adventtr

Vishay Intertechnology, Inc. ( NYSE: VSH) just recently re-financed its balance sheet, canceled revolving financial obligation, and revealed brand-new go-to-market techniques for 30 essential line of product. With a considerable quantity of money in the balance sheet, I think that we might see brand-new acquisitions and inorganic development, which might result in more FCF development. Even thinking about M&A threats or the actions of rivals, I believe that VSH does trade considerably underestimated.

Vishay’s Products

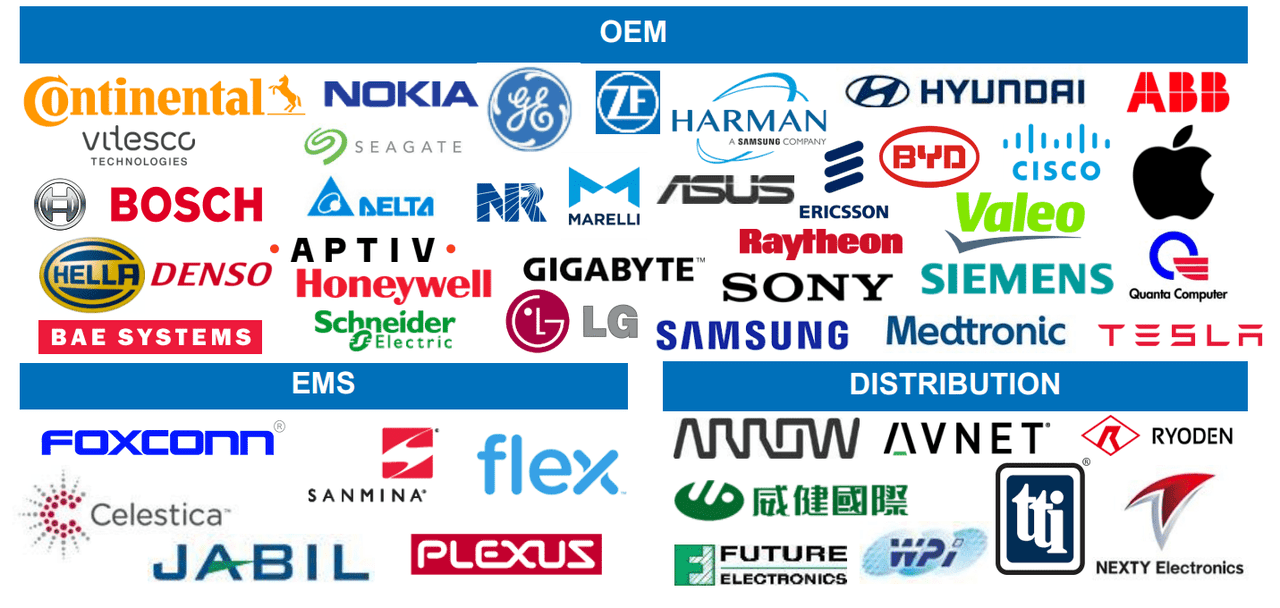

Vishay keeps among the biggest semiconductor production portfolios on the planet, in addition to other passive electronic parts that have an excellent output in numerous end markets, such as the automobile and commercial sectors.

Semiconductors consist of diodes, optoelectronic parts, and MOSFETs, to which are included resistors, inductors, and capacitors as passive aspects, utilized primarily in the management of energy circulations, and particularly electrical energy.

With more than 60 years of experience in establishing electronic items and presently taking part in a series of joint advancements for commercial automation procedures, in addition to 5G and IoT networks, I think Vishay might grow considerably in the coming years. Besides, the truth that numerous big, reputable, and ingenious corporations deal with Vishay might indicate that numerous existing customers are prepared to get brand-new advancements

Although production for Vishay is arranged under a single sector, the business identifies 2 market outlets based upon the kind of item it makes: semiconductors and passive parts. Semiconductors are primarily utilized in incorporated systems to manage and handle energy procedures and efficiency functions in ignition and circulation routing.

On the other hand, the passive parts organization consists of, as I stated previously, inductor resistors and capacitors that are regularly utilized in electrical systems to manage and handle the circulation of electrical energy.

Beyond the technical particularities of each of these items and the centers it provides to its consumers, in my view, the essential thing is to highlight the comprehensive production capability that Vishay presently has in addition to the global circulation network that permits it to find its items in a comprehensive series of end markets.

