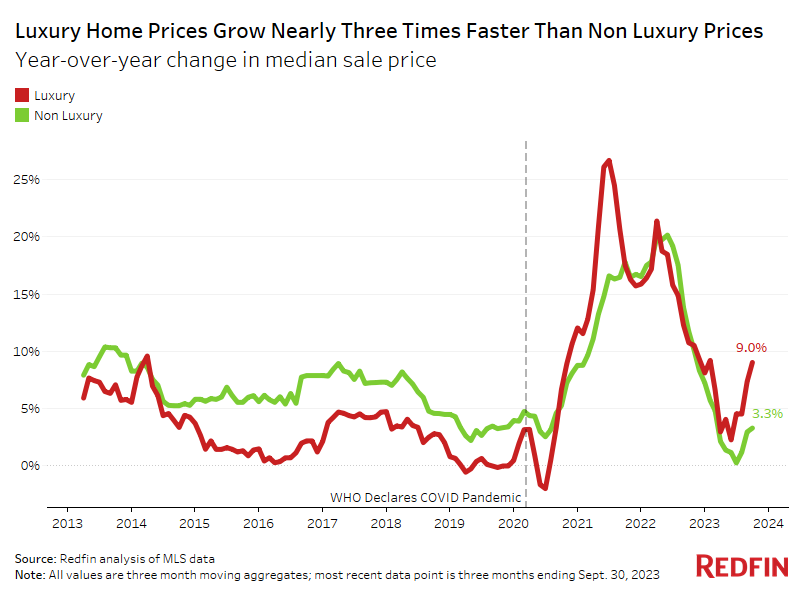

High-end home rates increased 9% to the greatest third-quarter level on record, growing almost 3 times faster than non high-end rates. High-end sales and listings likewise held up fairly well– a turnaround from in 2015– as an increasing share of high-end purchasers got away the discomfort of high home loan rates by paying in money.

The mean price of high-end U.S. homes increased 9% year over year to $1.1 million in the 3rd quarter, while the mean price of non high-end homes climbed up 3.3% to $340,000. Both were at the greatest level of any 3rd quarter on record.

This is according to an analysis that divided all U.S. houses into tiers based upon Redfin Price Quotes of the homes’ market price since Oct. 15, 2023. This report specifies high-end homes as those approximated to be in the leading 5% of their particular city location based upon market price, and non high-end homes as those approximated to be in the 35th-65th percentile based upon market price.

43% of High-end Home Purchases Are Spent For in Money, Up From 35% In 2015

” Rich property buyers have more tools to weather the storm of high home loan rates,” stated Redfin Senior citizen Vice President of Realty Operations Jason Aleem “A lot of them can pay for to pay in money, implying they’re leaving high home loan rates completely. Others are selecting to handle a greater rate and re-finance later on– a costly choice that isn’t practical for a great deal of lower-income customers. Wealthy Americans are still investing huge, in big part since of pandemic cost savings and durable real estate and stock worths.”

More than 2 in 5 (42.5%) high-end homes that offered in the 3rd quarter were acquired in money, up from simply over one-third (34.6%) a year previously. By contrast, simply 28% of non high-end homes that offered were purchased in money, little bit altered from the 3rd quarter of 2022.

” While numerous high-end purchasers have the resources to advance even when home loan rates rise, stubbornly high rates and home rates will likely press some upscale home hunters to the sidelines in the coming months,” stated Redfin Chief Financial expert Daryl Fairweather “ High expenses, together with the uptick in the variety of high-end homes for sale, might trigger high-end cost development to cool.”

