naphtalina/iStock through Getty Images

Financial investment quick

The Federal Reserve’s choice to hold the policy rate at a 5 manage in its November FOMC conference is a possible bullish pivotal moment for United States equities over the coming 12– 18 months. Financiers have currently raised the quote on U.S. indices considering that Fed Chair Jerome Powell spoke today, with the S&P 500 index futures rallying some 70 points in the other day’s trade. The concentration of the benchmark indices is to be greatly factored, and the overweighting to tech might in fact show to be a positive crosscurrent for financier returns in the coming durations in my viewpoint.

Naturally, markets are not out of the woods right now. There is still a series of policy conferences in the coming months that might enforce more limiting conditions on the economy. In the meantime, nevertheless, Powell has actually kept in mind that the committee is carefully keeping track of financial information to make its choices.

The Committee looks for to accomplish optimum work and inflation at the rate of 2 percent over the longer run. In assistance of these objectives, the Committee chose to keep the target variety for the federal funds rate at 5-1/4 to 5-1/2 percent. The Committee will continue to examine extra details and its ramifications for financial policy.”

— Federal Reserve November FOMC Declaration

A prospective modification in threat hunger suggests high beta names are as soon as again appealing, which suggests possible allotment to development sectors such as tech and interaction services. The latter, in specific, has engaging risk-reward chances when watching out 1 to 3 years into the future based upon my analysis. For financiers looking for direct exposure to this thematic, The Lead Interaction Solutions ETF ( NYSEARCA: VOX) is one concern to think about.

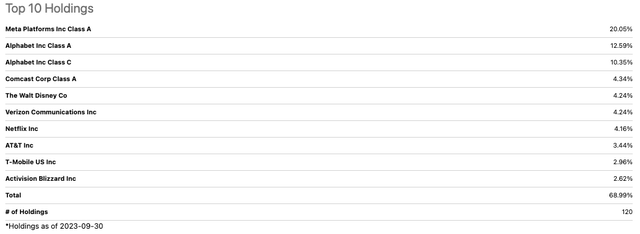

The fund provides focused direct exposure to ~ 120 holdings within the interaction and tech sector, although ~ 97% of the weight remains in interactions. Seriously the leading 10 holdings make up 69% of the portfolio’s weighting. It has $3.12 Bn in AUM and charges an expenditure ratio of 0.1% on this, with dividends of $1.12 in the TTM.

Figure 1.

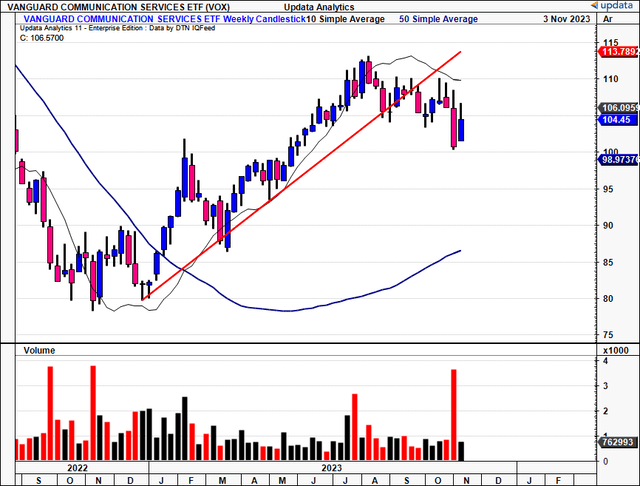

Like a lot of sectors and markets, the fund has actually crossed underneath its 200DMA, and 50DMA in the last couple of months, accompanying the turnaround in broad equities. Nevertheless, with a mix of (1) the Fed’s time out on rates, (2) current profits development in Q3 for the interaction services sector, (3) predicted development rates progressing, and (4) a possible end-of-year rally in equity markets, there is scope for VOX to continue intensifying wealth in the coming years in my viewpoint. They important threat is the sector’s (and VOX’s) beginning multiples, which might push returns in the coming 12-month duration.

Because vein, my suggestions for all 3 financial investment horizons are as follows:

Basic–

- Short-term (next 12 months)- Bullish; Beginning assessments are still high at 19.3 x profits. However these have actually boiled down substantially in current months, and there is a case to be produced this sector to trade at a premium provided the profits development and underlying basics within. Including on weak point and measuring positions with a turnaround rally towards completion of the year is promoted.

- Medium-term (1-3 years)- Bullish; Sales + profits development forecasts can be found in remarkably more powerful than anticipated for Q3, with interaction services blazing a trail in upside surprises and YoY development. This boosts potential customers for capital gratitude and multiples growth from 1 to 3 years ahead. Sharp pullbacks within the long-lasting pattern are engaging entry indicate enhance money-weighted returns.

