International unpredictability continued to drive volatility in the lead market in 2023, with costs remaining yo-yoing throughout the year.

The commercial metal’s biggest application has actually generally remained in lead-acid batteries, while it is likewise a crucial product for pigments, weights, cable television sheathing and ammo.

The increase of lithium-ion battery-powered electrical lorries (EVs) as an option to the internal combustion engine is most likely to weigh on need for lead-acid batteries; nevertheless, EV producers are still using this battery type to power electrical systems consisting of lights, windows, navigation, air-conditioning and air bag sensing units. Lead-acid batteries in addition have a function to play in renewable resource storage systems.

Lead is generally mined as a spin-off of zinc, silver and to a lower degree, copper. Need modifications and mining disturbances for these metals can play an outsized function in forming the supply side of the lead market.

As 2024 methods, the Investing News Network is recalling at the primary patterns ahead area in 2023 and what’s ahead for costs, supply and need in the brand-new year. Continue reading to discover what professionals see coming.

How did lead carry out in 2023?

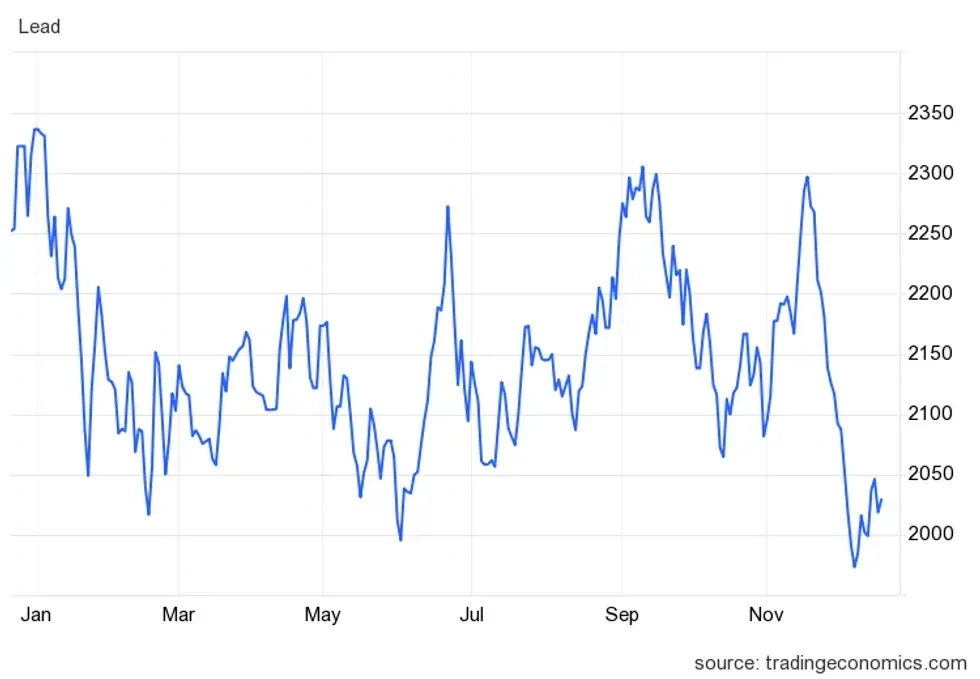

Beginning the year above the US$ 2,300 per metric heap (MT) level, the lead cost rapidly shed almost 11 percent in the very first 3 weeks of the year on weak need issues.

Lead increased to touch the US$ 2,300 level when again in June, which experts at Wood Mackenzie credited to the suspension of operations at Newmont’s (NYSE: NEM, TSX: NGT) Peñasquito polymetallic mine in an “currently tight” lead concentrate market. “Strong OE automobile figures were likewise encouraging on the need side of lead’s market basics. Nevertheless, the larger macroeconomic photo has actually been less robust just recently, especially in China,” mentioned the June report summary.

Although lead costs would evaluate the US$ 2,300 level once again in September, Peñasquito’s go back to production in October pressed costs pull back to around US$ 2,064 per MT. Verification of this reboot accompanied lead costs deteriorating especially relative to other LME costs, mentioned Wood Mackenzie

Lead costs slipped by almost 14 percent from the start of 2023 to their floor of the year at US$ 1,973 per MT on December 7.

Lead’s cost efficiency in 2023.

Chart through TradingEconomics

A December market report from the International Lead and Zinc Study Hall (ILZSG) reveals that in the very first 10 months of 2023, worldwide supply of lead went beyond that of need by 41 thousand tonnes. Worldwide lead mine production increased by 1.5 percent and lead metal production was up by 2.8 percent over the exact same duration in 2022, while intake of the metal increased by a simple 0.3 percent.

The January launch of production at Galena Mining’s (ASX: G1A) Abra lead-silver mine in Australia, keeps in mind the ILZSG, added to the increase in mine production. The very first significant lead-only mine to be brought into production given that 2005 has a yearly lead production capability of 95 thousand tonnes.

China, both the world’s biggest manufacturer and customer of the metal, increased its imports of lead focuses by 22 percent, with exports of refined lead metal growing by more than 64 percent compared to the very first 10 months of 2022. In ILZSG’s October 2023 projection, the group associated the development in Chinese need for lead to the 13.4 percent boost in lead-acid battery output over the very first 7 months of 2023.

What elements will move the lead market in 2024?

Heading into 2024, what supply and need elements are anticipated to drive costs for lead?