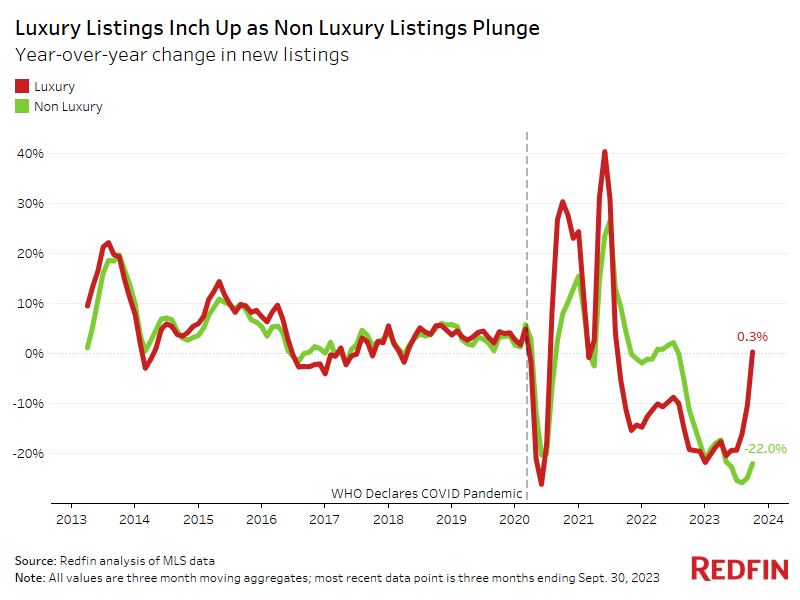

Real Estate Supply Is Up 3% in the High-end Market– And Down 21% in the Non High-end Market

The overall supply of high-end homes for sale (active listings) grew 2.9% from a year previously in the 3rd quarter, compared to a record 20.8% decrease in the supply of non high-end homes.

Likewise, high-end brand-new listings increased 0.3%, while non high-end brand-new listings fell 22%. Luxury brand-new listings were listed below pre-pandemic levels, however not by much. Non high-end brand-new listings, on the other hand, stood at the most affordable third-quarter level given that 2012.

This marks a turnaround from in 2015, when both real estate supply and sales were falling more greatly in the high-end market than in the non high-end market.

One factor high-end listings have actually held up fairly well is high-end property owners are less most likely to feel locked into their low home loan rate, either since they do not have a home loan at all or since they have the methods to move and handle a greater rate. Put another method, rich property owners have more versatility to transfer, which relaxes high-end real estate stock.

Another factor high-end listings are outshining is an boost in homebuilding. Recently constructed homes tend to be more costly, implying they frequently fall under the high-end tier. It deserves keeping in mind that structure might begin to slow since home loan rates are now hovering around 8%– the greatest level in more than twenty years– which is reducing property buyer need.

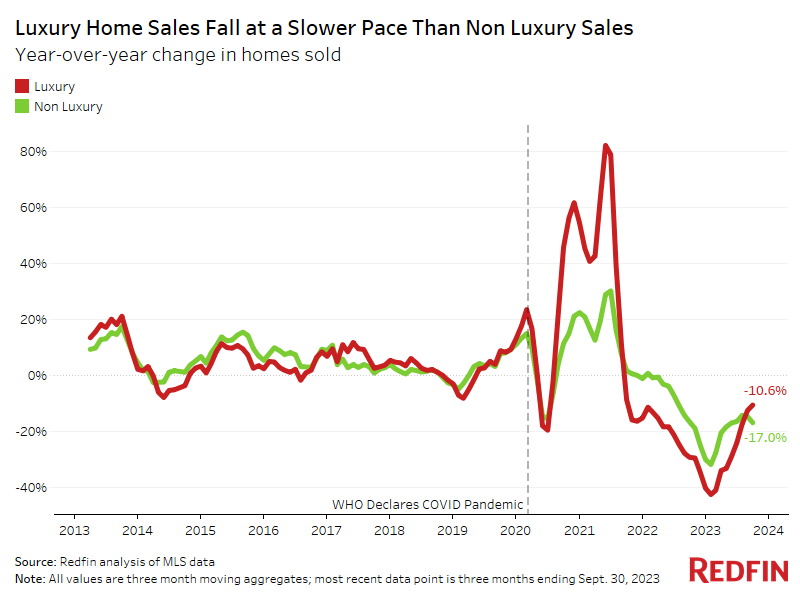

High-end Home Sales Are Falling, However Not as Quick as Non High-end Sales

High-end home sales decreased 10.6% year over year in the 3rd quarter, compared to a 17% drop in non high-end sales.

