Viktor Aheiev

In my most current Federal Reserve Watch post, I argued that the Federal Reserve a little altered positions in early April in action to the business bank failures it was needing to handle.

That modification, as I displayed in the post, altered a great deal of analytical series around that time and I continue to discover these modifications turning up in a growing number of various locations.

Today, I will talk about some modifications that have actually been shown just recently in the bond markets.

In impact, beginning in April there was a really guaranteed modification in the manner in which financiers appeared to see things.

Given that completion of March to the close of the marketplace on Friday, the yield on both the 5-year U.S. Treasury note and the 10-year U.S. Treasury note have actually increased by about 100 basis points.

The yield on the 5-year Treasury note has actually increased from about 3.6 percent to about 4.5 percent.

The yield on the 10-year Treasury note has actually increased from about 3.5 percent to about 4.5 percent.

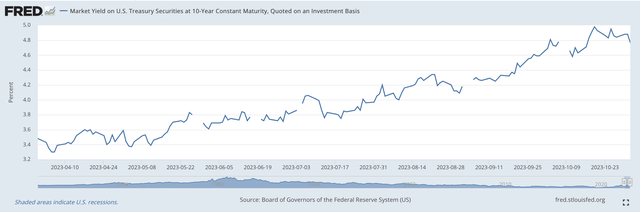

Here we see the motion in the yield on the 10-year U.S. Treasury note.

Yield on 10-year U.S. Treasury note ( Federal Reserve)

You can see that the increase from late March is rather consistent.

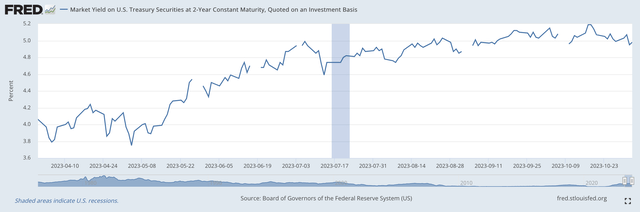

Next, we see the motion in the yield on the 5-year U.S. Treasury note.

Yield on 5-year U.S. Treasury note ( Federal Reserve)

The increase in this yield approximately follows the course of the yield on the 10-year.

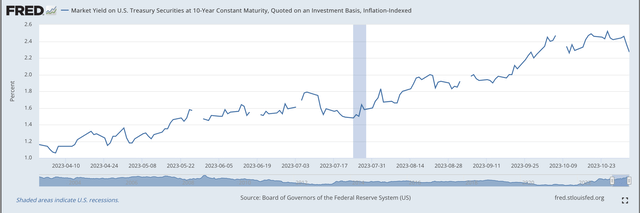

Now, what is intriguing is that the yield on the Treasury Inflation Protected securities (POINTERS), both the 5-year maturity and the 10-year maturity increased by approximately 100 basis points throughout this time duration also.

Yield on the 10-year U.S. Treasury Inflation Protected Securities ( Federal Reserve)

The chart for the yield on the 5-year Pointers was approximately the very same and I have actually selected not to provide it at this time.

So, what are we attempting to state here?

Well, it appears as if throughout this time duration, the yields on the 5-year U.S. Treasury notes and the yields on the 10-year U.S. Treasury notes increased … approximately … 100 basis points.

Throughout this very same period, the yields on the 5-year U.S. Treasury Inflation Secured notes and the yields on the 10-year U.S. Treasury Inflation Secured notes likewise increased by … approximately … 100 basis points.

Impressive.

Going a bit additional, we try to approximate the inflationary expectations financiers construct into market yields by deducting the yield on the Pointers security from the small yield on the note.

Therefore, if the small yield on the existing 10-year U.S. Treasury note is 4.5 percent and the yield on the 10-year U.S. Treasury Inflation Secured security is presently 2.1 percent, as they were at the marketplace close on November 3, 2023, then the inflationary expectations developed into the small yield is 2.4 percent.

When we compare this with the estimate for inflationary expectations developed into the end-of-March number, we discover that inflationary expectations are almost the like the existing number.

That is, over the previous 7 months, financiers have approximately the very same expectations for inflation now as they had at completion of March.

And, the inflationary expectations developed into the yield on the 5-year U.S. Treasury note have actually not altered over the previous 7 months, at the end of March.

Therefore, with all that has actually gone on in the U.S. economy and on the planet, financiers in the U.S. bond markets have actually not altered their outlook for inflation over the next 5-year duration and over the next 10-year duration.

That is, financiers anticipate that the substance inflation rate in the U.S. economy over the next 5- to ten-year duration will be approximately around 2.3 percent.

Note this is above the target level of inflation that the Federal Reserve is striving … however it is not “method over” the target level of inflation that the Federal Reserve is striving.

U.S. Economic Development

So what does this state about financiers’ view of the future of financial development?

Well, continuing the technique currently started, we develop the conclusion that the financial investment neighborhood appears to think that the U.S. economy will experience a substance rate of development over the next 5 years … and over the next 10 years … of about 2.2 percent.

Keep In Mind that I am discussing the substance rate of development over the next 5- to 10-years, and I am stating absolutely nothing about whether there will be several economic downturns over this time duration.

What the marketplaces appear to be informing us is that we can anticipate the economy will end the next 10 years at a level that can be attained by a 2.2 percent substance rate of development every year.

Not too worn-out.

Simply as an example, the U.S. economy grew by 2.3 percent annually from completion of the Great Economic downturn in 2009 to the start of the Covid-19 economic crisis in March 2020.

So, financiers in the bond market are stating that the next 10 years of financial development will not be too far various from the financial development that was attained in the 2010s.

And, with inflation remaining down around 2.2 percent annually over this time duration.

One additional note, the substance rate of inflation in the 2010s had to do with the very same level.

The Majority Of Intriguing

The most intriguing thing, nevertheless, that I obtain from these information is that over the previous 7 months, there has actually been a really impressive modification in the outlook bond market financiers have about the outlook for the economy.

At the end of March, right before the modification in the habits of the Federal Reserve, bond financiers were anticipating that the economy would grow at around a 1.2 percent to 1.3 percent rate of development over the next 5- to ten-years.

Mindsets altered in April and we now see that bond financiers are anticipating the economy to grow by about 100 basis points more over the next 5- to ten-years.

This is rather an impressive modification!

The bond market is stating that the Fed will bring inflation approximately to a level not far above its target rate of inflation.

And, the bond market is stating that the financial development to be attained over the next years will be around the level that was attained in the 2010s.

In General, excusable.

However, what a shift in financier beliefs. Financiers throughout the very first part of the year were seeing a really, really disappointing course for the U.S. economy.

Now, the course they see is excusable … not too various from what was experienced in the 2010s.

Intriguing …