- Long-lasting (3+ years) – Bullish – in the long run, the United States still provides the most engaging risk/reward calculus when thinking about the mix of basics, speed of development, and financial development projections. Continued allotment to instruments such as VOX is appealing based upon the efficiency of these elements. Allotment is for that reason called for over the long term.

Technical–

- Short-term (coming days to weeks): Bullish; current rally from 6-month lows has actually seen essential levels gotten with a possible regain of the August highs, which saw a triple leading development throughout August to September.

- Medium-term (coming weeks to months): Neutral; still waiting for verification on bullish signals and variety trade might be supported up until we take essential levels. Still has actually not regained formerly tried breakouts.

- Long-lasting (coming months): Neutral; associated to the above.

Net-net, I rate VOX a buy based upon the elements raised in this report.

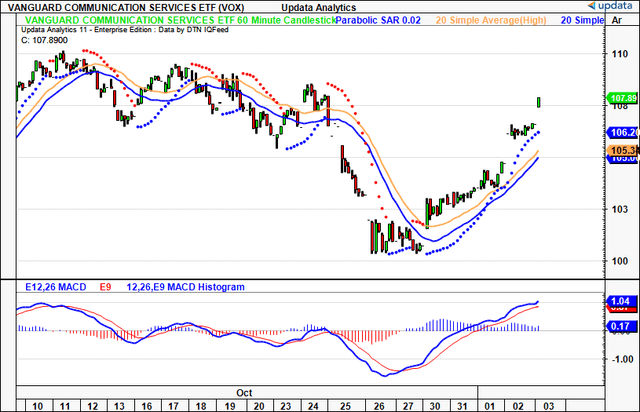

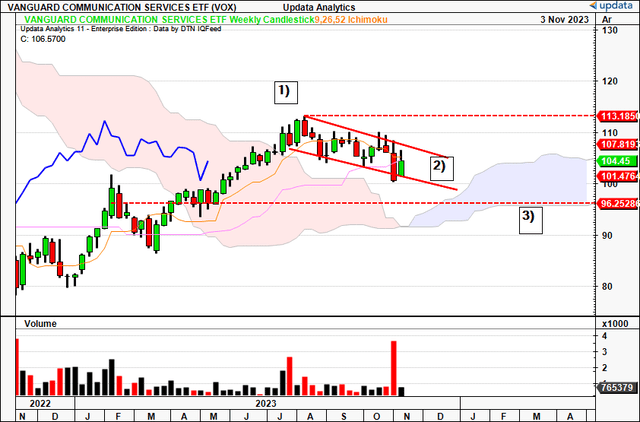

Figure 2. VOX trading in 3-month sag with bullish harami development forming, securing open of last week in October.

Talking points

- Additional tightening up off the table– in the meantime, a minimum of

The Fed’s choice to hold its policy rate stable today has actually been a short-term driver for equities in my view. This, integrated with stronger-than-expected profits development and forecasts. (gone over later on) have financiers well-positioned in the long account.

It appears that business are shooting on all cylinders coming out of the 3rd quarter, which does not always suggest a difficult landing situation in the U.S. However we should not get too ecstatic right now. There is scope that the time out in the treking cycle might enhance the size of Treasury auctions throughout all areas of the yield curve to money the federal government’s deficit. This might see the net result of pressing yields greater, and for that reason secure the advantage for stocks.

However, this is the 2nd choice where the Fed has actually picked to keep its policy rate within a 5-handle considering that July, around about the time when equity markets started to roll over. Still, Fed chair Jerome Powell did acknowledge in his speech that ” the procedure of getting inflation sustainably down, 2% has a long method to go”.

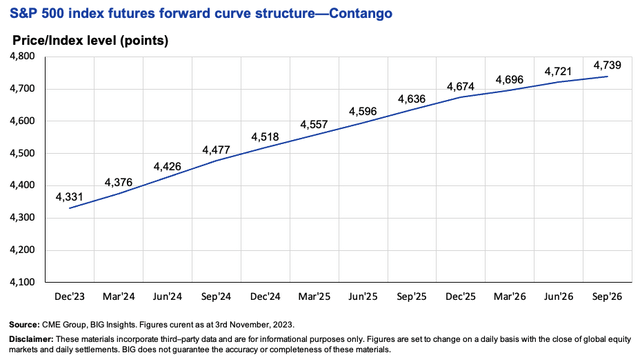

The expression “long method to go” ought to not be overlooked and definitely isn’t a signal of completion of the treking cycle. However what is clear is that markets have actually definitely marked down a more positive view of what organization might appear like moving forward. The yield on the United States 10-year has actually contracted ~ 50bps off its highs of 5%, and now trades around at a 4.5% manage, levels not seen considering that September. Second of all, the U.S. futures market stays positive on the development of domestic stocks. The forward curve of the S&P 500 index futures is still in a state of contango, suggesting market individuals are bullish on equity market gains (and the underlying basics driving them) out up until 2026.