Home sales are still falling from a year ago throughout the board since home loan rates have actually climbed up a lot. However the decreases have actually alleviated– particularly for high-end sales. That stated, both high-end and non high-end home sales were at the most affordable third-quarter levels given that 2014.

High-end Home Sales Leap 36% in Tampa, Which Is Home to Numerous Money Purchasers

While high-end home sales were below a year previously in many locations, 14 significant U.S. cities saw boosts. In Tampa, FL, high-end sales rose 35.8% year over year in the 3rd quarter– the biggest boost in the nation. Next came Las Vegas (33.4%), Austin, TX (14.5%), Sacramento, CA (10.1%) and San Francisco (9.6%).

” It’s an appropriate time to be a money purchaser, and there are a great deal of money purchasers in Florida,” stated Redfin Tampa Sales Supervisor Eric Auciello “We’re still seeing numerous upscale home hunters relocate from the Northeast and West Coast since they desire lower taxes, various politics and/or to be closer to household. Tampa likewise has a lots of brand-new building and construction, a great deal of which is high-end condominiums.”

High-end brand-new listings in Tampa increased 13.9% year over year in the 3rd quarter, a bigger boost than every city however New york city.

Increasing flood insurance coverage expenses are most likely another factor Tampa’s high-end market is outshining its non high-end market, Auciello stated. Money purchasers aren’t needed to acquire flood insurance coverage. And for high-end purchasers who do get home mortgages, their high-end homes are frequently raised even more above the ocean and constructed more resiliently, which frequently makes them much easier to guarantee. In addition, upscale purchasers are most likely to be able to pay for increasing insurance coverage premiums.

Metro-Level High-end Market Emphasizes: Q3 2023

Redfin’s metro-level information consists of the 50 most populated U.S. cities, with the exception of Houston, which we got rid of due to an information concern. All modifications listed below are year-over-year modifications.

- Rates: The mean price of high-end homes increased most in New Brunswick, NJ (15.3%), Virginia Beach, VA (11%) and Baltimore (8.7%). It fell most in Austin, TX (-8.8%), Oakland, CA (-6%) and Seattle (-4.6%).

- Supply: Active listings of high-end homes increased most in Austin (46%), San Antonio (25.6%) and Nashville (22.9%). They fell most in Cincinnati (-19.4%), Chicago (-18.3%) and Newark, NJ (-16.6%).

- New listings: New listings of high-end homes increased most in New York City (17.1%), Tampa, FL (13.9%) and San Antonio (12.7%). They fell most in Atlanta (-19.8%), Newark (-18.4%) and Chicago (-17.2%).

- Home sales: High-end home sales increased most in Tampa (35.8%), Las Vegas (33.4%) and Austin (14.5%). They fell most in New york city (-33.5%), Philadelphia (-23.2%) and Baltimore (-23%).

10 The Majority Of Costly U.S. Home Sales: Q3 2023

- Aspen, CO: $76M

- Aspen, CO: $63.8 M

- Miami Beach, FL: $57M

- New York City, NY: $52M

- Palm Beach, FL: $50M

- Aspen, CO: $47.9 M

- Carpinteria, CA: $46.9 M

- New York City, NY: $40M

- Miami Beach, FL: $36M

- Coral Gables, FL: $36M

High-end Real Estate Market Summary by City Location: Q3 2023

| U.S. City Location | Typical List Price | Typical List Price, YoY Modification | Active Listings, YoY Modification | Brand-new Listings, YoY Modification | Residences Sold, YoY Modification | Typical Days On Market |

