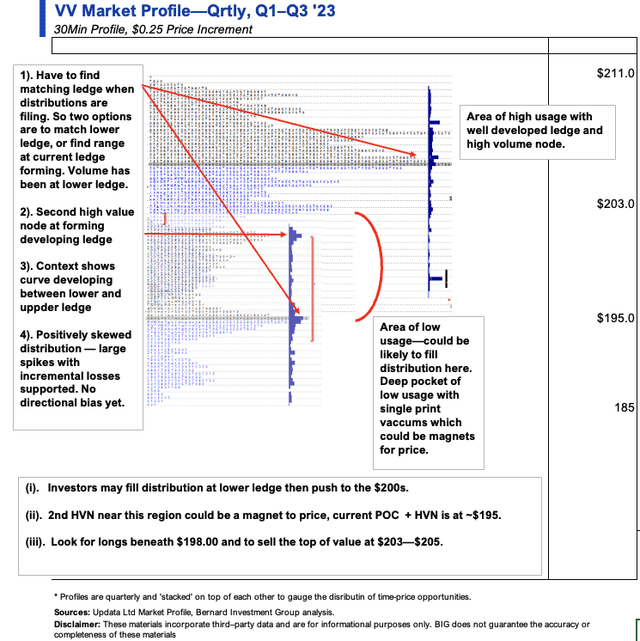

- Observations: September saw U.S. nearly finish a complete circulation, and we anticipated to open October lower, which we did. On the rate use chart (Figure 9) there’s a high volume node (” HVN”) at the $195s forming into a ledge which I approximate financiers will continue filling up until it matches the remarkable ledge + HVN above $205, which formed a vacuum + space down in September which has actually considering that been a magnet for rate (Figure 10). Cost targets are collected at this area too (Figure 11). There is a pocket of low use in between $195 and $203, which might bring in rate use– specifically if stocks rally after the Fed’s numbers. We currently see high rate use and a second HVN at the $200s with another ledge forming here. The matching low use pocket might bring in variety trade as the circulation fills. Information is favorably manipulated, which supports this rotational view with sharp snapback rallies. As we remain in an under-developed curve, I would not play an instructions at this phase, however aim to price rotation in between these crucial levels.

- Secret levels: $ 195–$ 205 is the crucial variety, in between the 2 HVN’s and filling the low-usage pocket in this location. If rate stays caught here, sideways action would be the minimum expectation.

- Actionable method: Prevent the breakout in the meantime, up until we see additional ledge advancement from $195–$ 200. Longs below $195 are supported to offer the top of worth above $205. Rotational trade is therefore supported, unless we cut through the $195-$ 205 area at rate– then we ‘d require to re-evaluate this.

Figure 9.

Figure 10.

Figure 11.

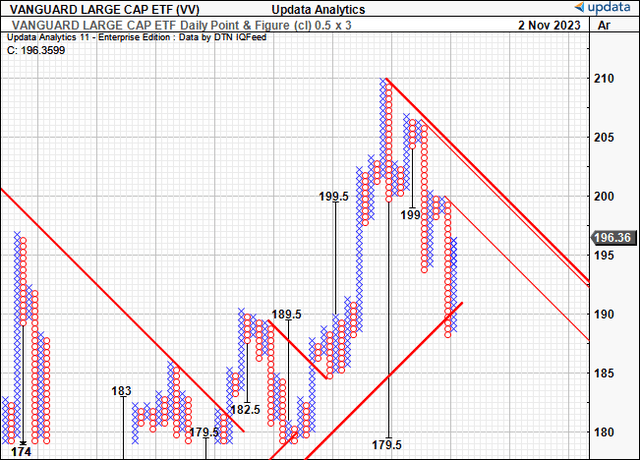

3. Directional pattern predisposition

Once again the pattern image is contrasted throughout various time horizons. The following conversation highlights this.

