Dragon Claws

It’s an unusual world we reside in nowadays, where you now need to pay additional for a streaming membership simply to enjoy a choose NFL championship game I had actually when believed that so long as you’re ready to endure commercials, then you might expect no additional expense beyond a cable television membership or a television antenna!

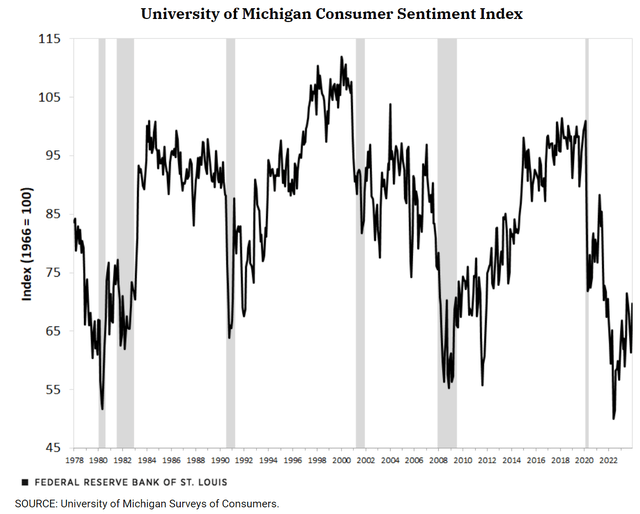

However I digress, turning to the economy, joblessness is low in the U.S. and in lots of parts of the world, and yet customer belief stays rather low regardless of that reality. As revealed listed below, customer belief is even lower than where it remained in 2010, when the U.S. was coming out of the Great Economic downturn.

In these complicated times, it’s any person’s guess where the economy will land by the end of the year, which’s why financiers might be well served to layer into long lasting names that are financially important for all market environments.

This brings me to Crown Castle Inc. ( NYSE: CCI), which I think fits that mold. I last covered CCI here back in October with a ‘Strong Buy’ score, noting its engaging worth and speeding up development in little cell releases.

It appears that the marketplace had actually concurred with my thesis, as the stock has actually offered financiers a 32% overall return ever since, besting the 13% increase in the S&P 500 ( SPY) over the very same timeframe. In this post, I offer an upgrade and talk about why CCI stays an engaging buy at present for its dividend and worth, so let’s begin!

Why CCI?

Crown Castle is among simply 3 big cell tower REITs that control the landscape, along with peers American Tower ( AMT) and SBA Communications ( SBAC). It has more than 40K cell towers and 85K path miles of fiber that touches every significant U.S. market.

CCI has actually grown to its existing size from modest starts. Due to its long lasting service design of renting out much required area in a growing cordless market, CCI has actually produced outsized returns over its history. This consists of the previous 15 year duration, in which CCI has actually offered financiers a 731% overall return, far exceeding the 464% of the S&P 500, as revealed listed below.

CCI vs. SPY Overall Return ( Looking For Alpha)

Those who follow the stock carefully understand that CCI has actually seen some obstacle over the previous year, as shown by its 25% decrease in share rate over the tracking 12 months. That’s because after years of aggressive growth, the leading cordless names Verizon ( VZ), AT&T ( T), and T-Mobile ( TMUS) have actually drawn back their capital costs, particularly as it connects to their 5G financial investments.

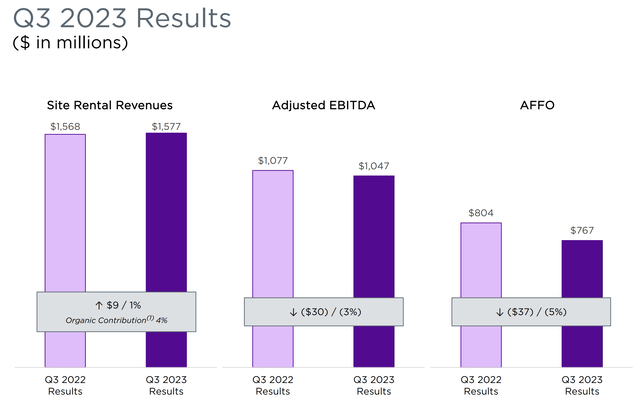

This has actually led to a downturn in leasing activity, which management’s assistance indicates that it will continue into the existing year. As revealed listed below, Website leasing earnings grew by simply 4.4% YoY on a natural basis (slowest considering that 2020), and both changed EBITDA and AFFO decreased by 3% and 5%, respectively, throughout the 3rd quarter.

While these heading figures might be less than outstanding, there are underlying patterns that support a development story below the surface area. This is supported by the reality that after years of financial investment into the little cell area, this section appears prepared to turn the corner. This is shown by management’s expectations that little cells will see 13% natural development in 2024, driven by an approximated $60 million in core leasing activity and the addition of 14,000 brand-new nodes this year, after including 10,000 in 2023.