|---|---|---|---|---|---|---|

| Anaheim, CA | $ 3,900,000 | 2.6% | 0.1% | 5.1% | -5.5% | 41 |

| Atlanta, GA | $ 1,250,000 | 4.2% | -13.6% | -19.8% | -13.5% | 30 |

| Austin, TX | $ 1,778,000 | -8.8% | 46.0% | 9.9% | 14.5% | 69 |

| Baltimore, MD | $ 1,125,000 | 8.7% | -13.1% | -9.8% | -23.0% | 28 |

| Boston, MA | $ 2,250,000 | 2.3% | 6.4% | 5.2% | -12.9% | 26 |

| Charlotte, NC | $ 1,300,000 | 8.3% | 0.8% | 4.2% | -14.7% | 40 |

| Chicago, IL | $ 1,215,000 | 8.0% | -18.3% | -17.2% | -17.6% | 64 |

| Cincinnati, OH | $ 785,000 | 2.4% | -19.4% | -5.5% | -19.6% | 14 |

| Cleveland, OH | $ 713,500 | 6.3% | -1.8% | 3.3% | -18.7% | 22 |

| Columbus, OH | $ 850,000 | 5.1% | 1.3% | -3.0% | -10.0% | 40 |

| Dallas, TX | $ 1,375,000 | 2.0% | 13.0% | 6.9% | 3.4% | 37 |

| Denver, CO | $ 1,690,000 | 0.9% | 20.3% | 11.0% | -5.8% | 17 |

| Detroit, MI | $ 649,900 | 7.4% | -16.1% | -5.5% | -4.3% | 16 |

| Fort Lauderdale, FL | $ 1,600,000 | 4.9% | 3.2% | -14.2% | -16.2% | 84 |

| Fort Worth, TX | $ 1,077,500 | 0.2% | 11.4% | -7.2% | -7.6% | 44 |

| Indianapolis, IN | $ 830,000 | 6.3% | 8.1% | 9.0% | -5.1% | 16 |

| Jacksonville, FL | $ 1,295,000 | 3.6% | 4.6% | 2.2% | 1.9% | 42 |

| Kansas City, MO | $ 880,000 | 6.5% | 2.3% | -6.1% | -18.8% | 32 |

| Las Vegas, NV | $ 1,175,000 | -1.4% | -9.6% | -4.8% | 33.4% | 63 |

| Los Angeles, CA | $ 3,400,000 | -2.0% | 6.4% | -1.0% | -7.7% | 48 |

| Miami, FL | $ 2,850,000 | 1.8% | 7.0% | 8.3% | -10.7% | 125 |

| Milwaukee, WI | $ 915,000 | 8.4% | -9.0% | -9.4% | -22.5% | 57 |

| Minneapolis, MN | $ 1,000,000 | 2.6% | 9.9% | 4.8% | -6.0% | 22 |

| Montgomery County, PA | $ 1,283,100 | 6.9% | -13.5% | -13.1% | -19.7% | 21 |

| Nashville, TN | $ 1,700,000 | 6.3% | 22.9% | 4.6% | -7.6% | 66 |

| Nassau County, NY | $ 2,400,000 | 5.6% | 6.2% | 10.8% | -0.6% | 43 |

| New Brunswick, NJ | $ 1,850,000 | 15.3% | -11.3% | 4.4% | -20.4% | 39 |

