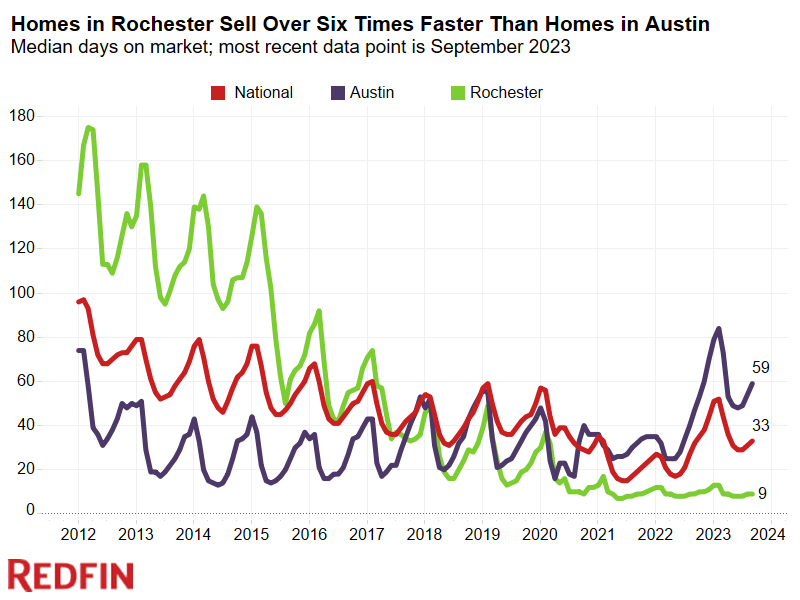

Albany, Rochester and Buffalo are amongst the country’s fastest real estate markets. Austin, when understood for its speed, is among the slowest.

In Albany, NY, the normal home that offered in September went under agreement in simply 8 days, making it the fastest market in the nation. Next came Rochester, NY (9 ), Grand Rapids, MI (9) Buffalo, NY (11 ), San Jose, CA (12) and Seattle (12 ).

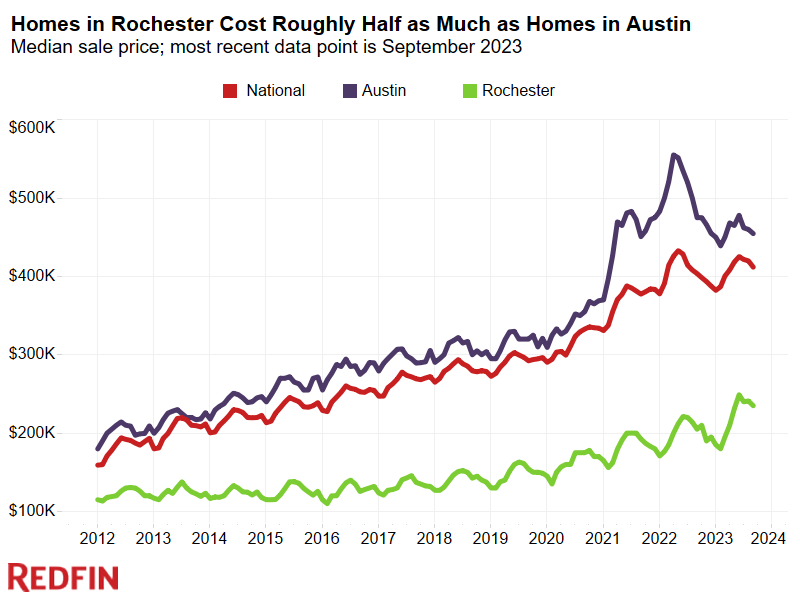

Aside from Seattle and San Jose, all of the 6 fastest markets have mean home price well listed below the nationwide level of $412,081– one factor homes in these cities are getting took up so rapidly. The normal home that offered in Rochester last month chose $235,000, making it the fourth most budget friendly city in the country. Buffalo ranked 8th, with a mean price of $255,000, and Albany and Grand Rapids ranked 21st and 24th, with mean price of $310,000 and $320,000, respectively. That’s based upon a list of U.S. cities with populations of a minimum of 750,000.

