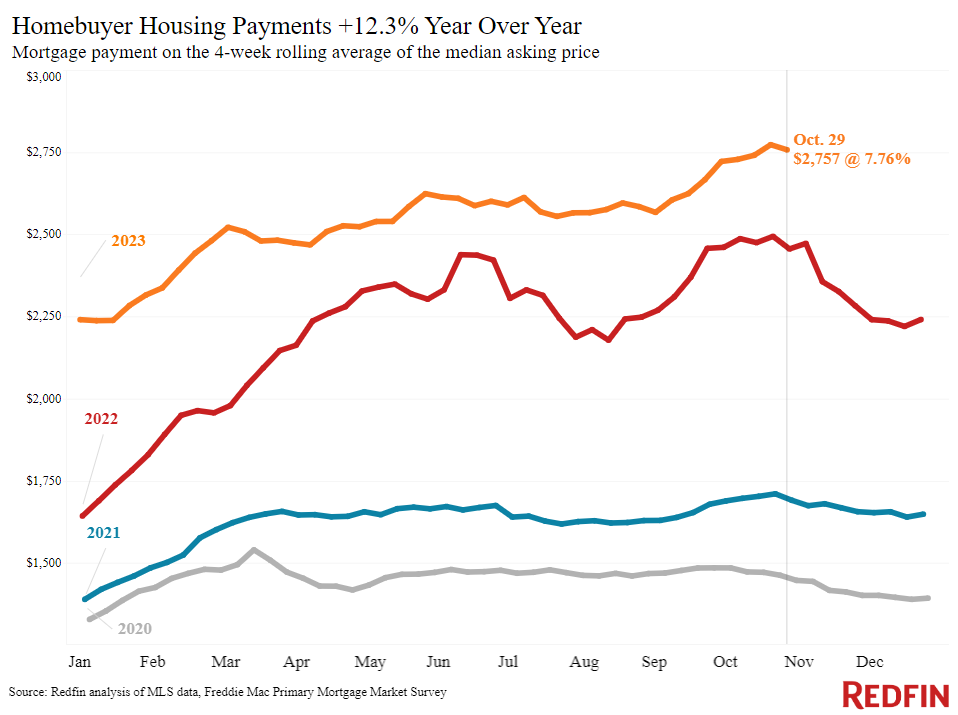

Budget plans are getting some relief today, with everyday average rates dropping significantly from 8% to 7.5% over the recently.