Mixed Revenues, Lower EPS Revisions, However The Business Appears To Trade Undervalued At 3-4x EBITDA

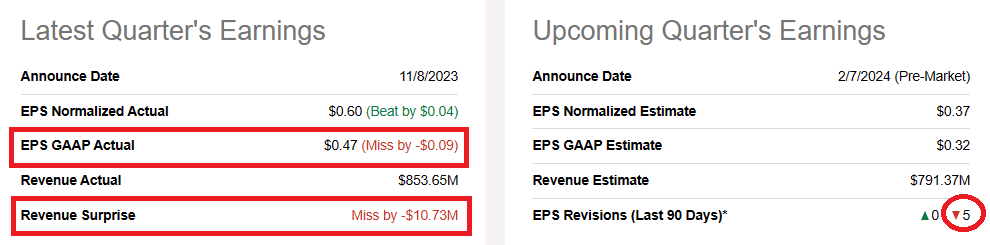

I am dissatisfied about the current combined outcomes provided in November, that included lower EPS and quarterly net sales development than anticipated. EPS was close to $0.47, and profits had to do with $853 million. Furthermore, it is not perfect that, in the last 90 days, the last EPS modifications were cynical.

Source: SA

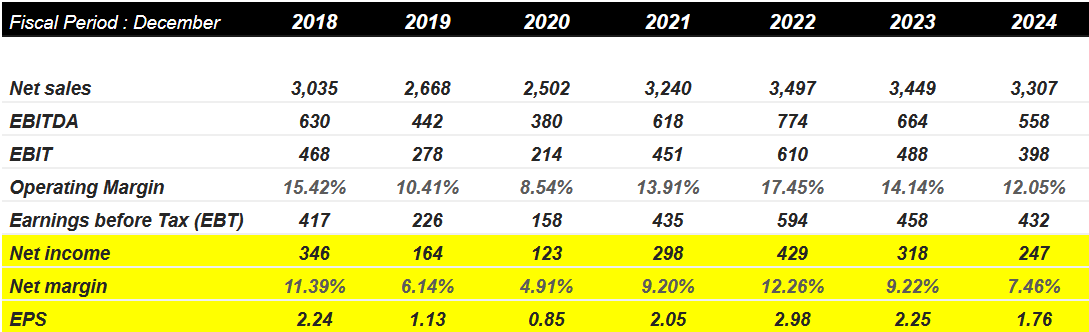

In my view, the expectations for 2024 and 2023 are positive. Financiers anticipate an operating margin of near 14% -13%, a net margin of 9% -7%, and a 2024 EPS of near 1.76. I do not believe the expectations might assist describe the existing trading multiples.

