JHVEPhoto/iStock Editorial through Getty Images

Introduction

Shares of online travel and lodging business Expedia ( NASDAQ: EXPE) leapt over 16% in early trading on Friday, after pounding both Q3 earnings and revenues price quotes. The business likewise licensed a brand-new $5 billion share buyback on the top of its existing $1.8 billion share bought program.

Expedia saw strong total reservation metrics in the middle of strong need for international travel, with its accommodations gross reservations striking a brand-new high of $18.5 billion, an boost of 8% compared to the very same duration in 2022. This marks the greatest level of gross reservations for any 3rd quarter in the business’s history. Income likewise saw a considerable increase, reaching $3.9 billion, up by 9% from 2022, setting a record for the business’s quarterly efficiency.

The development in earnings from the business-to-consumer (B2C) sector especially sped up, exceeding in 2015’s figures by over 400 basis points. The business-to-business (B2B) section was especially strong, with earnings reaching a record $995 million, representing a considerable 26% boost from the previous year.

Earnings for the quarter was strong at $425 million. Changed earnings was a lot more outstanding, skyrocketing to a record $778 million for any quarter. The business’s changed EBITDA reached a turning point at $1.2 billion, which is not just a 13% boost from 2022 however likewise shows a margin growth of 110 basis points.

Record-Low Appraisal

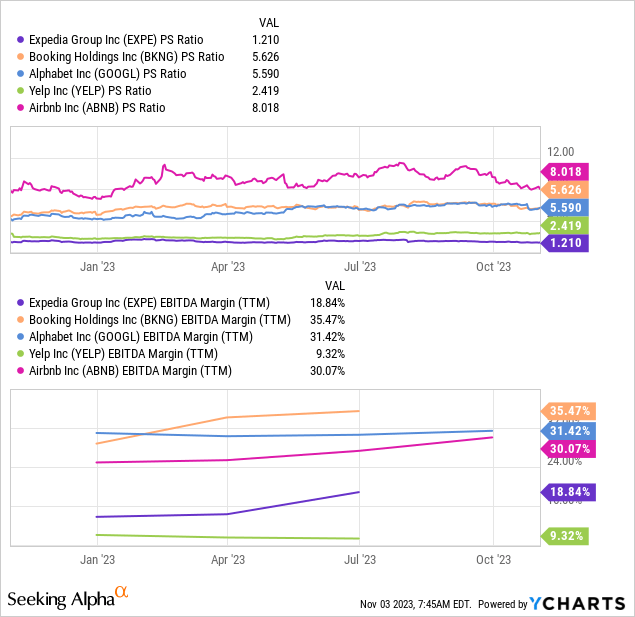

Expedia has actually had a hard time to successfully take on market leader Reservation Holdings ( BKNG), which owns the popular scheduling platform Booking.com. In this regard, Expedia’s marketing effectiveness tracks considerably behind Reservation, which is plainly shown in its total lower margins and failure to scale successfully. Therefore, Expedia’s EBITDA margin (TTM) presently stands at simply listed below 20%, compared to Reservation, which boasted EBITDA margins of over 30% even at a much smaller sized scale. Furthermore, Reservation likewise holds greater development rates, with earnings growing 21% in Q3.

Nonetheless, Expedia is growing its total EBITDA margin at a greater rate, as Reservation has little space delegated even more scale. In this regard, Reservation’s EBITDA margin fell from almost 40% pre-pandemic levels to around 35%, due to greater marketing expenses in the middle of increased competitors for personal lodging such as from Airbnb ( ABNB). Expedia, on the other hand, continues to increase its margins, growing from 17% to over 20%. In the revenues call, management specified that due to strong earnings efficiency and expenditure control, with expenditures total growing slower than earnings, it provided record EBITDA of $1.2 billion, which was up 13% with an EBITDA margin of nearly 31%. Its totally free capital stays healthy too, at $2.3 billion year-to-date.

While I think that Reservation is the more quality service in general, and likewise a buy at existing levels, the assessment disparity appears too big, offered Expedia’s constant margin growth. In this regard, Expedia trades at simply 1.2 times Cost to Sales (P/S) and at a forward Cost to Incomes (P/E) ratio of 10, compared to Reservation, trading at 5.6 times P/S and 20 times forward P/E.

Most significantly, nevertheless, stays the reality that Expedia’s balance sheet stays strong, with liquidity of $7.6 billion, driven by unlimited money balances of $5.1 billion and an undrawn revolving credit line of $2.5 billion. From a financial obligation viewpoint, its financial obligation level stays at roughly $6.3 billion with a typical expense of capital at just 3.7%. Therefore, its gross utilize ratio has actually boiled down to 2.4 x. This permits versatility with regard to capital allotment, offered its enormous $5 billion share buyback, representing over 30% of Expedia’s existing market cap. To put this into viewpoint, this would be as if Apple ( AAPL) revealed a brand-new $840 billion share buyback.

Takeaways

Expedia continues to profit of the international travel healing, as evidenced by its outstanding third-quarter outcomes. The strong total travel need, especially throughout the summertime season, has actually boosted its efficiency throughout all sections.

Nonetheless, the outlook for international travel stays unpredictable, with prospective earnings deceleration as customers diminish their pandemic cost savings and seek to minimize travel. Economic unpredictabilities and the risk of another pandemic posture considerable dangers to the travel sector and Expedia, in specific. Nonetheless, if Expedia keeps its strong execution and leverages its aggressive share buyback program, there’s space for share rates to increase regardless of near-term obstacles.