Figure 3.

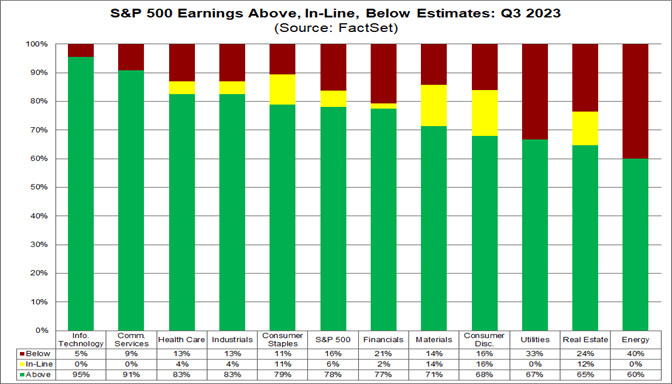

- Incomes efficiency + forecasts stay on point

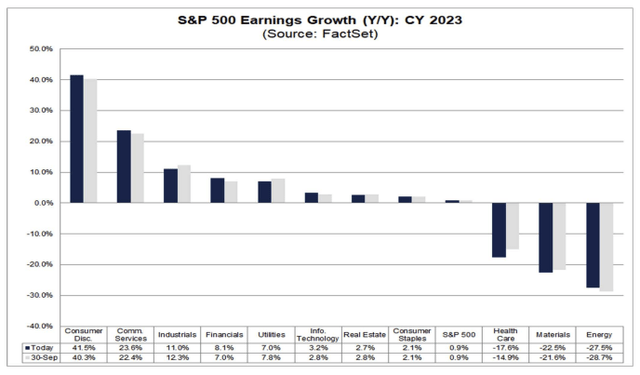

The outsized efficiency throughout sectors in Q3 profits can not be ignored either. Business not just shocked on both lines to the advantage by a big magnitude however are forecasting much better organization over the next 1– 2 years. Markets have actually properly discounted this belief into stock costs, reversing the U.S. criteria from the October lows.

Particularly, 8 out of 11 sectors reported year-over-year profits development, with interactions services blazing a trail. An overall of 73% of business reporting within the sector reported above income price quotes, and 91% reported profits above what Wall Street was anticipating. On a combined basis, FactSet reports ” the profits development rate for the Interaction Solutions sector increased to 42.2% from 32.2% over this duration”. Development was driven by essential names within the sector, consisting of Meta ( META), Alphabet ( GOOG), and Comcast ( CMCSA). Each are extremely weighted constituents within VOX, hence a favorable indication for financiers.

Figure 4.

Source: FactSet

Figure 4a.

This efficiency has actually led the crowd at Citi to keep its obese ranking on the interaction services sector as we roll into the 4th quarter. It has actually offered a comprehensive list of buy scores throughout large-cap names within the area. The approximated overall return displayed in Figure 5 varieties from 21% to 65% throughout the company’s leading choices. A variety of these names are held within VOX.

Figure 5.

Source: Citi, through Looking For Alpha

- Are premium multiples validated?

Coming 12 months’ returns for any financial investment class are greatly affected by beginning assessments. VOX trades at 19.3 x profits, ahead of the broad fund average ETF universe, and ahead of FactSet’s 13.2 x section average. The concern is what bearing this might have in forward returns over the next year.

For example, there are specific funds trading at analytical discount rates, such as those focused in Europe and energies, where the capacity for reversions or drawing in inflows is rather high.

Nevertheless, there is equivalent scope for those scores to be warranted, simply as there is scope for the interaction services sector to validate its premium multiples in my viewpoint. Offered what was gone over previously around Q3 profits development, and forecasts for sales and revenue development progressing, it is completely affordable that financiers are pricing in greater expectations for the sector relative to the non-US and nearby markets.