Houses in budget friendly locations have actually ended up being more competitive as real estate price has actually diminished due to increasing home mortgage rates and still-high home rates. The typical 30-year-fixed home mortgage rate struck 8% recently for the very first time in 23 years, sending out the normal property buyer’s month-to-month payment up considerably from a year back.

” You may not believe of Rochester as a hotspot, however individuals are still gathering into our location and supply stays extremely low,” stated Kimberly Hogue, a regional Redfin realty representative. “Specifically for somebody including a big-city spending plan, paying $400,000 for a gorgeous single-family home in a preferable community is a no brainer, and there simply aren’t enough to walk around. Even with home mortgage rates near 8%, homes here are still budget friendly.”

The scenario is a bit various in close-by Buffalo, according to regional Redfin representative James Strzalkowski, who has actually observed indications that the marketplace is starting to slow.

“ Buffalo was promoted for many years as a cost effective city with a lot to provide, consisting of less expensive labor, however our regional economy is altering. Home rates and the basic expense of living are reaching other parts of the nation,” he stated. “We have a real estate lack in part since individuals can’t pay for to move, however homes that are noted are beginning to sit for longer and see rate drops as home mortgage rates increase and inflation affects our city.”

In Austin, House Utilized to Fly Off the Shelves. Now It’s the 3rd Slowest Real Estate Market in the Nation.

In New Orleans, the normal home that offered in September went under agreement in 70 days, making it the slowest market in the nation. Next came Honolulu (62 ), Austin, TX (59 ), West Palm Beach, FL (58 ), McAllen, TX (53) and Charleston, SC (53 ).

Houses in the majority of the previously mentioned markets have actually traditionally taken longer to offer than the normal U.S. home. The outlier is Austin, where homes have actually traditionally offered much faster. Austin took off in appeal throughout the pandemic as ratings of remote employees relocated from pricey seaside cities to make the most of the location’s fairly budget friendly real estate. In turn, home rates escalated and numerous property buyers were evaluated.

Austin’s real estate market has actually lost its edge in big part since it has actually ended up being more pricey. The normal home that offered in September chose $450,000, or 9.2% more than the normal U.S. home. That space has actually narrowed given that home rates peaked last spring, when homes in Austin were costing almost 30% more than the normal U.S. home.

Metro-Level Summary: September 2023

| U.S. City Location | Mean Days on Market | Year-Over-Year Modification in Mean Days on Market (in Days) | Mean Home Price |