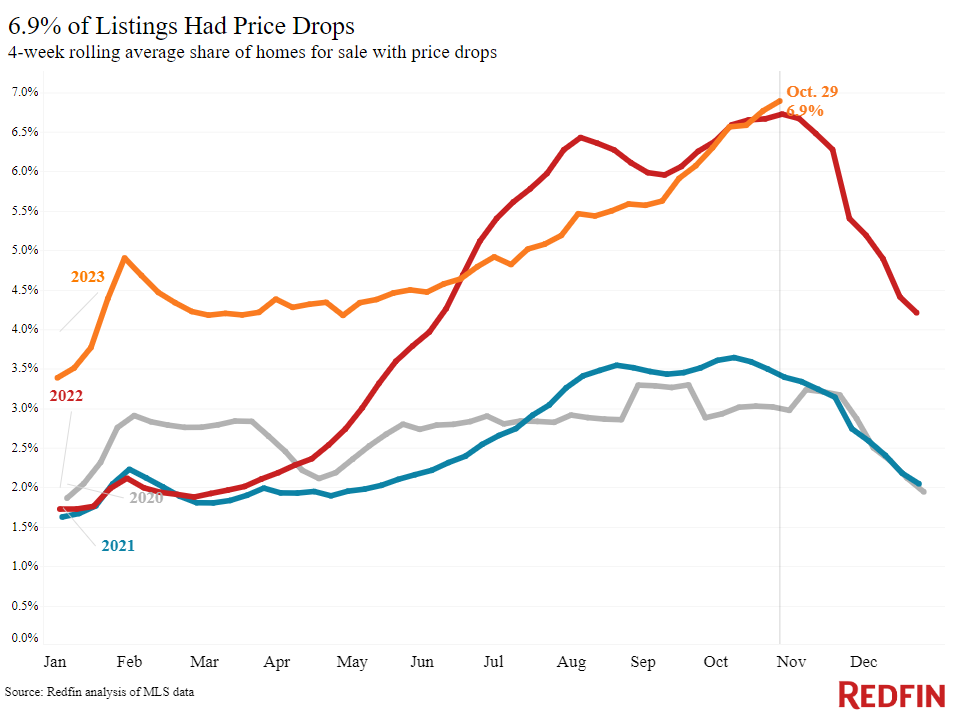

Almost 7% of for-sale homes published a cost drop throughout the 4 weeks ending October 29, usually, the greatest part on record. The record comes as home loan rates hover at raised levels, striking their greatest level in 23 years recently and cutting deep into purchasers’ budget plans. High rates have actually required some sellers to reduce their asking cost to offset high rates of interest on regular monthly payments. It deserves keeping in mind that purchasers are getting a little bit of relief today, a minimum of briefly: Financial occasions sent out everyday typical home loan rates from 8% to 7.5% over the recently.

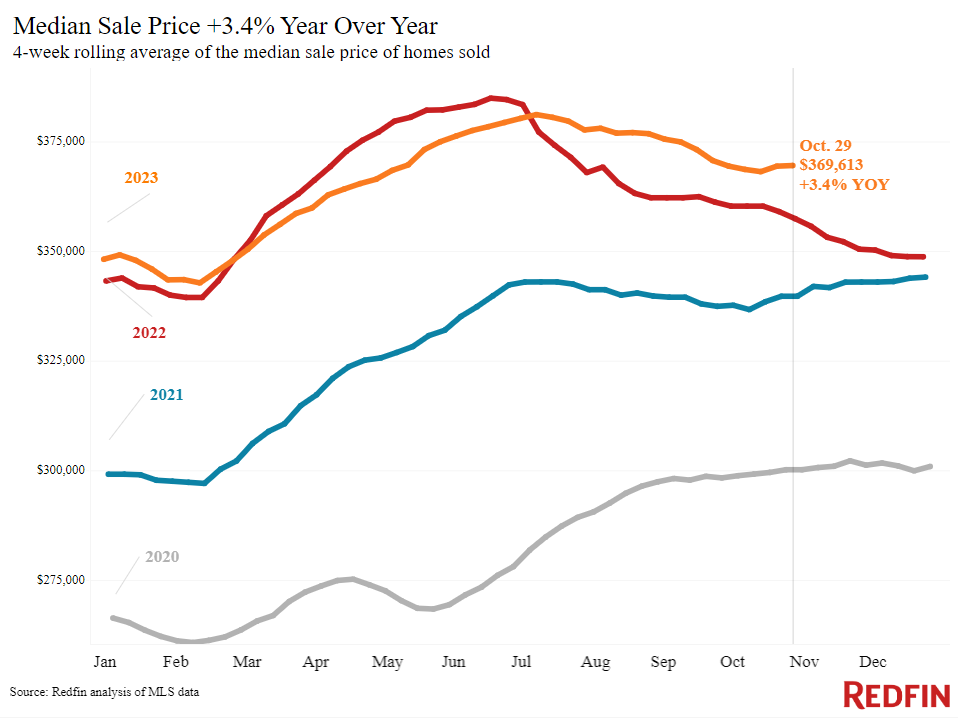

Price are still up 3% from a year earlier. That’s partially due to the fact that sale-price information is a delayed sign, showing offers that went under agreement a month or more earlier. Development in price might slow in the coming months as it begins to show sales that went under agreement as home loan rates struck 8% in October.