Source: Market Screener

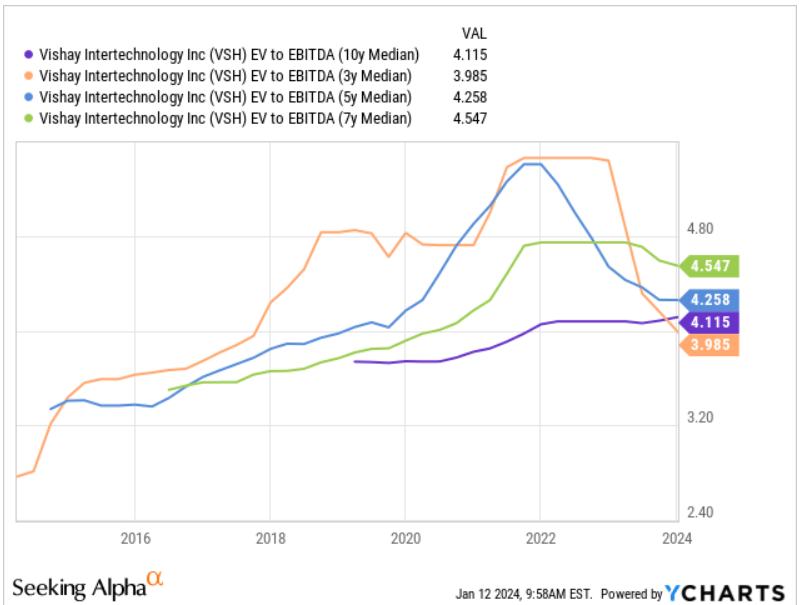

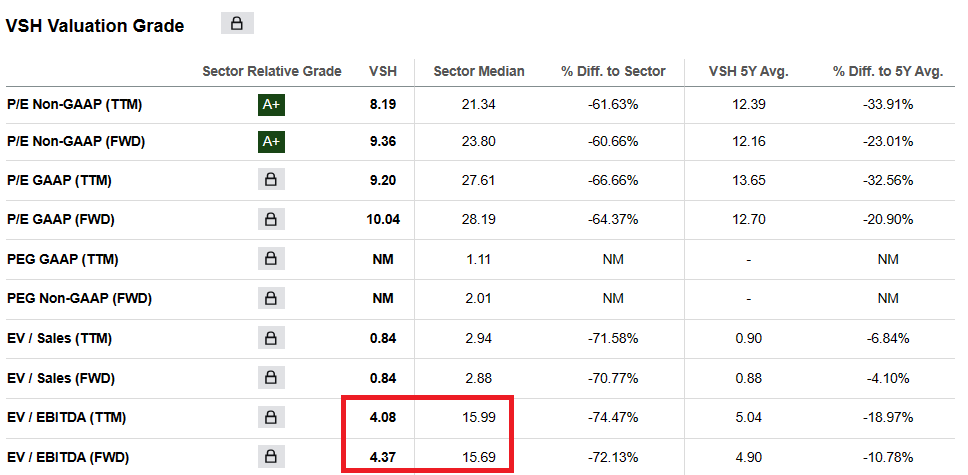

Vishay seems trading at near 3x-4x EBITDA, which, in my view, is not just listed below the multiples seen in the semiconductor market. These multiples appear low even if we take a look at any other market.

Source: Ycharts

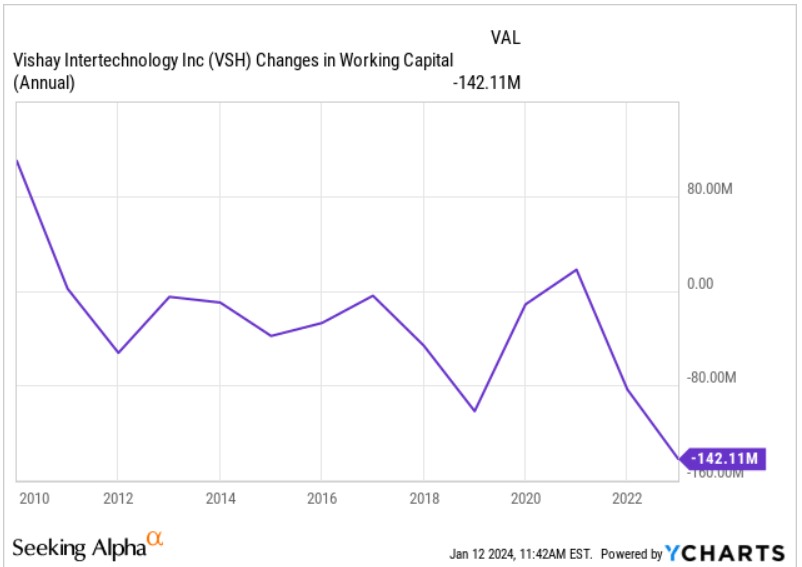

Unfavorable Working Capital, A Considerable Quantity Of Money, And Some Financial Obligation