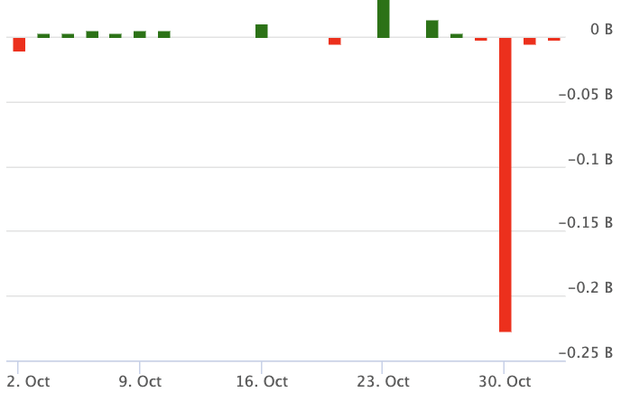

At 19x profits, this is likewise listed below the broad market and in line with 2018– 2019 levels, even as far back as what we saw in 2013, and 2014. Still, this wasn’t enough to keep financiers bought VOX at the end of Q3, with the fund understanding its biggest net outflow over the last 12 months, as seen in Figure 6. In summary, it appears that financiers are pricing another duration of outperformance for interaction services. This is supported by research study from FactSet that discovered, of the 11,270 scores on stocks in the S&P 500, 62% of interaction services sectors have purchase scores, in contrast to customer staples with 47%, for instance.

Figure 6. VOX fund streams, October ’22– October’ 23.

Technical factors to consider

1. Relating to momentum

We have actually undoubtedly triggered essential momentum levels rolling into November. On a per hour frame, we have actually seen 2 exceptional realities that indicate a duration of advantage in the coming days to weeks. One is the bullish cross of the MACD at the end of October, which reversed the pattern of the MACD.

Figure 7.

2nd, we had a cost space to the advantage leading into November, which retook the 2nd space below earlier in the month. 3, the parabolic SAR provided an early by signal last month also– together with the bullish cross of the MACD– and the rate line likewise crossed above the 20DMA’s of low and high. This substantiates the reality that VOX is setting greater highs and greater lows. On the day-to-day chart, we have yet to cross the MACD, however we are now checking the 20DMA of highs as I compose, so the coming weeks of trade are essential to assess where we may sit within the pattern.

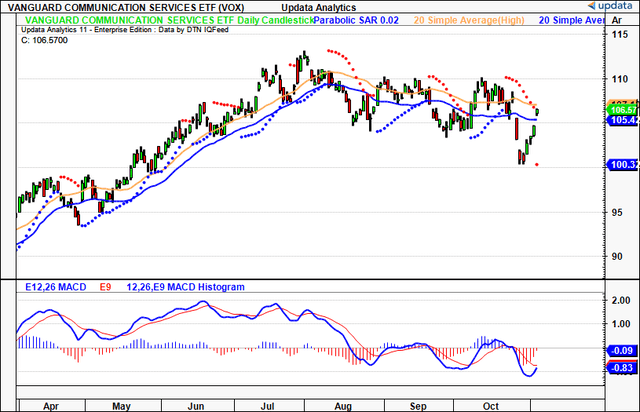

After backing and filling considering that July, the fund has actually done really bit in regards to directional predisposition, however held back the drawback rather well, thinking about the remainder of the market has actually carried out.

Figure 8.