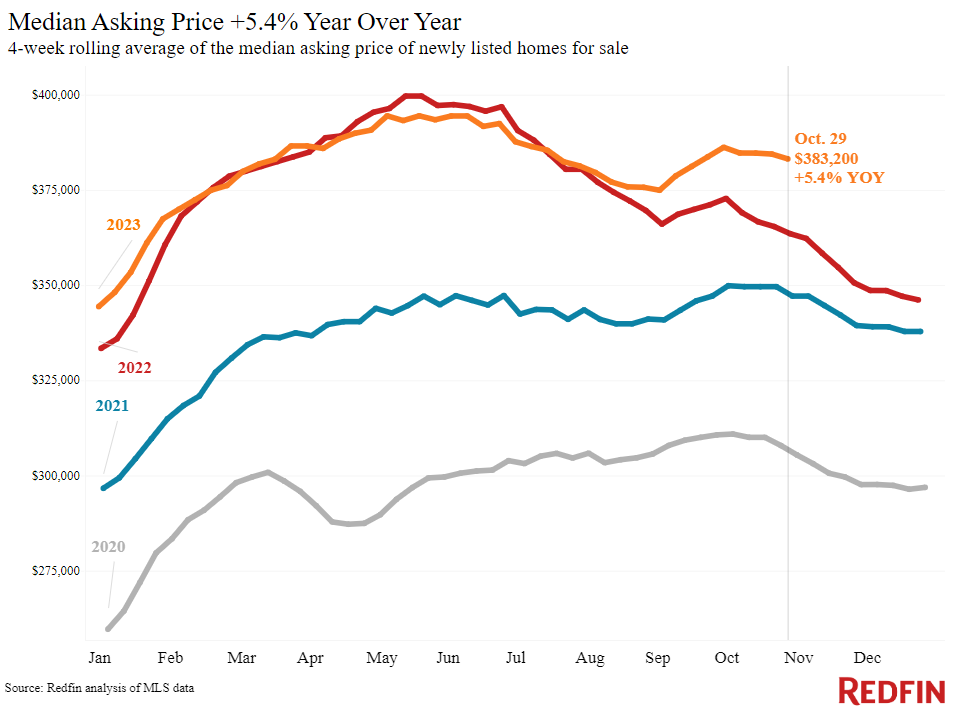

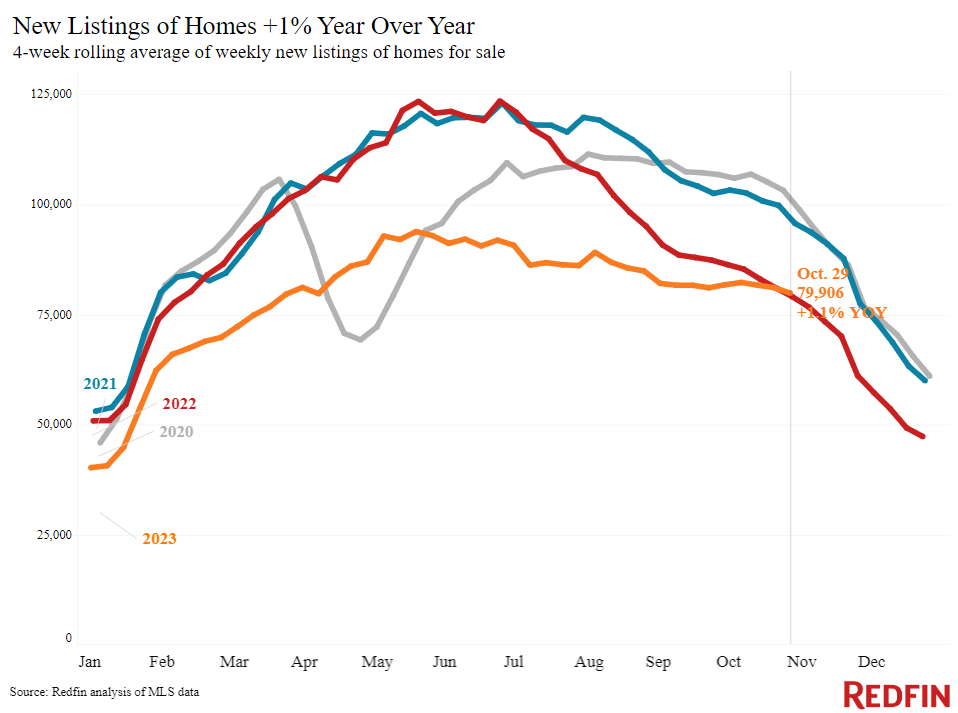

Another factor for increasing price is that in spite of sluggish need, low stock is propping up rates. The overall variety of homes for sale is down 10% year over year; brand-new listings are up 1% from a year earlier– simply the 2nd boost considering that July 2022– however that’s partially due to brand-new listings falling rapidly at this time in 2015. Cost drops ending up being more widespread than ever while rates continue increasing shows today’s strange real estate market. Redfin representatives explain an inequality in between sellers’ high expectations and the truth of purchasers’ budget plans, stating it’s more vital than ever for sellers to cost relatively from the start to bring in purchasers and offer rapidly.

” Some sellers are pricing expensive due to the fact that they have FOMO after their next-door neighbor’s home offered well over asking cost 2 years earlier,” stated Seattle Redfin Premier representative Patrick Beringer “While low stock is driving some competitors and reasonably budget-friendly homes in popular communities are still offering quick, they’re getting 2 or 3 deals rather than 20 deals at the height of the marketplace. With home loan rates in the 7.5% to 8% variety, purchasers just do not have the budget plan they would have had 2 years ago and even one year earlier.”