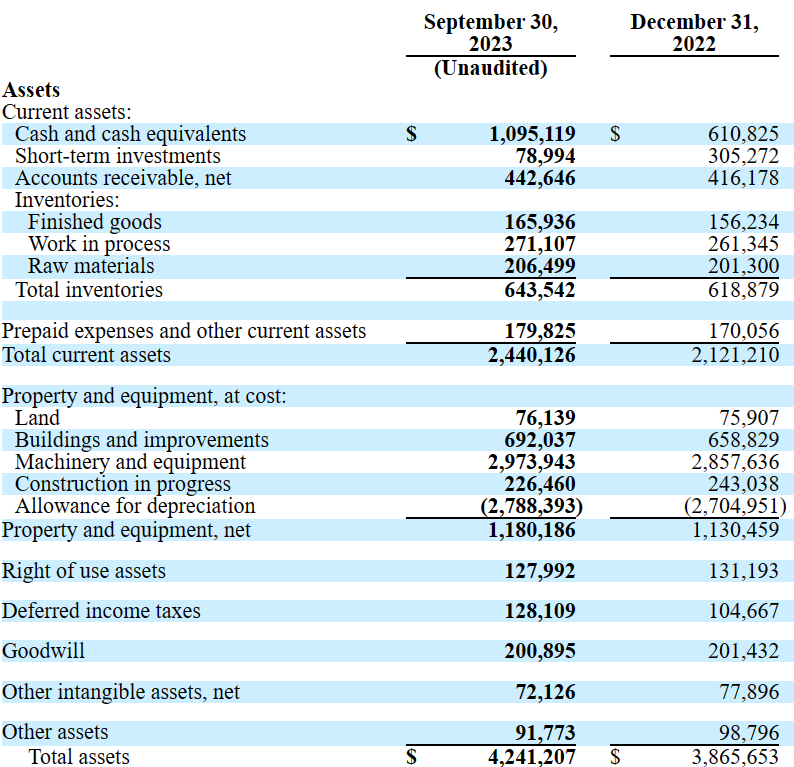

Since September 30, 2023, Vishay reported a considerable quantity of money of near $1095 million, with short-term financial investments near $78 million and receivable of $442 million. In addition, with an overall stock of $643 million, overall existing properties are close to $2.440 billion.

The existing ratio is not just bigger than 1x, which indicates liquidity appears fine. Vishay likewise reports unfavorable working capital, which indicates that the business does not require financial obligation funding or anything associated to fund its operations.

Source: Ycharts

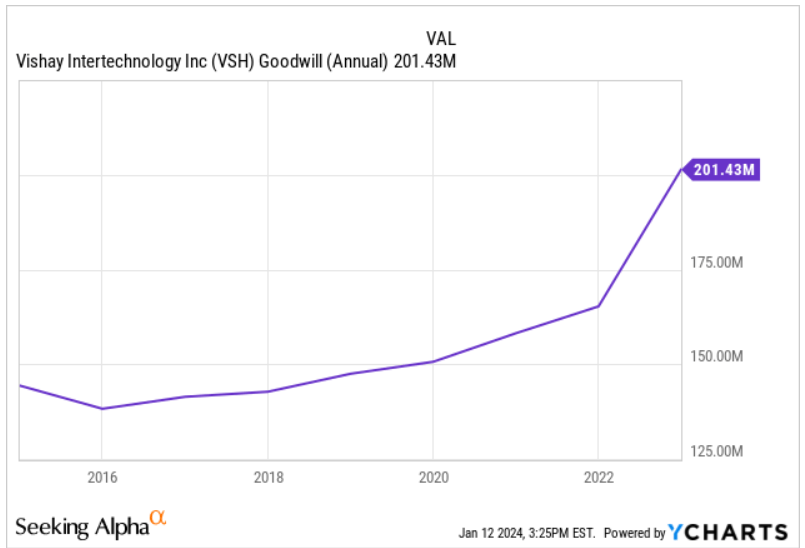

Besides, with net residential or commercial property and devices near $1.180 billion, postponed earnings taxes of about $128 million, and goodwill worth $200 million, overall properties stand at $4.241 billion. The asset/liability ratio is more considerable than 2x, so the balance sheet appears strong.

Source: 10-Q

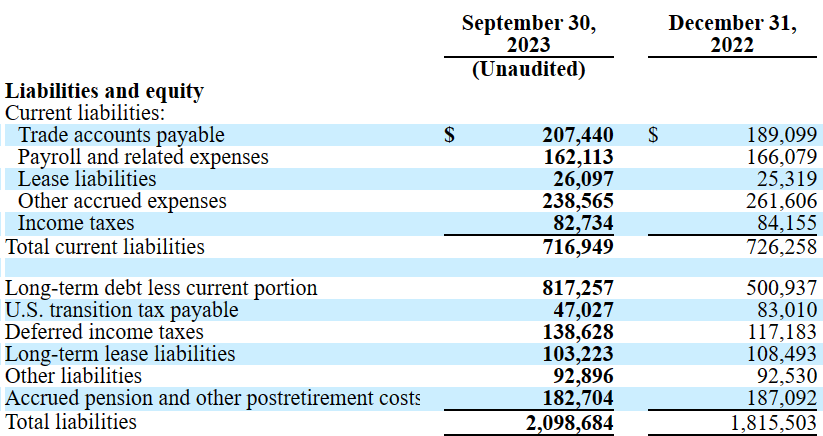

I am not worried about the overall quantity of financial obligation since cash appears considerable. Nevertheless, it deserves keeping in mind that long-lasting financial obligation has actually just recently increased. Particularly, trade accounts payable stood at near $207 million, with payroll and associated costs of about $162 million, long-lasting financial obligation of about $817 million, and overall liabilities of around $2.098 billion.