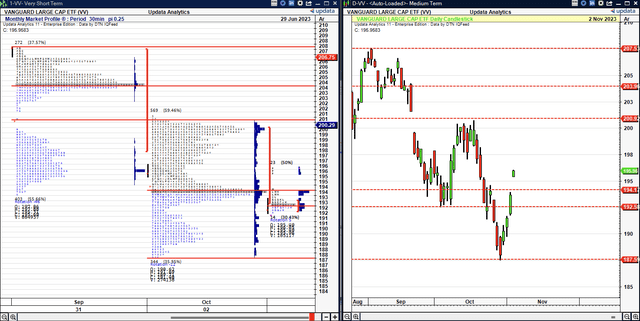

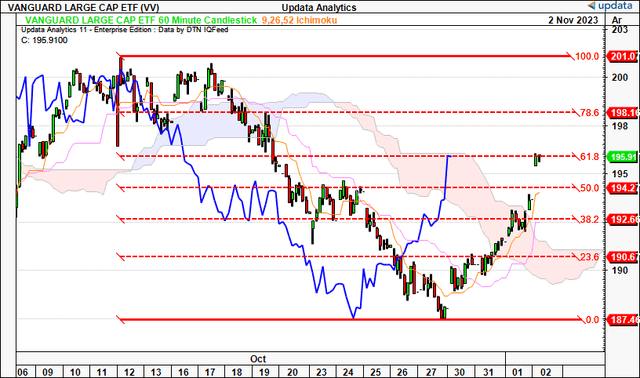

Figure 12 Short-term (60-minute chart, aiming to coming days)–

Observations + crucial levels:

- Bullish view is necessitated in the short-term provided 1) Fed notes, 2) bounce from October lows, and 3) bullish cross into the cloud.

- We have actually currently backtracked 61.8% of the October down-leg and might press to the $198s as the next level. $201 would catch the previous high.

- Lagging line will push above the cloud which is a bullish signal and the turning line crossed the base line in a bullish setup too. A pinch at the cloud might see U.S. trending from here.

- Want To $198 then $201 as the next benefits, $192 then $190 as disadvantage locations.

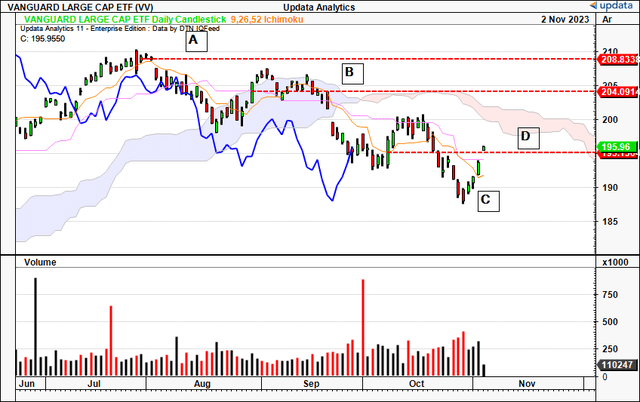

Figure 13. Medium-term (day-to-day chart, aiming to the coming weeks)–

Observations + crucial levels:

- August saw the big engulfing pattern at A with subsequent space down which didn’t get retaken in September, leading to a sharp turnaround listed below the cloud by month’s end.

- Marabzuzo line at B was taken in exact same month and was the top of the cloud up until November. 3 waves down and we bottomed last month at C.

- Cost gaped above the marabuzo line from October in today’s session at D and this might be a bullish indication. However we still are below cloud assistance, both turning + conversion lines are trending lower. Lagging line is well behind.

- Net levels to see are $200 above the cloud by mid-November, then $204 beyond this. Lastly, $208 would secure the August highs. Listed below $190 on the disadvantage is bearish.

- Today I’m neutral on this setup.

Figure 14. Long-lasting (weekly chart, aiming to coming months)–

Observations + Secret levels:

- Bearish engulfing at 1) is the long-lasting resistance that needs to be retaken to catch ’22– ’23 pattern.

- Seriously, we are heading to October Marubozu line with this week’s candle light at 2), which is itself a Marubozu with little disadvantage shadow.

- We require to secure $196, then $200, then $203, crucial level from back in July at 3). We are still above the cloud, and lagging line simply bounced from cloud top, an excellent indication.

- Secret levels are those from above, and we require to prevent <