In the Seattle city, for example, the normal property buyer’s regular monthly home loan payment is $232 more than it would have been a year earlier. It’s almost $2,000 more than it would have been 2 years earlier.

| Seattle city location: Property buyer’s normal regular monthly home loan payments | |||

| Typical home loan rate (30-year repaired) | Mean home-sale cost | Common regular monthly home loan payment | |

| Late October 2021 | 3.14% | $ 723,000 | $ 3,218 |

| Late October 2022 | 7.08% | $ 762,000 | $ 4,863 |

| Late October 2023 | 7.76% | $ 774,500 | $ 5,095 |

Leading indications

| Indicators of homebuying need and activity | ||||

| Worth (if suitable) | Current modification | Year-over-year modification | Source | |

| Everyday typical 30-year set home loan rate | 7.51% (Nov. 2) | Down from 7.9% a week previously | Up from 7.09% | Home Loan News Daily |

| Weekly typical 30-year set home loan rate | 7.76% (week ending Nov. 2) | Down a little from 7.79% a week earlier; still near greatest level in 23 years | Up from 7.08% | Freddie Mac |

| Mortgage-purchase applications (seasonally changed) | Down 1% from a week previously (since week ending Oct. 27) | Down 22% to its most affordable level in almost thirty years | Home Loan Bankers Association | |