Source: 10-Q

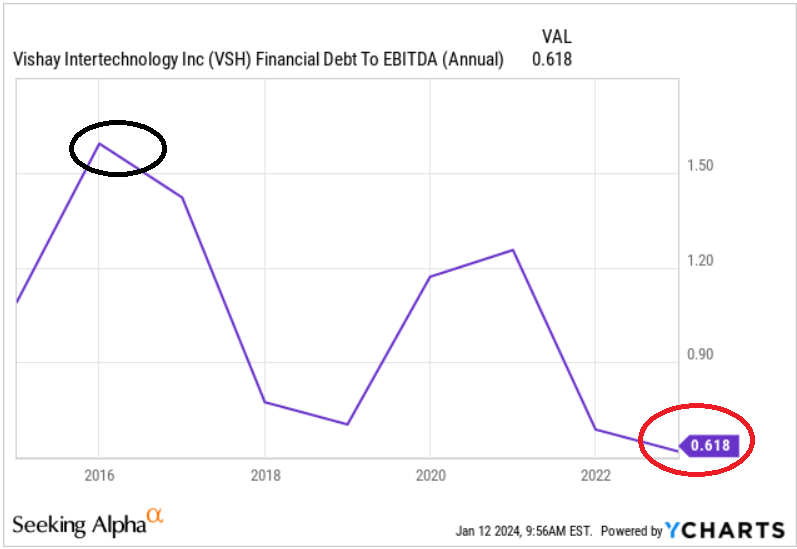

Current Financial Obligation Decrease Might Suggest Greater EV/FCF Multiples

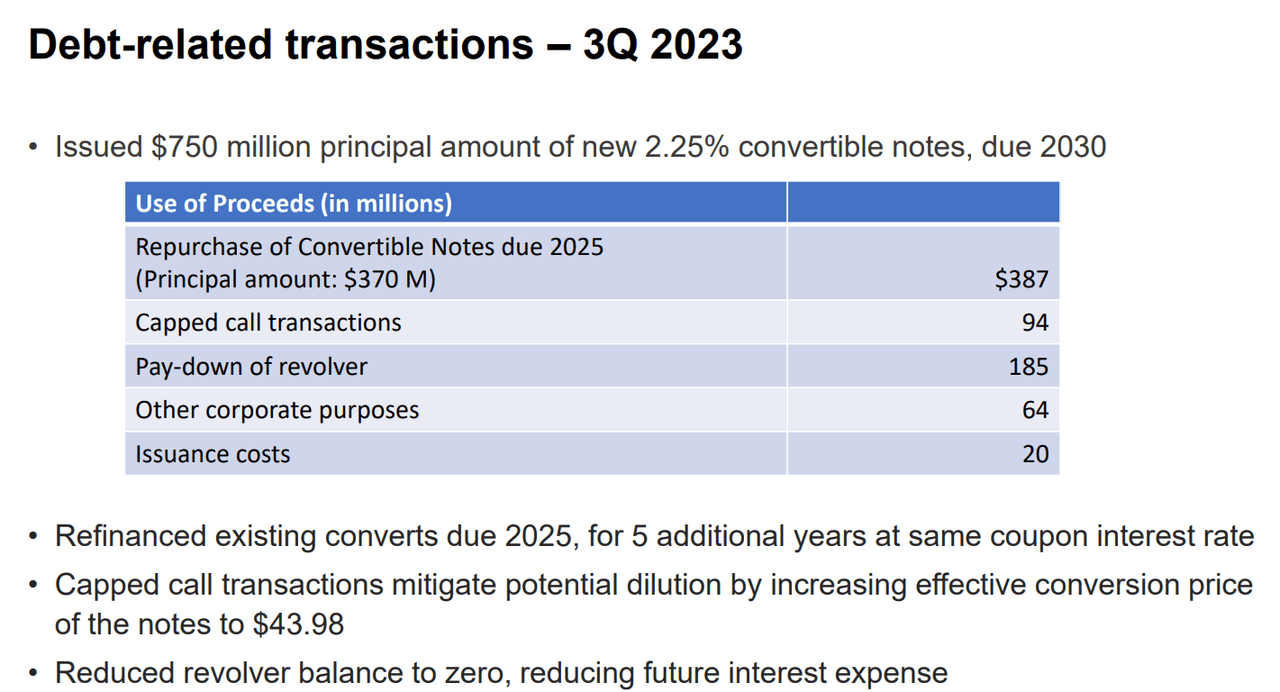

I modified the business’s long-lasting financial obligation and current financial obligation contracts to comprehend the expense of capital Vishay. I saw financial obligation contracts, consisting of SOFR plus 1.60%, however Vishay likewise kept in mind 2.25% convertible senior notes due in 2030. Offered these figures, I think that presuming a WACC of near 7% would be conservative.

Based upon Vishay’s existing overall take advantage of ratio, loanings bear interest at SOFR plus 1.60%, consisting of the relevant credit spread. Vishay likewise pays a dedication cost, likewise based upon its overall take advantage of ratio, on undrawn quantities. The undrawn dedication cost, based upon Vishay’s existing overall take advantage of ratio, is 0.25% per year.

In September 2023, the Business provided $750,000 aggregate principal quantity of 2.25% convertible senior notes due 2030 to certified institutional purchasers pursuant to an exemption from registration offered by Guideline 144A under the Securities Act. The Business utilized the net profits from this offering to redeem $370,242 principal quantity of its exceptional 2.25% convertible senior notes due 2025, to minimize the exceptional balance of its Amended and Restated Credit Center, to participate in capped call deals (as more explained listed below), and for other basic business functions. Source: 10-Q

Worrying the overall quantity of take advantage of, it is reasonable to state that the monetary debt/EBITDA ratio decreased considerably. In my view, as quickly as other financiers see these decreases in the financial obligation levels, we might see need for the stock. From 2016 to 2023, the monetary debt/EBITDA ratio reduced from 1.5 x to about 0.6 x.