| New York City, NY | $ 3,395,000 | 3.0% | 0.5% | 17.1% | -33.5% | 72 |

| Newark, NJ | $ 1,625,000 | 7.7% | -16.6% | -18.4% | -22.7% | 16 |

| Oakland, CA | $ 2,750,000 | -6.0% | -9.0% | -1.3% | 4.1% | 13 |

| Orlando, FL | $ 1,170,000 | 6.4% | 2.4% | 0.6% | 1.4% | 25 |

| Philadelphia, PA | $ 993,000 | 2.4% | 2.4% | 1.2% | -23.2% | 40 |

| Phoenix, AZ | $ 1,577,500 | 0.2% | 1.3% | 2.6% | 9.5% | 59 |

| Pittsburgh, PA | $ 750,000 | 2.2% | 2.2% | 2.3% | -15.8% | 60 |

| Portland, OR | $ 1,317,700 | -0.6% | 7.1% | 2.4% | -6.9% | 23 |

| Providence, RI | $ 1,300,000 | 2.8% | -6.3% | -13.0% | -17.8% | 29 |

| Riverside, CA | $ 1,380,000 | 2.2% | -2.0% | -1.5% | -10.5% | 50 |

| Sacramento, CA | $ 1,500,000 | 0.0% | 8.2% | 8.9% | 10.1% | 35 |

| San Antonio, TX | $ 964,000 | 4.2% | 25.6% | 12.7% | -16.1% | 47 |

| San Diego, CA | $ 3,250,000 | 2.8% | 7.0% | 1.4% | 2.0% | 33 |

| San Francisco, CA | $ 4,936,000 | -1.8% | 17.3% | 11.3% | 9.6% | 42 |

| San Jose, CA | $ 4,572,500 | 2.8% | -7.2% | -4.8% | 1.8% | 13 |

| Seattle, WA | $ 2,575,000 | -4.6% | -0.6% | -1.2% | 7.3% | 13 |

| St. Louis, MO | $ 847,500 | 8.0% | 0.6% | 4.6% | -1.3% | 12 |

| Tampa, FL | $ 1,306,500 | -3.2% | 22.5% | 13.9% | 35.8% | 23 |

| Virginia Beach, VA | $ 999,000 | 11.0% | -9.0% | -12.2% | -11.8% | 34 |

| Warren, MI | $ 846,000 | 5.5% | -7.9% | -4.0% | -15.1% | 24 |

| Washington, D.C. | $ 1,662,200 | 5.1% | 2.0% | -1.9% | -4.4% | 36 |

| West Palm Beach, FL | $ 2,917,000 | 8.0% | 18.9% | 5.4% | 6.5% | 83 |

| National– U.S.A. | $ 1,134,000 | 9.0% | 2.9% | 0.3% | -10.6% | 40 |

Non High-end Real Estate Market Summary by City Location: Q3 2023

| U.S. City Location | Typical List Price | Typical List Price, YoY Modification | Active Listings, YoY Modification | Brand-new Listings, YoY Modification | Residences Sold, YoY Modification | Typical Days On Market |