The marketplace might have just just recently started to heat up to CCI’s little cell technique, which is based upon the worth proposal they contribute to its existing facilities. Little cells are contributed to structures like energy poles and deal with CCI’s towers to offer expanded cordless capability and protection.

Growth of little cells might likewise be important to CCI’s clients like Verizon and T-Mobile which are strongly broadening their repaired cordless consumer base. For instance, Verizon alone is seeing around 400K net repaired wireless includes per quarter, and ended its last noted quarter with 2.7 million repaired cordless connections. CCI’s management just recently provided an upgrade on its little cell technique as follows:

We are regularly discovering methods to develop little cells and fiber more effectively. These effectiveness enable us to offer the most economical and trusted network options for clients. We aim to provide the greatest risk-adjusted returns for our investors through continually developing on the core abilities that I simply pointed out that create special worth in business we own and run. These abilities minimize the general expense of releasing and running interactions networks, which ends up being much more engaging for our clients in times of increasing capital expenses.

Dangers to CCI consist of the current activist participation from Elliot Financial investment Management, which has actually constructed a $2 billion stake in the business, requiring a CEO modification and a re-evaluation of its fiber service, suggesting that it desires for CCI to spin-off the system. It appears that Elliot got its dream, as CCI revealed the retirement of its CEO reliable on January 16 th, with interim CEO Melone, who has actually worked as CTO of Verizon in the past to enter the function. Elliot’s participation presents a level of unpredictability in the near term.

Likewise, CCI’s take advantage of ratio is presently raised with a net financial obligation to TTM EBITDA ratio of 6.8 x, going beyond management’s long-lasting target of around 5x. This is, nevertheless, due in part to the Sprint-related churn and management anticipates to naturally minimize the take advantage of ratio to be in line with its BBB financial investment grade credit score from S&P. In the meantime, CCI has lots of liquidity, with $5 billion in readily available capital under its revolving credit center, versus $750 million worth of financial obligation maturities in 2024.

Significantly for earnings financiers, CCI presently yields a reputable 5.6% and the dividend protection ratio is rather raised at 85%. Nevertheless, management anticipates the very first half of 2024 to be a trough for AFFO, with yearly development resuming in the 7% to 8% variety in 2025, with dividend development to resume next year too. This is based upon expectations that leasing will enhance in the 2nd half of this year and beyond, as clients continue to develop out 5G.

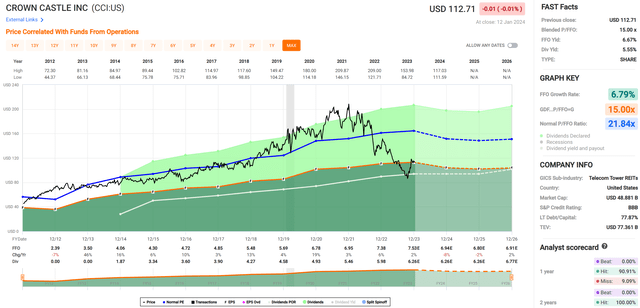

Finally, I continue to see worth in CCI at the existing rate of $112.71 with a forward P/FFO of 15.3, which I think to be extremely sensible for a long-lasting development story with moat-worthy properties. This is based upon expectations that CCI might fairly attain AFFO/share development in the mid- to high-single digit over the long term, which when integrated with the existing dividend yield, might produce yearly returns in excess of 10%. As revealed listed below, CCI likewise trades at a product discount rate to its regular P/FFO of 21.8.

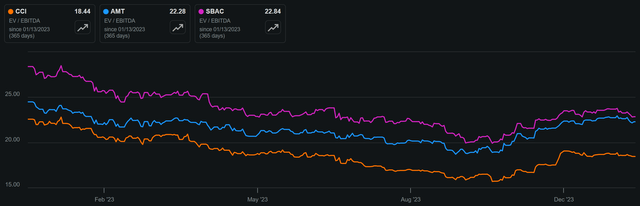

As revealed listed below, CCI likewise trades at a significant discount rate to its peers AMT and SBAC, with an EV/EBITDA of 18.4 while offering a greater dividend yield than its 2 peers.

CCI vs. Peers EV/EBITDA ( Looking For Alpha)

Financier Takeaway

Regardless of the current downturn in leasing activity, Crown Castle stays a long-lasting development story with its strong portfolio of properties and concentrate on growing little cells. While there are threats to think about such as Elliot’s participation and raised take advantage of ratio, I think that CCI’s long-lasting capacity for AFFO development and dividend earnings make it an appealing financial investment chance. In addition, its existing discount rate to its peers and historic appraisal metrics even more support its worth proposal.

As 5G release continues to increase and the need for cordless facilities boosts, I think that CCI will continue to see strong development in the years ahead. While I stay bullish on CCI, I am reducing it from a ‘Strong Buy’ to a ‘Purchase’ based upon the share rate having actually offseted its considerable losses considering that the last time I went to the stock.