8vFanI

2023 has actually typically been a great year for organization advancement business, as their financial obligation financial investments have mainly drifting rates of interest, whereas most of financial obligation loanings generally have actually repaired rates.

TriplePoint Endeavor Group ( NYSE: TPVG) is a BDC that concentrates on business which currently are backed by equity capital companies, with a particular location of concentration on VC-backed companies in the endeavor development phase, which have not yet gone public.

The Q1 ’23 collapse of Silicon Valley Bank and some other lending institutions affected the VC market, and consequently impacted TPVG. VC offer activity is method down in 2023, and underlying business are having a more difficult time getting extra financing, relying on their situations. Countering that as we progress is that there’s a lot of dry powder waiting to be used.

Business Profile:

TPVG is an internally handled BDC, headquartered on Sand Hill Roadway in Silicon Valley, with local workplaces in New york city City, San Francisco and Boston. Because beginning, TPVG has actually dedicated over $10B to 900+ business throughout the world. It typically does 3-4 year fundings, with a loan-to-enterprise worth of less than 25%. The portfolio business are normally getting ready for an IPO or M&A in the next 1-3 years.

Holdings:

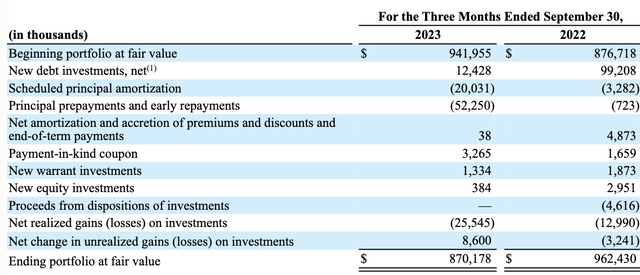

TPVG held financial obligation financial investments in 54 portfolio business, warrants in 106 portfolio business, and equity financial investments in 48 portfolio business. Since 9/30/23, the portfolio had an expense worth of $924M and a reasonable worth of $870M.

The loan portfolio is 62.1% drifting rate and 37.9% repaired rate, not as much in drifting rates as some other BDCs, however that mix has actually definitely increased TPVG’s NII over the previous 7 quarters. (See Profits area listed below for more information.)

Management approximates that yearly NII/Share increases $.08 for each 100 basis point boost in the prime rate, while a 100 basis point decline would lead to a $.07 decline. Nevertheless, BDCs can reduce that decline by increasing loan activity.

TPVG’s warrant and direct equity financial investments provide future possible benefit to its book worth. Since 9/30/23, its 122 warrant positions had a latent gain of $12.7 M on an expense basis of $30M.

The typical financial obligation portfolio yield increased to 15.1% in Q3 ’23, vs. 14.7% in Q1-2 ’23, and 13.8% in Q3 ’22.

TPVG’s biggest market direct exposure is Customer Products & & Provider, at 16.7%, followed by E-Commerce, at 15.4%, Financial Institutions & & Provider, at 8.4%, Health Care Tech and Service Softwares, both at 7.2%, with Service Software, Realty Solutions, Service Products & & Solutions, other Financial Solutions, and Travel & & Leisure accounting for 26.7% of its direct exposure.

Like other BDCs, TPVG’s management rates the credit reliability of its held business each quarter. It has a 5-tier grading system, Clear, or 1, being the greatest ranking and Red, or 5, being the most affordable.

Since Sept. 30, 2023, the weighted typical financial investment ranking of the TPVG’s financial obligation financial investment portfolio was 2.10, vs. 2.07 at the end of Q4 ’22.

Since 9/30/23, there were 7 business in the bottom 2 tiers, valued at $38.65 M, ~ 5% of portfolio reasonable worths vs. 1 business valued at $9.1 M, 1.1% of reasonable worth, at 12/31/22.

Since 9/30/23, the leading 2 tiers had 41 business, valued at $675.5 M, (86.3% of the financial obligation portfolio), vs. 51 business, valued at $755M, (88.5%), at 12/31/22.