|---|---|---|---|---|---|---|

| Anaheim, CA | $ 1,010,000 | 4.3% | -28.9% | -20.9% | -9.1% | 26 |

| Atlanta, GA | $ 377,000 | 1.9% | -26.8% | -34.9% | -16.6% | 26 |

| Austin, TX | $ 457,900 | -10.0% | -10.4% | -24.0% | -13.1% | 54 |

| Baltimore, MD | $ 357,000 | 3.5% | -29.5% | -27.9% | -25.4% | 11 |

| Boston, MA | $ 677,000 | 4.2% | -30.5% | -25.0% | -27.5% | 19 |

| Charlotte, NC | $ 360,000 | 1.4% | -11.4% | -18.1% | -13.5% | 36 |

| Chicago, IL | $ 305,000 | 5.2% | -26.0% | -20.9% | -16.9% | 46 |

| Cincinnati, OH | $ 255,000 | 6.3% | -33.6% | -22.2% | -23.0% | 7 |

| Cleveland, OH | $ 205,000 | 6.8% | -25.0% | -21.6% | -17.8% | 11 |

| Columbus, OH | $ 298,800 | 6.7% | -19.6% | -20.2% | -18.2% | 34 |

| Dallas, TX | $ 390,000 | -3.0% | -9.2% | -15.6% | -9.5% | 32 |

| Denver, CO | $ 566,300 | -2.0% | -20.4% | -21.2% | -13.6% | 14 |

| Detroit, MI | $ 157,000 | 3.3% | -20.4% | -19.3% | -13.3% | 13 |

| Fort Lauderdale, FL | $ 410,000 | 6.0% | -5.9% | -11.8% | -9.1% | 43 |

| Fort Worth, TX | $ 325,000 | -3.7% | -9.4% | -20.7% | -8.9% | 31 |

| Indianapolis, IN | $ 265,000 | 4.5% | -20.0% | -24.4% | -25.2% | 9 |

| Jacksonville, FL | $ 352,500 | -0.4% | -13.6% | -25.7% | -0.5% | 44 |

| Kansas City, MO | $ 278,000 | 3.7% | -17.7% | -22.0% | -19.6% | 15 |

| Las Vegas, NV | $ 398,500 | -6.2% | -39.0% | -40.1% | -3.4% | 31 |

| Los Angeles, CA | $ 815,000 | 0.6% | -30.7% | -23.6% | -17.2% | 31 |

| Miami, FL | $ 480,000 | 8.8% | -15.7% | -17.4% | -12.5% | 43 |

| Milwaukee, WI | $ 290,000 | 8.6% | -24.3% | -14.5% | -25.9% | 36 |

| Minneapolis, MN | $ 360,000 | 1.4% | -17.7% | -17.0% | -14.0% | 16 |

| Montgomery County, PA | $ 450,000 | 7.1% | -20.0% | -16.3% | -22.7% | 12 |

| Nashville, TN | $ 430,000 | 0.4% | -7.9% | -21.4% | -12.5% | 44 |

| Nassau County, NY | $ 630,000 | 4.1% | -32.6% | -25.7% | -19.5% | 23 |

| New Brunswick, NJ | $ 511,000 | 9.2% | -34.7% | -27.0% | -23.4% | 23 |

| New York City, NY | $ 717,000 | 3.9% | -24.2% | -24.3% | -28.5% | 45 |

| Newark, NJ | $ 518,000 | 11.4% | -32.2% | -27.2% | -30.4% | 23 |

| Oakland, CA | $ 925,000 | -2.6% | -15.7% | -0.7% | -12.7% | 13 |

| Orlando, FL | $ 380,000 | 0.9% | -10.7% | -13.9% | -7.3% | 19 |

| Philadelphia, PA | $ 245,000 | 7.9% | -19.1% | -22.1% | -22.8% | 36 |

| Phoenix, AZ | $ 430,000 | -6.5% | -33.7% | -33.4% | -3.0% | 38 |

| Pittsburgh, PA | $ 200,000 | 4.2% | -24.7% | -23.8% | -20.4% | 47 |

| Portland, OR | $ 538,000 | -1.3% | -28.3% | -27.8% | -18.6% | 13 |

| Providence, RI | $ 445,000 | 8.5% | -31.6% | -26.2% | -21.2% | 20 |

| Riverside, CA | $ 550,000 | -0.9% | -31.4% | -28.0% | -19.7% | 33 |

| Sacramento, CA | $ 558,500 | -2.9% | -32.8% | -25.6% | -12.9% | 15 |

| San Antonio, TX | $ 294,500 | -0.2% | -7.8% | -20.7% | -20.8% | 44 |

| San Diego, CA | $ 855,000 | 2.4% | -37.1% | -27.9% | -14.3% | 13 |

| San Francisco, CA | $ 1,365,000 | -3.8% | -23.9% | -19.6% | -16.5% | 19 |

| San Jose, CA | $ 1,470,000 | 4.3% | -29.1% | -11.8% | -18.7% | 10 |

| Seattle, WA | $ 765,000 | -3.8% | -30.5% | -24.6% | -16.5% | 9 |

| St. Louis, MO | $ 230,000 | 5.0% | -16.0% | -15.5% | -20.1% | 10 |

| Tampa, FL | $ 368,000 | -0.5% | -17.4% | -21.3% | -4.4% | 19 |

| Virginia Beach, VA | $ 330,000 | 6.8% | -22.8% | -20.7% | -24.4% | 20 |

| Warren, MI | $ 285,000 | 3.6% | -23.7% | -19.3% | -19.4% | 13 |

| Washington, D.C. | $ 516,100 | 1.2% | -23.0% | -19.8% | -18.0% | 26 |

| West Palm Beach, FL | $ 445,000 | 6.0% | -11.2% | -19.2% | -7.4% | 51 |

| National– U.S.A. | $ 340,000 | 3.3% | -20.8% | -22.0% | -17.0% | 27 |