Bruce Bennett

The present scenario in the Middle East in addition to current voluntary production restrictions on the part of significant OPEC+ members highly show that BP ( NYSE: BP) might be set, not for a record year in 2024, however for a strong year in regards to profits however. After the escalation of the Israel-Gaza dispute in October, Iran-backed Houthis have actually begun to assault shipping in the Red Sea and stress with Iran likewise jeopardized among the most crucial oil arteries worldwide: the Strait of Hormuz. Offered this background, I think oil business in basic might succeed in 2024 and if OPEC+ continues to support item rates throughout the year, BP might provide strong lead to 2024.

Previous ranking

Just relatively just recently, in September, did I happen and updated shares of BP to buy in the context of OPEC+’s voluntary supply restrictions. Shares of BP have actually decreased 12% considering that, generally due to falling petroleum rates. Saudi Arabia and Russia, 2 of the biggest oil-producing nations worldwide, chose to willingly restrict petroleum production: Saudi Arabia at the time reduced its production by 1M barrels a day and Russia revealed a 300 thousand barrel a day export decrease. Ever since, nevertheless, OPEC+ members accepted deepen production cuts and the security scenario in the Middle East has actually significantly degraded which I think will eventually increase BP’s profits capacity. OPEC+ cost actions particularly are a factor for me to double down on BP as the business is set from greater typical petroleum rates. BP is likewise among the least expensive production business in the large-cap energy sector, with a P/E ratio of 6.5 X.

Degrading Middle East security setup

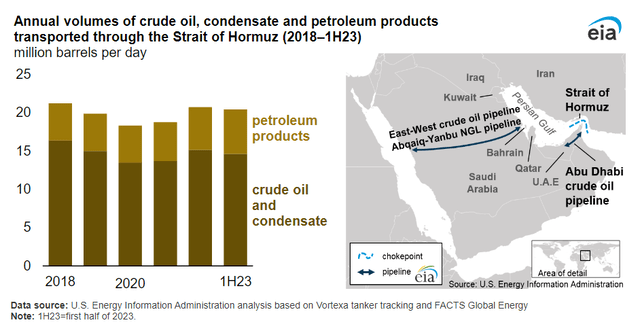

A lot has actually occurred considering that I last dealt with BP. Israel and Gaza are at war and Iran-backed Houthis are performing attacks on container ships in the Bab-el-Mandeb Strait and the Red Sea. Iran is likewise a hazard to worldwide oil products by bending its muscles in the Strait of Hormuz, the strait that links the Persian Gulf and the Gulf of Oman. The Strait of Hormuz is among the most crucial oil arteries worldwide and, according to the Energy Info Administration, the equivalent of 20% of worldwide petroleum liquids production travels through this strait.

EIA

Houthi attack s in the Red Sea intensified as the group as the biggest attacks on shipping on Tuesda y. Undoubtedly, intensifying stress in the Middle East, which is still among the world’s essential locations for petroleum production, is a prospective driver for greater item rates. A barrel of petroleum presently costs about $72.68 which offers energy business like BP with the prospective to grow their profits if rates stay high throughout 2024. The setup in the Middle East is at least beneficial to such a circumstance at the minute.

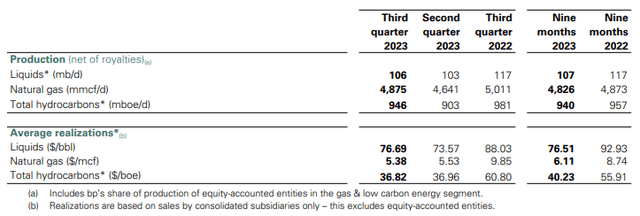

BP’s typical petroleum cost in the third-quarter, as an example, was $76.69 per barrel which revealed a decrease of 13% compared to the year-earlier duration. BP’s quarterly cost breakdown was launched at the end of October 2023 ( Source). Nevertheless, with stress in the Middle East increasing once again, there is a substantial opportunity for BP to take advantage of an uptick in rates also. In addition, OPEC+ members reached an contract in Q4 ’23 to deepen production cuts till completion of Q1′ 24. My expectation for 2024 is that these output cuts will be extended throughout the year with extra cost assistance procedures most likely must petroleum rates decrease.

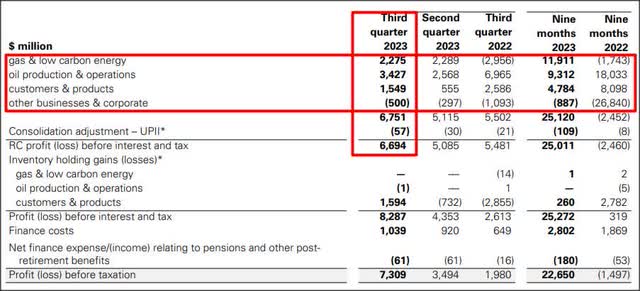

BP

BP’s organization pattern enhanced in the third-quarter of FY 2023 due to a small rebound in petroleum rates (the average petroleum cost increased 4% Q/Q in Q3′ 23). In overall, BP created $6.7 B in revenues (before interest and taxes) in the third-quarter, the bulk originating from its oil production and operations section ($ 3.4 B). Undoubtedly, BP is extensively rewarding at a ~$ 73-74 cost level which had to do with equivalent to the typical cost accomplished for its petroleum items in the second-quarter ($ 73.57). Throughout Q2′ 23, BP created more than $5.1 B in profits for its investors and the energy company has actually accomplished a typical quarterly revenue of $8.3 B in FY 2023 (up till September).