Profits:

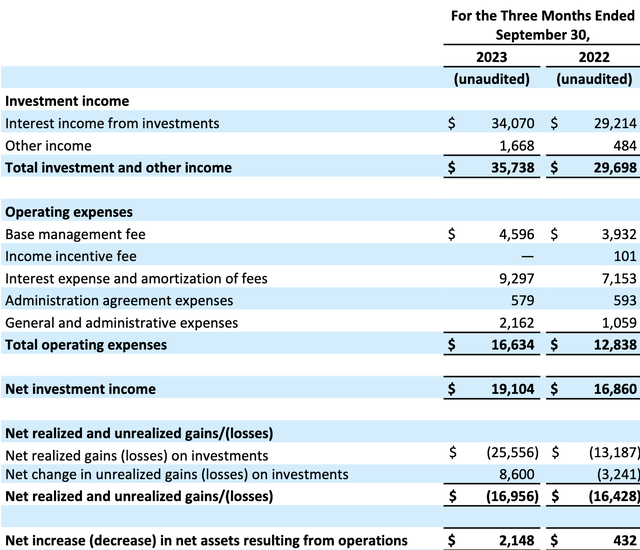

Q3 ’23: Overall financial investment earnings increased 20%, generally due to $4.8 M more in interest earnings. On the other side, interest expenditure increased just $2.1 M throughout the quarter, showing the advantage of greater rates of interest on TPVG’s portfolio.

Net financial investment earnings, NII, increased 13.3%, to $19.1 M.

Web understood losses were $25.56 M, mainly from the write-off of Hi.Q, Inc., which was ranked Red in TPVG’s ranking system, and gotten rid of from its portfolio. There was an $8.6 M modification in latent gains.

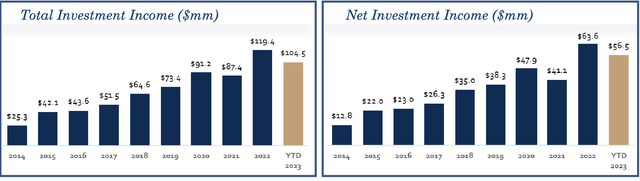

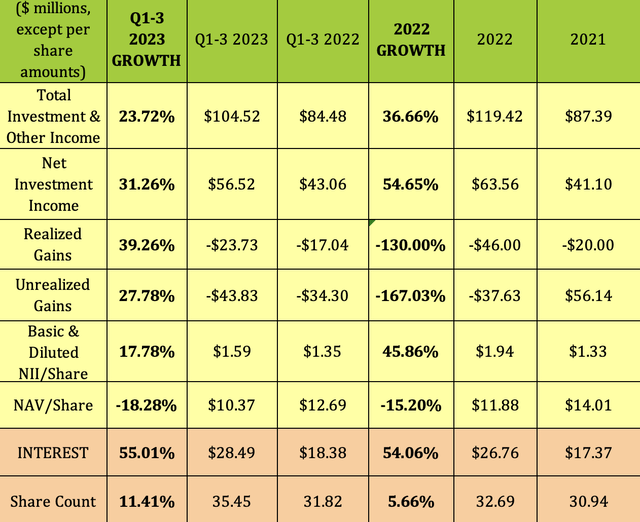

Q1-3 ’23: Overall financial investment earnings increased by $20M, up 23.7%, while NII increased 31.26%, up ~$ 13M. NII/share increased 17.8%, with the share count up by 11.4%. TPVG has an ATM stock program, which it utilized to raise $6.2 countless net earnings throughout Q3 ’23.

As kept in mind above, TPVG had $25.56 M in understood losses in Q3 ’23, which brought the Q1-3 overall to $23.73 M, up $6M vs. Q1-3 ’22.

NAV/share dropped 18.3%, to $10.37.

Concealed Dividend Stocks Plus

In addition to the $25.545 M in understood losses in Q3 ’23, TPVG likewise had 2 other products which impacted its portfolio worth – $20M in arranged amortization, and $52.2 M in prepayments. The ending portfolio worth was $870.18 M:

With 23.7% overall financial investment earnings development, and 31.26% NII development up until now in 2023, TPVG is on a speed to quickly exceed its 2022 full-year figures.

New Service:

TriplePoint Capital LLC signed $58.1 M in term sheets with endeavor development phase business in Q3 ’23, vs. $114M in Q2 ’23. TPVG closed $5.6 M in brand-new financial obligation dedications to 3 endeavor development phase business.

TPVG moneyed $12.7 M in financial obligation financial investments to 5 portfolio business with a 14.2% weighted typical annualized yield, and got $37.3 M in loan primary prepayments. There was a 15.1% weighted typical annualized portfolio yield on overall financial obligation financial investments in Q3 ’23.