|---|---|---|---|

| Albany, NY | 8 | -5 | $ 310,000 |

| Anaheim, CA | 33 | -9 | $ 1,090,000 |

| Atlanta, GA | 28 | 1 | $ 387,000 |

| Austin, TX | 59 | 12 | $ 450,000 |

| Bakersfield, CA | 28 | -6 | $ 341,250 |

| Baltimore, MD | 21 | -4 | $ 375,000 |

| Birmingham, AL | 47 | 3 | $ 277,950 |

| Boston, MA | 20 | -1 | $ 685,000 |

| Buffalo, NY | 11 | -1 | $ 255,000 |

| Camden, NJ | 20 | -4 | $ 325,000 |

| Cape Coral, FL | 43 | 19 | $ 385,000 |

| Charleston, SC | 53 | -1 | $ 425,000 |

| Charlotte, NC | 39 | 1 | $ 390,000 |

| Chicago, IL | 50 | -7 | $ 321,000 |

| Columbus, OH | 37 | -2 | $ 330,000 |

| Dallas, TX | 36 | 4 | $ 422,900 |

| Dayton, OH | 20 | -8 | $ 209,950 |

| Denver, CO | 20 | -1 | $ 580,000 |

| Detroit, MI | 16 | -5 | $ 183,165 |

| El Paso, TX | 34 | 1 | $ 254,475 |

| Fort Lauderdale, FL | 51 | 5 | $ 425,000 |

| Fort Worth, TX | 37 | 9 | $ 357,760 |

| Frederick, MD | 20 | -8 | $ 517,495 |

| Fresno, CA | 22 | 0 | $ 401,000 |

| Grand Rapids, MI | 9 | -1 | $ 320,000 |

| Greensboro, NC | 27 | 0 | $ 275,000 |

| Greenville, SC | 45 | 2 | $ 326,000 |

| Honolulu, HEY THERE | 62 | 10 | $ 727,444 |

| Houston, TX | 34 | 8 | $ 333,200 |

| Indianapolis, IN | 14 | 2 | $ 299,992 |

| Jacksonville, FL | 44 | 8 | $ 360,000 |

| Kansas City, MO | 23 | 3 | $ 312,750 |

| Knoxville, TN | 47 | -1 | $ 364,000 |

| Lake County, IL | 48 | -6 | $ 337,750 |

| Las Vegas, NV | 37 | -10 | $ 415,000 |

| Los Angeles, CA | 36 | -7 | $ 875,000 |

| Louisville, KY | 22 | 1 | $ 255,000 |

| McAllen, TX | 53 | 23 | $ 251,000 |

| Memphis, TN | 39 | 5 | $ 275,000 |

| Miami, FL | 51 | 0 | $ 510,000 |

| Milwaukee, WI | 39 | -7 | $ 305,000 |

| Minneapolis, MN | 21 | -1 | $ 375,000 |

| Montgomery County, PA | 17 | -4 | $ 435,000 |

| Nashville, TN | 50 | 11 | $ 440,000 |

| Nassau County, NY | 26 | -2 | $ 653,000 |

| New Brunswick, NJ | 24 | -19 | $ 510,000 |

| New Orleans, LA | 70 | 42 | $ 278,985 |

| New York City, NY | 52 | 2 | $ 695,000 |

| Newark, NJ | 25 | -6 | $ 525,000 |

| North Port, FL | 42 | 18 | $ 442,831 |

| Oakland, CA | 14 | -10 | $ 930,000 |

| Oklahoma City, OKAY | 17 | 4 | $ 248,000 |

| Omaha, NE | 13 | 2 | $ 300,000 |

| Orlando, FL | 26 | 5 | $ 395,000 |

| Oxnard, CA | 37 | -10 | $ 840,000 |

| Philadelphia, PA | 38 | -3 | $ 270,000 |

| Phoenix, AZ | 40 | -5 | $ 442,000 |

| Pittsburgh, PA | 49 | -3 | $ 225,000 |

| Portland, OR | 21 | -1 | $ 545,000 |

| Providence, RI | 23 | -4 | $ 450,000 |

| Raleigh, NC | 37 | 0 | $ 435,000 |

| Richmond, VA | 13 | -2 | $ 370,000 |

| Riverside, CA | 36 | -7 | $ 545,000 |

| Rochester, NY | 9 | 0 | $ 235,000 |

| Sacramento, CA | 16 | -13 | $ 575,000 |

| Salt Lake City, UT | 34 | 1 | $ 506,250 |

| San Antonio, TX | 50 | 17 | $ 318,075 |

| San Diego, CA | 16 | -12 | $ 867,500 |

| San Francisco, CA | 24 | -5 | $ 1,450,000 |

| San Jose, CA | 12 | -16 | $ 1,487,000 |

| Seattle, WA | 12 | -9 | $ 769,990 |

| St. Louis, MO | 18 | -3 | $ 255,000 |

| Stockton, CA | 15 | -15 | $ 540,000 |

| Tacoma, WA | 15 | -11 | $ 533,900 |

| Tampa, FL | 25 | 5 | $ 380,000 |

| Tucson, AZ | 46 | -2 | $ 360,000 |

| Tulsa, OKAY | 18 | 4 | $ 260,000 |

| Virginia Beach, VA | 21 | -4 | $ 333,950 |

| Warren, MI | 17 | -5 | $ 296,000 |

| Washington, D.C. | 30 | -6 | $ 520,000 |

| West Palm Beach, FL | 58 | 8 | $ 470,000 |

| Worcester, MA | 19 | -3 | $ 433,000 |

| National– U.S.A. | 33 | 1 | $ 412,081 |

Editor’s note: A previous variation of this report mentioned that Austin was the 2nd slowest real estate market. It is the 3rd slowest. The report has actually been upgraded.