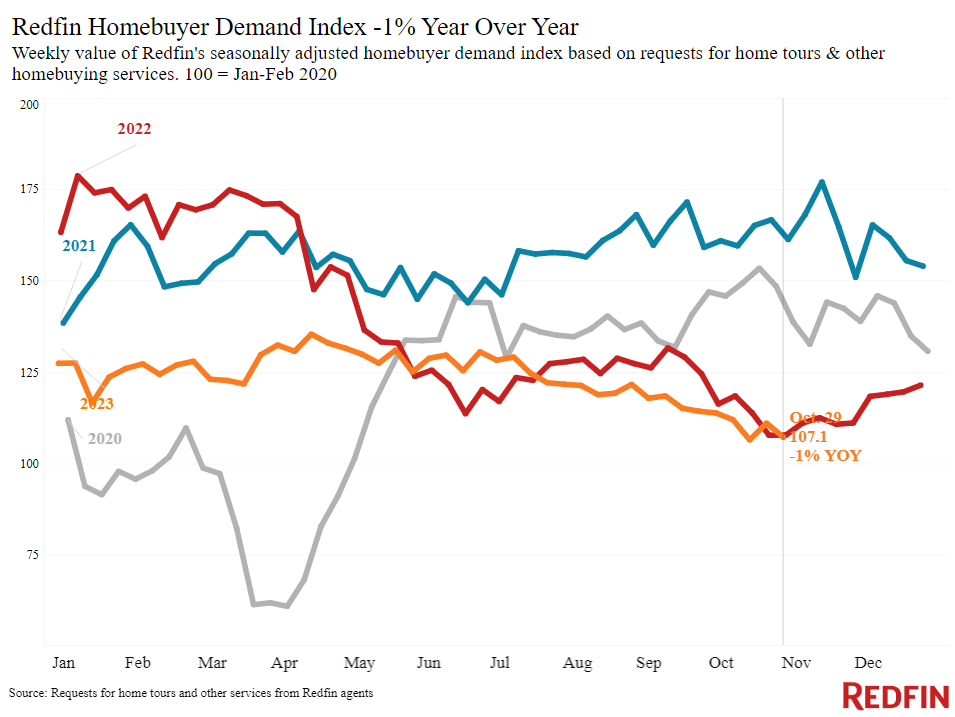

| Redfin Property Buyer Need Index (seasonally changed) | Down 6% from a month previously (since the week ending Oct. 29) | Down 1% | Redfin Property Buyer Need Index, a step of ask for trips and other homebuying services from Redfin representatives | |

| Google look for “home for sale” | Down 6% from a month previously (since Oct. 28) | Down 12% | Google Trends | |

| Exploring activity | Down 16% from the start of the year | At this time in 2015, it was down 27% from the start of 2022 | ShowingTime, a home visiting innovation business | |

Secret housing-market information

| U.S. highlights: 4 weeks ending October 29, 2023

Redfin’s nationwide metrics consist of information from 400+ U.S. city locations, and is based upon homes noted and/or offered throughout the duration. Weekly housing-market information returns through 2015. Topic to modification. |

|||

| 4 weeks ending October 29, 2023 | Year-over-year modification | Notes | |

| Mean price | $ 369,613 | 3.4% | Rates are up partially due to the fact that raised home loan rates were hindering rates throughout this time in 2015 |

| Mean asking cost | $ 383,200 | 5.4% | Most significant boost in a year |

| Mean regular monthly home loan payment | $ 2,757 at a 7.76% home loan rate | 12% | $ 16 shy of all-time high set a week previously |