On the supply side, potential customers of mine growths and the possible reboot of operations in European smelters will be crucial elements to view,” Adrià Solanes, Partner Financial Expert at FocusEconomics, informed INN through e-mail.

The ILZSG projections that world mine supply will increase by 2.9 percent in 2024 to 4.71 million tonnes, compared to 3.3 percent development in 2023. Increased lead supply is seen coming out of Australia, the 2nd biggest lead producing nation, along with other leading manufacturers such as India and Russia.

Market individuals will likewise be watching on Peru’s federal elections in April 2024. The nation is the world’s 5 biggest lead manufacturer, and has a strong job pipeline. Nevertheless, political instability and continuous demonstrations versus mining jobs might have an unfavorable influence on mining financial investment in the nation, reports Mining Weekly

Brand-new sources of mine supply for lead in 2024 consist of Adriatic Metals’ (ASX: ADT, LSE: ADT1, OTCQX: ADMLF) Vares silver mine in Bosnia and Herzegovina, which is anticipated to start production in January, disallowing any more hold-ups.

Examining at worldwide refined lead supply, ILZSG sees a 2.3 percent boost to 13.14 million tonnes in 2024, compared to a 2.7 percent boost on the books for 2023 and a 1.7 percent decrease in 2022. The reboot of Trafigura’s Stolberg smelter in Germany is anticipated to add to increased refined lead supply for 2024.

As a spin-off metal, the worldwide supply of lead is likewise securely connected to zinc mine production. A too-low cost environment for zinc can trigger miners to reduce operations as the expense of production consumes into their margins. In 2023, zinc has actually been the second-worst carrying out metal on the LME after nickel due to an enormous supply overhang in the middle of stilted need.

With financial unpredictability still weighing on worldwide markets as we head into 2024, that supply imbalance is anticipated to stay. “Relating to the worldwide market balance, the Group prepares for that worldwide supply of refined zinc metal will go beyond need in both 2023 and 2024 with the degree of the surpluses anticipate at 248,000 tonnes and 367,000 tonnes respectively,” mentioned the ILZSG.

What about worldwide need for lead? “Demand-wise, much will depend upon the strength of the automobile sector, the health of China’s commercial sector and the speed of financial reducing in Western economies,” stated Financial expert Adrià Solanes.

Taking a look at the worldwide automobile market, an S&P Global Movement report reveals a forecasted boost of 8.9 percent in brand-new light lorry sales for 2023 over the previous year. Nevertheless, that figure in 2024 is set to drop to just a 2.8 percent boost in sales.

The increasing expense of living in numerous nations produced by growing inflation and greater rate of interest will still be front of center heading into 2024, which will no doubt hinder customer need for lorries.

” 2024 is anticipated to be another year of cagey healing, with the automobile market moving beyond clear supply-side threats, into a murkier macro-led need environment,” Colin Couchman, executive director of worldwide light lorry forecasting for S&P Global Movement, mentioned in the report.

As the biggest customer of lead, China’s financial health is certainly an aspect for financier factor to consider. The World Bank is forecasting 5.2 percent yearly development in 2023 for China, the world’s second biggest economy, and requiring slower development of 4.5 percent in 2024 and 4.3 percent in 2025. The weakest section of China’s market has actually been its residential or commercial property sector, with financial investment down 9.4 percent in 2023. Lead has a number of crucial applications in real estate and facilities building and construction.

Nevertheless, need for refined lead metal in China is anticipated to grow by 2.4 percent in 2024 after a forecasted 1.9 percent of need development in 2023, according to ILZSG information. That’s compared to a considerable decrease of 6.4 percent for 2023 in the United States with a healing of 3.1 percent projection for 2024. On an international scale, need for refined lead metal is set to increase by 2.2 percent in 2024, after a 1.1 percent boost in 2023. Need for lead is likewise anticipated to increase in India, Japan and Korea.

Regardless of these boosts in need, the ILZSG “prepares for that worldwide supply of refined lead metal will go beyond need by 35,000 tonnes in 2023. In 2024, a bigger surplus of 52,000 tonnes is anticipated.”

What other crucial patterns and drivers should financiers watch out for in the lead market in 2024? “Stimulus policies in China will be a crucial short-term driver of need for the metal. Prompt and significant assistance to the commercial and residential or commercial property sector would increase lead costs,” Solanes described.

In mid-2023, China’s National Advancement and Reform Commission revealed financial stimulus procedures to stimulate development in the automobile, residential or commercial property and durable goods sectors. Market individuals will be looking for any effect China’s financial stimulus procedures may have for the lead sector along with any extra procedures that might be on the horizon in 2024.

Over the longer-term, the shift far from nonrenewable fuel sources to renewable resource sources provides an opportunity of need in the lead market. “The primary hidden pattern to keep an eye on is the switch to green and electrical energy, as lead-acid batteries are extensively utilized to power both low-voltage and renewable resource systems,” included Solanes.

Do not forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Melissa Pistilli, hold no direct financial investment interest in any business discussed in this short article.

Editorial Disclosure: The Investing News Network does not ensure the precision or thoroughness of the details reported in the interviews it performs. The viewpoints revealed in these interviews do not show the viewpoints of the Investing News Network and do not make up financial investment suggestions. All readers are motivated to perform their own due diligence.

From Your Website Articles

Associated Articles Around the Web