Management continues to anticipate financings in the $25M to $50M variety in Q4 ’23, with $10M moneyed up until now this quarter.

Dividends:

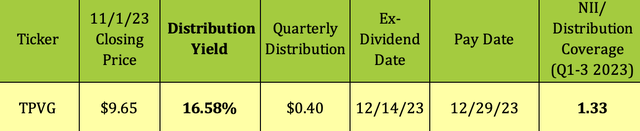

Management stated a 4th quarter circulation of $0.40/ share, payable on Dec. 29, 2023, which brings the overall stated circulations to $14.65/ share considering that its 2005 IPO.

When inquired about The $.40 quarterly dividend on the Q3 ’23 profits call the other day, CEO Jim Labe stated, “We still see $0.40 as a strong number moving forward, offered the totally scaled up portfolio and the yields that are being produced and the level of set rate utilize we have, we believe it bodes well for long-lasting protection.”

Concealed Dividend Stocks Plus

Certainly, Nii/dividend protection has actually been strong in 2022, at 1.25 X, and even more powerful in Q1-3 ’23, at 1.33 X, in the greater tier of BDC dividend protection.

Concealed Dividend Stocks Plus

Success and Utilize:

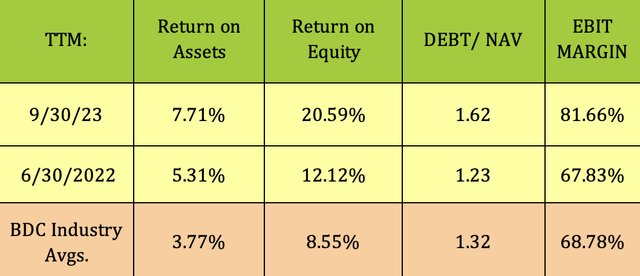

TPVG’s ROE leapt to a business record in Q3 ’23, increasing to more than 20.0%. ROA and EBIT margin likewise enhanced, and all 3 metrics are far above market averages.

Debt/NAV utilize enhanced a bit in Q3 ’23, decreasing from 1.67 X in Q2, 23 however still above the market average of 1.32 X.

Concealed Dividend Stocks Plus

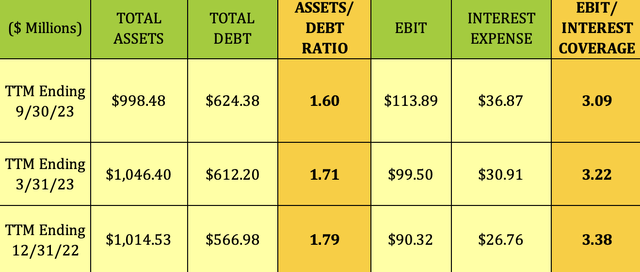

The asset/debt ratio slipped from 1.71 X to 1.6 X in the previous 6 months, as did the EBIT/interest protection element, which decreased a bit, from 3.22 X to 3.09 X.

Concealed Dividend Stocks Plus

Financial Obligation and Liquidity:

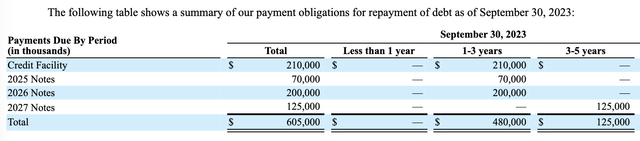

TPVG had overall liquidity of $262.5 M and overall unfunded dedications of $141.9 M, since 9/30/23.

TPVG’s financial obligation is consisted of a Credit Center, and Senior Notes. 79% of its financial obligation, $480M, including its credit center, grows in 1-3 years, with the $125M balance coming due in 3-5 years.

TPVG’s financial obligation is ranked BBB by Dun & & Bradstreet.

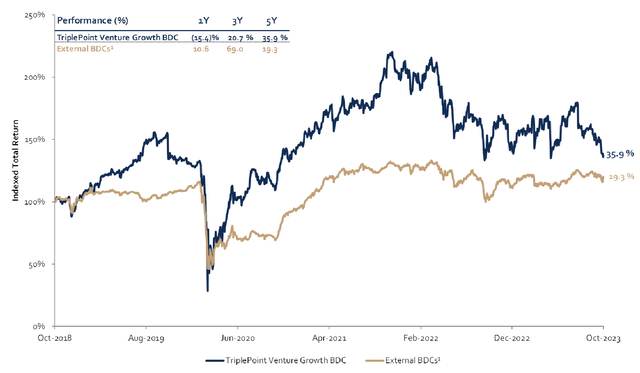

Efficiency:

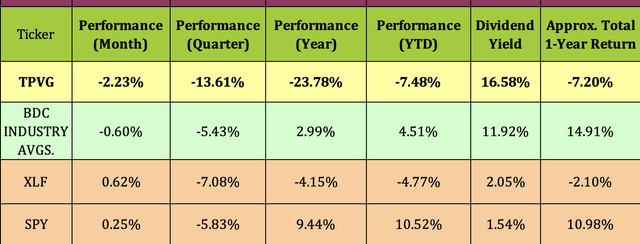

TPVG has actually had a bumpy ride of it up until now in 2023, falling -7.5%, and lagging the BDC market the broad Financial sector and the S&P 500. It has actually likewise routed over the previous month, quarter, and previous year.

Concealed Dividend Stocks Plus

Recalling even more in time, TPVG has actually surpassed externally handled BDC’s by a large margin over the previous 5 years, getting 35.9%, vs. 19.3%.

Expert Cost Targets:

At its 11/1/23 $9.65 closing rate, TPVG 12.27% listed below Wall Street experts’ typical rate target of $11.00.

Concealed Dividend Stocks Plus

Evaluations:

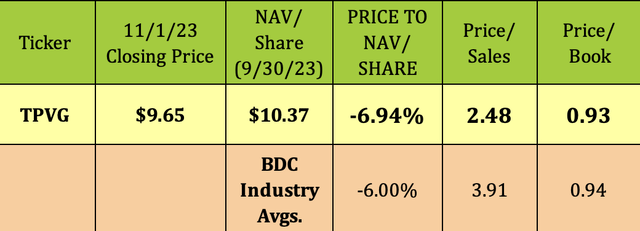

At $9.65, TPVG is costing a 6.94% discount rate to its 9/30/23 NAV/share of $10.37, vs. the market typical discount rate of 6%. It likewise has a lower P/sales of 2.48 X.

Concealed Dividend Stocks Plus

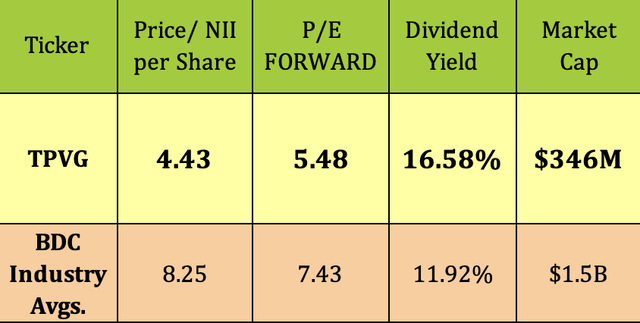

Nevertheless, TPVG’s profits multiples are much lower than market averages – Its tracking price/NII is 4.43 X almost 50% more affordable than the market average; and its forward P/E is 5.48 X, ~ 25% lower than typical:

Concealed Dividend Stocks Plus

Parting Ideas:

A favorable outcome of tightening up credit in the VC world is that now companies are focusing more on money burn than development at all expenses. This enhanced discipline needs to lead to more powerful hidden business, and, consequently, enhanced results for V’s and BDCs.

BDCs have terms in their loan agreements which can help them in recuperating a few of the financial investment losses when a business’s financial resources turn lower. These frequently include restructuring/refinancing choices. So, although TPVG has actually an increased quantity of business in its most affordable 4 and 5 tiers, there can still be chances to recuperate those financial investments.

There’s a brief float of 6.95% vs. TPVG, and it’s only ~ 5.5% above its 52-week low. It looks extremely oversold on its long term stochastic chart.

While it’s proper that TPVG is having problems due to a hard general environment, something to keep in mind is that BDC threat direct exposure is much smaller sized than that of the VCs and equity funds which sponsor the underlying business.

The leading 2 tiers of held business in TPVG’s ranking system was quite steady, at 86.3% since 9/30/23, vs. 88.5%), at 12/31/22.

We rate TPVG a buy. This is a skilled management, which has actually been through different organization cycles, and has actually regularly produced worth for investors.

We plan to purchase brand-new shares of TPVG, which costing their most affordable rate level considering that the 2020 COVID pullback.

All tables provided by Hidden Dividend Stocks Plus, unless otherwise kept in mind