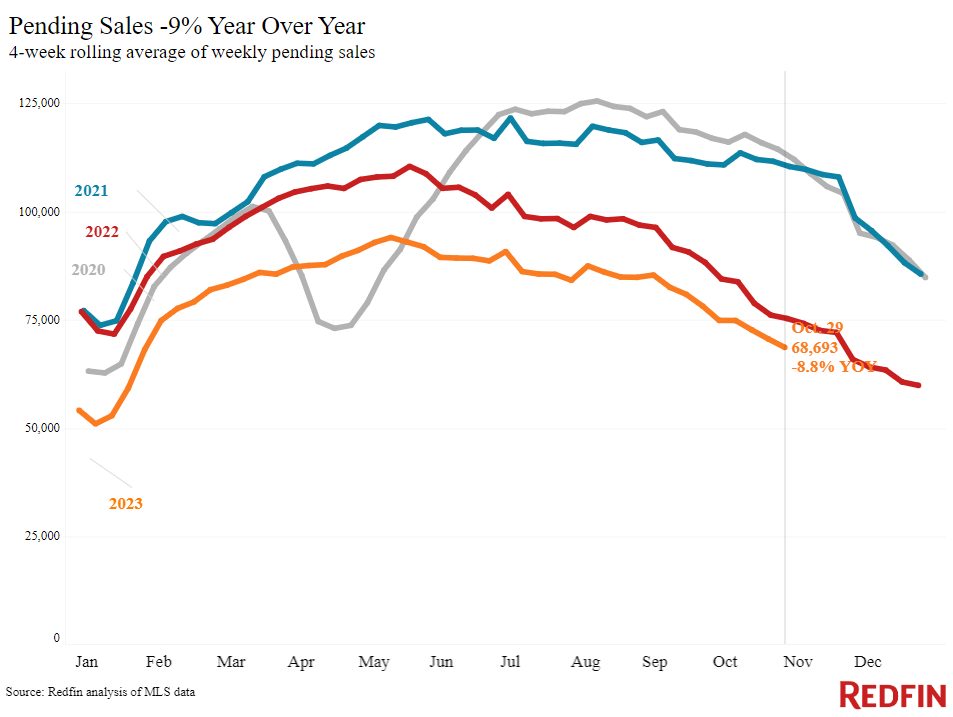

| Pending sales | 68,693 | -8.8% | |

| Brand-new listings | 79,906 | 1.1% | 2nd year-over-year boost considering that July 2022; the very first was a week previously. The boost is partially due to the fact that brand-new listings were falling at this time last year. |

| Active listings | 858,570 | -10.2% | Tiniest decrease considering that July |

| Months of supply | 3.7 months | +0.3 pts. | Greatest level considering that February

4 to 5 months of supply is thought about well balanced, with a lower number showing seller’s market conditions. |