Source: Ycharts

I likewise valued that Vishay reported brand-new refinancing contracts, minimized the revolver balance to absolutely no, and reduced future interest expenditure. With the need for Vishay’s financial obligation, I believe business design is still well acknowledged. Thanks to the brand-new financial obligation conditions, I can not dispose of more stock need.

Moving Production Facilities To Jurisdictions With Low Taxes Or Much Better Labor Laws May Bring FCF Development

Vishay plans to move production centers and labor to other areas where the business discovers advantages due to the expense or tax centers. In addition, the long-lasting gross development, as specified in their reports, is based upon the possibility of acquisitions of comparable innovation companies while preserving an amortization of continuous financial investments through the irreversible expense restructuring technique.

Thinking about the overall quantity of money, I believe Vishay might obtain numerous brand-new targets. As an outcome, we might see considerable FCF development driven by inorganic development. Offered the current boost in goodwill and previous acquisitions, I presumed that Vishay understood well how to obtain targets, incorporate brand-new groups, and get expense synergies.

Source: Ycharts

New Efforts, Growth Tasks, And New Item Lines Might Bring Net Sales Development

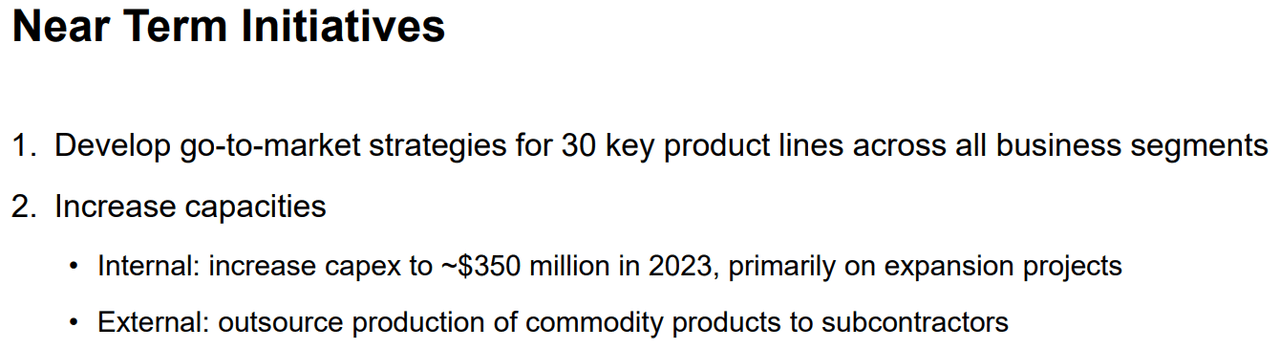

In the last discussion to financiers, management assured to establish go-to-market techniques for 30 essential line of product. Besides, the business anticipates to increase its capex to fund growth jobs.