BP

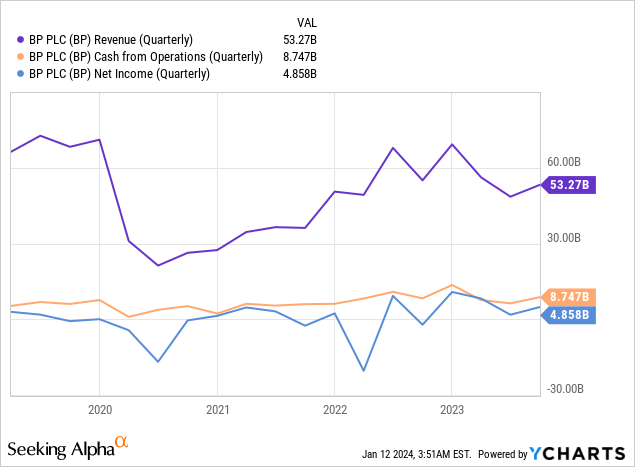

In the long term, BP’s profits, capital and profits have actually shown to be extremely unstable … which is a reflection of more comprehensive market characteristics. BP’s profits nose-dived throughout the pandemic, however they have actually considering that gradually recuperated. The next bearishness, nevertheless, might lead to yet another draw-down in BP’s profits and profits.

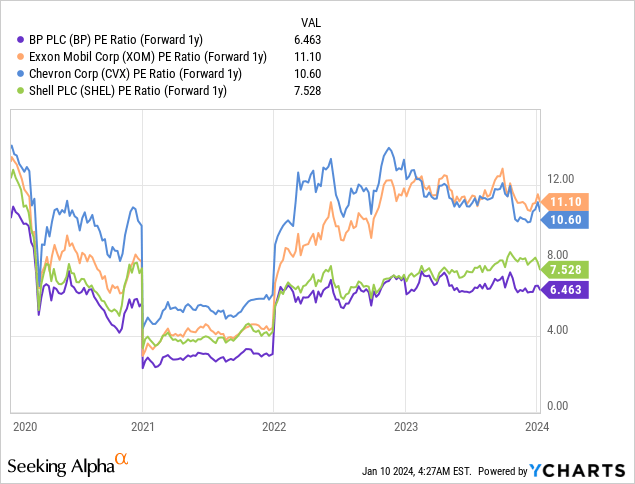

BP’s appraisal vs. U.S. competitors

BP appears to be trading at a genuinely inexpensive appraisal multiplier. With high rates for petroleum items increasing the energy sector’s profits, BP has actually seen a decrease in its P/E ratio. Nevertheless, even under factor to consider of cyclically-inflated EPS, BP is trading at an appealing price-to-earnings ratio of 6.5 X, in my viewpoint, and the British energy business is even more affordable than Shell ( SHEL) which has a 7.5 X P/E ratio. BP is forecasted, on a agreement basis, to make $5.35 per-share next year which underpins the appraisal and the company is anticipated to grow its profits ~ 5% yearly in the next 2 years.

ExxonMobil ( XOM) and Chevron ( CVX), to consist of the 2 greatest U.S. competitors in the market, trade at P/E ratios of 11.1 X and 10.6 X. I think BP might quickly trade at 8-9X FY 2024 profits offered its high level of quarterly success and presuming that petroleum rates stay high in FY 2024, which indicates a reasonable worth variety of $42-47. My multiplier variety (8-9X) and reasonable worth quote do not alter with short-term variations in petroleum rates. U.S. competitors likewise trade at greater appraisal ratios than BP, recommending that the company has revaluation capacity also.

BP may be underestimated relative to U.S. business due to their more powerful dividend records and aggressive stock buybacks which have actually supplied assistance for their share rates. U.S. business are likewise greatly purchased U.S. shale areas which, a minimum of in theory, provide the capacity for faster production development.

Threats with BP, Outlook 2024

Petroleum rates are unforeseeable and affected by world occasions such as terrorist attacks, wars, natural disasters and financial decreases. Present stress in the Middle East particularly have the prospective to result in a sharp uptick in petroleum rates if the security scenario even more degrades. On the other hand, a resolution of the Israel-Gaza dispute and particularly a less aggressive posture of Iran in the Strait of Hormuz might result in much lower petroleum rates and for that reason decreased profits capacity for BP.

As an outcome, BP’s particular item rates dangers equate into possibly depressed success throughout a down-turn in the energy market which then might waterfall into a slower speed of dividend development or a lower quantity of stock buybacks that support BP’s stock cost. Petroleum rates are clearly the greatest impact on BP’s financials and offered the cost assistance the OPEC+ has actually supplied here most just recently, OPEC+ output choices must be carefully followed and kept track of. My expectation is for OPEC+ to continue to be price-supportive force in 2024. BP’s typical rates in the production organization are likewise worth following as a decrease in rates will right away equate to lower profits and profits.

If petroleum rates stay high, nevertheless, I would not be amazed to see stock buybacks or possibly even brand-new acquisitions in 2024 and beyond. BP is for that reason, primarily, a capital return play for financiers in a market where OPEC+ might play a more aggressive function moving forward.

Last ideas

Middle Eastern stress, particularly in Israel-Gaza, the strait of Hormuz and the Red Sea are worrying patterns. An escalation of the Israel-Gaza scenario, which might draw Iran even more into the dispute, would be a worst-case circumstance offered the value of the Strait of Hormuz for worldwide petroleum products, however most likely beneficial from a prices viewpoint. BP is still extensively rewarding at petroleum rates of $73 per barrel and I think the present security scenario in the Middle East, a low P/E ratio relative to U.S. competitors and an aggressive OPEC+ company make BP in general a leading bet on petroleum markets in FY 2024!