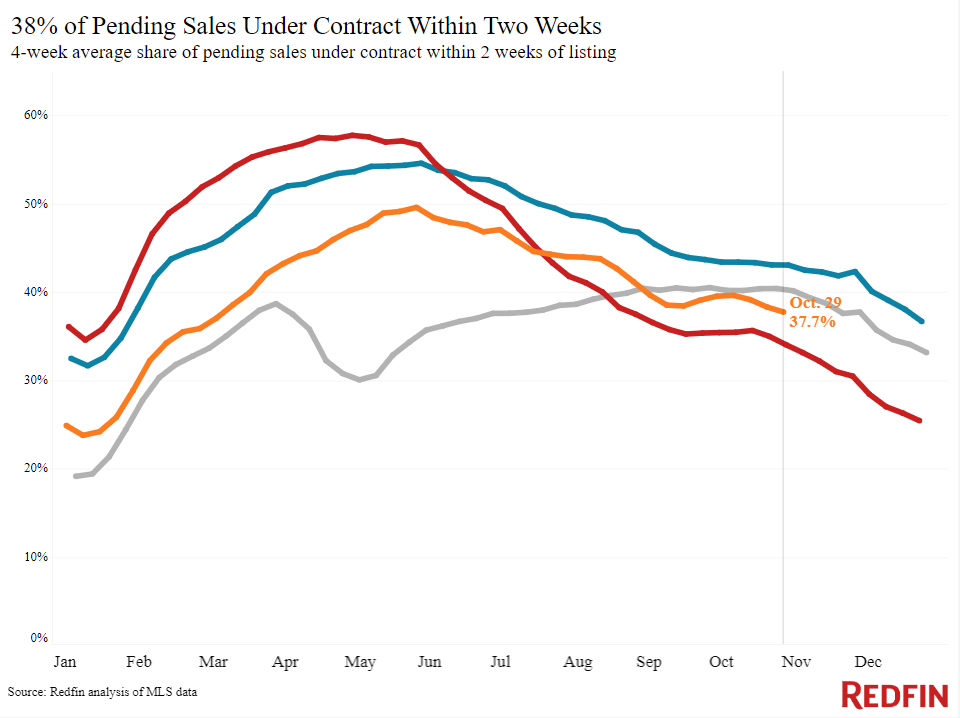

| Share of homes off market in 2 weeks | 37.7% | Up from 34% | |

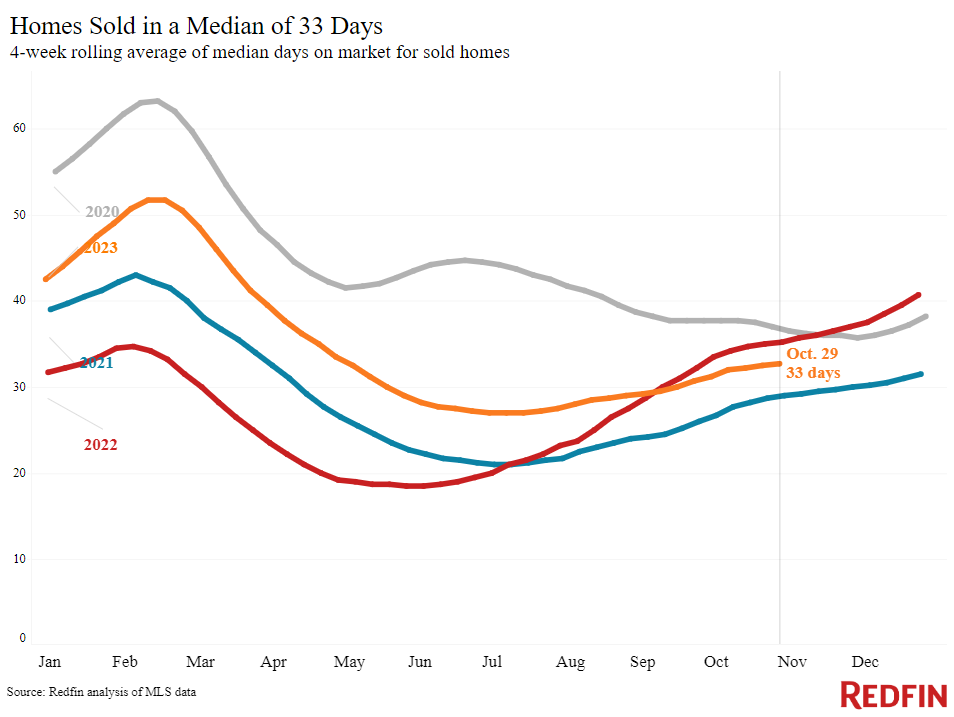

| Mean days on market | 33 | -2 days | |

| Share of homes offered above sale price | 29.4% | Up from 28% | |

| Share of homes with a cost drop | 6.9% | +0.2 pts. | Record high |

| Typical sale-to-list cost ratio | 99.1% | +0.4 pts. | |

| Metro-level highlights: 4 weeks ending October 29, 2023

Redfin’s metro-level information consists of the 50 most populated U.S. cities. Select cities might be omitted from time to time to make sure information precision. |

|||

| Metros with greatest year-over-year boosts | Metros with greatest year-over-year declines | Notes | |

| Mean price | Newark, NJ (14.8%)

San Jose, CA (13.6 ) Anaheim, CA (11.5%) West Palm Beach, FL (10.6%) Columbus, OH (10.3%) |

Austin, TX (-6%)

Fort Worth, TX (-3%) Tampa, FL (-1.8%) Portland, OR (-1.2%) San Antonio, TX (-1.1%) |

Decreased in 5 cities |

| Pending sales | Austin, TX (2%)

Tampa, FL (1.3%) Las Vegas (0.2%) |

Portland, OR (-23.5%)

Sacramento, CA (-21.6%) San Antonio, TX (-21.6%) Seattle (-18.1%) Newark, NJ (-16.4%) |

Decreased in all however 3 cities |

| New listings | Phoenix (13.9%)

San Jose, CA (12.7%) Miami (12.1%) Tampa, FL (10.7%) West Palm Beach, FL (10.6%) |

Atlanta (-22.5%)

Portland, OR (-14.7%) Seattle (-12%) Nashville, TN (-10.2%) San Antonio, TX (-9.8%) |

Increased in 16 cities |

Describe our metrics meaning page for descriptions of all the metrics utilized in this report.