These brand-new efforts might result in capability boosts, net sales development, and FCF development velocity in the coming years. As an outcome, we might see stock need boost.

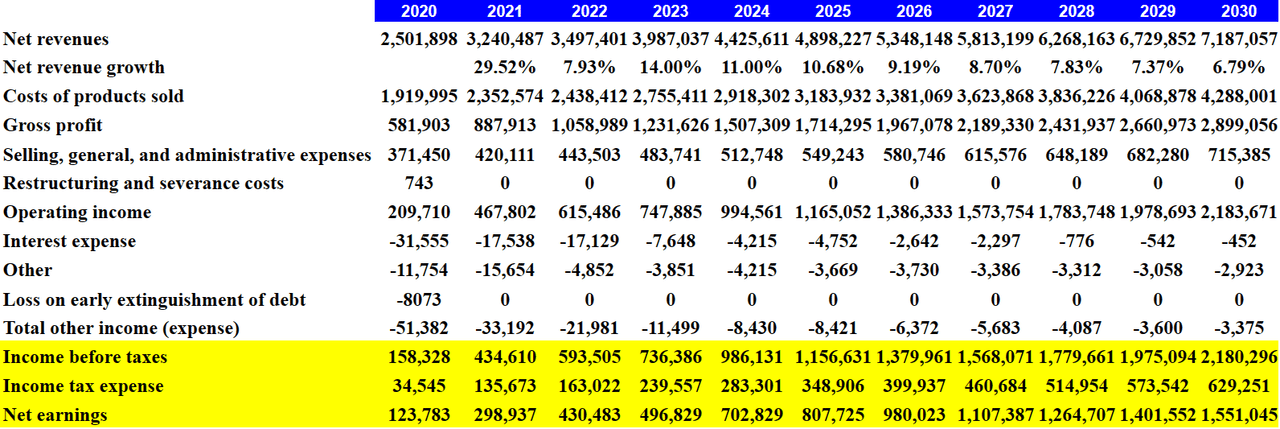

My Monetary Expectations Based Upon Previous Presumptions, And Previous Financials

The international semiconductor production devices market is anticipated to grow at near 7.9% from 2023 to 2030. Nevertheless, Vishay’s profits grew 29% in 2021 and 7.9% in 2022. For this reason, I consisted of net sales development in between 14% and 6% under my earnings declaration forecasts, which I think is reasonable for Vishay.

The international semiconductor production devices market size was approximated at USD 103.1 billion in 2023 and is anticipated to broaden at a compound yearly development rate of 7.9% from 2024 to 2030. Source: Semiconductor Production Devices Market Report