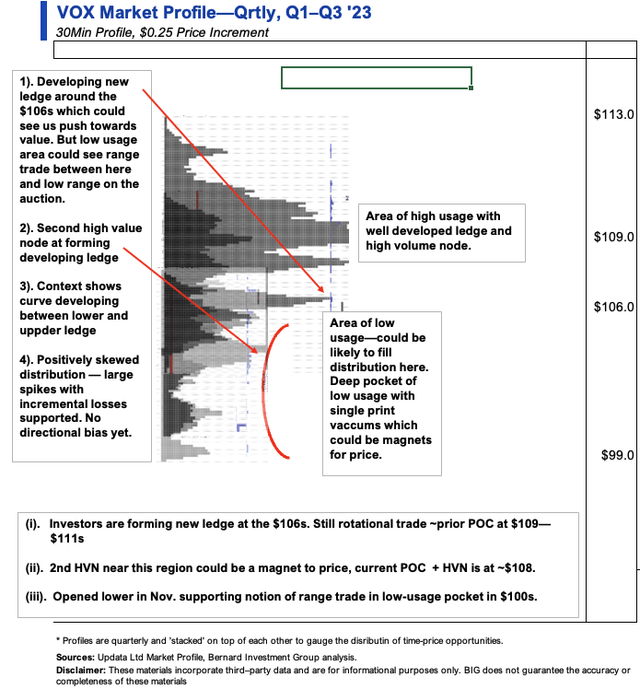

2. Alter, directional predisposition of rate circulation

- Observations: A complete circulation was finished in September, requiring a directional relocation. Offering historic context back to Q1, there was a clear pocket of low use from the $109s–$ 100s. This was the directional predisposition the fund would venture to. We opened October lower as anticipated and started to fill this low-usage location. Financiers have actually considering that started to form a ledge at the $106 area, with a 2nd high-value node forming a ledge in the $100 area (Figure 9). The context reveals a curve establishing in between the upper and lower ledges, with the unequaled lower ledge being filled as we speak. The reality this low use pocket is likewise being filled recommends that we might turn in between these levels in the coming months. The circulation is favorably manipulated, with big spikes forming the bell curve, sporting the concept of incremental rate motions with sharp, snapback rallies. Regrettably, the scope for directional trade is not yet supported.

- Secret levels: $109-$ 110 is the high-volume node and high-usage location serving as resistance. Longs listed below the $100s and from $100–$ 105 are supported with the current breakout. Matching ledge from $103–$ 105 might show to be strong locations of assistance.

- Actionable technique: Considered That (i) circulation is not finished, (ii) favorably manipulated information, and (iii) low use pockets, directional trade is not yet supported. Variety trade is rather in between the 2 worth locations. When the circulation is finished, I would be aiming to the advantage.

Figure 9.

3. Directional predisposition of patterns

There are blended signals over the horizons on the predisposition of patterns.

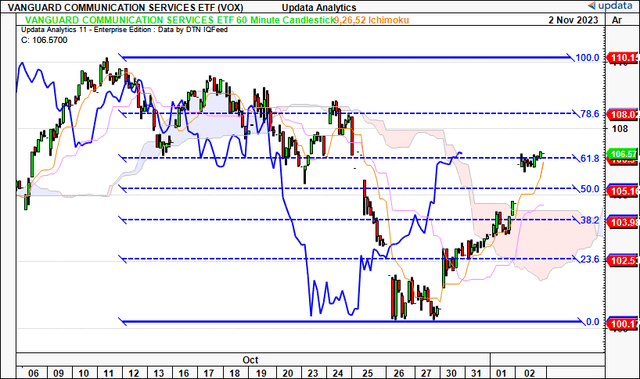

Figure 10 Short-term (60-minute chart, aiming to coming days)–

Observations + essential levels:

- Now bounced from October lows and tracking to previous highs.

- Bullish cross into cloud, backtracked 61.8% of the carry on the fibs.

- Presently checking this level, appears like a battle in between bulls + bears with series of tight closes after big advantage space.

- Secret levels are $108 on the advantage, then $110 at the previous high. On the drawback, $103–$ 105 are the 2 levels, which would break us back into the cloud.

- We are bullish on the short-term.

Figure 11. Medium-term (day-to-day chart, aiming to the coming weeks)–

Observations + essential levels:

- Drawing back to 4-month variety with most current turnaround, with A being the marubozu line that evaluated + stopped working in August.

- We have actually simply broken the marubozu line from October at C, and the next level would be $107 at B, representing the August marubozu line and cloud top by the end of November.

- Incredible selling volume in October has actually brought more supply on market and these were rapidly demolished as revealed by the intra-trend hammer today.

- We require a break above $107 to be bullish, and lagging line cross to support this.

Figure 12. Long-lasting (weekly chart, aiming to coming months)–

Observations + Secret levels:

- Have not broken sag that began at 1) yet however looking more useful. Bullish harami development forming with shadow closing above recently’s close.

- Lagging line within the cloud, requires a cross above the $107 mark in the coming weeks for a bullish view.

- Next level is $111 on the advantage, and we require to keep away from $96 which was an essential level from 2022.

- Neutral on this chart for the time being.

Conversation Summary

Simply put, interaction services is primed to rally provided the set of near-term drivers gone over in this report. Beyond that, the outlook for the sector stays strong in my viewpoint. Financiers have actually currently raised the quote on VOX considering that its 3-month debt consolidation after the Fed’s choice to stop briefly. Being a high-beta sector, any rally in the broad indices will inflect favorably on the fund. I would still be gotten ready for more variety trade from the $100–$ 110 area up until rate circulation finishes its bell curve from Q1– Q3, which we are approaching based upon my analysis. Later on, I would be aiming to the advantage. As a suggestion, the suggestions are:

Basic predisposition– Bullish throughout perpetuity frames.

Technical– Short-term bullish, require verifications on mid to long term.

Net-net, I rate VOX a buy on the conclusion of these elements.