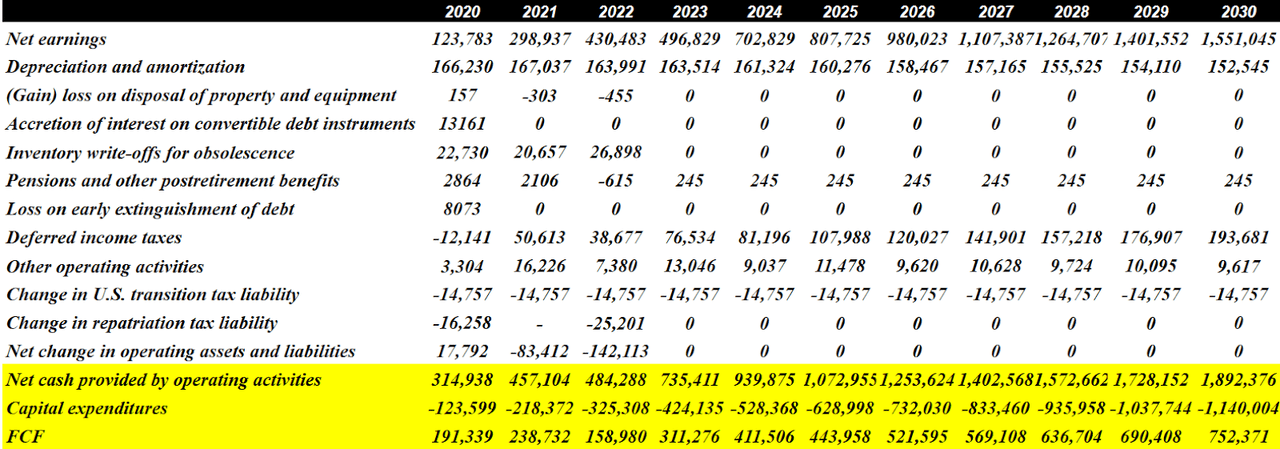

My expectations for Vishay consist of 2030 net earnings of $7.187 billion with expenses of items offered of $4.288 billion, and 2030 gross earnings of $2.899 billion. In addition, with selling, basic, and administrative costs worth $715 million, and net profits of near $1.551 billion.

Source: My Earnings Expectations

My capital expectations consist of 2030 devaluation and amortization of about $152 million. I did not have losses on disposal of residential or commercial property and devices, accretion of interest on convertible financial obligation instruments, or stock write-offs for obsolescence since they’re not reoccurring parts of business design. I likewise consisted of the 2030 modification in U.S. shift tax liability of almost $15 million and the 2030 net money offered by running activities worth $1.892 billion. Lastly, with 2030 capital investment of near -$ 1.141 billion, 2030 FCF might be near $752 million.

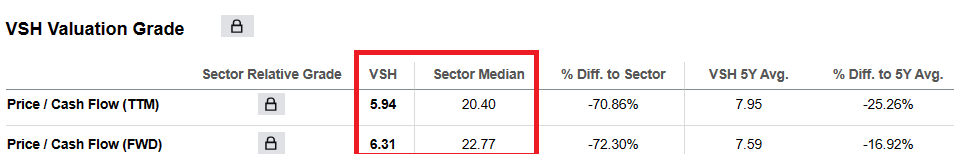

I took a look at the rivals’ assessments to evaluate the exit multiples in my DCF design. According to Looking For Alpha, the sector average stands at near 15x EBITDA, the average PE is close to 23x, and the price/cash circulation is close to 22x-20x. Vishay is trading at multiples that are considerably lower than that of rivals, so I presumed an appraisal of 6x FCF, which I think is rather conservative.

Source: SA Source: SA

With the presumptions made listed below, a WACC of 7.9%, the overall implied business worth would be close to $2.4 billion. Nevertheless, including the cash, which is considerable, and deducting the financial obligation exceptional, the projection cost would be close to $41 per share. Lastly, the internal rate of return would stand at near 11.6%.

Source: My DCF Design

Threats

Typically, the competitors for this kind of organization is exceptional and keeps low market entry expenses in import and transport capabilities. Listed below, I information the primary rivals according to the sort of item.

Source: 10-k

As we see, some individuals keep line of product in numerous of business and these other minority rivals. This likewise shows the debt consolidation that has actually existed in this market just recently, which Vishay wants to benefit from by placing itself as a 2nd supply business.

Firstly, it must be kept in mind that the development that the business has actually experienced recently has actually happened primarily through its tactical tasks. And this does not indicate that the pattern will continue in the future. The failure to identify companies or future combination after their acquisition are threats to be taken into consideration as part of this business’s core technique.

Class B stock investors own nearly 50% of the business’s ballot power, and these shares remain in the hands of couple of individuals who can choose the business’s future and not generate future monetary instruments to obtain financial obligation for the purchase of other business. Besides, in my view, financiers do not like when business report 2 or more share types since the share count is often incorrect.

We have 2 classes of typical stock: typical stock and Class B typical stock. The holders of typical stock are entitled to one elect each share held, while the holders of Class B typical stock are entitled to 10 choose each share held. At December 31, 2022, the holders of Class B typical stock held around 48.5% of the ballot power of the Business. The ownership of Class B typical stock is extremely focused, and holders of Class B typical stock efficiently can trigger the election of directors and authorize other actions as investors. Source: 10-k

Conclusion

The current decrease of the revolving financial obligation commitments and the lower net take advantage of might bring brand-new innovators thinking about Vishay Technologies. Besides, the business just recently kept in mind brand-new efforts, consisting of brand-new go-to-market techniques for about 30 essential line of product and brand-new growth jobs. Even thinking about the presence of class B shares threats associated with rivals, or stopped working acquisitions, Vishay looks inexpensive at the existing EV/EBITDA ratio.